Top tools and technologies for banking customer experience in 2025

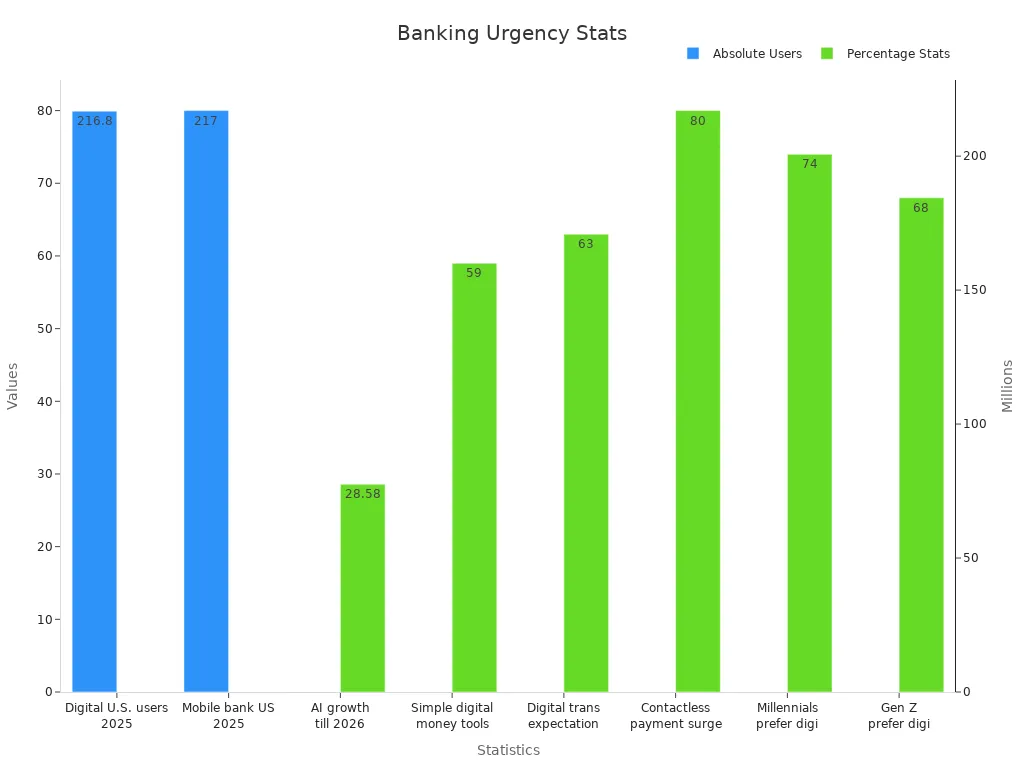

Banks face intense pressure to meet fast-changing customer expectations in 2025. The digital shift accelerates, with nearly 217 million projected mobile banking users in the U.S. alone and 80% of consumers seeking personalized cx. The demand for seamless, secure, and emotionally engaging banking customer experience drives rapid innovation. Leading tools such as AI-driven automation, omnichannel platforms, and hyper-personalization now define cx excellence. The following table highlights key statistics fueling this transformation:

| Statistic Description | Value |

|---|---|

| Projected digital banking users in the U.S. by 2025 | 216.8M |

| Annual growth rate of AI-driven banking market till 2026 | 28.58% |

| Surge in contactless payment adoption | 80% |

| Millennials preferring digital banking | 74% |

| Gen Z preferring digital banking | 68% |

Sobot and Sobot AI lead the way in banking customer experience trends, helping financial institutions deliver next-level cx through innovation and advanced tools.

AI and Automation in Banking

Sobot Chatbot for Customer Experience

Banks now rely on ai-powered chatbots to transform customer experience. Sobot’s AI Chatbot stands out by automating routine inquiries, providing 24/7 support, and delivering instant, accurate responses across multiple channels. This chatbot helps banks handle high volumes of customer requests without delays. Sobot’s solution supports multilingual communication and integrates with platforms like WhatsApp and SMS, making banking more accessible and efficient. Many businesses using Sobot have seen a 70% boost in productivity and up to 50% savings on agent costs. These improvements lead to faster service, higher satisfaction, and a more engaging cx.

