Top Insurance Chatbot Examples Compared for 2025

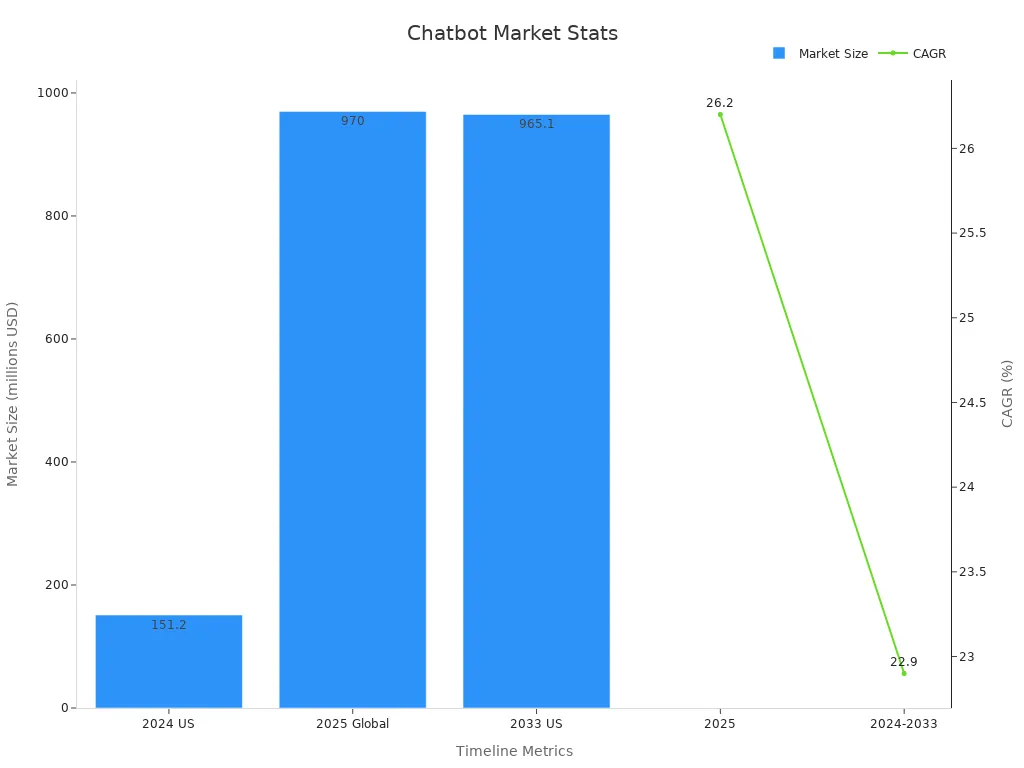

Sobot, along with top insurance chatbot examples like LivePerson, Aivo, and Kommunicate, leads the way in 2025 insurance solutions. Insurance chatbot adoption grows fast, with AI chatbots set to automate up to 30% of contact center tasks and save $23 billion in the USA by 2025. Features like omnichannel support, multilingual options, and automation help insurance agents deliver better customer experience and engagement. Performance, features, and value matter most for insurance chatbot selection. Customers now expect instant service, and chatbots like Sobot AI transform customer support for insurance agents.

Insurance Chatbot Use Cases Description Claim processing Assists clients in filing claims and tracking progress, ensuring proper documentation. Lead conversion Provides relevant quotes and information to facilitate purchases. Customer awareness and training Educates clients on services and guides actions like filing claims or purchasing policies.

Comparison Table

Key Features

Insurance chatbot solutions in 2025 offer a wide range of features that drive value for customer support teams. Sobot Chatbot stands out with AI-powered automation, omnichannel support, and multilingual capabilities. These features help insurance agents handle claims, answer questions, and guide customers through policy options. Other leading platforms also provide 24/7 customer support, automated claim processing, and real-time chat handoff to human agents. Advanced features like fraud detection, predictive analytics, and compliance checks ensure secure and efficient service.

