Top Chatbot Companies Revolutionizing Finance in Malaysia

Imagine having your financial questions answered instantly, no matter the time or place. Chatbots are making this possible in Malaysia’s finance sector. They’re transforming how you interact with banks and financial services by handling routine queries, offering advice, and even detecting fraud. Companies like Sobot are leading the way with their innovative solutions. Their technology helps businesses save time and money while improving your experience. It’s exciting to see how a chatbot for finance malaysia is reshaping the industry to be more efficient and customer-friendly.

The Role of Chatbots in Malaysia's Finance Sector

Enhancing Customer Service in Banking

Chatbots are changing how you interact with banks. They provide instant responses to your questions, whether it’s about account balances or loan inquiries. This means no more waiting in long queues or being put on hold. With 24/7 availability, chatbots ensure you get the help you need anytime. They even personalize their responses by recognizing your name and preferences, making the experience feel tailored just for you.

Here’s how chatbots have improved customer service metrics in banking:

| Metric | Improvement Description |

|---|---|

| Improved Customer Service | Instant responses reduce wait times and enhance your experience. |

| 24/7 Availability | You can get answers anytime, even outside business hours. |

| Personalization | Chatbots tailor responses based on your preferences. |

| Higher Security Levels | They detect fraud in real-time and alert bank personnel. |

Automating Financial Processes

Managing financial tasks can be time-consuming, but chatbots make it easier. They automate repetitive processes like bill payments, account updates, and even loan applications. This saves you time and reduces the workload for bank staff. For example, chatbots can handle up to 50% of customer concerns without needing live agents. This efficiency not only speeds up processes but also cuts costs for financial institutions.

Here’s a quick look at how automation benefits the finance sector:

| Statistic Description | Value |

|---|---|

| Expected savings for banks by 2023 | $7.3 billion |

| Time saved per inquiry by banking representatives | 4 minutes |

| Cost saved per query | $0.70 |

| Percentage of customer concerns addressed without live resources | 50% |

Supporting Fraud Detection and Prevention

Fraud is a major concern in the financial world, but chatbots are stepping up to help. They analyze your spending patterns and flag unusual transactions. If something seems off, they notify you immediately for verification. This quick action helps protect your money and gives you peace of mind. Did you know that 61% of companies have reported an increase in fraud attacks on consumer accounts? Chatbots play a crucial role in reducing these risks.

| Statistic | Percentage |

|---|---|

| Companies reporting over 1,000 fraud attempts | 35% |

| Companies reporting an increase in fraud attacks on consumer accounts | 61% |

| Companies reporting a rise in business account fraud attempts | 54% |

By combining speed, accuracy, and intelligence, chatbots are making Malaysia’s finance sector more secure and efficient. Whether it’s improving customer support, automating tasks, or preventing fraud, these tools are reshaping the way you experience financial services.

Delivering Personalized Financial Advice

Imagine having a financial advisor who’s always available, never gets tired, and knows your financial habits better than anyone else. That’s exactly what chatbots bring to the table. They’re not just about answering questions—they’re about helping you make smarter financial decisions.

Chatbots analyze your income, expenses, and savings to give you advice that fits your unique situation. For example, if you’re trying to save for a vacation, a chatbot can suggest areas where you can cut back on spending. It’s like having a personal budget coach in your pocket.

Here’s what makes chatbots so effective at delivering personalized financial advice:

| Functionality | Description |

|---|---|

| Personalized Guidance | Chatbots provide tailored advice based on individual financial situations and goals. |

| Analysis of Financial Patterns | They analyze income, expenses, and savings to offer specific recommendations. |

| Investment Recommendations | Chatbots can suggest investment options and explain complex financial products. |

| Tax Implications | They help users understand the tax consequences of their financial decisions. |

| Savings Opportunities | Chatbots identify areas where users can cut back on spending and increase savings. |

| Predictive Insights | They predict future financial trends based on historical data, aiding in informed decision-making. |

You might wonder, “Can a chatbot really help me with investments?” Absolutely. These tools simplify complex topics like stocks or mutual funds. They break things down into easy-to-understand terms, so you can make informed choices without feeling overwhelmed.

