Outstanding Customer Service in the Banking Industry

What defines excellent customer service in the financial service sector? It goes beyond quick transactions or user-friendly banking tools; it’s about fostering trust, building loyalty, and delivering seamless customer experiences. In the customer experience in banking industry, 82% of customers value trust more than fees and rates, underscoring the importance of getting it right. Banks that implement proactive communication—such as alerts for suspicious activity—experience a 22% boost in satisfaction. As customer expectations continue to rise, innovative solutions like AI-powered tools can cut resolution times by 35%, revolutionizing the banking experience. With Sobot’s cutting-edge technologies, financial institutions can effectively meet these evolving demands.

Key Elements of Excellent Customer Service in Banking

Personalization and Tailored Financial Solutions

Making banking more personal is no longer optional—it’s essential. Customers expect banks to understand their unique needs and provide personalized financial advice. Imagine receiving tailored loan offers or investment plans based on your financial goals. This level of personalization not only enhances customer satisfaction but also builds trust.

Banks that excel in personalization see tangible results. For example:

- 76% of consumers are more likely to engage with brands that personalize their communications.

- Financial institutions using advanced personalization strategies report a 20-30% increase in cross-selling success rates.

- AI-driven personalization improves customer satisfaction scores by 25%, with 83% of customers willing to share data for better experiences.

Mobile banking apps are leading the charge in making banking more personal. These apps offer personalized guidance, boosting satisfaction scores by 30%. By leveraging AI and customer data, banks can reduce churn rates by up to 15%, ensuring long-term loyalty.

Building Trust Through Transparency and Security

Trust is the cornerstone of excellent customer service in banking. Customers want to feel confident that their personal data is safe and handled with respect. Transparency plays a huge role in building this trust. When banks openly communicate how they use customer data, they foster stronger relationships.

Statistics highlight the importance of trust and security:

- 81% of people believe that how a business treats personal data reflects its respect for customers.

- 39% say data transparency is the most important factor for building trust.

- 43% feel companies aren’t doing enough to protect personal data online.

Banks can address these concerns by implementing robust security measures and clear data policies. Proactive communication, such as alerts for suspicious activity or quick card replacement services, reassures customers and strengthens trust.

Efficiency in Problem Resolution and Service Delivery

Speed and accuracy are critical in customer service in banking. Customers expect quick solutions to their problems, whether it’s resolving a transaction error or replacing a lost card. Efficient service delivery not only improves the customer experience but also boosts satisfaction.

For instance, Elements Financial transformed its application process by using automation. What used to take three weeks now takes just 15-20 minutes. This efficiency increased approved applications by 11%, proving that streamlined processes make a big difference.

Banks can measure their efficiency using criteria like average time to close issues and error rates in new account setups. Here’s a snapshot:

| Measurable Criteria | Description |

|---|---|

| Customer Satisfaction Metrics | Feedback gathered from surveys to assess communication and service speed. |

| Automation Efficiency | Time saved and error reduction through automated processes. |

| Average Time To Close Issues | Duration from identifying a problem to its resolution. |

| New Account Setup Error Rate | Percentage of accounts created with errors, reflecting service accuracy. |

By adopting automation and proactive communication, banks can deliver faster resolutions and enhance the overall customer experience.

Proactive Communication to Enhance Customer Experience

Proactive communication is a game-changer in the customer experience. Instead of waiting for customers to reach out, banks that take the initiative to connect with their clients build stronger relationships and foster trust. Imagine receiving a notification about a suspicious transaction before you even notice it. That’s the power of proactive engagement.

Banks that excel in this area see remarkable results. For example:

- Chase Bank implemented proactive communication strategies, which led to higher customer satisfaction and retention rates.

- Bank of America enhanced loyalty by offering personalized services and fraud prevention alerts.

- Revolut, known for its innovative approach, keeps customers engaged with timely updates and tailored financial insights.

These examples show how proactive communication can transform the customer experience in the banking industry. Customers feel valued when banks anticipate their needs and provide solutions before problems arise. Whether it’s a reminder about an upcoming payment or a quick update on account activity, these small gestures make a big difference.

Technology plays a crucial role here. AI-powered tools and data analytics enable banks to predict customer needs and deliver timely messages. For instance, a bank might use AI to identify patterns in spending and send personalized savings tips. This not only improves customer satisfaction but also strengthens loyalty.

Proactive engagement isn’t just about solving problems; it’s about creating meaningful interactions. When customers feel understood and supported, they’re more likely to stay loyal. By adopting these strategies, banks can set themselves apart in a competitive market.

Real-World Examples of Outstanding Customer Service in Banking

Nationwide: Rich Messaging to Show Customers They Care

Nationwide has set a benchmark in customer service by using rich messaging to connect with customers on a deeper level. Imagine receiving a message from your bank that not only informs you about your account activity but also offers helpful tips tailored to your financial goals. Nationwide’s approach goes beyond transactional communication. It focuses on building meaningful relationships with its customers.

This strategy has proven effective. Research shows that banks can increase revenue from primary customers by up to 20% by fostering more meaningful personal relationships. However, only 30% of customers rate their bank's service as excellent, and 59% have sought financial products from other providers.

Research indicates that banks could increase revenue from primary customers by up to 20% by fostering more meaningful personal relationships. Additionally, only 30% of customers rate their bank's service as excellent, and 59% have sought financial products from other providers, highlighting the need for improved customer service.