Feature Sobot Chatbot LivePerson Aivo Kommunicate 24/7 Customer Support ✅ ✅ ✅ ✅ Omnichannel Support ✅ ✅ ✅ ✅ Multilingual ✅ ✅ ✅ ✅ Automated Claims ✅ ✅ ✅ ✅ AI Knowledge Base ✅ ✅ ✅ ✅ Compliance Tools ✅ ✅ ✅ ✅ Customizable Workflows ✅ ✅ ✅ ✅

Integrations

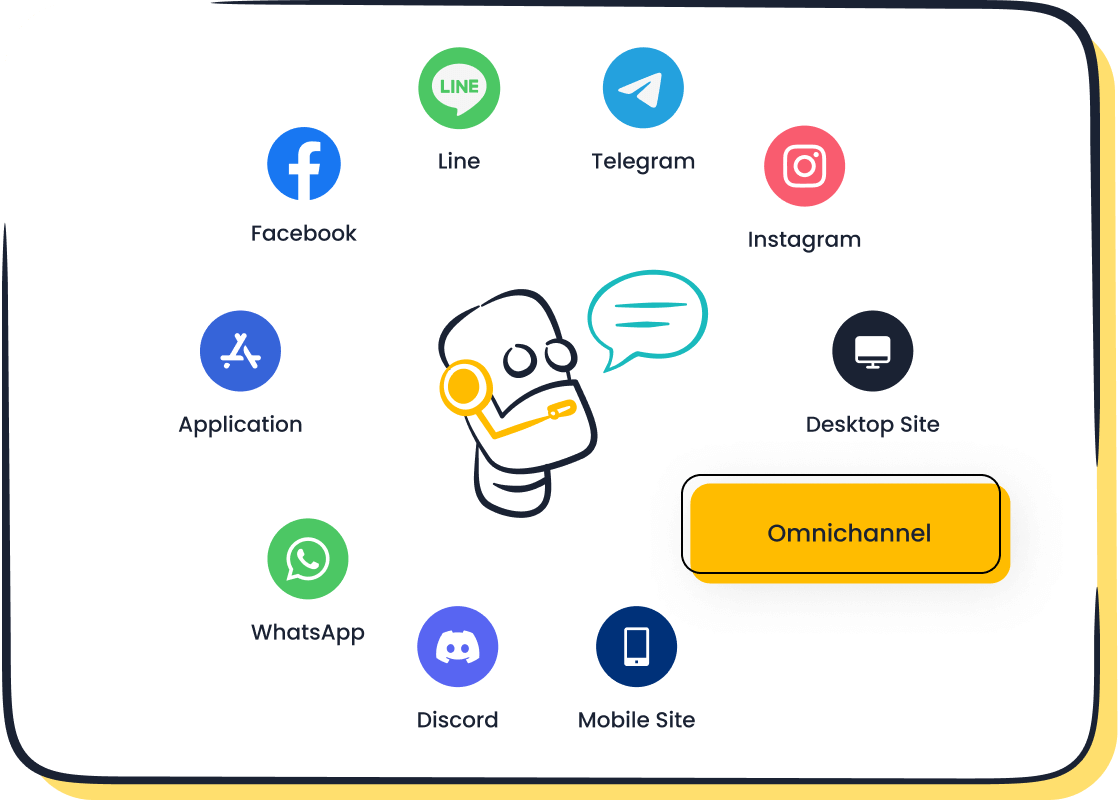

Third-party integrations play a key role in insurance chatbot performance. Sobot Chatbot connects with CRM systems, WhatsApp, SMS, and other customer-preferred channels. These integrations help agents access real-time data, automate workflows, and deliver seamless customer experiences. Platforms that support third-party integrations with analytics, document management, and cloud services enable faster claims and better customer support. Integrations with AI tools also improve fraud detection and policy recommendations.

Pricing

Pricing for insurance chatbot platforms varies by features, usage, and customization. Sobot Chatbot offers flexible plans tailored to business size and needs. Many providers use subscription models, pay-as-you-go, or enterprise pricing. Transparent pricing helps insurers plan budgets, while volume discounts and custom packages support scalability. For example, some platforms start with free tiers and scale up to enterprise solutions with advanced features and integrations.

Platform Pricing Model Transparency Customization Sobot Chatbot Tiered/Custom High High LivePerson Subscription/Custom Medium High Aivo Subscription Medium Medium Kommunicate Free/Paid Tiers High Medium

User Ratings

User ratings reflect satisfaction with chatbot features, customer support, and ease of use. Most insurance chatbot examples receive scores based on surveys, CSAT, and NPS. Sobot Chatbot earns high marks for reliability, multilingual support, and cost savings. Customers value fast response times, simple setup, and effective third-party integrations. Metrics like first contact resolution and average handling time show how chatbots improve customer experience and retention.

