Top 10 call center compliance regulations every business needs

Call center compliance stands as the foundation for customer trust in every industry. You face strict requirements from regulations like TCPA, GDPR, PCI DSS, HIPAA, FDCPA, Telemarketing Rules, DNC Registry, CCPA, TILA, and call center compliance and recording laws. Each of these regulations sets clear requirements to protect data, ensure transparency, and prevent abusive practices. When you follow a strong compliance checklist, you avoid penalties and boost customer trust. Recent industry data shows that call center compliance directly impacts customer trust, with non-compliance leading to financial loss and damaged relationships. Sobot and Sobot AI equip your call center operations with advanced tools that meet regulatory compliance requirements, helping you address compliance issues and build a reliable compliance program. As you read, assess your compliance checklist and see where you can strengthen customer trust.

TCPA

Overview

The Telephone Consumer Protection Act (TCPA) sets strict regulations for how you contact customers by phone. This law protects consumers from unwanted calls, texts, and faxes. TCPA compliance is essential for your call center because violations can lead to severe financial penalties and loss of customer trust. For example, Dish Network received a $280 million fine in 2017 for violating TCPA requirements. The table below highlights the financial risks of non-compliance:

| Compliance Aspect | Numerical Evidence | Impact/Significance |

|---|---|---|

| TCPA Violation Penalties | $500 to $1,500 per violation | High financial risk per infraction |

| Dish Network TCPA Fine | $280 million (2017) | Severe consequences for non-compliance |

Requirements

You must follow several key requirements under TCPA regulations:

- Obtain prior express written consent before making automated calls or sending texts.

- Honor Do Not Call (DNC) lists and update them regularly.

- Provide clear opt-out options for customers.

- Avoid calling before 8 a.m. or after 9 p.m. in the recipient’s local time.

- Maintain detailed records of consent and call activity.

- Train your staff on TCPA compliance requirements and best practices.

TCPA lawsuits often result from missing consent, poor DNC list management, or ignoring opt-out requests. Financial penalties can reach $1,500 per violation, and settlements often require costly operational changes. Reputational damage can also harm your business.

Sobot Voice/Call Center Tips

Sobot’s Voice/Call Center solutions help you meet TCPA requirements with advanced compliance tools. You can automate consent management, maintain accurate DNC lists, and track call activity in real time. Sobot’s intelligent IVR and call routing features ensure you respect customer preferences and time zones. The platform also supports detailed recordkeeping and agent training, making regulatory compliance easier to manage. By using Sobot, you reduce the risk of penalties and build stronger customer trust.

