10 Insurance Chatbot Templates That Save Time and Money

You want faster service, lower costs, and happier clients in insurance. That’s not easy when customer loyalty has dropped by 28% since the pandemic, and 29% of people leave after just one bad experience. More customers now expect self-service—demand has jumped 36%. Insurance chatbots step in to help. With chatbot solutions like Sobot AI, you get 24/7 support, quick answers, and fewer repeat questions. Insurance chatbots boost ticket resolution speed by 18% and raise conversion rates by 23%. You can use these templates to deliver better customer experience, cut costs, and streamline your operations. Sobot’s chatbot for insurance gives you a real edge.

Sobot Chatbot for Insurance

Features

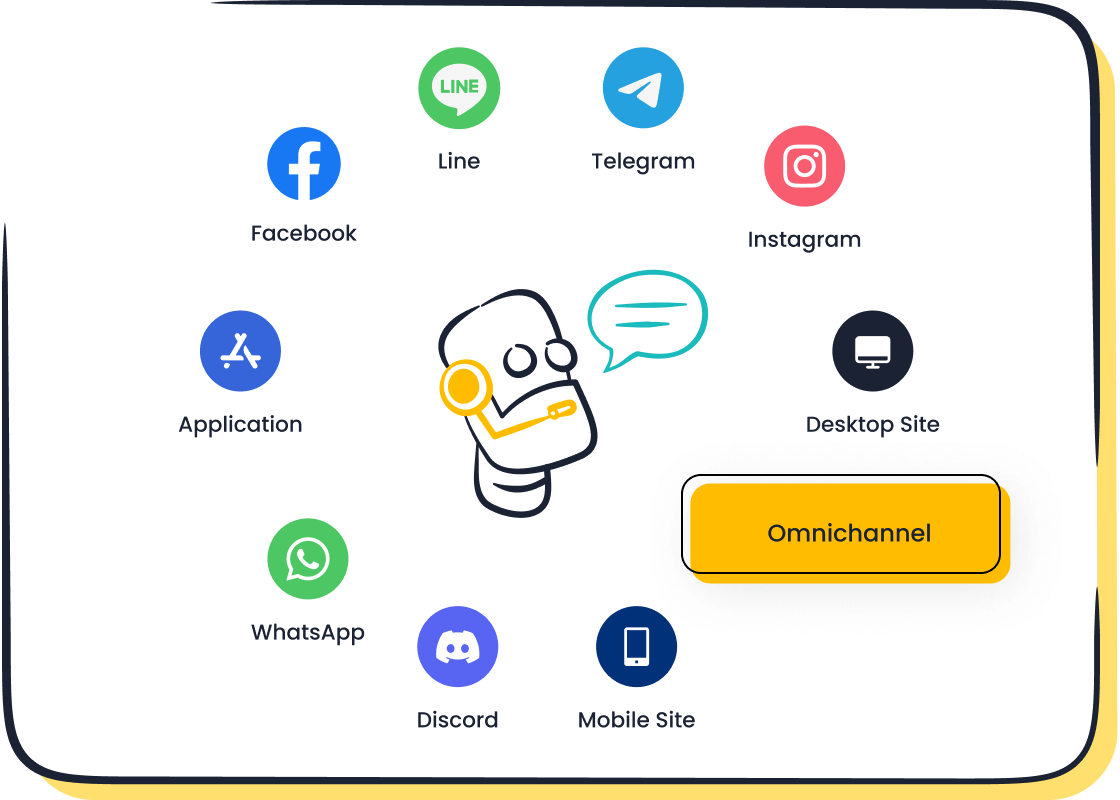

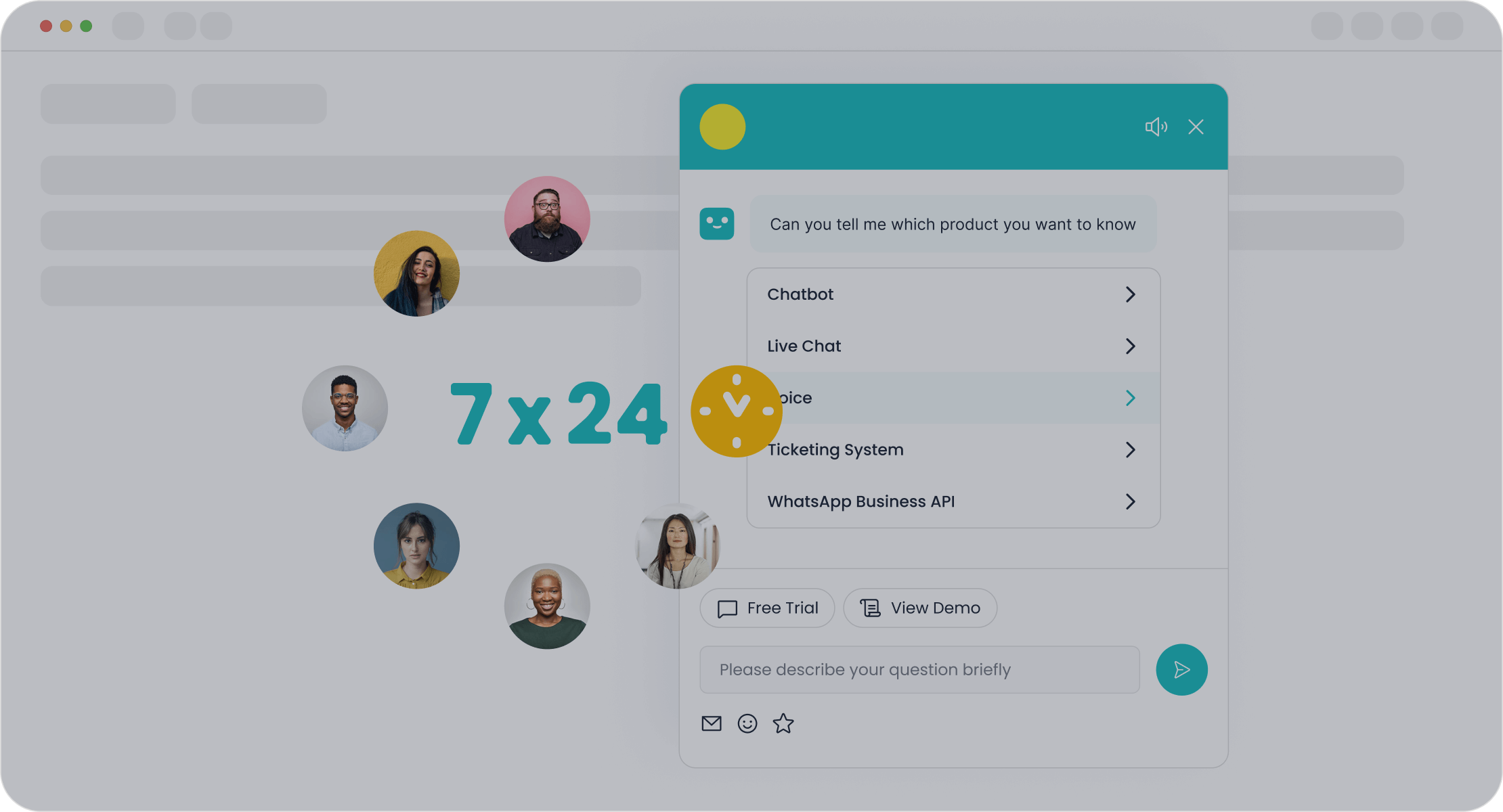

You want a chatbot for insurance that works everywhere your customers are. Sobot’s insurance chatbot brings you AI-powered, multilingual, and omnichannel support. You can connect with clients on web, mobile apps, WhatsApp, SMS, email, and even voice calls. Sobot’s insurance chatbots use industry-specific conversation flows, so you get answers that make sense for your business. The platform uses advanced AI, including OpenAI and Amazon Bedrock, to give human-like replies and instant response times. You also get secure AI that keeps your data safe and meets compliance needs.

| Feature / Capability | Description | Impact on Insurance Customer Service Efficiency |

|---|---|---|

| Omnichannel AI | Connects all channels (web, app, social, email, SMS, calls) | Seamless, consistent user experience |

| Scenario-based AI | Insurance-specific conversation flows | Personalized, relevant responses |

| Multi-faceted AI | AI Agent, Copilot, and Insight dashboards | Boosts agent productivity and accuracy |

| Generative AI | Human-like, intelligent conversations | Better customer experience and engagement |

| Secure AI | Data privacy and compliance | Builds trust and meets regulations |

Benefits

You save time and money with Sobot’s insurance chatbots. The chatbot for insurance can handle regular questions 24/7, so your team focuses on complex cases. You get round-the-clock availability, which means customers never wait. Sobot’s solutions help you cut agent workload by 60% and improve conversion rates by 15%. Companies like Samsung saw a 30% jump in agent efficiency and a 97% customer satisfaction score. You also get over 300 reports and dashboards to track performance and improve your insurance solutions.

- Instant response times boost customer satisfaction.

- Automated lead qualification brings in more business.

- Personalized service increases loyalty and engagement.

- Secure data handling keeps your clients’ trust.

Nearly 75% of business owners say AI chatbots improved their customer experience with instant support.