Personalization and Efficiency

Ai enables banks to deliver personalized services at scale. Sobot’s chatbot uses customer data to tailor interactions, recommend products, and send proactive alerts. This approach increases conversion rates and builds loyalty. The following table highlights how ai and automation drive efficiency and personalization in banking:

| Metric / Improvement Area | Numerical Data / Statistic |

|---|---|

| Operational cost reduction through AI automation | 22-25% reduction expected over next five years |

| Routine inquiries handled by automation | 70% handled without human intervention |

| Fraud detection false positives reduction | Decreased by 60-80% |

| Financial forecasting accuracy improvement | 40% improvement reported |

| AI chatbot usage (Bank of America’s Erica) | Over 15 million users; 150 million client requests |

| Intelligent document processing | Up to 90% reduction in manual handling |

These numbers show how ai improves efficiency and delivers a more personalized customer experience.

Examples

Many leading banks use ai to enhance cx. BBVA uses ai-driven segmentation for personalized banking apps, which increases loyalty and customer insights. HSBC applies ai for real-time fraud detection, reducing losses. Sobot’s chatbot ecosystem helps businesses automate 66% of queries, save thousands monthly, and increase conversion rates by over 300%. Companies adopting ai chatbots report up to 90% faster response times and a 67% boost in sales conversions. These examples prove that ai is essential for delivering modern, personalized, and efficient customer experience in banking.

Omnichannel Platforms and Phygital Journeys

Unified Customer Contact

Banks today must meet customers wherever they are—whether in a branch, on a mobile app, or through online chat. A unified customer contact platform connects all these channels, creating a seamless customer experience. Customers can start a conversation online and finish it in person, or switch from a phone call to live chat without repeating information. This approach gives banks a complete view of customer behavior, allowing for more personalized service and faster problem resolution. Unified platforms also improve operational efficiency by reducing the need for multiple systems and streamlining communication. Customers benefit from shorter wait times, higher satisfaction, and more consistent service.

- A single digital banking platform provides a seamless and consistent experience for both retail and commercial customers.

- Unified communications platforms enhance customer experience by enabling seamless omnichannel communication, allowing customers to contact banks via phone, email, or live chat according to their preference.

- Centralized communication platforms improve response times by giving agents quick access to customer history and context.