Another great feature? Predictive insights. Chatbots use historical data to forecast trends, helping you plan for the future. Whether it’s saving for retirement or managing taxes, they’ve got you covered.

With chatbots, financial advice becomes accessible, personalized, and stress-free. They’re not just tools—they’re your financial partners, guiding you toward smarter decisions every step of the way.

Top Chatbot Companies in Malaysia Revolutionizing Finance

Sobot: AI-Powered Chatbot Solutions for Finance

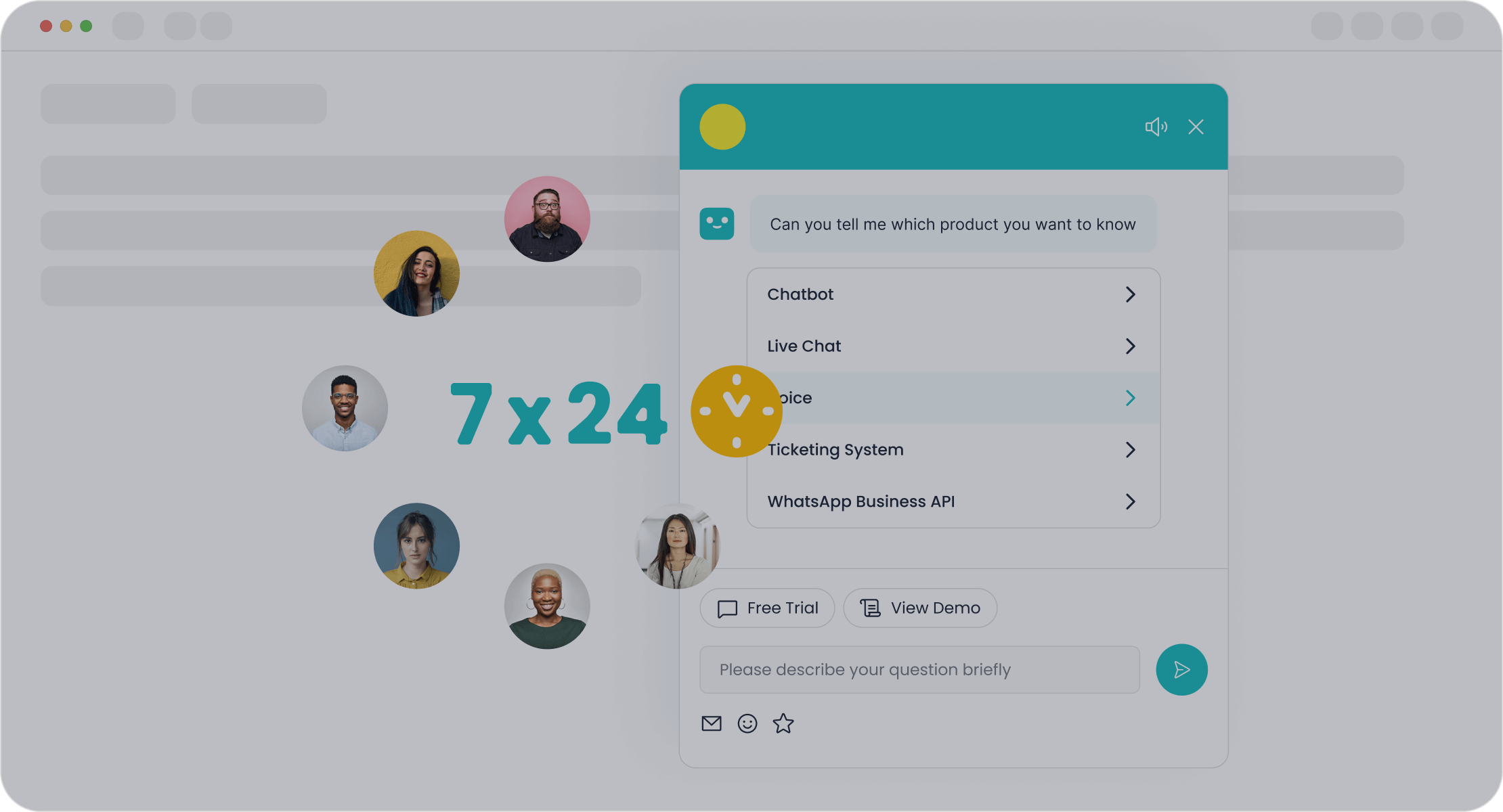

When it comes to AI-powered chatbot services, Sobot stands out as a leader in Malaysia’s financial sector. With its innovative approach, Sobot has redefined how businesses interact with customers. Its artificial intelligence-based chatbot is designed to handle customer queries efficiently, offering 24/7 support and personalized interactions. This makes it an invaluable tool for financial institutions aiming to enhance customer satisfaction and streamline operations.