Use Cases

You can use Sobot’s insurance chatbot for many tasks. Automate claims, answer policy questions, and qualify leads. The chatbot for insurance helps with onboarding, sends reminders, and manages renewals. Opay, a leading financial platform, used Sobot’s solutions to unify customer service across channels. They raised satisfaction from 60% to 90% and cut costs by 20%. You can do the same for your agency.

Pricing

Sobot offers flexible pricing for insurance chatbots. You can choose a subscription plan for predictable monthly costs or pay-per-use if your needs change. Custom options are available for advanced insurance solutions. Pricing depends on features, security, and integration. For most insurance agencies, Sobot’s chatbot solutions deliver strong ROI by reducing manual work and improving user experience.

Tars Insurance Chatbot

Features

You want an insurance chatbot that makes your job easier. Tars gives you a set of tools to automate your daily tasks. Here’s what you get:

- 24/7 support for common questions, so your clients never wait.

- Personalized insurance advice and policy suggestions for each customer.

- Automatic quote generation based on what users need.

- Claims processing and tracking, guiding customers step by step.

- Payment and renewal reminders sent out automatically.

- Integration with platforms like WhatsApp for smooth notifications.

- No-code chatbot builder, so you can set up flows without programming.

- AI integration to handle tough questions and improve conversations.

- Multilingual support for clients who speak different languages.

- Live chat handoff to human agents when needed.

- Analytics to help you track and improve your insurance chatbots.

These features help you handle more requests, save time, and give better service.

Benefits

Tars insurance chatbots help you work smarter, not harder. You can answer more questions without hiring more staff. The chatbot handles claims, quotes, and policy details, so you focus on complex cases. Many users report saving thousands of calls each month and offering 24/7 service. One government agency saved over 4,000 calls monthly. A finance manager said the chatbot brought in quality leads for two years straight. You also get fewer emails and more satisfied customers. With Tars, you boost engagement and cut down on manual work.

Tip: Use analytics from your insurance chatbot to spot trends and improve your service even more.

Pros & Cons

Here’s a quick look at what you might like—and what you should consider:

| Pros | Cons |

|---|---|

| Easy no-code setup | Higher starting price than some options |

| Works on many channels (web, WhatsApp, etc.) | Limited integrations at lower tiers |

| Handles claims, quotes, and reminders | Customization may require higher plans |

| Multilingual and AI-powered | |

| Live agent handoff for complex issues |

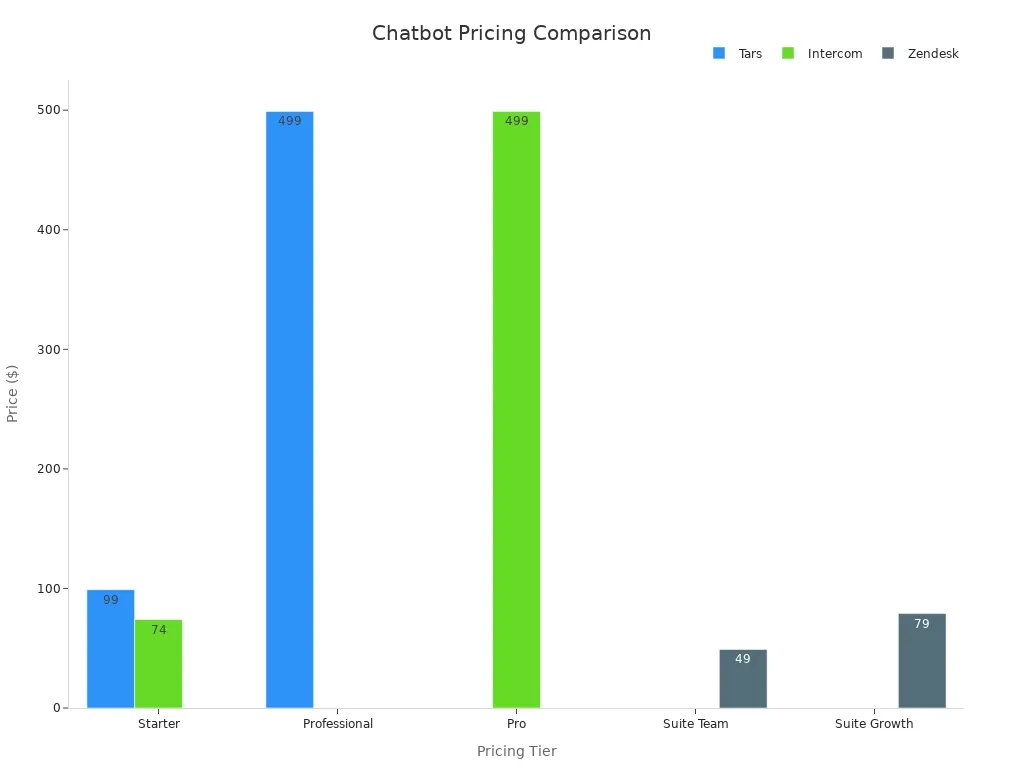

Pricing

Tars offers three main pricing tiers. The Starter plan costs about $99 per month and gives you basic features and customization. The Professional plan is around $499 per month, adding more channels and support. For large agencies, Enterprise pricing is custom. Tars sits in the middle of the market—more than some, less than others. You pay for ease of use and automation.