Sobot Financial Solution

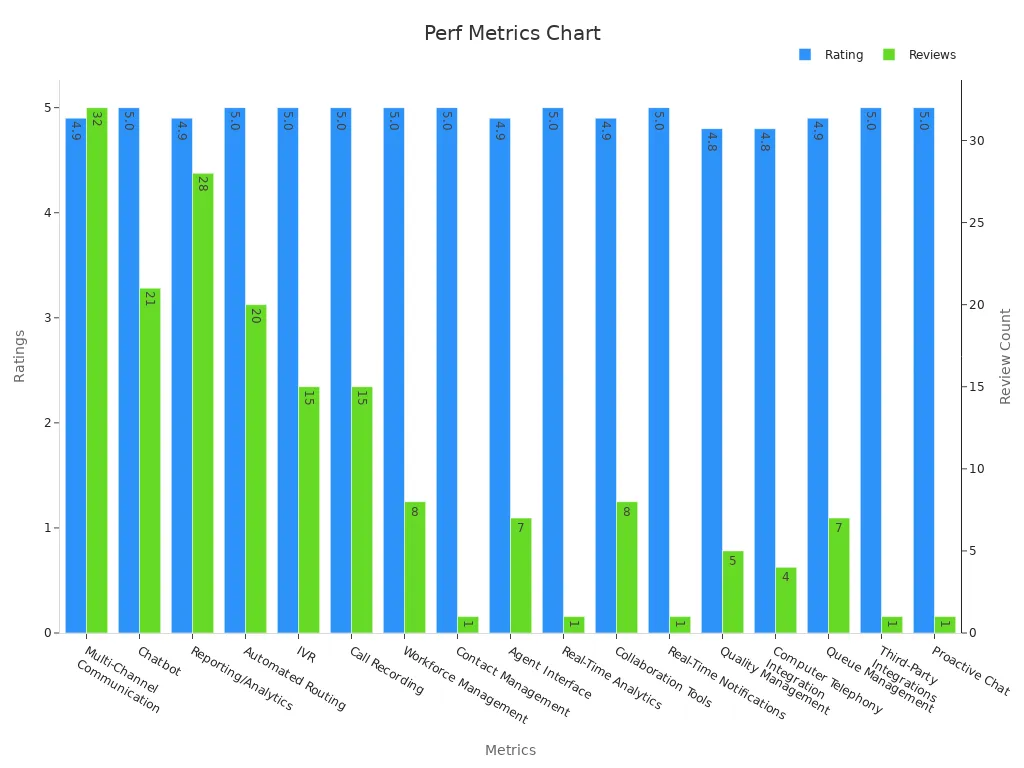

Sobot’s Financial Solution delivers a powerful omnichannel experience for banks and financial institutions. The platform integrates online chat, voice, email, and social media into one workspace. Agents see a complete customer history, which helps them resolve issues quickly and accurately. Sobot’s solution supports WhatsApp, Meta, Instagram, and Telegram, making it easy for customers to reach out on their preferred channels. The platform’s advanced analytics and reporting tools help banks track performance and improve service quality. Clients report a 90% customer satisfaction rate and a 17% increase in conversion rates after adopting Sobot. The following table highlights Sobot’s performance metrics:

| Metric / Feature | Rating (out of 5) | Number of Reviews |

|---|---|---|

| Multi-Channel Communication | 4.9 | 32 |

| Chatbot | 5.0 | 21 |

| Reporting/Analytics | 4.9 | 28 |

| Automated Routing | 5.0 | 20 |

| IVR | 5.0 | 15 |

| Call Recording | 5.0 | 15 |

Best Practices

Leading banks achieve strong customer experience results by combining digital and physical touchpoints. For example, Emirates NBD reached a 93% digital account opening rate by blending app-based onboarding with in-branch support. Mashreq achieved an NPS of 80 by enabling fast online account opening with selfie and ID scan. Top performers use journey mapping, AI chatbots, and executive-level support to drive continuous improvement. Banks that focus on end-to-end journey design and measure KPIs like NPS and customer effort score see higher satisfaction and loyalty. McKinsey found that banks with superior customer experience deliver 116% higher shareholder returns. These best practices show that a unified, omnichannel approach is key to future-ready banking.

Hyper-Personalization Trends

AI-Driven Personalization

Banks now use AI to deliver personalized experiences that match each customer’s needs. AI analyzes internal data to predict what clients want, then sends messages tailored to their preferences. This approach improves campaign effectiveness and builds loyalty. Many banks use AI to create content at scale, offer hyper-personalized banking services, and individualize every step of the customer journey. Nearly half of organizations using AI for personalisation report measurable gains in revenue, productivity, or margins. Continuous learning AI systems adapt to changing customer preferences, while AI-powered chatbots like Sobot deepen relationships by providing instant, relevant support.

| Metric | Evidence | Impact |

|---|---|---|

| Customer Satisfaction | AI personalisation leads to a 25% increase in satisfaction scores | Enhanced customer experience through AI personalization |

| Customer Churn Reduction | Banks report a 10-15% reduction in churn with personalization | Stronger customer retention and revenue preservation |

| Mobile Banking Adoption | Personalized features drive 31% higher adoption | Increased engagement with digital platforms |

| Cross-Selling Success | Advanced personalisation increases cross-selling by 20-30% | Improved revenue through targeted product offers |

| Regional Bank Case Study | 22% more app engagement, 18% product growth, 13% less attrition | Real-world benefits of AI personalization in banking |

Customer Data and Insights

Customer data powers personalisation in banking. Banks collect information about spending, preferences, and behaviors to design personalized offers and advice. Half of consumers want their bank to be more proactive with relevant financial information. Personalized offers and educational content can turn short-term users into loyal advocates. Banks use customer affinities, such as travel perks or luxury cards, to boost confidence and conversion rates. Fintech companies analyze financial backgrounds and segment customers to tailor products and marketing. This data-driven approach improves acquisition, retention, and risk management.

