Top Features That Define Digital Banking Customer Experience

A great digital banking customer experience puts your needs first with seamless, secure, and personalized service. You expect fast account setup, strong security, intuitive apps, and real-time updates. Leading banks use must-have features like AI-driven chatbots, omnichannel access, and personal finance tools to meet rising customer expectations and boost customer engagement. Sobot AI stands out by helping banks deliver these services efficiently. Recent studies show that 70% of customers want seamless experiences across channels, and 72% value personalization in their banking customer experience.

Onboarding

A frictionless onboarding process sets the tone for your entire digital banking journey. When you sign up for a new bank account, you want the experience to be quick, easy, and secure. Banks that deliver a smooth onboarding process see higher customer satisfaction and loyalty. Studies show that up to 60% of customers abandon the process if it feels too complex or slow. In fact, a McKinsey study found that every one-point increase in onboarding satisfaction can boost customer revenue by 3%. If a bank acquires $500 million in new customers, that’s $15 million more in annual revenue. You can see why banks invest in making onboarding as seamless as possible.

Fast Account Setup

You expect to open an account in minutes, not days. Fast account opening means you can start using your new bank right away. Banks track several key metrics to measure how well they deliver on this promise:

| Performance Metric | Description / Benefit |

|---|---|

| Conversion Rates | More customers complete the account opening process when it is fast and simple. |

| Abandonment Rates | Fewer people drop out when the steps are clear and quick. |

| Completion Times | Shorter times mean you get access to your account sooner. |

| Customer Satisfaction (CSAT) | Higher scores reflect a better experience. |

| Customer Acquisition Cost (CAC) | Lower costs come from faster onboarding. |

Sobot’s financial solution helps banks automate and speed up account opening, reducing drop-offs and improving satisfaction. With Sobot, you can enjoy a streamlined process that gets you banking faster.

Seamless KYC

Know Your Customer (KYC) checks are essential for security, but they should not slow you down. Modern banks use digital KYC to verify your identity quickly and safely. eKYC can cut onboarding times by up to 90%, turning days into minutes. Some banks now verify identities in under 15 seconds, thanks to AI and machine learning. This not only saves time but also lowers costs by up to 80%. Sobot’s platform supports seamless KYC integration, so you can complete your account opening without hassle. When banks make KYC easy, you get a better experience and are more likely to stay loyal.

Security

Security stands at the heart of a great banking customer experience. You want to know your money and personal information are safe every time you use digital banking. Banks now use advanced security tools to protect you from threats and build your trust.

Fraud Detection

You face many risks online, but banks work hard to keep your accounts safe. They use real-time fraud detection, biometric authentication, and encryption to spot and stop threats fast. Over 60% of banking CEOs worry about AI-related security issues, so banks invest in the latest technology to protect you. These steps help you feel safe when you transfer money or check your balance.

- 86% of people worry about data privacy.

- 68% feel uneasy about how much data businesses collect.

- 40% do not trust companies to use their data the right way.

- 30% will not share personal data for any reason.

Banks must show you they take security seriously. Sobot helps banks by offering secure communication and compliance with strict rules. With Sobot, banks can use encrypted channels and follow laws like GDPR and CCPA. This keeps your information safe and builds trust in your banking customer experience.

Privacy Protection

You want to know your bank will not misuse your personal data. Trust grows when you see your bank as honest and careful with your information. Research shows that trust in digital banking comes from how competent, honest, and caring a bank seems. If you trust your bank, you are more willing to use digital services and share information.

Banks that protect your privacy win your loyalty. Sobot’s platform supports privacy by design, making sure your data stays safe at every step. When you see strong privacy measures, you feel confident using digital banking. This trust leads to higher satisfaction and a better banking customer experience.