GDPR

Applicability

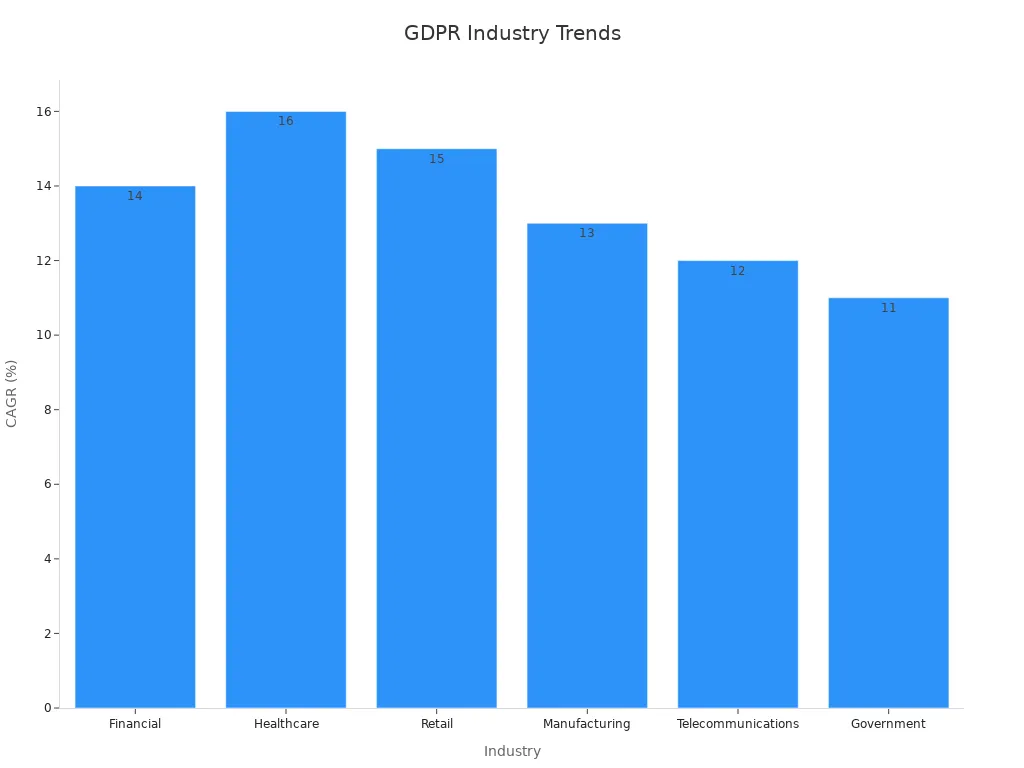

You must understand how GDPR applies to your business. This regulation affects any company that handles customer data from the European Union, even if your business operates outside Europe. GDPR sets strict data privacy regulations for all industries, including finance, healthcare, retail, manufacturing, telecommunications, and government. The scope of GDPR continues to grow, with more organizations investing in compliance solutions each year.

| Category | Details |

|---|---|

| Industry-wise GDPR Market Growth (2018 to 2025 forecast) | Financial sector market size grows from $1.2B to $3.8B (14% CAGR); Healthcare from $850M to $2.9B (16% CAGR); Retail from $700M to $2.5B (15% CAGR); Manufacturing from $500M to $1.8B (13% CAGR); Telecommunications from $450M to $1.6B (12% CAGR); Government from $400M to $1.4B (11% CAGR) |

| Organizational Size Market Growth | SMEs GDPR service market grows from $1.2B (2018) to $3.8B (2025 forecast); Large enterprises from $3.5B (2018) to $10.5B (2025 forecast) |

| Regional GDPR Enforcement and Fines | Spain issued over 800 fines by 2024; Italy fined Clearview AI €20M; Ireland issued 22 fines totaling €1.31B; Luxembourg 25 fines worth €746M; Germany and Netherlands had highest breach notifications (106,731 and 92,657 respectively) |

| Compliance and Readiness Levels | 53% of EU/UK companies felt well-prepared for GDPR in 2023; 35% moderately prepared; 10% slightly ready; 2% unprepared |

| US Companies GDPR Impact and Compliance | 30% fully compliant by Q2 2024; 45% partially compliant; 25% non-compliant; 40% appointed Data Protection Officers; average annual GDPR compliance spend approx. $1.2M |

| GDPR Fines and Enforcement Trends | Total fines since 2018 reached €2.92B (~$3.1B); 1,098 fines issued between 2021-2023; 11 EU countries issued fines over €1M between 2022-2023 |

| Market and Regulatory Impact | GDPR compliance reduced business growth by 37% in Europe; 75% of European businesses report improved data management; demand for Data Protection Officers surged over 700% since enforcement |

You see that data privacy regulations impact every sector. Regulatory compliance is not optional. Fines for violations can reach millions of euros, and data breach notification requirements are strict.

Data Protection

GDPR requires you to protect customer data and sensitive data at every stage. You must track where you store sensitive data, how you process it, and who can access it. Data privacy regulations demand that you respond quickly to data breaches and keep detailed records of all incidents.

- You need to identify all data sources and classify sensitive data.

- Regular data discovery scans help you find risks.

- You must measure how fast you fix privacy issues.

- Track incident response rates and employee training.

- Monitor access controls and vendor compliance.

Tip: Use metrics like the number of data subject access requests, response times, and privacy training rates to measure your compliance program’s strength.

Data privacy regulations also require you to notify authorities and customers quickly after a data breach. This builds trust and shows your commitment to protecting customer data.

Sobot Compliance Features

Sobot’s Voice/Call Center solutions help you meet GDPR and other data privacy regulations. You get secure data storage, encrypted call recordings, and access controls that protect sensitive data. Sobot’s unified workspace lets you manage customer data efficiently and respond to data breaches fast. The platform supports detailed audit trails and compliance reporting, making regulatory compliance easier for your team.