Future of Banking Customer Experience

Hyper-personalized banking will shape the future of customer experience. Banks that use AI, machine learning, and big data analytics will deliver real-time, anticipatory engagement. This shift increases satisfaction, loyalty, and revenue. Marketing becomes more efficient, as banks target campaigns to specific needs. Younger generations expect seamless, personalized digital banking experiences. The AI in banking market is projected to reach $64.5 billion by 2028, showing rapid adoption of hyper-personalization technologies (source). Sobot’s AI-powered solutions help banks meet these demands by providing secure, scalable, and personalized customer journeys. In the next five years, hyper-personalization will move from a competitive edge to a basic requirement for banks.

Mobile-First and Digital Banking Experience

Mobile Apps and Communication

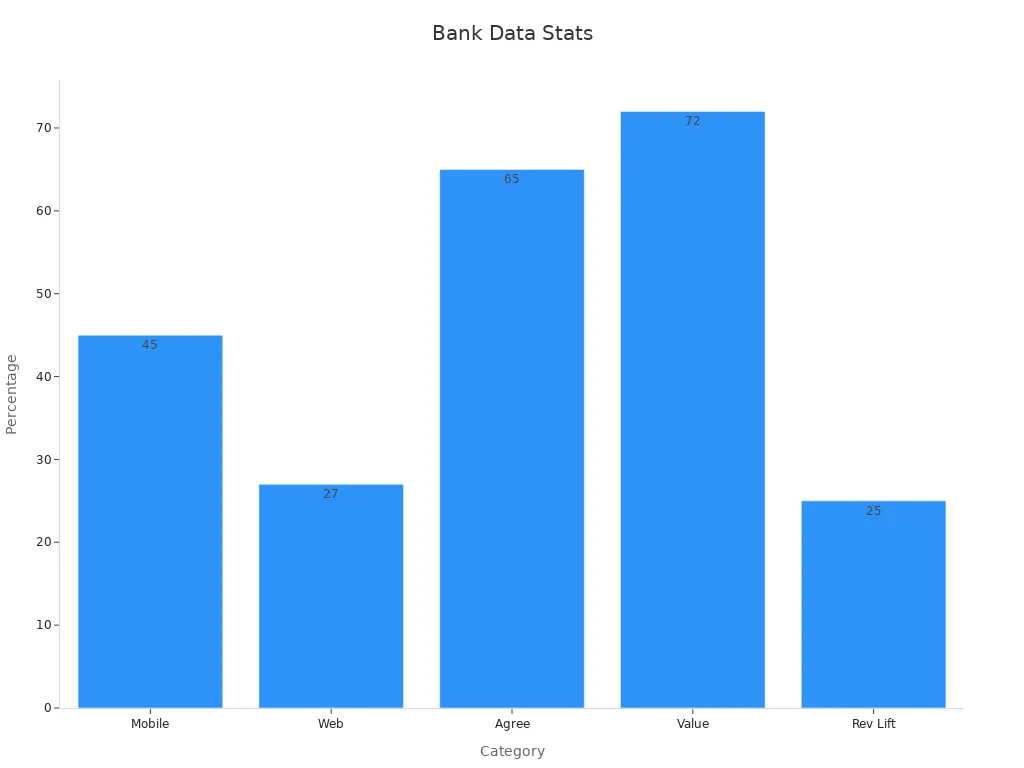

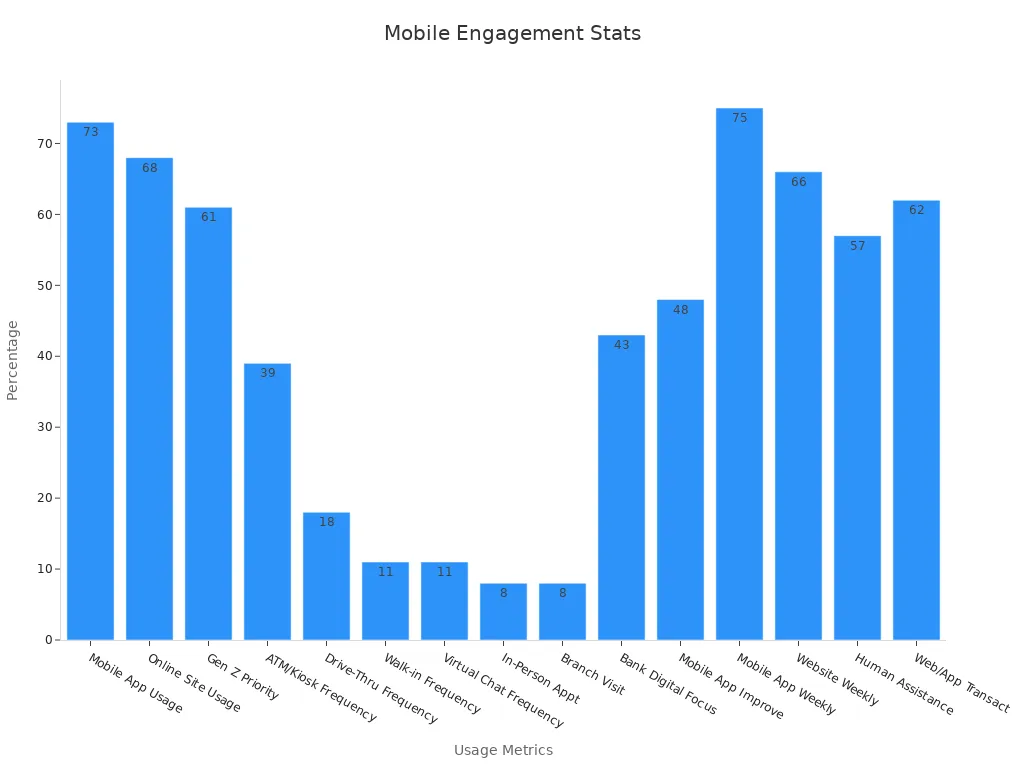

Banks now focus on mobile-first banking experiences to meet customer needs. Most people prefer using mobile banking apps for daily transactions. The adoption rate of mobile banking in the U.S. stands at 89%, with projections reaching 91% by 2024. This shift shows that mobile apps have become the main communication channel for digital banking. The following table highlights how customers interact with different banking channels:

| Statistic Description | Value / Insight |

|---|---|

| Percentage of customers regularly using mobile banking apps | 73% |

| Percentage of customers using online banking websites | 68% |

| Generation Z prioritizing mobile apps as #1 feature | 61% |

| Percentage of consumers using mobile banking in the U.S. | 89%, projected to reach 91% by 2024 |