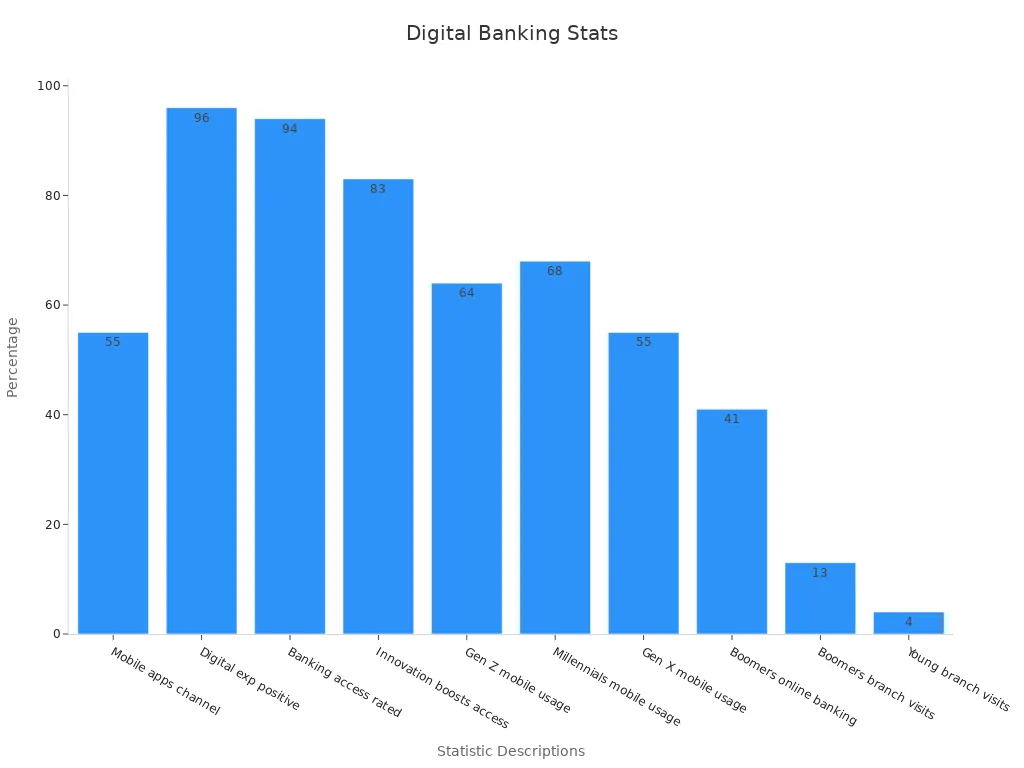

Mobile App

Mobile banking apps have changed how you manage your money. You can check your balance, pay bills, and transfer funds anytime. These apps play a big role in shaping your customer experience. Studies show that 97% of millennials and 89% of all consumers rely on mobile banking apps. About 60% of millennials use mobile banking apps as their main way to handle finances. This shift means banks must focus on making their apps easy to use and accessible everywhere.

Intuitive Design

You want a mobile banking app that feels simple and clear. If you get confused or frustrated, you might stop using it. Good design helps you find what you need fast. Here are some key features that make an app intuitive:

- Simplicity and clarity: Easy menus and clear icons help you avoid mistakes.

- Personalization: The app remembers your preferences and shows you what matters most.

- Security: You see clear signs that your information is safe.

A well-designed mobile banking app can boost customer satisfaction by 21% compared to branch banking. Personalization in these apps can also increase revenue growth by up to 15%. Source