Sobot also offers AI-powered tools to automate data discovery and monitor compliance metrics. You can track privacy training, manage data subject requests, and ensure your call center meets all data privacy regulations. With Sobot, you stay ahead of regulations and protect your business from costly fines.

PCI DSS

Payment Data

You handle payment data every day in your call center. PCI DSS, or Payment Card Industry Data Security Standard, sets strict regulations for how you collect, process, and store cardholder information. These regulations protect your customers from fraud and data breaches. You must never store sensitive data like the full card number, CVV, or PIN after authorization. PCI DSS requires you to mask card numbers and use secure methods for payment processing. A study on payment gateways found that PCI DSS compliance leads to fewer violations and a lower risk of data breaches. This shows that following these regulations is not just about avoiding fines—it is about protecting your customers’ trust.

Security Standards

PCI DSS outlines twelve core requirements for data security. You need to build and maintain secure networks, protect sensitive data, and monitor all access to payment systems. Regular vulnerability testing and strong access controls are essential. Common failures include using default passwords, weak encryption, and poor log monitoring. Audits show that organizations with strong compliance programs have fewer security incidents. You must treat compliance as an ongoing process, not a one-time event. Continuous monitoring, risk assessments, and regular staff training help you meet regulatory compliance and keep your systems safe.

Tip: Use validated third-party applications and enforce strict access control policies to strengthen your data security posture.

- PCI DSS compliance involves:

- Internal and external audits

- Encryption of sensitive data

- Continuous monitoring and vulnerability testing

- Administrative controls and secure system development

Sobot Data Security

Sobot’s Voice/Call Center solutions help you achieve PCI DSS compliance with advanced security features. You get encrypted call recordings, secure data storage, and detailed access controls. Sobot’s unified workspace ensures that only authorized agents can view or handle sensitive data. Real-time monitoring and analytics help you detect and respond to threats quickly. Sobot supports seamless integration with your payment systems, making it easier to follow PCI DSS regulations. With Sobot, you build a strong data security foundation and maintain customer trust while meeting all regulatory compliance requirements.