| Percentage of consumers using mobile apps weekly | Almost 75% |

| Consumer preference for common transactions via web/mobile | 62% |

Banks invest in digital onboarding to make account setup fast and easy. A frictionless onboarding process helps customers start using services quickly. Many banks now use digital tools to guide users through onboarding, reducing wait times and paperwork.

Security and Trust

Security remains a top concern for mobile banking users. Banks build trust by using strong security measures, such as two-factor authentication and encrypted transactions. The rise in smartphone usage from 35% to 80% in 2020 shows that more people trust mobile technology for financial tasks. Jibun Bank in Japan gained over 500,000 new accounts after launching secure mobile banking services. Studies show that privacy and security assurances help customers feel safe, leading to higher retention and ongoing use of digital banking.

Banks that prioritize security during onboarding see higher customer satisfaction and loyalty.

Sobot in Digital Banking

Sobot supports banks in delivering a seamless digital banking experience. Its AI-powered platform helps banks automate onboarding, customer support, and communication across channels. For example, OPay used Sobot’s multi-language system and unified access to expand into new markets. Sobot’s integration with WhatsApp Business Platform made communication easier and reduced business costs. Banks using Sobot report a 100% increase in operational efficiency and up to a 68% reduction in staffing needs during peak periods. Sobot’s solutions ensure that onboarding and support remain fast, secure, and customer-friendly.