- Customer Satisfaction Score (CSAT) and Net Promoter Score (NPS) measure loyalty and happiness.

- Qualitative reviews highlight ease of use and strong customer support.

- Business KPIs such as conversion rate and retention rate show real impact.

Evaluation Criteria

Selecting the right insurance chatbot requires a careful look at several core criteria. These factors ensure that insurers deliver a consistent customer experience, maintain high performance, and achieve operational efficiency.

AI Capabilities

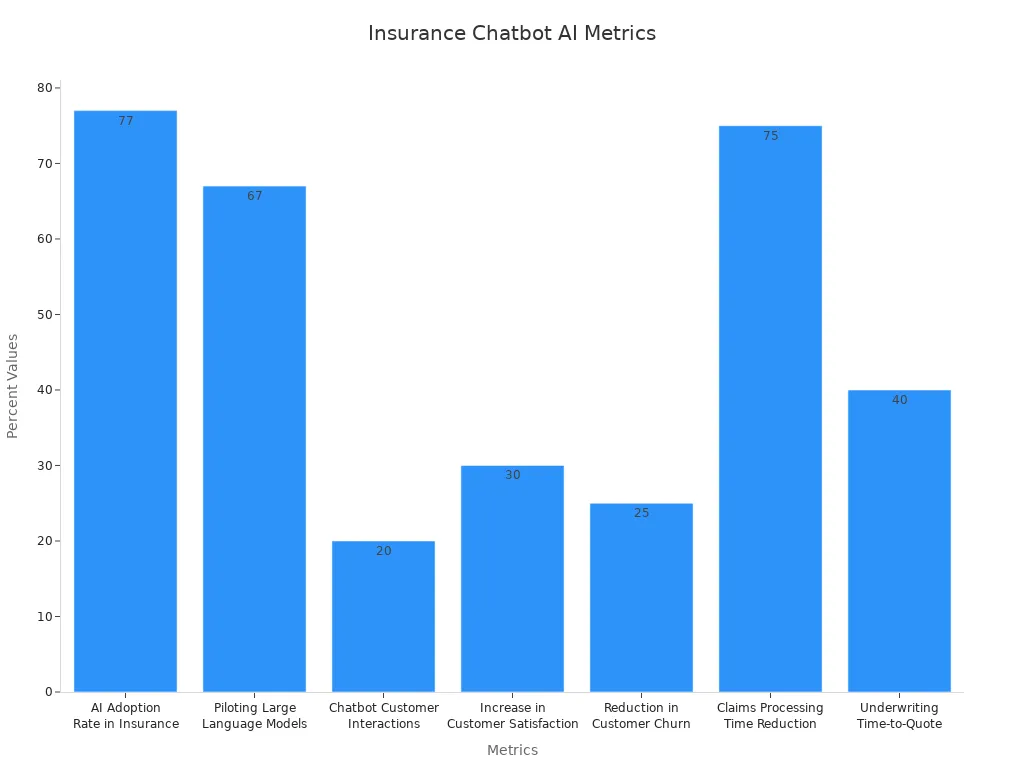

AI chatbots now drive most customer interactions in insurance. Research shows that 77% of insurers have adopted AI, with 67% piloting large language models for advanced ai responses and natural language processing. These chatbots handle 20% of all customer interactions, leading to a 30% increase in customer satisfaction and a 25% reduction in churn. Sobot leverages AI to automate workflow automation, provide insightful analytics, and deliver accurate responses across channels.

Compliance & Security

Insurance chatbot solutions must protect client data security and meet strict compliance standards. Benchmarks focus on reliability, robustness, and ethical compliance. Testing with thousands of real-world scenarios ensures chatbots respond safely to sensitive queries. Regular assessments and user feedback drive continuous improvement. Sobot’s platform supports secure data handling and compliance with industry regulations, helping insurers build trust with customers.