HIPAA

Health Data

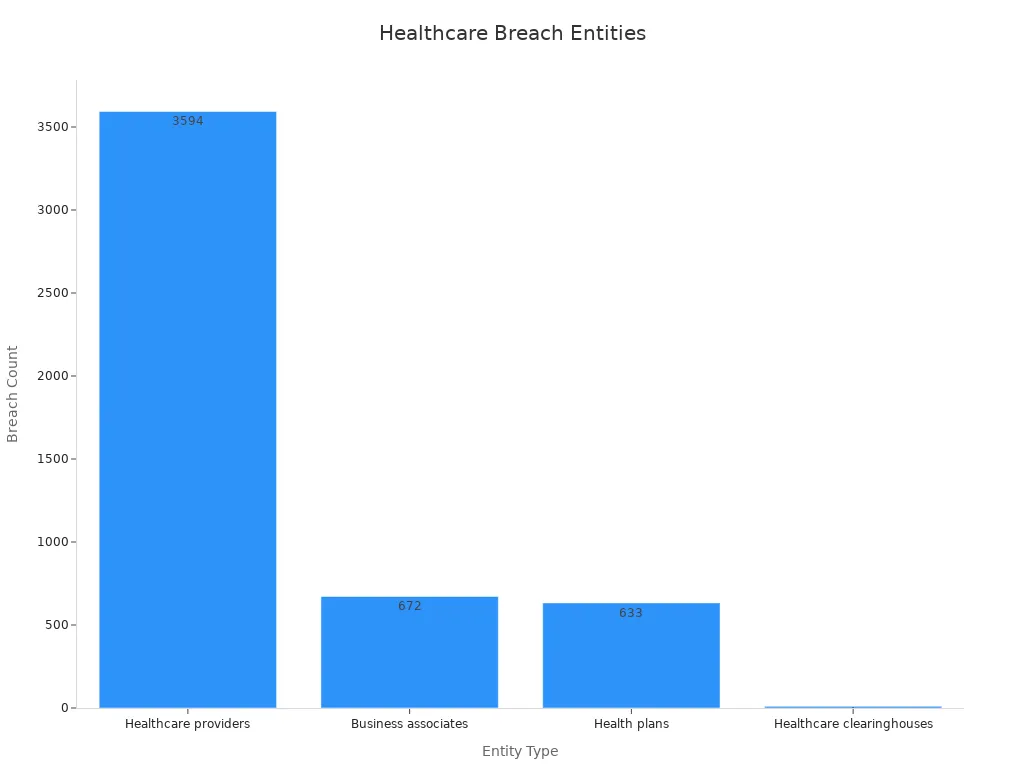

You handle sensitive health data every day in your call center. HIPAA, or the Health Insurance Portability and Accountability Act, sets strict regulations to protect patient information. These regulations apply to healthcare providers, health plans, and business associates. The number of healthcare data breaches has increased sharply in recent years. In 2021, there were 715 reported breaches, compared to just 199 in 2010. Over 50 million individuals were affected in 2021 alone, which is about 15% of the US population. The table below shows the growing impact of non-compliance:

| Statistic Category | Data / Trend |

|---|---|

| Number of breaches reported (2010) | 199 cases |

| Number of breaches reported (2021) | 715 cases |

| Individuals affected (2021) | 50 million (approx. 74,000 per breach) |

| Total records exposed since 2009 | Approximately 359 million records lost, stolen, or exposed |

| Leading cause of breaches | Hacking/IT incidents (~50% of breaches), often via phishing |

| Unauthorized access/disclosure | About 25% of breaches due to improper or malicious access |

Privacy Rules

HIPAA privacy rules require you to implement strong administrative, physical, and technical safeguards. You must train your staff, restrict access to health data, and use encryption to protect information. Regular audits and incident response plans help you detect and respond to threats quickly. Regulations demand that you document all privacy policies and keep detailed records. Employee negligence remains a leading cause of breaches, so ongoing training is essential. HIPAA violations can result in fines up to $1.5 million per violation, with the average cost per violation reaching $9.3 million. Following these regulations helps you avoid costly penalties and maintain trust.

Tip: Conduct regular security awareness training and enforce role-based access controls to reduce risks.

Sobot Secure Solutions

Sobot’s Voice/Call Center solutions help you achieve HIPAA compliance with advanced security features. You get encrypted call recordings, secure data storage, and strict access controls. Sobot’s unified workspace ensures only authorized agents can access protected health information. Real-time monitoring and audit trails make it easy to track compliance and respond to incidents. Sobot supports your regulatory compliance efforts by automating privacy policy management and providing continuous security updates. With Sobot, you can confidently meet HIPAA regulations and protect your patients’ data.

FDCPA

Debt Collection

The Fair Debt Collection Practices Act (FDCPA) sets clear requirements for how you collect debts from consumers. These requirements protect people from unfair or abusive practices. You must follow strict rules about when and how you contact customers. The FDCPA has led to important changes in the industry. For example, new disclosure requirements have reduced costly formal disputes. The table below shows how FDCPA regulations affect debt collection:

| Metric / Outcome | Numerical Finding / Effect Description |

|---|---|

| Reduction in access to credit card accounts | Very small overall; effect concentrated among sub-prime borrowers |

| Equivalent credit score impact | Reduction equivalent to 3 points or less on consumers' credit scores |

| Change in interest rates | No observed overall change |

| Introductory 0% APR offers for prime borrowers | Slight reduction after debt collection restrictions |

| Formal disputes of collection records | Decrease in costly formal disputes following new disclosure requirements |

| Payments on collections | Short-term decline |

You must understand these requirements to avoid penalties and maintain trust.

Communication Rules

You need to follow strict communication rules under the FDCPA. These requirements include contacting consumers only during allowed hours and avoiding prohibited language. If you break these requirements, you risk legal action and damage to your reputation. Regulators like the CFPB and FTC now focus on how you handle consumer complaints and experiences. They link poor interactions to possible violations. You must also secure consumer data and keep up with changing requirements. Automated communication monitoring and AI-driven auditing help you meet these requirements and improve compliance.