You can check the latest details on the Tars pricing page.

Landbot Insurance Chatbot

Features

You want an insurance chatbot that feels easy to use and quick to set up. Landbot gives you a no-code drag-and-drop builder, so you can create chatbots without any programming. You can ask multiple questions in one go, which speeds up data collection from your clients. Landbot lets you save prospect data straight into your CRM, so you never lose a lead. You get automatic email notifications when new leads come in. The chatbot works on your website and WhatsApp, and you can use reply buttons for faster answers. Landbot also lets you use GIFs, images, and videos to make conversations more engaging.

- Conditional logic flows personalize each chat.

- Multi-purpose question blocks collect info with less friction.

- Integrations with tools like Zapier and SendGrid automate your workflows.

- Reusable blocks (called BRICKS) help you build new bots faster.

Benefits

Landbot insurance chatbots help you work smarter. They handle routine questions, help with claims, and give real-time updates. You can automate appointment scheduling, so your agents have more time for complex cases. Landbot remembers customer preferences, making each chat feel personal. Big insurers like Allstate and Liberty Mutual use insurance chatbots to manage policies and claims, which cuts down on calls and boosts customer satisfaction. Allianz Benelux saw their chatbot process over 92,000 search terms and get a 90% positive feedback score from 18,000+ chats. That means happier customers and less work for your team.

Tip: Use Landbot’s analytics to see how your insurance chatbot performs and find ways to improve.

Pros & Cons

| Aspect | Pros | Cons |

|---|---|---|

| User Interface | No-code builder makes chatbot creation easy | Some users find the interface confusing at first |

| Deployment | Works on websites, WhatsApp, and Messenger | Mobile responsiveness can be inconsistent |

| Customization | Lets you add your branding | Custom flows can feel limited |

| Conversational Logic | Advanced logic for dynamic chats | Not as strong for complex AI conversations |

| Integrations | Connects with many third-party tools | Fewer native integrations than some platforms |

| Analytics | Built-in dashboards for tracking | Reporting could be deeper |

| Security & Compliance | Focuses on secure data handling | — |

| Collaboration | Supports teamwork and scaling | — |

| Cost | Reduces operational expenses | Tiered pricing—cost depends on features and usage |

Pricing

Landbot uses a tiered pricing model. You pay based on the features and number of chats you need. While exact prices for insurance chatbots are not always public, Landbot is known for being cost-effective compared to some enterprise solutions. You can start with basic plans and scale up as your agency grows. Always check their official pricing page for the latest details.

Chatfuel Insurance Chatbot

Features

You want an insurance chatbot that works fast and doesn’t need coding skills. Chatfuel gives you a no-code platform, so you can build chatbots for Facebook, Instagram, and Messenger in minutes. You just drag and drop to design your chatbot. Here’s what you get:

- Automates repetitive tasks like collecting customer info and answering common questions.

- Guides users through claim filing, helping them upload documents for the First Notice of Loss.

- Keeps your customer data safe and follows privacy rules.

- Lets you segment your audience and track how your chatbot performs with built-in analytics.

- Connects with popular CRM systems, so you manage all your customer chats in one place.

- Helps you capture leads and send personalized messages to boost conversions.

- Supports cross-selling by using customer data to suggest the right insurance products.

Tip: You can use Chatfuel to handle routine insurance questions, so your agents have more time for complex cases.

Benefits

Chatfuel insurance chatbots help you save time and money. You can automate claims, answer policy questions, and qualify leads without extra staff. Many insurance agencies use Chatfuel to improve customer service and cut costs. Here’s a quick look at how Chatfuel performs:

| Performance Metric | Description & Impact | Example / Case Study |

|---|---|---|

| Accuracy | Correct answers build trust and satisfaction | MoneyBot hit 92% accuracy for account questions |

| Response Time | Fast replies keep users happy | MoneyBot replied in 3 seconds, much faster than humans |

| Conversion Rate | More users request quotes or buy policies | Chatbots guide users to request quotes, boosting conversions |

| Escalation Rate | Fewer handoffs to agents mean more efficiency | Tech chatbot minimized escalations to humans |

| Cost Savings | Lower costs by automating routine chats | Chatbots cut cost per conversation |

| User Engagement | Longer sessions show users like the chatbot | Personalized messages keep users coming back |

Pros & Cons

You want to know what works well and what to watch out for. Here’s a quick list:

-

Pros

- Easy to use, even if you don’t code.