- Reliability and robustness in responses

- Bias detection and ethical safeguards

- Ongoing compliance reviews

Customer Experience

A chatbot must deliver a seamless and consistent customer experience. Case studies from Europe and the US show that ai chatbots provide 24/7 support, reduce response times, and cut operational costs. For example, insurers like Alm. Brand Group and Aspire General Insurance Services use chatbots to guide customers during crises and automate claims. Sobot’s omnichannel and multilingual features ensure customers receive timely help in their preferred language, improving satisfaction and retention.

Scalability

Scalability ensures chatbot performance during peak loads, such as policy renewals or disaster claims. Modern chatbots use cloud-native technologies and microservices to remain resilient and responsive. Platforms like Sobot undergo rigorous stress testing and real-time monitoring, maintaining service quality even during traffic surges. This approach protects both customer experience and revenue.

Support & Pricing

Support and pricing models shape the overall value of an insurance chatbot. AI chatbots offer immediate responses and proactive engagement, while dynamic pricing models adjust to customer needs. Sobot provides flexible plans, automation tools, and performance tracking and analytics, helping insurers optimize costs and improve service. Usage-based pricing and personalized engagement further enhance the value proposition.

When evaluating insurance chatbot solutions, insurers should prioritize omnichannel support, multilingual capabilities, and automation. These features empower agents to deliver efficient, high-quality service across every customer touchpoint.

Insurance Chatbot Examples

Sobot Chatbot Overview

Sobot Chatbot stands out among insurance chatbot examples for its advanced AI, omnichannel support, and multilingual capabilities. Sobot helps insurance companies automate customer support, handle claims, and guide users through insurance-specific conversation flows. The chatbot operates 24/7, providing round-the-clock availability and instant response times. Sobot integrates with WhatsApp, SMS, and CRM systems, making it easy for agents to access customer data and automate workflows.

Key Features:

- AI-powered automation for routine queries and claims

- Omnichannel support across chat, voice, and messaging apps

- Multilingual support for global customer bases

- No-code setup with customizable workflows

- Real-time analytics and reporting

Integrations:

Sobot connects with popular CRM platforms, WhatsApp Business API, and ticketing systems. This ensures seamless customer engagement and a reduced workload for agents.

Pros:

- High efficiency and cost savings

- Easy deployment and customization

- Secure and compliant with industry standards

Cons:

- Advanced features may require training for optimal use

Ideal Use Cases:

- Automating claims processing

- Lead conversion

- Customer support for policy inquiries

Real-World Results:

Sobot’s clients report up to 70% productivity improvement and 50% cost reduction. The chatbot helps businesses gain 30% more leads and boosts conversions by 20%. Companies like Samsung and Luckin Coffee trust Sobot for reliable customer engagement.

Sobot’s AI chatbot can handle up to 80% of routine customer inquiries, reducing service costs by 30-40% and improving operational performance. Learn more

LivePerson Overview

LivePerson offers a robust insurance chatbot that focuses on conversational AI and customer engagement. The platform supports automated claims, policy management, and real-time chat handoff to human agents.

Key Features:

- AI-driven conversations

- Omnichannel messaging

- Automated claims and policy updates

Integrations:

LivePerson connects with CRM, analytics, and messaging platforms.

Pros:

- Strong conversational AI

- Flexible integrations

Cons:

- Customization may require technical expertise

Ideal Use Cases:

- Customer support for insurance policies

- Automated claims assistance

Real-World Results:

Insurance providers using LivePerson report faster response times and improved customer satisfaction.

Aivo Overview

Aivo delivers an insurance chatbot designed for instant response times and seamless customer support. The platform uses AI to automate claims, answer policy questions, and provide personalized recommendations.

Key Features:

- AI-powered chat and voice support

- Multilingual capabilities

- Automated claims processing

Integrations:

Aivo integrates with CRM, WhatsApp, and analytics tools.

Pros:

- Fast deployment

- Multilingual support

Cons:

- Some advanced features may require additional setup

Ideal Use Cases:

- Handling high volumes of customer inquiries

- Multilingual customer support

Real-World Results:

Aivo’s chatbot helps insurers reduce customer service costs and improve engagement rates.

Kommunicate Overview

Kommunicate provides an insurance chatbot solution focused on automation and easy integration. The platform supports insurance-specific conversation flows and offers a user-friendly interface.