Note: Real-time monitoring and script checks can help you avoid violations and ensure your team follows all requirements.

Compliance Practices

Recent trends show a shift toward consumer-centric compliance models. You must balance strict requirements with positive consumer engagement. The table below highlights common compliance challenges and solutions:

| Compliance Challenge or Solution | Description |

|---|---|

| Ineffective Communication | Contacting consumers outside allowed hours or using prohibited language risks violations and damages trust. |

| Data Security Vulnerabilities | Failure to encrypt or secure consumer data risks breaches and legal consequences. |

| Falling Behind Regulatory Changes | Constantly evolving regulations require proactive monitoring and adaptation. |

| Automated Communication Monitoring | Real-time call/message monitoring flags potential FDCPA violations and ensures script compliance. |

| AI-Driven Compliance Auditing | Machine learning audits activities, predicts risks, and manages documentation for regulatory adherence. |

| Real-Time Regulatory Updates | Platforms provide instant alerts on regulatory changes, enabling quick compliance adjustments. |

| Data Encryption and Secure Sharing | End-to-end encryption protects sensitive consumer information from breaches and lawsuits. |

You can use Sobot’s Voice/Call Center to automate compliance procedures, monitor calls, and receive real-time regulatory updates. Sobot’s secure data storage and AI-powered auditing help you meet all FDCPA requirements and adapt to new compliance procedures quickly.

Telemarketing Rules

TSR Overview

You must follow telemarketing rules to protect your business and your customers. The Telemarketing Sales Rule (TSR), enforced by the FTC, sets clear standards for legal and ethical outbound calling. These rules require you to disclose your identity and the purpose of your call right away. You must also respect calling time restrictions and keep your call lists updated. Violations can lead to civil penalties of up to $51,744 per violation and even nationwide injunctions. The TSR also requires you to keep records, such as caller ID information and call transfer logs, for at least 24 months. This helps trace fraudulent activity and supports enforcement. Advocacy groups support these rules because they close enforcement gaps and protect consumers from deceptive practices.

- Civil penalties up to $51,744 per violation

- Immediate disclosure of caller identity and purpose

- Strict calling time restrictions (8 a.m. to 9 p.m.)

- Recordkeeping for caller ID and call transfers

- Prompt opt-out handling and honoring do-not-call requests

Sobot Outbound Features

Sobot’s Voice/Call Center platform helps you meet telemarketing rules and maintain compliance. You can automate outbound calls, manage consent, and track call activity in real time. Sobot’s system supports caller ID authentication and call recording, which are essential for compliance. The platform also provides bulk outbound task automation, smart call routing, and detailed analytics. With Sobot, you can easily update call lists, honor opt-out requests, and keep accurate records for audits. These features help you avoid penalties and build customer trust.

Tip: Use Sobot’s unified workspace to monitor compliance metrics and train your team on telemarketing rules.

Best Practices

To reduce compliance risks, you should follow these best practices:

- Obtain written consent before making telemarketing calls.

- Keep detailed records of consents, opt-outs, and do-not-call requests for at least four years.

- Monitor dialing devices to avoid calls to restricted numbers.

- Provide easy opt-out options for customers.

- Audit your processes and train employees regularly.

- Review scripts to include required disclosures and company identification.

- Restrict calls to approved time windows and adjust for state laws.

By following these steps and using Sobot’s compliance tools, you can ensure your outbound campaigns meet all telemarketing rules and protect your business from costly violations.