- Works on Facebook, Instagram, and Messenger.

- Automates sales, lead capture, and follow-ups.

- Connects with Kommo CRM for better upselling and cross-selling.

-

Cons

- Pricing starts low but can get expensive as you add more conversations.

- WhatsApp support costs more than Facebook or Instagram.

Note: If you need a chatbot that works across even more channels, you might want to check out Sobot’s omnichannel insurance chatbots, which also offer voice, SMS, and web chat in one platform.

Pricing

Chatfuel offers different plans based on where you want to use your insurance chatbot. For Facebook and Instagram, prices start at $14.39 per month. If you want to use WhatsApp, plans begin at $41.29 per month. The more conversations you need, the higher the price. You can pick a plan that fits your agency’s size and needs. Always check the Chatfuel pricing page for the latest details.

Elfsight Insurance Chatbot

Features

You want an insurance chatbot that is easy to add to your website. Elfsight gives you a plug-and-play widget that works with almost any site builder. You can set up the chatbot in minutes—no coding needed. The chatbot answers policy questions, helps with claims, and guides users through forms. It supports multiple languages, so you can serve clients from different backgrounds. You can customize the look and feel to match your brand. Elfsight also lets you set up quick replies and automated greetings to make every chat feel personal.

- 24/7 instant support for your customers

- Multi-language support for global reach

- Customizable design and chat flows

- Easy integration with popular website platforms

Benefits

Elfsight insurance chatbots help you save time and keep your clients happy. You can handle up to 80% of customer questions without extra staff. This means your team can focus on complex cases. The chatbot gives instant answers, so your clients never have to wait. According to G2.com, Elfsight’s insurance chatbot has a 4.8 out of 5 rating from over 800 users. Most people love the fast help and personal touch. Industry surveys show that 74.5% of users feel satisfied or very satisfied after using insurance chatbots. You also get fewer missed leads and better customer loyalty.

Tip: Use insurance chatbots to reduce claim settlement times and boost customer trust.

Pros & Cons

| Pros | Cons |

|---|---|

| Easy to install and use | Limited advanced AI features |

| Works on most websites | No live agent handoff |

| Supports many languages | Some features require higher plans |

| Customizable look and feel |

You get a simple setup and strong support. If you need deep AI or live chat, you might look at other options like Sobot, which offers advanced omnichannel insurance chatbot solutions.

Pricing

Elfsight uses a subscription model. You can start with a free plan to test the insurance chatbot on your site. Paid plans begin at around $5 per month and go up based on features and usage. You pay more for extra chats, advanced customization, or analytics. This makes Elfsight a budget-friendly choice for small agencies that want to try insurance chatbots without a big investment. Always check Elfsight’s pricing page for the latest details.

BotPenguin Chatbot for Insurance Agents

Features

You want a chatbot for insurance agents that is easy to set up and powerful enough to handle your daily work. BotPenguin gives you a no-code platform, so you can build and launch insurance chatbots without any tech skills. You get smart conversations powered by ChatGPT, which means your clients get answers that sound natural. BotPenguin lets you train your chatbot on your own data, so it can answer questions about your specific insurance products. You can connect with clients on WhatsApp, Facebook, Instagram, Telegram, and your website. The platform supports voice chat through Twilio and offers live chat for real-time help. You can create as many chatbots as you need, and use over 60 integrations to connect with your CRM, support tools, or scheduling apps.

| Feature | Benefit for Insurance Agents |

|---|---|

| No Code Required | Build chatbots easily, no tech skills needed |

| ChatGPT Integration | Smarter, more natural conversations |

| Custom Training on Data | Personalized answers for your insurance business |

| 60+ Native Integrations | Connects with CRM, support, and scheduling tools |

| Native Live Chat | Real-time help for customers |

| Unlimited Chatbot Creation | Make as many chatbots as you want |

| Voice Support via Twilio | Talk to clients using voice |

| Analytics | Track how your chatbots perform |

| Multi-Platform Support | Reach clients on many channels |

| White-label Solutions | Brand your chatbot for insurance agents |

Benefits

You save time and money when you use insurance chatbots from BotPenguin. These bots answer up to 80% of customer questions without help from a human. You can focus on complex cases while the chatbot for insurance agents takes care of the rest. Your clients get instant answers, even at night or on weekends. BotPenguin helps you handle claims, policy questions, and reminders, making your service faster and more reliable. You also get real-time updates and proactive messages, which keep your clients engaged and happy. Many insurance agents see higher customer satisfaction and lower costs after switching to insurance chatbots.