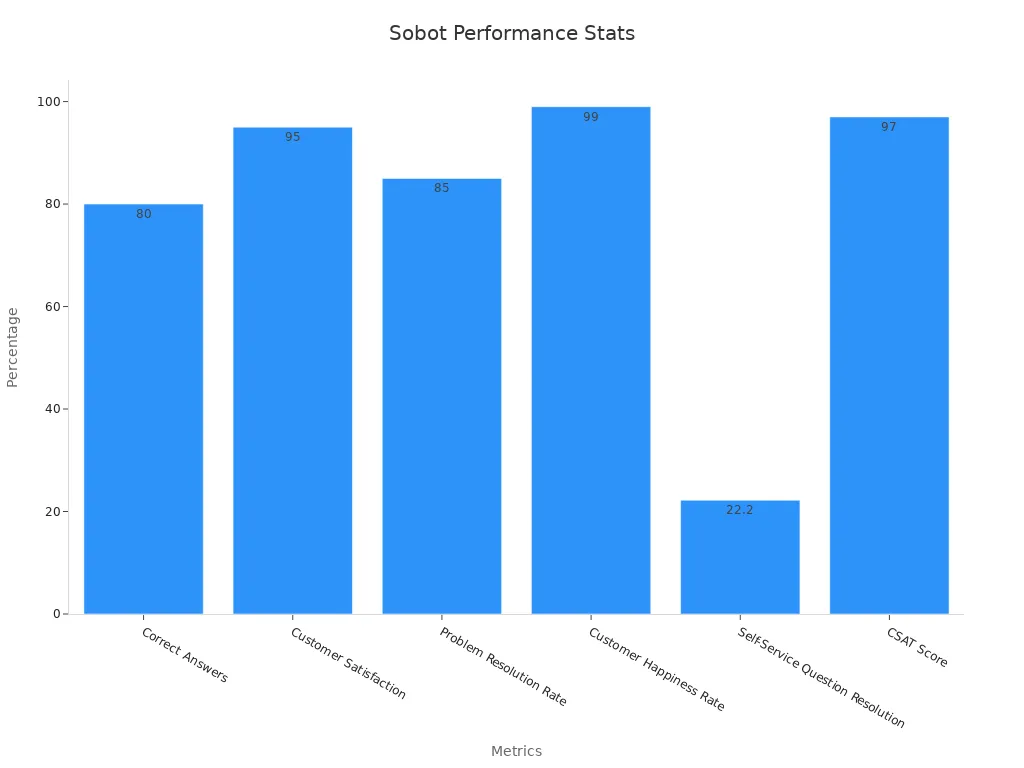

Sobot’s chatbot doesn’t just answer questions—it solves problems. It boasts impressive performance metrics, such as a 97% customer satisfaction score (CSAT) and an 85% problem resolution rate. These numbers highlight its ability to deliver accurate and timely solutions.

| Metric | Value |

|---|---|

| Correct Answers | Over 80% |

| Customer Satisfaction | Over 95% |

| Problem Resolution Rate | 85% |

| Customer Happiness Rate | 99% |

| Self-Service Question Resolution | 22.2% |

| Customer Satisfaction Score (CSAT) | 97% |

What sets Sobot apart is its omnichannel capability. It integrates seamlessly with platforms like WhatsApp, SMS, and email, ensuring customers can reach you through their preferred channels. Whether you’re a bank looking to automate loan applications or a fintech startup aiming to improve customer engagement, Sobot’s chatbot services offer a tailored solution.