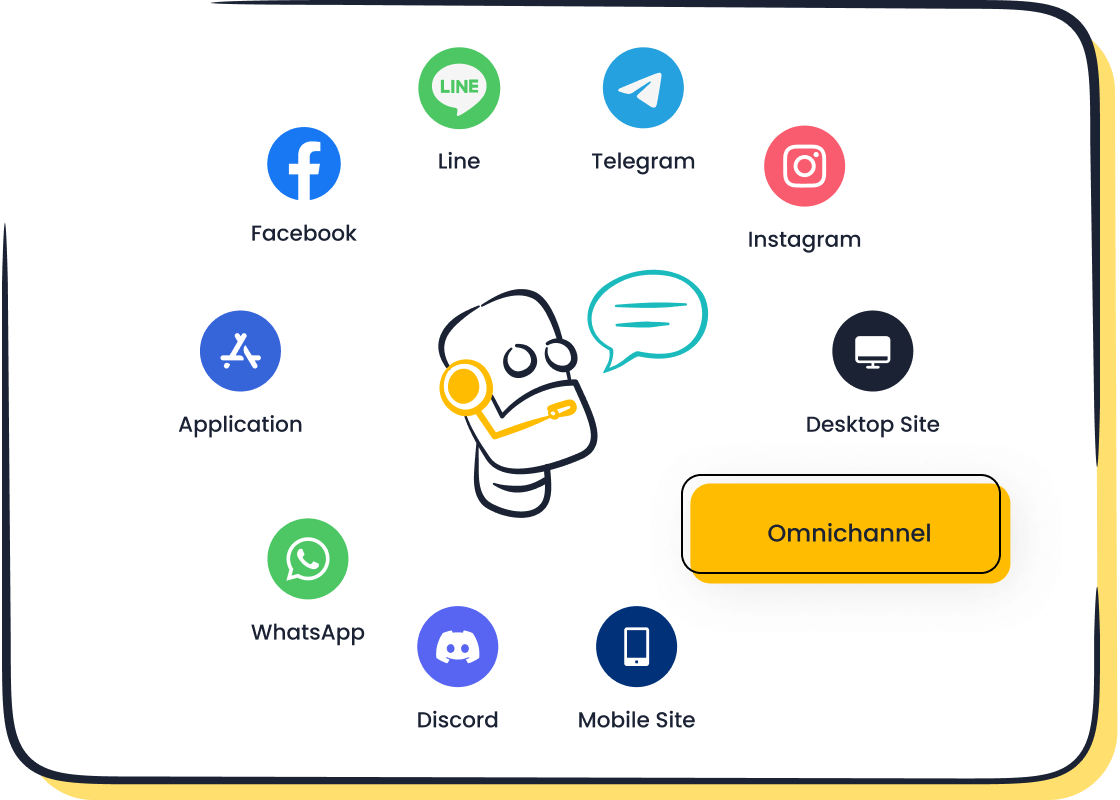

Omnichannel Access

You expect your mobile banking experience to be smooth, whether you use your phone, tablet, or computer. Omnichannel access means you can start a task on one device and finish it on another without losing progress. Research shows that omnichannel strategies centered on mobile banking apps help banks keep up to 89% of their clients.

Sobot’s omnichannel platform gives you a unified workspace. You can get support, ask questions, or manage your account across chat, email, and even WhatsApp—all from your mobile banking app. This seamless experience removes friction and keeps you engaged.

- 40% of global banking transactions now happen on mobile devices.

- After COVID-19, mobile banking apps saw interaction rates as high as 94%.

When banks use tools like Sobot, you get a consistent, reliable, and secure customer experience every time you log in.

Notifications

Staying informed is a key part of a great digital banking customer experience. You want to know what happens with your money right away. Banks use notifications to keep you updated and engaged. These alerts help you feel in control and build trust in your digital banking customer experience.

Real-Time Alerts

You expect to get instant updates when something important happens in your account. Real-time alerts tell you about deposits, withdrawals, suspicious activity, or bill payments. These notifications help you spot problems fast and keep your money safe. When you receive a real-time alert, you can act quickly if something looks wrong.

Real-time alerts improve your digital banking customer experience by giving you peace of mind. You know your bank is watching out for you.

Sobot’s omnichannel platform lets banks send secure, instant alerts across channels like SMS, email, and WhatsApp. This keeps you connected wherever you are. Banks that use real-time notifications see higher customer satisfaction and lower fraud rates.

Personal Updates

Personal updates make your digital banking customer experience feel unique. You get messages about spending habits, savings goals, or special offers tailored just for you. Personalization increases how often you open and react to notifications.

- Personalized push notifications have four times higher reaction rates than generic ones.

- Basic personalization increases open rates by about 9%.

- Rich push notifications with images or emojis can boost click rates by up to 70%.

- Advanced targeting based on your behavior or location can triple retention rates.

- Customer segmentation in mobile campaigns leads to 50% higher click-through rates and 39% better retention.

Sobot helps banks deliver these personal updates using AI and customer segmentation. You receive the right message at the right time, which makes your digital banking customer experience more engaging and rewarding. For more on how personalization drives results, see this report.

Personal Finance

Managing your money well starts with the right tools. Digital banking now gives you access to features that help you track spending, set goals, and make smarter choices. You want your bank to offer solutions that match your needs and help you build better habits.

Budget Tools

Budgeting tools in digital banking apps help you plan and control your finances. You can set spending limits, track bills, and see where your money goes. Many people find these tools helpful for building good money habits.

| Evidence Aspect | Details |

|---|---|

| Usage Rates | 20.9% of people use budgeting apps; 45.3% use some digital financial tool. |

| Engagement Frequency | Nearly 80% of budgeting app users check them at least weekly. |

| User-Reported Helpfulness | Most users say budgeting apps are "very helpful." |

| Key Features | Easy interfaces, expense tracking, goal setting, bill reminders. |

| Challenges | 55.9% struggle with overspending; others face irregular income or lack of knowledge. |

| Role in Financial Success | Budgeting apps help build habits but work best as part of a bigger plan. |

AI-powered tools, like those offered by Sobot, automate expense tracking and send reminders. These features make it easier for you to stick to your budget. Banks use performance metrics such as customer satisfaction scores and new customer acquisition to measure how well these tools work. Source

Spending Insights

Spending insights show you patterns in your purchases. You can see how much you spend on groceries, restaurants, or travel. This helps you make better decisions and adjust your habits.