DNC Registry

Registry Basics

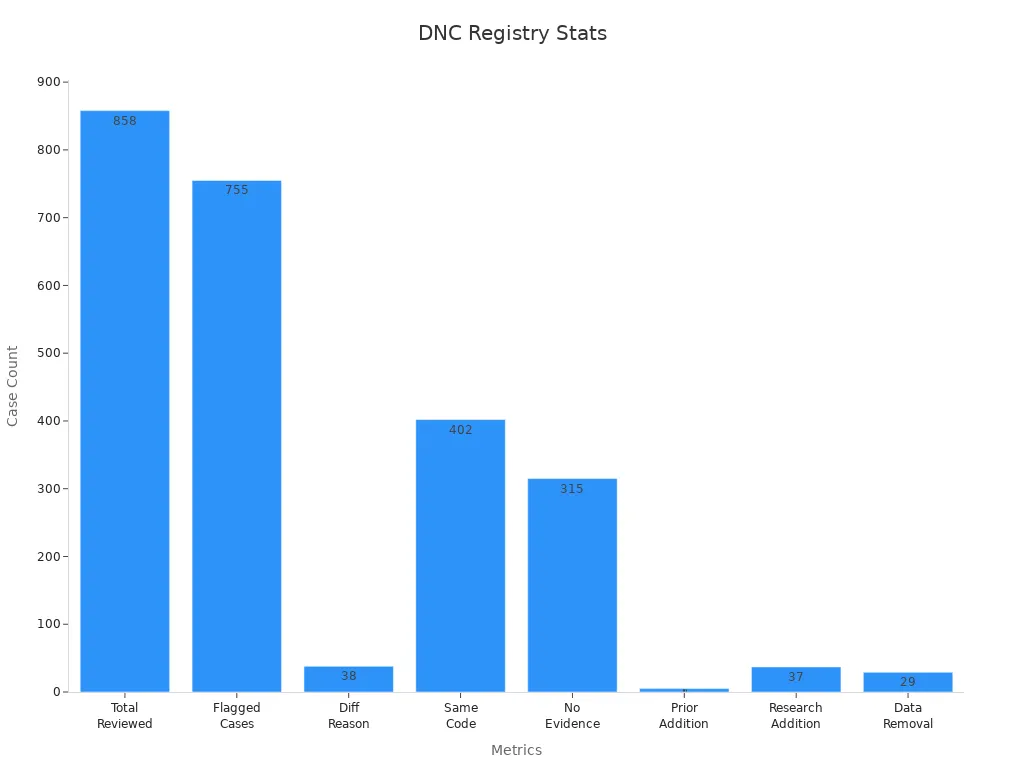

You must understand the Do Not Call (DNC) Registry to protect your business and respect customer preferences. The DNC Registry helps you avoid calling people who do not want telemarketing calls. Accurate management of the registry is critical for compliance and customer trust. Mistakes in DNC coding can lead to unwanted calls, complaints, and penalties. The following table shows how often errors occur in DNC registry management:

| Metric / Finding | Data / Statistic |

|---|---|

| Total cases manually reviewed | 858 |

| Cases with current DNC flag and reason code in SEER*DMS | 755 |

| Distribution of DNC reason codes among 755 cases | 58% Patient requested no contact; 20% Physician denied; 13% Patient unaware of cancer; 4% Patient mentally disabled; 4% Other; 1% Unknown |

| Cases with evidence supporting a different DNC reason code | 5% of 755 cases (38 cases) |

| Cases with evidence supporting current DNC code status | 53% of 755 cases (402 cases) |

| Cases with no evidence supporting either flag or code | 42% of 755 cases (315 cases) |

| Cases wanting data removed from registry | 29 cases (3% of total) |

| Time spent on manual review | ~150 hours (10 minutes per record) |

These numbers show the importance of regular reviews and updates for DNC registry compliance.

Compliance Steps

You can follow a clear process to ensure DNC Registry compliance:

- Register with the DNC Registry and get a Subscription Account Number (SAN).

- Download the registry for your area codes and renew your subscription each year.

- Scrub your call lists against the registry at least every 31 days.

- Use automated tools to reduce errors and save time.

- Provide clear opt-out options on every call and honor requests quickly.

- Document all opt-out requests and keep accurate records.

- Train your team on DNC rules and compliance procedures.

- Monitor call recordings to check for compliance.

Tip: Written documentation and regular training help you avoid costly compliance mistakes.

Sobot Call Management

Sobot’s Voice/Call Center platform makes DNC Registry compliance simple. You can automate call list scrubbing, manage opt-out requests, and track compliance in real time. Sobot’s unified workspace lets you update DNC lists and monitor agent activity easily. The system provides detailed audit trails and supports regular compliance training for your team. With Sobot, you reduce manual errors and keep your business safe from penalties. You also build stronger customer trust by respecting their preferences and following all compliance rules.