IBM Watson Assistant: Advanced AI for Financial Services

IBM Watson Assistant is another major player in Malaysia’s financial chatbot landscape. Known for its advanced natural language processing (NLP), this tool excels in understanding and responding to complex customer queries. It’s no surprise that IBM Watson Assistant is often ranked among the top IT companies offering chatbot development services globally.

The financial impact of IBM Watson Assistant is remarkable. It has saved businesses millions of dollars by improving customer containment and conversation routing.

| Evidence Type | Amount (USD) |

|---|---|

| Customer containment savings | 13 million |

| Conversation routing savings | 6.7 million |

| Efficiency from sales agent assist | 2.4 million |

According to G2 Crowd, IDC, and Gartner, IBM’s watsonx Assistant is one of the best chatbot builders in the space with leading natural language processing (NLP) and integration capabilities.

IBM Watson Assistant also outperforms competitors like Google Dialogflow and Microsoft LUIS in accuracy, making it a reliable choice for financial institutions. Its ability to integrate with existing IT systems ensures a seamless customer experience, further solidifying its position as a leader in chatbot services.

TeaCode.io: Custom Chatbot Development Services

If you’re looking for tailored chatbot solutions, TeaCode.io is a name to consider. This company specializes in creating custom chatbots that meet the unique needs of financial institutions. Their approach is rooted in transparency, reliability, and a deep understanding of client requirements.

TeaCode.io’s chatbots enhance customer engagement by offering immediate, personalized interactions. They also integrate seamlessly with existing systems, ensuring a smooth user experience. Clients often praise the company for its proactive communication and ethical approach. Here’s what makes TeaCode.io stand out:

- Great communication and proactive in suggesting improvements.

- High-quality performance compared to other providers.

- Significant increase in app users since collaboration began.

- Flexibility and professionalism in delivering better solutions.

TeaCode.io’s expertise in chatbot development services has made it a trusted partner for financial institutions in Malaysia. Whether you need a chatbot for finance Malaysia or a solution to improve customer engagement, TeaCode.io delivers results that exceed expectations.

Virtuals Protocol: Emerging Chatbot Startups in Malaysia

Malaysia’s chatbot landscape is buzzing with innovation, and Virtuals Protocol is one of the exciting names to watch. This startup is making waves by developing decentralized AI agents that cater to industries like entertainment and gaming. Their products, such as AI Souls and AI WAIFU, are redefining how businesses interact with customers. While their focus isn’t solely on finance, their technology shows the potential to expand into this sector.

Virtuals Protocol isn’t alone in this space. Other chatbot startups in Malaysia are also contributing to the industry’s growth. For instance:

| Startup Name | Description |

|---|---|

| Virtuals Protocol | Decentralized AI agents for entertainment and gaming industries, offering products like AI Souls and AI WAIFU. |

| Brandchat | Focuses on enhancing customer engagement through chatbots. |

| VOX | Develops chatbots for various applications, including customer service. |

| Growthbotics | Provides AI-driven solutions for business growth through chatbots. |

| Accord Innovations | Innovates in chatbot technology for financial services. |

These companies are pushing boundaries, showing how chatbots can transform industries beyond finance. If you’re a business owner, you might find inspiration in how these startups are leveraging AI to solve real-world problems. Whether it’s improving customer engagement or streamlining operations, the possibilities are endless.

Virtuals Protocol and its peers highlight the growing importance of chatbots startups in Malaysia. They’re not just creating tools; they’re shaping the future of customer interactions. As the demand for smarter, more efficient solutions grows, these startups are well-positioned to lead the charge.

AirAsia’s Ask Bo: AI Chatbot Enhancing Customer Experience

If you’ve ever flown with AirAsia, you’ve probably encountered Ask Bo, their AI-powered chatbot. This virtual assistant is a game-changer for customer service. It handles everything from booking flights to answering frequently asked questions, making your travel experience smoother and more enjoyable.