- Over 11,000 people in the U.S. shared that more than half expect their finances to get worse next year.

- Nearly 50% have already cut back on non-essential shopping.

- About 30% plan to spend less on eating out and entertainment.

- Tools like SpendingPulse™ reveal that Saturday is the busiest shopping day, and spending peaks during holidays.

Banks use these insights to help you save money and avoid overspending. Sobot’s AI-driven solutions can analyze your spending and send you tips or alerts. This empowers you to make informed choices and reach your financial goals.

AI Support

AI support has become a game-changer in digital banking customer experience. You now expect fast answers, helpful advice, and support in your language, any time you need it. Banks use AI-powered chatbots to meet these needs and make your banking journey smoother.

Chatbot Assistance

Chatbots help you get answers quickly. You can ask about your balance, open an account, or block a lost card—all without waiting for a human agent. Sobot Chatbot stands out as a must-have tool for digital banking customer experience. It supports many languages, so you can chat in the language you prefer. The chatbot handles routine questions, saving you time and making banking easier.

Studies show that AI-based support increases customer satisfaction. In one study, customers rated their satisfaction at 4.03 out of 5 after using AI support. AI also speeds up transactions by about 25% and boosts engagement by 20%. Source

Banks track how well chatbots work by looking at two main things:

- Problem Resolution Rate: How many questions the chatbot solves without help.

- Customer Satisfaction Rate: How happy you feel after using the chatbot.

Sobot’s chatbot helps banks improve both. For example, Opay used Sobot’s omnichannel solution and saw customer satisfaction jump from 60% to 90%. The chatbot also helped cut costs and increased conversion rates by 17%. You get faster help, and banks work more efficiently.

24/7 Service

You want support any time, day or night. AI chatbots make this possible. With 24/7 service, you can reset your password, check your account, or get urgent help whenever you need it. This always-on support is key to a great digital banking customer experience.

| Operational Benefit | Description |

|---|---|

| 24/7 Customer Support | Chatbots answer questions any time, reducing wait times. |

| Instant Response | Quick help for urgent tasks like blocking a lost card. |

| Cost Savings | Banks save money by automating routine support. |

| Improved Customer Retention | Always-available help builds trust and loyalty. |

Sobot’s AI support gives you instant answers and keeps your banking safe and easy. Banks can serve customers across time zones and handle more requests without hiring extra staff. This leads to better customer engagement and a stronger digital banking customer experience.

Self-Service

Self-service features have changed how you interact with your bank. You can now manage your accounts and payments without visiting a branch. This shift gives you more control and saves you time. Banks also benefit because self-service reduces their workload and improves efficiency.

Account Management

You can handle most banking tasks on your own with digital account management. You open new accounts, update your details, and check your balance from your phone or computer. This remote access means you do not need to wait in line or fill out paper forms. Digital banking services let you manage your finances anytime, anywhere. This approach streamlines onboarding and reduces repeated data entry, making it easier for you to get started with a new bank.

Cloud-based banking platforms, like those supported by Sobot, help banks offer real-time account updates and faster service. These systems use APIs to connect different services, so you get a smooth experience. Banks can onboard new customers quickly and keep your information up to date. Self-service opportunities like these improve both your experience and the bank’s operations.

Self-service banking solutions, including ATMs and online platforms, help banks deliver consistent and secure service across all channels.

Automated Payments

Automated payments make it easy for you to pay bills, transfer money, or set up recurring payments. You do not have to remember due dates or worry about late fees. AI-powered systems now enable near-instant payments with just a few taps. Many banks use biometric authentication, so you can approve payments quickly and safely.

- 74% of U.S. consumers used faster payment services in the past year.

- Digital wallet use grew by 32% in 2023.

- Over half of consumers plan to use more automated payment options in the future.

AI also helps banks route payments efficiently and spot fraud in real time. Sobot’s omnichannel solutions support secure, automated transactions across chat, email, and mobile apps. You get reliable service, and banks reduce errors and costs.

Automated self-service features help you save time and make banking easier. Banks see fewer mistakes and faster transactions.

Personalization

Personalization in digital banking means you get services and advice that fit your unique needs. Banks use AI and machine learning to study your habits, predict what you want, and give you the right offers at the right time. This approach helps you feel understood and valued every time you use your banking app.