Key Features:

- Automated customer support

- Omnichannel messaging

- Customizable workflows

Integrations:

Kommunicate connects with popular messaging apps and CRM systems.

Pros:

- Simple setup

- Good for small to medium insurers

Cons:

- Limited advanced analytics

Ideal Use Cases:

- Basic claims support

- Customer onboarding

Real-World Results:

Kommunicate users report improved customer engagement and reduced workload for agents.

GEICO Mobile Virtual Assistant

GEICO’s Mobile Virtual Assistant is a well-known insurance chatbot example. It helps customers manage policies, file claims, and get quotes directly from the mobile app.

Key Features:

- Policy management

- Claims filing

- 24/7 customer support

Integrations:

Integrated within GEICO’s mobile ecosystem.

Pros:

- Easy access for customers

- Fast claim updates

Cons:

- Limited to GEICO customers

Ideal Use Cases:

- Mobile-first customer support

- Instant policy updates

Real-World Results:

GEICO’s chatbot improves customer satisfaction and speeds up claims processing.

Zurich Zuri

Zurich Insurance’s Zuri chatbot delivers automated customer support and claims assistance. Zuri uses AI to answer questions and guide customers through insurance processes.

Key Features:

- Automated claims support

- Policy information

- Multilingual chat

Integrations:

Connects with Zurich’s digital platforms.

Pros:

- Multilingual support

- Personalized responses

Cons:

- Limited to Zurich’s services

Ideal Use Cases:

- Claims guidance

- Policy information

Real-World Results:

Zurich reports higher customer engagement and faster resolution times.

Allstate ABIE

Allstate’s ABIE chatbot provides automated support for policyholders. ABIE answers questions, helps with claims, and offers policy details.

Key Features:

- Automated Q&A

- Claims assistance

- Policy management

Integrations:

Works within Allstate’s digital channels.

Pros:

- Quick answers

- Reduces call center volume

Cons:

- Only for Allstate customers

Ideal Use Cases:

- Routine customer inquiries

- Claims status updates

Real-World Results:

Allstate has seen improved customer support efficiency and higher satisfaction scores.

Progressive Flo

Progressive’s Flo chatbot offers instant help with quotes, claims, and policy questions. Flo uses AI to deliver personalized customer support.

Key Features:

- Quote generation

- Claims tracking

- 24/7 support

Integrations:

Available on Progressive’s website and app.

Pros:

- Fast, friendly responses

- Easy to use

Cons:

- Limited to Progressive products

Ideal Use Cases:

- Quote assistance

- Claims tracking

Real-World Results:

Flo helps Progressive maintain high customer satisfaction and quick response times.

A case study from AIMultiple shows that insurance chatbot examples can achieve a 90% success rate in assisting clients with claims and converting leads. Automation of routine inquiries allows agents to focus on complex sales, improving efficiency and engagement. Source

Research published in Nature highlights that chatbots handle up to 80% of routine customer inquiries, reducing service costs by 30-40%. Over 3 billion users interact with chatbots monthly, showing their impact on customer support and engagement. Source

Head-to-Head Analysis

AI & Automation

Sobot Chatbot leverages advanced AI to automate routine insurance tasks, including automated lead qualification and customer query handling. This approach boosts agent productivity and ensures higher conversion rates. Many insurers, such as Zurich and Allianz, have seen up to a 70% reduction in manual data entry time and a 50% drop in operational costs by using AI-powered chatbots. These solutions also improve fraud detection and deliver 24/7 support, which increases customer satisfaction and retention.

- Zurich Insurance reduced manual labor by 30% through AI automation.

- Lemonade’s AI chatbot can settle claims in three seconds, showing the speed of modern solutions.

- AI chatbots automate tasks like FNOL, triage, and claims status updates, leading to increased efficiency and improved qualification of customer needs.