Ask Bo stands out because it’s designed with you in mind. It’s available 24/7, so you can get help whenever you need it. Whether you’re checking flight schedules or managing your bookings, Ask Bo simplifies the process. It even supports multiple languages, catering to Malaysia’s diverse population.

Here’s what makes Ask Bo so effective:

- 24/7 Availability: You can access it anytime, even during odd hours.

- Multilingual Support: It speaks your language, making communication effortless.

- Quick Resolutions: It provides instant answers, saving you time.

AirAsia’s chatbot isn’t just about convenience; it’s about creating a better customer experience. By automating routine tasks, Ask Bo frees up human agents to focus on more complex issues. This approach not only improves efficiency but also enhances customer satisfaction.

Ask Bo is a shining example of how chatbots are revolutionizing industries in Malaysia. It shows that with the right technology, companies can deliver exceptional service while staying ahead of the competition.

Key Use Cases of Chatbots in Malaysia's Finance Industry

Automating Customer Support for Banks

Imagine reaching out to your bank and getting instant answers without waiting on hold. Chatbots make this possible by automating customer support. They handle routine queries like account balances, transaction histories, and branch locations. This frees up human agents to focus on more complex issues, improving overall efficiency.

Banks in Malaysia have seen remarkable improvements with chatbots. For example, response times have dropped by 37%, and resolution times are now 52% faster. This means you get the help you need quicker than ever. Plus, chatbots reduce the ticket-to-order ratio by 27%, making operations smoother. These advancements not only enhance your experience but also boost customer satisfaction by 1%.

💡 Tip: Chatbots like Sobot’s AI-powered solution offer 24/7 availability, ensuring you can access support anytime. With its omnichannel capabilities, you can connect through WhatsApp, SMS, or email—whatever works best for you.

Streamlining Loan and Credit Card Applications

Applying for a loan or credit card can feel overwhelming, but chatbots simplify the process. They guide you step-by-step, ensuring you provide all the necessary information. This reduces errors and speeds up approvals. In fact, banks using AI-powered chatbots have cut loan processing times by 50%. That means more applications get processed with the same staff, saving time and resources.

By 2025, chatbots are expected to save organizations $80 billion in customer service costs. This efficiency benefits both banks and customers. You’ll enjoy faster approvals, while banks can allocate resources to other areas. Sobot’s chatbot, for instance, excels in automating workflows, making it a valuable tool for financial institutions aiming to streamline operations.

Enhancing Fraud Detection and Security Alerts

Fraud prevention is a top priority for banks, and chatbots play a crucial role here. They monitor your transactions in real-time, flagging anything unusual. If something seems off, you’ll get an instant alert to verify the activity. This quick action helps protect your money and gives you peace of mind.

Did you know that 61% of companies have reported a rise in fraud attacks on consumer accounts? Chatbots help reduce these risks by analyzing spending patterns and identifying anomalies. Their ability to act swiftly makes them an essential part of modern banking security.

🔒 Note: Sobot’s AI chatbot integrates seamlessly with financial systems, offering robust fraud detection capabilities. Its intelligent design ensures accurate monitoring, keeping your finances secure.

Providing Real-Time Financial Assistance

Imagine having a financial assistant who’s always ready to help, no matter the time or place. That’s exactly what chatbots bring to the table. They provide real-time assistance by analyzing your financial data and offering tailored solutions. Whether you’re looking for advice on savings accounts or need help with a loan application, chatbots make the process quick and easy.

Here’s how chatbots excel at providing real-time financial assistance:

- They understand a wide range of questions and connect you to live agents when needed.

- They analyze your spending habits to recommend personalized financial products, like savings accounts or investment options.

- They proactively engage with you to highlight relevant financial opportunities you might not have considered.

Research shows that AI chatbots can handle 80% of customer support queries, significantly improving response times and customer satisfaction.