Tailored Offers

You want your bank to know what matters to you. Tailored offers use your spending patterns, savings goals, and life events to suggest products or deals that match your needs. Open banking data lets banks create hyper-personalized experiences, which can boost engagement rates by up to 50%. In fact, 82% of customers say they will share personal data if it means getting more personalized experiences.

- 84% of bank customers would switch to a bank offering AI-powered insights and personalized financial advice.

- 74% are likely to stay with banks that help them reach financial goals using AI-driven insights.

- 70% want banks to use technology to better understand their financial needs.

- Personalized banking leads to stronger relationships, higher product adoption, and less customer churn.

Banks like JPMorgan Chase and Bank of America use machine learning to predict your needs and deliver advice through their apps. Banco Bradesco saw a 56% jump in loan applications and a 30% rise in conversion rates after adding a personalized menu for each customer. Sobot’s customer segmentation tools help banks send you targeted offers and messages, making your experience even more relevant.

AI Recommendations

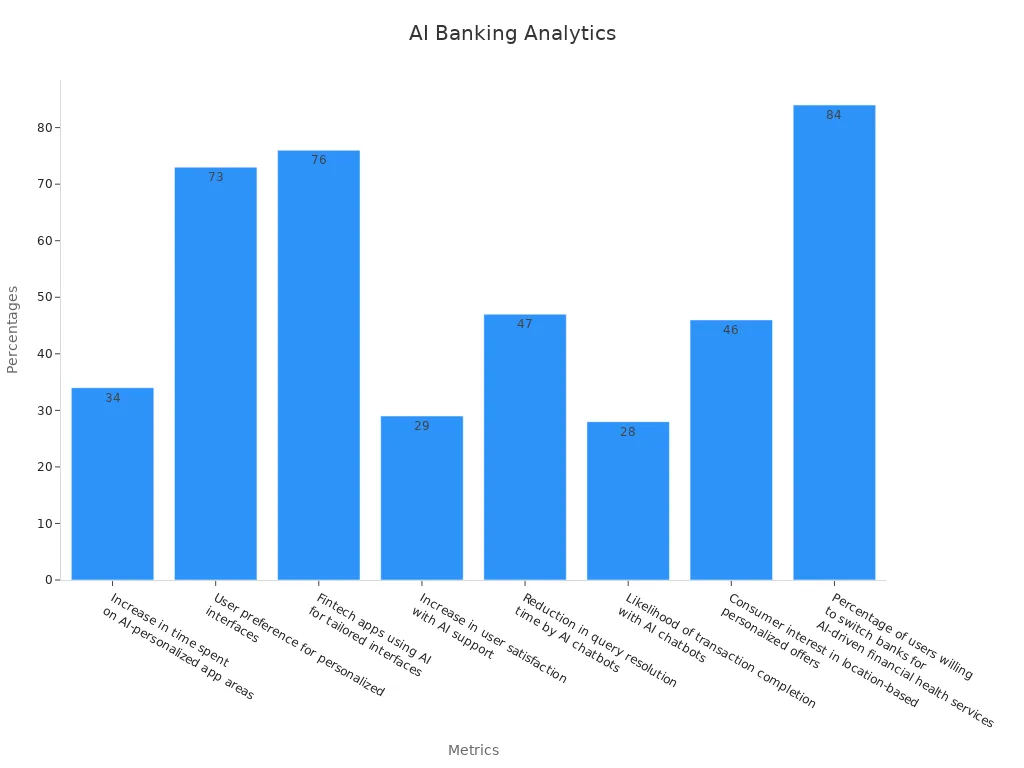

AI recommendations take personalization to the next level. These smart suggestions use real-time data to help you make better financial decisions. You might see tips on saving money, reminders about bills, or offers for new products based on your recent activity.

Nearly half of consumers expect more personalization from mobile banking apps. AI-driven bots can keep track of your needs across channels, improving your experience and raising sales conversion rates by 24%.

| Metric / Insight | Value / Description |

|---|---|

| Increase in time spent on AI-personalized app areas | 34% higher compared to non-personalized sections |

| User preference for personalized interfaces | 73% of users prefer personalized interfaces |

| Fintech apps using AI for tailored interfaces | 76% of fintech apps utilize AI for personalization |

| Increase in user satisfaction with AI support | 29% improvement in satisfaction with AI-powered chatbots |

| Reduction in query resolution time by AI chatbots | 47% faster resolution time |

| Likelihood of transaction completion with AI chatbots | 28% higher likelihood compared to traditional support channels |

| Consumer interest in location-based personalized offers | 46% of consumers interested in receiving personalized offers on mobile devices |

| Users willing to switch banks for AI-driven services | 84% would consider switching banks for AI-driven financial health services |

Sobot’s AI-powered platform uses dynamic segmentation and predictive engagement to deliver timely, relevant recommendations. You get advice and offers that match your life stage and financial goals. This level of personalization builds trust and makes your banking experience smoother. With personalised banking experiences, you enjoy services that truly fit your needs.