CCPA

Consumer Rights

You have a responsibility to respect the rights of your customers under the California Consumer Privacy Act (CCPA). This law gives people control over their personal information. You must inform customers about the types of customer data you collect and how you use it. The CCPA grants several important rights:

- The right to know what personal information you collect, use, or share.

- The right to delete personal information upon request.

- The right to opt out of the sale or sharing of personal information.

- The right to correct inaccurate data.

- The right to limit the use of sensitive information.

- The right to non-discrimination for exercising these rights.

You must respond to requests quickly and provide clear notices about your privacy practices. These rights help you build trust and show your commitment to customer privacy and compliance.

Data Handling

You need to handle customer data with care to meet CCPA compliance. Companies that invest in compliance save an average of $2.3 million each year by avoiding fines and legal costs. Most consumers—87%—support banning the sale of data without consent. This shows that strong compliance practices matter to your customers. CEOs also agree, with 83% saying compliance is essential for trust.

| Statistic / Insight | Value / Detail |

|---|---|

| Value of personal information protected annually by CCPA | Over $12 billion |

| Percentage of companies not fully compliant as of last year | Over 90% |

| Percentage of businesses acknowledging positive impact of privacy laws | 80% |

| Estimated cost per data request without automation | Up to $1,400 |

| Example of enforcement fine (Sephora, 2022) | $1.2 million |

You can see that compliance not only protects customer data but also improves your reputation and reduces risk. When you automate data handling, you lower costs and respond to requests faster.

Sobot Privacy Tools

Sobot’s Voice/Call Center solutions help you achieve CCPA compliance with advanced privacy tools. Sobot uses AI-powered automation to manage customer data securely and efficiently. The platform provides 24/7 support, task automation, and strong data protection policies. You can track consent, automate responses to data requests, and maintain transparency with your customers.

| Metric / Insight | Description |

|---|---|

| AI-powered customer interactions by 2025 | Expected to power 95% of customer interactions |

| Customer preference for data protection | 73% of customers prefer companies prioritizing data protection |

| Operational cost savings example | Companies reported $1.3 million savings by reducing ticket volumes through AI automation |

| Ethical AI practices | Regular audits, robust data protection, transparency, and opt-out options |

| Sobot's features | 24/7 support, automation, security, and integrity of customer data |

Sobot’s privacy tools align with CCPA requirements and help you demonstrate compliance. You can protect customer privacy, reduce operational costs, and build lasting trust with your customers.

TILA & Disclosures

Lending Rules

You must follow the Truth in Lending Act (TILA) to protect your customers from unfair lending practices. TILA sets clear rules for lenders and helps consumers understand the true cost of credit. Here are some important points:

- TILA protects you from inaccurate and unfair credit billing and credit card practices.

- Lenders must give you clear information about loan costs so you can compare offers.

- You have the right to cancel certain loans within three days, which helps you avoid high-pressure sales.

- The Office of the Comptroller of the Currency (OCC) enforces accurate disclosure of annual percentage rates (APR) and finance charges.

- Federal law and interagency guidance support these disclosure and enforcement rules.

These lending rules help you make informed decisions and keep your business in line with compliance standards.

Disclosure Standards

You need to meet strict disclosure standards under TILA. Lenders must use forms like the Loan Estimate and Closing Disclosure to show all fees and terms. Most institutions have adopted the TRID rule, which combines TILA and RESPA disclosures. Strong compliance programs use technology, regular training, and audits to reduce violations. Most violations are technical and isolated, not systemic. When you follow disclosure standards, you help customers understand their loans and avoid surprises. Ongoing monitoring and vendor management also support compliance and reduce risk.

Tip: Use automated systems to track disclosures and keep your compliance program strong.

Compliance Tips

To maintain compliance with TILA and disclosure rules, you should:

- Collect all six required pieces of application information before issuing a Loan Estimate.

- Train your staff regularly to ensure accurate data collection.

- Only revise fees when a defined triggering event occurs.

- Issue courtesy revised Loan Estimates with updated information, but do not reset fee tolerances unless allowed.

- Keep documentation for all revised Loan Estimates and retain records for three years.

- Track multiple revised Loan Estimates to monitor fee tolerance thresholds.