Chatbots also monitor your transactions for suspicious activity. If something seems off, they’ll alert you immediately. This quick action helps protect your money and gives you peace of mind. For example, they can flag unusual spending patterns or unauthorized withdrawals, ensuring your finances stay secure.

- Chatbots analyze your behavior to suggest financial products tailored to your needs.

- They automate loan applications, cutting down processing time and boosting satisfaction.

- They monitor transactions in real-time, alerting you to potential fraud instantly.

With chatbots, you get more than just answers—you get solutions that are fast, accurate, and personalized. They’re transforming how you manage your finances, making it easier and safer than ever.

Improving Customer Retention Through Personalized Engagement

Keeping customers happy is key to building loyalty, and chatbots are experts at this. They use personalized interactions to make you feel valued and understood. By analyzing your behavior, chatbots offer recommendations that match your preferences, whether it’s a new financial product or a better way to save.

Here’s how chatbots enhance customer retention:

- They provide after-sales support and onboarding assistance, ensuring you start off on the right foot.

- They gather feedback through surveys and interactions, helping businesses improve their services.

- They use customer journey data to retarget and re-engage you with relevant offers.

Companies that invest in personalized and consistent support see higher customer satisfaction scores. Chatbots make this possible by delivering tailored experiences that keep you coming back. For instance, they can remind you about upcoming payments or suggest ways to optimize your budget.

💡 Tip: Chatbots like Sobot’s AI-powered solution excel at creating personalized engagement. They integrate seamlessly with customer engagement applications, ensuring you get the support you need when you need it.

Chatbots don’t just solve problems—they build relationships. By offering consistent and personalized interactions, they make you feel like more than just a number. This approach boosts loyalty and ensures you stick with the services that truly understand your needs.

Comparing Global, Regional, and Local Chatbot Providers

Strengths of Global Chatbot Providers

Global chatbot providers bring unmatched expertise and scalability to the table. These companies often lead the IT industry with advanced technologies like natural language processing (NLP) and machine learning. Their chatbots are designed to handle high volumes of queries while maintaining accuracy and efficiency. For instance, they excel in improving customer engagement, reducing costs, and offering 24/7 availability.

| Performance Indicator | Description |

|---|---|

| Improved Customer Engagement | Chatbots enhance interaction with customers, leading to better engagement and satisfaction. |

| Cost Savings | Automation through chatbots reduces operational costs for financial services. |

| 24/7 Availability | Chatbots provide round-the-clock service, ensuring customer queries are addressed anytime. |

| Enhanced Data Analytics | They analyze customer data to identify preferences and behavior patterns for better service. |

| Scalability | Chatbots can easily scale to handle increased query volumes without additional resources. |

| Faster Response Times | Quick responses improve customer satisfaction and engagement. |

| Personalization | Tailored recommendations enhance the customer experience, making clients feel valued. |

| Improved Efficiency | Automating customer service allows human representatives to focus on complex queries. |

These providers also offer extensive integration capabilities, making it easier for financial institutions to connect chatbots with existing systems. This ensures a seamless experience for both businesses and customers. If you're looking for a solution that combines reliability, scalability, and cutting-edge technology, global providers are a strong choice.

Advantages of Regional Players in Southeast Asia

Regional chatbot providers in Southeast Asia bring a unique edge to the IT industry. They understand the local market better than global players, which allows them to offer solutions tailored to regional needs. For example, established financial services players in the region leverage their expertise and customer trust to deliver reliable chatbot solutions.

Here’s what makes regional players stand out:

- Established financial services players have broad expertise and customer trust but may lack flexibility.

- Established consumer players leverage large customer bases to expand into financial services.

- Pure-play fintechs offer competitive pricing and superior user experiences due to their flexible structures.

- Consumer technology platforms integrate financial services into existing offerings, enhancing user engagement.

These companies often focus on affordability and user experience, making their chatbots ideal for small to medium-sized businesses. If you're in Southeast Asia, regional providers can offer you a balance of quality and cost-effectiveness.