Did you know? Leading insurers use chatbots to speed up claims and boost customer satisfaction. You can do the same with BotPenguin.

Pros & Cons

Here’s a quick look at what you might like about BotPenguin—and what to consider:

-

Pros

- Easy setup with no coding.

- Works on many platforms.

- Handles many insurance tasks, like claims and policy updates.

- Offers live chat and voice support.

- Lets you create unlimited chatbots for insurance agents.

-

Cons

- Some advanced features may need higher-tier plans.

- Custom branding options may require extra setup.

Tip: Use analytics to see which insurance chatbots perform best and adjust your flows for better results.

Pricing

BotPenguin offers flexible pricing for insurance chatbots. You can start with a free plan to test basic features. Paid plans begin at around $5 per month, which is great for small agencies. If you need more advanced features, like custom branding or more integrations, you can choose higher-tier plans. You only pay for what you need, so it’s easy to scale as your agency grows. Always check the official BotPenguin pricing page for the latest details.

ManyChat Insurance Chatbot

Features

You want a chatbot that connects with your clients where they spend time. ManyChat lets you build insurance chatbots for Facebook Messenger, Instagram, WhatsApp, and SMS. You can use a drag-and-drop builder, so you do not need to code. ManyChat supports automated replies, lead capture, and appointment scheduling. You can set up reminders for policy renewals or claims. The platform also lets you send broadcast messages to groups of customers. ManyChat integrates with tools like Google Sheets and Mailchimp. You can track every conversation with built-in analytics.

Tip: You can use ManyChat’s templates to launch insurance chatbots in just a few minutes.

Benefits

ManyChat helps you save time and reach more clients. You can answer questions 24/7, so your customers never wait. Insurance chatbots handle claims, policy details, and quotes. This means your team can focus on complex cases. ManyChat’s automation brings in more leads and keeps your clients engaged. You can send reminders about renewals or payments. ManyChat reports that businesses see up to 80% open rates on messages sent through chatbots. That means more people read your updates and offers.

Pros & Cons

| Pros | Cons |

|---|---|

| Easy to use, no coding needed | Some features cost extra |

| Works on many channels | WhatsApp support needs approval |

| Fast setup with templates | Limited advanced AI |

| Good for lead capture and reminders | Analytics can be basic |

You get a simple tool for building insurance chatbots. If you want more advanced AI or deeper analytics, you might look at platforms like Sobot, which offer more features for insurance chatbots and customer service.

Pricing

ManyChat offers a free plan with basic features. Paid plans start at $15 per month and go up based on the number of contacts and channels you use. You pay more for WhatsApp and SMS features. ManyChat’s pricing works well for small agencies that want to try insurance chatbots without a big investment. You can check the latest details on the ManyChat pricing page.

Cognigy Insurance Chatbot

Features

You want an insurance chatbot that feels smart and easy to use. Cognigy gives you a platform that uses AI to talk with your customers in real time. You can set up chatbots for your website, mobile app, or even voice calls. Cognigy supports over 20 languages, so you can help clients from many places. You get a drag-and-drop builder, which means you do not need to code. The platform connects with your CRM and other tools, so you keep all your customer info in one place. You can also use Cognigy to send reminders, answer policy questions, and help with claims.

- AI-powered conversations

- Multilingual support

- No-code chatbot builder

- Integration with CRM and support tools

- Voice and text channels

Benefits

Cognigy helps you save time and make your customers happy. You can answer questions 24/7, so clients never have to wait. Insurance chatbots like Cognigy handle simple tasks, which lets your team focus on harder problems. Many companies report that using insurance chatbots cuts their support costs by up to 30%. You also get faster claims processing and fewer missed leads. If you want to see even more benefits, you can look at Sobot’s insurance chatbots, which offer strong reporting and easy setup for agencies of any size.

Tip: Use insurance chatbots to send reminders about renewals and payments. This keeps your clients engaged and reduces missed deadlines.

Pros & Cons

Here’s a quick look at what you might like about Cognigy and what you should think about:

| Pros | Cons |

|---|---|

| Easy to use, no coding needed | Advanced features may cost more |

| Works in many languages | Setup can take time for big projects |

| Connects with many tools | Some users find the interface busy |

| Handles voice and text |

Pricing

Cognigy uses custom pricing. You need to contact their sales team to get a quote. The price depends on how many conversations you want and which features you need. Most insurance agencies pay more for advanced AI and extra channels. If you want a clear, flexible plan, you can check out Sobot’s insurance chatbots, which offer both subscription and pay-per-use options. Always ask for a demo before you decide.