Proactive and Empathetic Support

AI-Powered Assistance

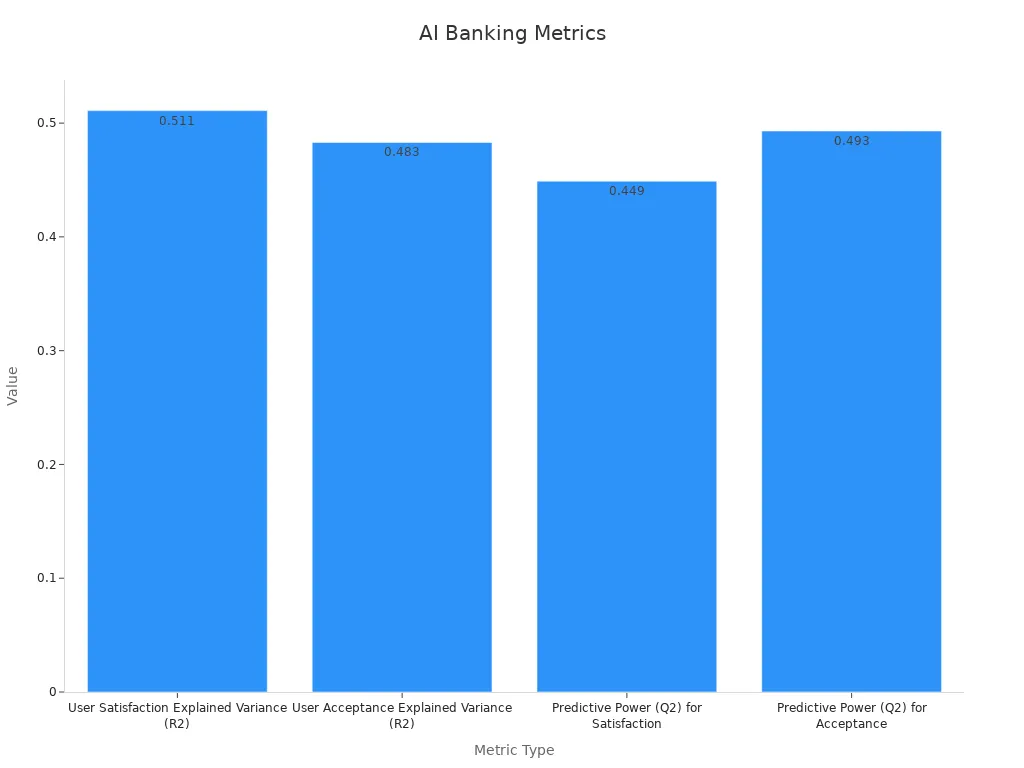

Banks use ai to deliver proactive support and anticipate customer needs. Modern ai systems analyze customer interactions, predict issues, and offer solutions before problems escalate. Sobot’s AI-powered platform helps banks automate onboarding, provide instant responses, and create self-service opportunities for routine questions. This approach improves customer experience by reducing wait times and increasing satisfaction. The following table shows how ai features impact user satisfaction and acceptance in banking:

| Metric / Factor | Description / Impact on User Satisfaction and Acceptance | Quantitative Evidence |

|---|---|---|

| User Satisfaction Explained Variance (R2) | 51.1% of variance in user satisfaction explained by AI factors and expectation confirmation | R2 = 0.511 |

| User Acceptance Explained Variance (R2) | 48.3% of variance in user acceptance explained by satisfaction and corporate reputation | R2 = 0.483 |

| Predictive Power (Q2) for Satisfaction | Model's predictive power for user satisfaction | Q2 = 0.449 |

| Predictive Power (Q2) for Acceptance | Model's predictive power for user acceptance | Q2 = 0.493 |

| Visual Attractiveness | Positively related to user satisfaction | Significant positive relationship |

| Problem Solving | Positively related to user satisfaction | Significant positive relationship |

| Communication Quality | Positively related to user satisfaction | Significant positive relationship |

| Corporate Reputation | Positively impacts user acceptance | Significant positive relationship |

| Customization | Found insignificant in this study for satisfaction | Insignificant impact |

| Trendiness | Found insignificant in this study for satisfaction | Insignificant impact |

Human-Centered Service

While ai improves efficiency, customers still value human-centered service for complex needs. Most people feel more comfortable when a real person helps them resolve issues. Banks that combine ai with live agents deliver a more balanced customer experience. Sobot’s omnichannel platform allows seamless handoff from chatbot to human agent, ensuring customers receive personalised service when needed.