Unique Offerings of Local Malaysian Companies

Local Malaysian chatbot companies bring something special to the table. They focus on solving specific challenges faced by businesses in Malaysia, offering highly localized solutions. For example, Tesco's Talia chatbot reduced reliance on physical materials by providing a digital catalog, achieving a 54% engagement rate via Messenger. Similarly, a Malaysian general insurance company implemented an AI chatbot on Facebook Messenger, leading to a fivefold increase in visitor-to-lead conversion rates.

Here’s why local providers shine:

- Tesco's Talia Chatbot: Reduced physical material use and achieved an 85% inquiry handling rate.

- Malaysian General Insurance Company: Enhanced lead conversion with a 5x increase in visitor-to-lead ratios.

Local providers also excel in understanding cultural nuances and language preferences, making their chatbots more relatable and effective. If you're a business in Malaysia, these companies can offer you solutions that truly resonate with your audience.

Future Trends in Chatbots for Finance in Malaysia

AI-Powered Conversational Interfaces

Imagine chatting with a financial assistant that understands your needs instantly. AI-powered conversational interfaces are making this a reality. These advanced chatbots use natural language processing to understand your questions and provide accurate answers. They don’t just respond—they engage in meaningful conversations, making your interactions feel more human.

Take a look at how global financial institutions are already leveraging this technology:

| Financial Institution | Implementation Description | Key Outcomes |

|---|---|---|

| JPMorgan Chase | COIN (Contract Intelligence) system reviews legal documents and extracts data points. | Saves 360,000 hours of manual work annually. |

| Bank of America | Virtual assistant Erica serves users and handles client requests. | Over 19.5 million users and 100 million requests. |

| USAA | Conversational AI system provides personalized financial guidance. | Achieved a 10-point increase in Net Promoter Score. |

| Capital One | Eno text-based assistant helps track unusual charges and manage account security. | Enhances customer interaction through natural language. |

In Malaysia, the demand for conversational AI solutions is growing rapidly. A report by Accenture reveals that 70% of financial services executives in the country see AI and virtual assistants as the future of customer service. With tools like Sobot’s chatbot, you can experience seamless, personalized interactions across platforms like WhatsApp and SMS. These solutions are not just about convenience—they’re about transforming how you manage your finances.

Integration with Blockchain for Secure Transactions

Security is a top priority in finance, and blockchain technology is taking it to the next level. When combined with chatbots, blockchain ensures your financial transactions are secure and transparent. Every interaction is recorded on an immutable ledger, giving you a clear audit trail and peace of mind.

Here’s how blockchain enhances chatbot functionality:

| Benefit | Description |

|---|---|

| Secure Data Handling | Blockchain ensures that data exchanged during interactions is securely stored and protected. |

| Transparent Transactions | All interactions are recorded on the blockchain, providing a clear audit trail. |

| Enhanced User Trust | The immutability of blockchain builds trust as users can be confident their data is secure. |

Malaysia’s move toward digital banking aligns perfectly with this trend. The central bank’s issuance of digital banking licenses to five consortiums highlights the shift toward secure, online financial services. By integrating blockchain with chatbots, financial institutions can offer you a safer and more reliable way to manage your money.

Multilingual Support for Malaysia's Diverse Population

Malaysia’s rich cultural diversity makes multilingual support essential for financial services. Chatbots that can communicate in Malay, English, Mandarin, and other languages ensure everyone feels included. This isn’t just about convenience—it’s about creating a more inclusive financial ecosystem.

Here’s why multilingual support matters:

- Malaysia’s main languages include Malay, English, and Mandarin, reflecting its linguistic diversity.

- The country’s multicultural society includes Malays, Chinese, Indians, and indigenous groups, each with unique preferences.

- A majority of Malaysians express a desire for increased linguistic diversity in services.

Sobot’s chatbot excels in this area. Its multilingual capabilities allow you to interact in your preferred language, making financial services more accessible. Whether you’re applying for a loan or seeking investment advice, these chatbots ensure you get the support you need in a language you understand.

💡 Tip: Multilingual chatbots don’t just improve communication—they build trust and loyalty by showing that your needs matter.