Claims Processing

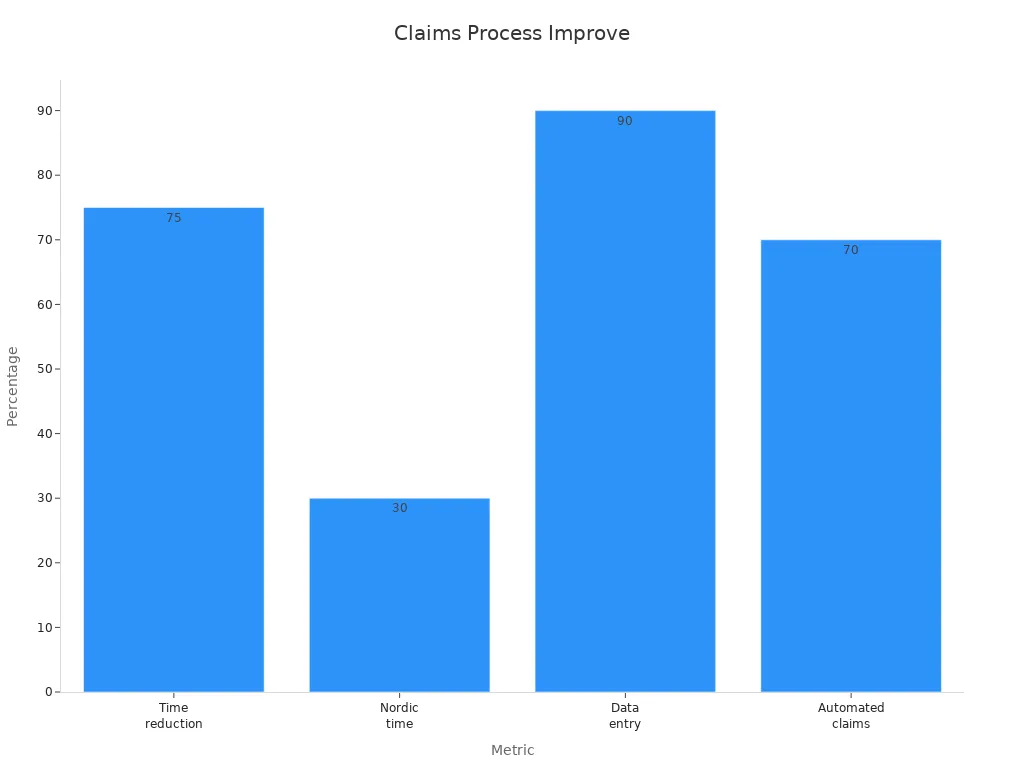

Insurance chatbots now process claims much faster than traditional methods. Sobot Chatbot enables real-time claims updates and document submission, which streamlines the entire process. The following table highlights improvements across the industry:

| Metric / Case Study | Improvement / Result |

|---|---|

| Claims processing speed | 2x faster than traditional methods |

| Fraud detection accuracy | 99.9% accurate claim decisions |

| Operational cost reduction | 20-40% reduction |

| Allianz claim handling time | Reduced by 30 minutes per claim |

| TrueLayer chatbot query handling | 82% of customer queries handled autonomously |

| Customer satisfaction boost | Up to 90% increase |

| Manual data entry errors | Reduced by up to 90% |

Multilingual Support

Sobot Chatbot provides multilingual support, allowing insurance companies to serve customers in their preferred language. This feature removes language barriers and ensures 24/7 service across digital channels. Industry research shows that multilingual chatbots improve customer experience, increase response rates, and help insurers deliver scalable, individualized service. During high-demand periods, such as the Covid-19 pandemic, this capability proved essential for maintaining customer satisfaction and qualification of diverse leads.

Ease of Deployment

Sobot Chatbot offers a no-code setup and seamless integration with CRM systems, making deployment simple and fast. Many insurers report sub-second response times and 99.9% system uptime. For example, Pier Insurance processes claims in under 30 seconds, and Metromile’s digital platform allows customers to file claims directly through the app. These features reduce human error, lower costs, and improve agent productivity, supporting rapid qualification and conversion of customer inquiries.

Customization & ROI

Customization drives strong ROI for insurance chatbots. Sobot Chatbot enables personalized workflows, automated lead qualification, and tailored policy recommendations. Industry data shows that chatbots contributed to over $8 billion in cost savings in 2022 by automating customer interactions. Companies report up to 30% reduction in support expenses and 80% consumer satisfaction. Chatbots also enhance conversion by simplifying claims, onboarding, and payment collection, while predictive analytics improve qualification and lead generation.