Customer Engagement

In-App Support

You want help right when you need it. In-app support gives you answers inside your mobile banking apps, so you do not have to leave or switch to another platform. This makes your experience smooth and keeps you focused on your tasks. Many users expect live chat or help icons in their apps. In fact, 64% of customers want live chat support within apps. When you get help without leaving the app, you avoid frustration and save time.

- In-app support lets you get push notifications for quick updates.

- You can use chat buttons or help icons for instant answers.

- You give feedback right in the app, which helps banks improve support.

- Real-time chat ratings encourage support teams to work faster.

Most people prefer brands that personalize support based on their journey. About 80% of customers say this makes them more likely to stay loyal. When banks collect feedback and offer help in real time, you feel valued. Sobot’s all-in-one contact center lets banks add live chat, chatbots, and feedback tools directly into mobile banking apps. This helps banks improve customer experience and keeps you engaged.

| Statistic / Insight | Explanation |

|---|---|

| 64% of customers expect live chat support within apps | You want instant, contextual help without switching platforms. |

| 80% of customers prefer personalized content | You value support that fits your needs and journey. |

Omnichannel Experience

You use many channels to connect with your bank—mobile banking apps, websites, phone calls, and even in-branch visits. Omnichannel experience means you get the same quality of service everywhere. You can start a task on your phone and finish it on your computer without repeating yourself. This seamless transition builds trust and makes you feel understood.

- Omnichannel banking keeps your information accurate across all channels.

- You do not have to repeat your story when you switch from chat to phone.

- Consistent service quality increases your satisfaction and loyalty.

A recent survey found that 25% of people see irrelevant messages as a barrier to engagement. Omnichannel banking solves this by giving you personalized, timely support. Sobot’s WhatsApp Business API and unified contact center help banks manage all your interactions in one place. This makes it easy for banks to improve customer experience and for you to get help whenever and wherever you need it.

Mobile banking apps play a big role in this. They let you move between channels smoothly and keep your banking journey simple. Research from retail shows that mobile devices drive 65% of website traffic and 46% of digital orders, proving the power of mobile and omnichannel strategies. When banks use these tools, you get better service and stay loyal longer.

You shape the future of digital banking customer experience by demanding fast onboarding, strong security, and personalized service. Banks now invest in innovation, security, and AI to meet your needs.

- Mobile banking users will reach over 3.6 billion by 2024, showing rapid growth and rising customer expectations.

- Personalized support and real-time feedback drive customer loyalty and satisfaction.

- Security, including 24/7 uptime and fraud detection, remains a top priority.

Trusted partners like Sobot help banks deliver seamless banking customer experience, gather customer feedback, and adapt quickly. Ongoing investment in digital solutions ensures your customer banking experience stays ahead of change.

FAQ

What makes a digital banking customer experience great?

You want a digital banking customer experience that is fast, secure, and personal. Top banks use AI, real-time alerts, and easy apps. Sobot helps banks deliver these features. Studies show 72% of people value personalization in their digital banking customer experience. Source

How does Sobot improve digital banking customer experience?

Sobot gives banks AI chatbots, omnichannel support, and secure communication. You get instant help, real-time updates, and personal offers. Opay used Sobot and raised its digital banking customer experience satisfaction from 60% to 90%. Sobot’s tools make your banking journey smoother.

Why is security important in digital banking customer experience?

You trust your bank with your money and data. Strong security, like fraud detection and privacy protection, keeps you safe. Sobot’s platform uses encrypted channels and follows strict rules. This builds trust and improves your digital banking customer experience.

Can I get help anytime with digital banking customer experience?

Yes! Sobot’s AI chatbots work 24/7. You can ask questions or solve problems any time, day or night. This always-on support is a key part of a great digital banking customer experience.

What role does personalization play in digital banking customer experience?

Personalization means you get advice and offers that fit your needs. Banks use AI to study your habits and send you the right messages. Sobot’s platform helps banks personalize your digital banking customer experience, making it more helpful and engaging.

Tip: Look for banks that use AI and omnichannel tools like Sobot for the best digital banking customer experience.