Predictive Analytics for Financial Planning

Imagine having a financial assistant that not only answers your questions but also predicts your future financial needs. That’s the power of predictive analytics in chatbots. These tools analyze your spending habits, income, and savings to give you insights that help you plan better. Whether you’re saving for a house or managing monthly expenses, predictive analytics makes it easier to stay on track.

Chatbots use advanced AI models to forecast trends and offer personalized advice. For instance, they can analyze historical market data to predict asset prices or help you create a tailored investment plan. Here’s a quick look at how predictive analytics is transforming financial planning:

| Application Type | Description |

|---|---|

| Predictive Analytics for Investment | AI models analyze historical market data to forecast future trends and asset prices. |

| Financial Forecasting | AI provides insights for better budgeting, investments, and risk management. |

| Personalized Financial Advice | Robo-advisors create tailored investment plans based on individual financial information and goals. |

| Predictive Analytics for Strategic Planning | Regression models predict future cash flows based on past data, aiding in financial position forecasting. |

These features make chatbots more than just tools—they become your financial partners. They don’t just tell you what’s happening now; they help you prepare for what’s next. With predictive analytics, you can make smarter decisions and feel more confident about your financial future.

Voice-Activated Chatbots for Enhanced Accessibility

Have you ever wished you could manage your finances without lifting a finger? Voice-activated chatbots make that possible. They let you interact hands-free, which is perfect when typing isn’t an option. Whether you’re driving or multitasking, these chatbots ensure you stay connected to your financial goals.

Voice recognition technology has made chatbots more accessible and user-friendly. It’s no wonder that 93% of consumers report satisfaction with their voice assistants, with 50% saying they’re very satisfied. These tools are also becoming more common in business settings. In fact, 72% of U.S. consumers have used voice interfaces for business interactions, and the number of voice-enabled devices is expected to hit 8.4 billion by 2024.

Here’s why voice-activated chatbots are game-changers:

- They allow hands-free interactions, making them ideal for busy or physically challenged users.

- They provide instant responses, improving user engagement and satisfaction.

- They make financial services more inclusive by catering to diverse needs.

With voice-activated chatbots, managing your finances becomes effortless. You can check your account balance, set savings goals, or even get investment advice—all through simple voice commands. These tools are paving the way for a more accessible and convenient financial future.

Chatbots are transforming Malaysia’s finance sector, making it more efficient and customer-focused. They handle routine tasks, provide personalized advice, and even help detect fraud. Companies like Sobot are leading this change with innovative solutions that improve customer satisfaction and streamline operations. Whether you’re a bank or a fintech startup, exploring chatbot technology could be the key to staying ahead. Why not take the first step toward smarter financial interactions today?

FAQ

What is a chatbot, and how does it work?

A chatbot is a software program that interacts with you through text or voice. It uses artificial intelligence (AI) to understand your questions and provide helpful answers. Think of it as a virtual assistant that’s always ready to help.

Can chatbots handle complex financial tasks?

Yes, they can! Chatbots analyze your financial data to assist with tasks like budgeting, loan applications, and even investment advice. They simplify complex processes, making them easier for you to understand and manage.

Are chatbots secure for financial transactions?

Absolutely! Chatbots use advanced encryption and security protocols to protect your data. Many also integrate with technologies like blockchain, ensuring your financial information stays safe and private.

Do I need coding skills to set up a chatbot for my business?

Not at all! Many chatbot platforms, like Sobot, offer user-friendly interfaces. You can design and deploy workflows with simple point-and-click tools—no coding required.

How do chatbots improve customer satisfaction?

Chatbots provide instant responses, personalized advice, and 24/7 availability. They reduce wait times and make interactions more engaging. By solving problems quickly and efficiently, they leave customers feeling valued and satisfied.

💡 Tip: If you’re considering a chatbot for your business, look for one with multilingual support and omnichannel capabilities to connect with more customers.

See Also

10 Leading Websites Utilizing Chatbots This Year

10 Most Effective Chatbots for Websites This Year

Simple Steps to Integrate Chatbots on Your Website