Decision Guide for Insurance Agents

Best for Large Insurers

Large insurers need a chatbot for insurance agents that can handle thousands of interactions at once. Sobot Chatbot delivers 24/7 support, instant responses, and seamless integration with CRM and claims systems. AI-driven chatbots like Sobot automate claims validation, reduce errors, and speed up processing. For example, MetLife improved first-call resolution by 3.5% and increased customer satisfaction by 13% after deploying an AI chatbot. Sobot’s scalability and compliance features help large insurers manage high claim volumes, improve data accuracy, and reduce operational costs. These capabilities lead to improved client retention and higher conversion rates.

Tip: Choose a solution that supports seamless escalation to human agents, as 60% of customers value easy hand-offs.

Best for Startups

Startups benefit from chatbots that offer fast deployment, easy customization, and cost efficiency. Sobot Chatbot provides a no-code setup and flexible workflows, making it ideal for emerging insurance companies. Startups using chatbots report double-digit productivity gains and CSAT scores above 85%. Sobot’s AI detects customer intent, collects feedback, and routes queries to the right agent, supporting rapid growth and efficient service. The chatbot’s scalability allows startups to handle more customers without increasing costs, driving better conversion and customer satisfaction.

| Capability | Startup Benefit |

|---|---|

| 24/7 Support | Always-on customer engagement |

| Ticket Deflection | Lower support costs |

| Sales Enablement | Higher conversion rates |

Best for Customer Service

For customer service excellence, Sobot Chatbot stands out with high intent recognition accuracy and fast response times. Leading AI chatbots achieve over 90% accuracy in understanding customer needs. Sobot’s omnichannel and multilingual support ensures customers get help in their preferred language, improving satisfaction. Metrics like first-contact resolution above 80% and CSAT scores over 4.2/5 show that Sobot enhances user experience and supports improved client retention.

Customer service teams should monitor performance metrics and gather feedback to keep improving chatbot effectiveness.

Best Value

Sobot Chatbot offers strong value through cost savings, increased efficiency, and higher conversion. The platform automates routine tasks, provides 24/7 service, and reduces the need for large support teams. Market trends show that AI-driven chatbots help insurers cut costs, boost operational efficiency, and deliver personalized service. Sobot’s flexible pricing and robust features make it a top choice for insurers seeking maximum ROI.

Insurance chatbot examples like Sobot, LivePerson, and Aivo deliver real results for insurers. Sobot stands out for its AI, omnichannel support, and multilingual features, making it ideal for large insurers and startups. Insurance chatbot examples improve claims speed by up to 2x and cut costs by 30% (source).

Insurance professionals should match insurance chatbot examples to business needs for the best results. Use this guide to select the right insurance chatbot examples for agents and customer support in 2025.

FAQ

What are the main benefits of using insurance chatbot examples?

Insurance chatbot examples help insurers automate claims, answer questions, and reduce costs. Sobot Chatbot users report up to 70% productivity improvement and 50% cost savings. These chatbots also boost customer satisfaction by providing 24/7 support and instant responses.

How do insurance chatbot examples improve claims processing?

Insurance chatbot examples speed up claims by automating document collection and status updates. For example, Sobot Chatbot enables real-time claims tracking, which can double processing speed and reduce manual errors by up to 90%. This leads to faster payouts and happier customers.

Can insurance chatbot examples support multiple languages?

Yes, many insurance chatbot examples, including Sobot Chatbot, offer multilingual support. This feature allows insurers to serve diverse customer bases and improve accessibility. Multilingual chatbots help companies reach more clients and deliver consistent service worldwide.

Are insurance chatbot examples secure and compliant?

Most insurance chatbot examples follow strict security and compliance standards. Sobot Chatbot ensures data protection and meets industry regulations. Regular audits and secure integrations help insurers maintain customer trust and avoid compliance risks.

How easy is it to deploy insurance chatbot examples like Sobot?

Sobot Chatbot features a no-code setup and seamless integration with CRM systems. Insurance chatbot examples like Sobot can be deployed quickly, often within days. This ease of deployment helps insurers start automating customer service without technical barriers.

For more details on Sobot Chatbot’s features and deployment, visit the official website.

See Also

Best Website Chatbots To Use In The Year 2024

Leading Websites Featuring Chatbots Throughout 2024

Simple Steps To Add Chatbot Examples On Websites