SnatchBot Insurance Chatbot

Features

You want a chatbot that helps you handle insurance questions fast. SnatchBot gives you a no-code platform, so you can build insurance chatbots without any tech skills. You can use templates made for insurance, which makes setup quick. SnatchBot works on your website, Facebook Messenger, WhatsApp, and more. You can set up automated answers for claims, policy details, and quotes. The platform supports over 50 languages, so you can help clients from many places. You also get built-in analytics to track how your insurance chatbots perform.

Tip: Use SnatchBot’s drag-and-drop builder to launch your insurance chatbots in just a few hours.

Benefits

SnatchBot helps you save time and money. You can answer customer questions 24/7, so clients never have to wait. Insurance chatbots from SnatchBot handle up to 80% of routine requests, which means your team can focus on complex cases. Many insurance agencies report faster claims processing and fewer missed leads. You also get better customer satisfaction because people get instant answers. If you want even more advanced features, you can look at Sobot’s insurance chatbots, which offer strong omnichannel support and easy integration with your existing systems.

Pros & Cons

| Pros | Cons |

|---|---|

| No coding needed | Some advanced features cost extra |

| Works on many channels | Free plan has limits |

| Supports many languages | Analytics can be basic |

| Ready-to-use templates | Customization may take time |

You get a simple tool for building insurance chatbots. If you want deeper analytics or more advanced AI, you might consider Sobot, which offers detailed reporting and powerful automation.

Pricing

SnatchBot offers a free plan with basic features. Paid plans start at $30 per month and go up based on the number of messages and advanced options you need. You pay more for features like premium integrations or advanced analytics. This makes SnatchBot a good choice if you want to try insurance chatbots without a big investment. Always check the SnatchBot pricing page for the latest details.

Zendesk Insurance Chatbot

Features

You want a chatbot that helps you answer questions fast. Zendesk insurance chatbots let you talk to customers on your website, mobile app, or social media. You can set up automated replies for claims, policy details, and quotes. Zendesk gives you a drag-and-drop builder, so you do not need to code. You can connect your chatbot to your CRM and other tools. Zendesk also supports live chat handoff, so your team can step in when needed. The chatbot works in many languages, which helps you serve more clients.

Tip: Use insurance chatbots to collect customer feedback after each chat. This helps you improve your service.

Benefits

Insurance chatbots from Zendesk help you save time and keep your clients happy. You can answer questions 24/7, so customers never have to wait. The chatbot handles simple tasks, like checking policy status or filing claims. This means your team can focus on harder problems. Many insurance agencies say they see faster claims processing and fewer missed leads. You also get reports that show how well your chatbot is working. If you want even more advanced features, you can look at Sobot’s insurance chatbots, which offer strong omnichannel support and easy setup for agencies of any size.

Pros & Cons

Here’s a quick look at what you might like about Zendesk insurance chatbots:

| Pros | Cons |

|---|---|

| Easy to use, no coding needed | Advanced features may cost more |

| Works on many channels | Setup can take time for big projects |

| Connects with CRM and support tools | Some users find the interface busy |

| Supports live agent handoff |

You get a simple tool for building insurance chatbots. If you want deeper analytics or more advanced AI, you might consider Sobot, which offers detailed reporting and powerful automation.

Pricing

Zendesk uses a subscription model for insurance chatbots. Prices start at around $49 per month for basic plans. You pay more for extra features or more conversations. Most insurance agencies choose a plan based on their size and needs. Always check the Zendesk pricing page for the latest details. If you want flexible options, Sobot offers both subscription and pay-per-use plans for insurance chatbots.

Insurance Chatbots Comparison

Features Table

You want to pick the best insurance chatbots for your agency. It helps to see how each one stacks up. Here’s a quick table that compares the top 10 insurance chatbots on key features, pricing, and benefits. This makes it easy for you to spot which solutions fit your needs.

| Chatbot | Omnichannel | AI-Powered | No-Code Builder | Multilingual | 24/7 Support | Reporting | Starting Price | Best For |

|---|---|---|---|---|---|---|---|---|

| Sobot | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | Custom/Quote | All-in-one solutions |

| Tars | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | $99/mo | Lead gen, claims |

| Landbot | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | $39/mo | Fast setup, web chat |

| Chatfuel | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | $14.39/mo | Social media |

| Elfsight | ❌ | ✅ | ✅ | ✅ | ✅ | ✅ | $5/mo | Website widget |

| BotPenguin | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | $5/mo | Voice, unlimited bots |

| ManyChat | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | $15/mo | Messenger, WhatsApp |

| Cognigy | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | Custom/Quote | Enterprise, voice/text |

| SnatchBot | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | $30/mo | Templates, quick start |

| Zendesk | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | $49/mo | Support integration |

Tip: Sobot stands out with its all-in-one insurance chatbots, strong reporting, and secure AI. You can learn more about Sobot’s solutions here.