- 99% of customers feel more comfortable with human assistance for issue resolution.

- 80% of consumers expect to interact with a human agent when contacting a company.

- 68% of customers would not use a chatbot again after a bad experience.

A hybrid approach, blending ai and human support, creates a self-service strategy that meets both efficiency and empathy goals.

Customer Feedback Channels

Structured feedback channels help banks improve support and anticipate customer needs. AI-generated insights from customer interactions allow teams to act quickly and proactively. By embedding feedback tools in onboarding and support journeys, banks can reduce resolution times by 25% and increase satisfaction by 20%. Real-time feedback enables banks to adjust services, improve self-service opportunities, and build trust. Sobot’s platform supports omnichannel feedback collection, empowering banks to refine their customer experience strategy and maintain high standards.

Open Banking and Future Technologies

APIs and Embedded Banking

Open banking APIs and embedded banking platforms are transforming the future of banking customer experience trends. Banks now use APIs to connect with third-party services, making financial tools available directly within apps people already use. For example, Wells Fargo’s partnership with FISPAN lets customers access banking services inside their ERP systems. This approach removes the need to switch between apps, making banking seamless and efficient. Numerical studies show embedded finance can lower customer acquisition costs by up to 70% and boost engagement by 40%. E-commerce and ride-sharing platforms like Shopify and Uber have improved transaction speed and user satisfaction through these integrations. Sobot’s unified platform supports API-driven workflows, helping banks deliver integrated, real-time services that meet the demands of the bank of 2030.

Data Security

As open banking expands, data security becomes even more important for the future of banking customer experience trends. Each data breach costs U.S. companies an average of $4.88 million, according to IBM’s 2024 report. Only 31% of consumers fully trust third-party providers with their financial data. Banks must use strong authentication, encryption, and clear consent processes to protect customer information. Sobot’s solutions offer secure, scalable infrastructure with advanced encryption and compliance features. This helps banks maintain trust and meet strict security standards as they adopt open banking models. Trust remains fragile, so banks must actively protect data to ensure a positive future for customer relationships.

Future Banking Customer Experience Trends

The future of banking customer experience trends will be shaped by rapid technology adoption and changing customer needs. Key trends include:

- 87% of banks worldwide will use biometric authentication by 2025.

- Digital wallets will dominate U.S. e-commerce transactions, especially among Generation Z.

- Generative AI will improve efficiency by 35% in customer service.

- Cloud computing will unlock up to $80 billion in annual EBITDA for large banks by 2030.

- Over 60% of customers expect banks to understand their specific needs.

Banks face challenges with legacy systems and cybersecurity, but modular upgrades and strategic partnerships can help. Sobot’s integrated solutions support banks as they move toward the bank of 2030, ensuring they stay ahead in the future of banking customer experience trends.