- Use CFPB resources for continuous staff training.

- Monitor triggering events and redisclose quickly to reduce costs and speed up transactions.

The TRID rule requires you to compare disclosed fees with actual fees at closing. Six specific events allow you to reset fees and perform a good-faith analysis. Ongoing monitoring and retraining help you manage compliance risk. Sobot’s Voice/Call Center solutions can automate documentation, track disclosures, and support your compliance efforts, making it easier to stay up to date and avoid costly errors.

Call Center Compliance & Recording Laws

Consent Rules

You must always secure customer consent before recording calls. Laws differ by region. Some states in the U.S. require one-party consent, while others demand all parties agree. Failing to get proper consent can lead to fines, lawsuits, and loss of trust. You should clearly inform customers at the start of each call that you will record the conversation. This step supports call center compliance and protects your business from legal risks. Many companies use automated messages to announce call recordings and collect customer consent. This approach ensures you meet call recording compliance standards and avoid disputes.

Sobot Recording Features

Sobot’s Voice/Call Center platform gives you advanced tools for call center compliance. You can enable encrypted call recordings and set granular access controls. The system supports retention schedules and audit logs, which help you meet regulations like GDPR and HIPAA. Supervisors can use live monitoring, whisper coaching, and barging to enforce compliance in real time. Sobot’s AI-driven analytics provide transcription, speech analytics, and sentiment detection. These features help you spot compliance risks and improve agent performance. Privacy controls, such as pause and resume recording, address legal and privacy needs. Many banks and healthcare providers use Sobot to pass audits and resolve disputes. Companies have seen up to a 45% drop in escalation rates after using these tools.

Best Practices

To maintain strong call center compliance, you should:

- Always announce call recordings and get customer consent.

- Use secure storage and limit access to sensitive data.

- Set clear retention policies for call recordings.

- Monitor calls for compliance and train agents regularly.

- Use dashboards to track metrics like average handling time and first-call resolution.

Tip: Regularly review your call recording compliance process to adapt to new laws and industry standards.

By following these best practices and using Sobot’s features, you can protect your business, meet compliance requirements, and build customer trust.

You build customer trust when you follow a strong compliance checklist for your call center operations. Each regulation on your compliance checklist protects customer trust and helps you avoid compliance issues. Sobot’s Voice/Call Center solutions support your compliance program with tools that address compliance issues and improve call center operations. Studies show that 90% of customers stay loyal to brands they trust. To strengthen your compliance checklist, you should schedule regular training, review your compliance program, and use technology that solves compliance issues. Reach out to Sobot for help with compliance issues and to boost customer trust.

FAQ

What is call center compliance and why does it matter?

Call center compliance means following laws and industry rules when handling customer data and calls. You protect customer trust and avoid fines. For example, non-compliance can cost up to $51,744 per violation under telemarketing rules. Sobot helps you automate compliance tasks and reduce risks.

How does Sobot support call center compliance?

Sobot provides encrypted call recordings, real-time monitoring, and automated consent management. You can track compliance metrics, manage DNC lists, and access detailed audit trails. These features help you meet call center compliance requirements and pass audits with confidence. Learn more at Sobot Voice/Call Center.

What happens if you do not follow call center compliance regulations?

You risk heavy fines, lawsuits, and loss of customer trust. For example, GDPR violations have led to over €2.9 billion in fines since 2018 (source). Sobot’s compliance tools help you avoid these costly mistakes and maintain a strong compliance checklist.

How often should you review your call center compliance program?

You should review your call center compliance program at least every quarter. Regular reviews help you catch new risks, update policies, and train staff. Sobot’s unified workspace makes it easy to monitor compliance and schedule training sessions for your team.

Can Sobot help with global call center compliance requirements?

Yes. Sobot supports global call center compliance with features like time zone support, multilingual AI, and secure data storage. You can manage compliance for regulations such as GDPR, CCPA, and PCI DSS across different countries using one platform.

Tip: Use Sobot’s analytics to track compliance progress and spot areas for improvement.

See Also

Best Call Centers In The Philippines For 2024

Leading Analytics Tools For Call Centers In 2024

Comprehensive Guide To Quality Management Systems In Call Centers