Time & Cost Savings

Insurance chatbots help you save time and money every day. You can automate up to 80% of routine questions. This means your team spends less time on simple tasks and more time helping clients with complex needs. For example, Sobot’s insurance chatbots boost agent productivity by 70% and cut extra staffing costs by up to 50%. Opay used Sobot’s solutions and saw customer satisfaction jump from 60% to 90%, while costs dropped by 20%.

You get faster claims, fewer missed leads, and happier customers. If you want to grow your agency without hiring more staff, insurance chatbots are the way to go. Each of these templates offers unique benefits, but Sobot’s solutions give you the most flexibility and power for insurance customer service.

Want to see which insurance chatbots fit your business? Try a demo or explore more here.

Choosing a Chatbot for Insurance

Needs Assessment

Start by thinking about what your agency really needs. Do you want a chatbot for insurance that answers basic questions, or do you need something that can handle claims and renewals, too? Write down your main goals. Maybe you want to save time, cut costs, or give customers 24/7 support. Look at your current process. Are your agents spending too much time on simple tasks? If yes, insurance chatbots can help. For example, Sobot’s solutions let you automate up to 80% of routine questions, so your team can focus on more important work.

Selection Tips

Picking the right chatbot for insurance is easier when you know what to look for. Here are some tips:

- Check if the chatbot works on all the channels your customers use, like WhatsApp, web, and SMS.

- Make sure it is easy to set up. No-code builders save you time.

- Look for strong reporting tools. You want to see how well your chatbot performs.

- Choose insurance chatbots that support multiple languages if you serve a diverse group.

- Ask about security and data privacy. This is very important in insurance.

Tip: Sobot offers customizable solutions that fit agencies of all sizes. You can start small and scale up as your business grows.

Implementation Steps

Ready to get started? Follow these steps for a smooth launch:

- Pick your chatbot for insurance and sign up for a demo or free trial.

- Set up your main conversation flows, like claims, policy info, and renewals.

- Train your team on how to use the chatbot and review reports.

- Test the chatbot with real customers and collect feedback.

- Keep improving your chatbot based on what you learn.

You can see real results fast. For example, Opay used Sobot’s solutions and saw customer satisfaction jump from 60% to 90%. Want to learn more? Check out Sobot’s official site for details.

You can transform your agency with insurance chatbots. These tools answer questions 24/7, cut costs by up to 50%, and help you serve more clients without extra staff. Many businesses, like Opay, saw customer satisfaction jump to 90% after using insurance chatbots. Sobot gives you easy setup, strong reporting, and secure service.

Ready to see how insurance chatbots can help you? Try a demo or contact Sobot at sobot.io.

FAQ

What is an insurance chatbot?

An insurance chatbot is an AI-powered tool that helps you answer customer questions, process claims, and send reminders. You can use it on your website, WhatsApp, or SMS. Many agencies use insurance chatbots to save time and boost customer satisfaction.

How do insurance chatbots save money?

Insurance chatbots work 24/7 and handle up to 80% of routine questions. You spend less on extra staff and reduce call center costs. For example, Sobot’s insurance chatbot can cut agent workload by 60% and lower expenses by up to 50%.

Can I customize my insurance chatbot for my agency?

Yes! You can easily customize your insurance chatbot with your own conversation flows, branding, and languages. Sobot lets you build and launch a chatbot with no coding. You can even connect it to your CRM for better lead management.

Are insurance chatbots secure for handling client data?

Absolutely. Top insurance chatbots, like Sobot, use secure AI and follow strict privacy rules. Your client data stays safe and meets industry compliance standards. You can trust these tools to protect sensitive information.

What results can I expect from using an insurance chatbot?

You can expect faster response times, higher customer satisfaction, and more leads. For example, Opay used Sobot’s insurance chatbot and saw satisfaction jump from 60% to 90%. Many agencies report a 20% drop in costs and a 17% boost in conversions.

Want to learn more? Check out Sobot’s insurance chatbot solutions for real-world examples and a free demo.

See Also

Eight Key Advantages Of Integrating Chatbots On Websites

Leading Ten Chatbot Solutions For Websites In 2024

Ten Popular Websites Employing Chatbots In 2024