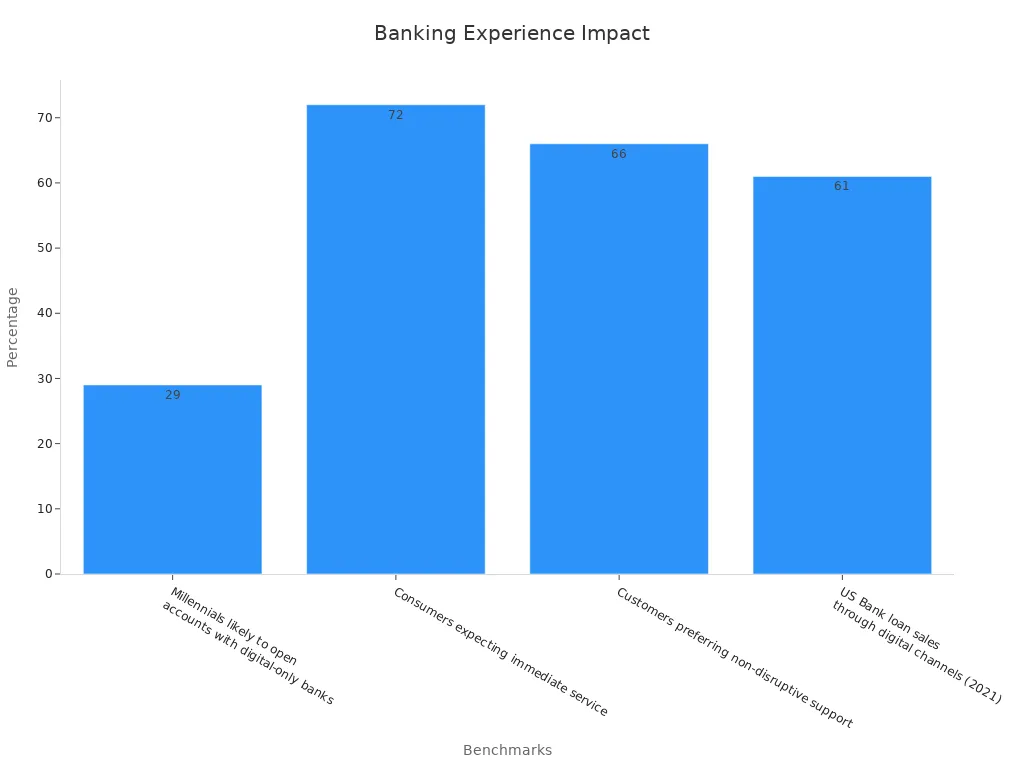

Banks that adopt AI, omnichannel platforms, and hyper-personalization see measurable gains in customer satisfaction and efficiency. The table below highlights key benchmarks shaping digital banking in 2025:

| Benchmark / Strategy | Data / Description |

|---|---|

| Millennials likely to open accounts with digital-only banks | 29% (Deloitte survey) |

| Mobile banking app downloads worldwide | Nearly 550 million |

| Consumers expecting immediate service | 72% |

| Customers preferring non-disruptive support | 66% (2024 survey) |

| US Bank loan sales through digital channels (2021) | 61% |

| Use of AI and big data | Personalization through data integration and predictive features |

| Digital adoption platforms (e.g., Whatfix) | In-app guidance, real-time assistance, analytics, reducing friction |

| Blockchain technology | Enhances security, transparency, and auditability |

| Multichannel integration and real-time responsiveness | Improves customer satisfaction and operational efficiency |

| Emphasis on trust and social responsibility | Builds customer loyalty and competitive advantage |

Banks should prioritize innovation, leverage solutions like Sobot, and adapt quickly to changing needs. Continuous feedback and agility help improve customer experience. Sobot’s secure, scalable platform gives banks a competitive edge for 2025 and beyond.

FAQ

What are the top banking customer experience trends for 2025?

Banks focus on AI-driven automation, hyper-personalization, and omnichannel support. According to BCG, the AI in banking market will reach $64.5 billion by 2028. Sobot’s solutions help banks stay ahead in these banking customer experience trends.

How does Sobot improve banking customer experience trends?

Sobot provides AI-powered chatbots, omnichannel platforms, and secure communication tools. Banks using Sobot report a 90% customer satisfaction rate and a 17% increase in conversion rates. These features align with the latest banking customer experience trends.

Why is omnichannel support important for banking customer experience trends?

Omnichannel support lets customers interact through their preferred channels, such as WhatsApp, email, or voice. This approach creates seamless journeys and higher satisfaction. Sobot’s unified platform enables banks to deliver consistent service, supporting key banking customer experience trends.

How do banks ensure security while following new banking customer experience trends?

Banks use encryption, two-factor authentication, and strict compliance standards. Sobot’s infrastructure offers advanced security and privacy features, helping banks protect data while adopting modern banking customer experience trends.

Can AI chatbots replace human agents in banking customer experience trends?

AI chatbots handle routine queries and boost efficiency. However, human agents remain essential for complex issues. Sobot’s platform blends AI with live support, ensuring banks meet all customer needs and lead in banking customer experience trends.

See Also

Discover The Leading Cloud Contact Centers For 2025

Best Ten Customer Voice Software Solutions For 2024

Leading Ten AI Tools For Enterprise Contact Centers