Nationwide’s rich messaging system addresses these gaps. By offering personalized insights and proactive updates, they create a personalized banking experience that keeps customers engaged and loyal.

Belfius: Simplifying Insurance Claims with Chatbots

Belfius has revolutionized the insurance claims process by introducing AI-powered chatbots. These chatbots guide customers through the claims process step-by-step, making it faster and easier than ever. You no longer have to wait on hold or navigate complex forms. Instead, Belfius ensures that your claim is handled efficiently with minimal effort on your part.

The results speak for themselves:

- Belfius has achieved an 87% increase in conversion rates for insurance claims after implementing chatbots.

This success highlights the power of automation in customer service. Chatbots not only save time but also reduce errors, ensuring a smoother experience for customers. With tools like Sobot’s AI-powered chatbots, banks can replicate this success and offer seamless support across multiple channels.

FirstBank: Personalized SMS Notifications for Customer Updates

FirstBank has mastered the art of proactive communication by using personalized SMS notifications. These messages keep customers informed about everything from account balances to upcoming payments. You don’t have to worry about missing important updates because FirstBank ensures you’re always in the loop.

This approach enhances trust and convenience. Customers appreciate the simplicity of receiving timely updates without having to log into their accounts. It’s a small gesture that makes a big difference in the overall experience.

FirstBank’s strategy aligns with the growing demand for personalized banking experiences. By tailoring notifications to individual needs, they strengthen customer relationships and foster loyalty. Banks looking to adopt similar strategies can benefit from solutions like Sobot’s omnichannel platform, which integrates SMS, email, and social media into a unified workspace for seamless communication.

Nets: Fraud Prevention with Two-Way SMS Communication

Fraud prevention is a top priority for banks, and Nets has taken a proactive approach by using two-way SMS communication. This method not only keeps customers informed but also empowers them to act quickly when something seems off. Imagine receiving a text message asking you to confirm a transaction you didn’t make. With just a quick reply, you can stop fraud in its tracks.

Why does this strategy work so well? Here are some key reasons:

- Two-Factor Authentication (2FA): SMS-based 2FA blocks 100% of automated bot attacks and 96% of phishing attempts. This ensures your account stays secure.

- Real-Time Alerts: Immediate notifications let you verify transactions instantly, preventing unauthorized actions.

- Transaction Monitoring: SMS alerts reduce fraud losses by up to 30%, giving you peace of mind.

- Identity Verification: SMS helps confirm your identity, significantly lowering the risk of identity theft.

This approach not only enhances security but also builds trust. Customers feel reassured knowing their bank is actively protecting their accounts. With tools like Sobot’s omnichannel solutions, banks can integrate SMS communication seamlessly into their customer service strategy. Sobot’s platform ensures that these alerts are timely, accurate, and easy to manage, making fraud prevention a breeze for both banks and their customers.

Opay and Sobot: Transforming Customer Experience with Omnichannel Solutions

Opay has set a new standard for customer service in banking by partnering with Sobot to implement omnichannel solutions. This collaboration has revolutionized how Opay interacts with its customers, making every interaction seamless and efficient.

Here’s a snapshot of the impressive results achieved:

| Metric | Value |

|---|---|

| Reduction in inbound discussion | 20% |

| Positive feedback rate | 96%+ |

| Correct answers rate | 80% |

| Customer satisfaction score | 95% |

| Self-service question resolution | 22.2% |

| Customer satisfaction score (CSAT) | 97% |

| Problem resolution rate | 85% |

| Customer happiness rate | 99% |

| Sign-off rate increase | 35% |

| COD collection rate increase | 40% |

These numbers tell a powerful story. By integrating Sobot’s omnichannel platform, Opay has streamlined customer interactions across social media, email, and voice channels. Customers no longer have to jump between platforms to get their issues resolved. Instead, they enjoy a unified experience that’s fast, accurate, and convenient.

Sobot’s intelligent IVR system and AI-powered chatbots have also played a key role. These tools handle repetitive queries, allowing agents to focus on more complex issues. The result? Faster resolutions and happier customers. With Sobot’s solutions, Opay has not only improved customer satisfaction but also reduced operational costs by over 20%.

If you’re looking to transform your customer service in banking, Sobot’s omnichannel solutions are the way to go. They’re designed to enhance every touchpoint, ensuring your customers feel valued and supported at every step.

Strategies for Banks to Improve Customer Service

Invest in Employee Training for Better Customer Interactions

Your employees are the face of your bank. Their ability to connect with customers directly impacts satisfaction and loyalty. Investing in their training ensures they’re equipped to handle diverse customer needs with empathy and efficiency.

Training programs focused on communication skills, problem-solving, and product knowledge can make a world of difference. For example, when employees understand how to explain complex financial products in simple terms, customers feel more confident in their decisions. This builds trust and strengthens relationships.

The numbers back this up:

| Metric | Impact |

|---|---|

| Reduction in customer effort | 15-20% |

| Improvement in retention rates | 10-15% |

| Reduction in operational costs | 15-20% |

| ROI timeframe | 12-18 months |

Financial institutions that base strategic decisions on robust statistical analysis of operational metrics are 2.5 times more likely to achieve their transformation objectives. (Deloitte, 2022)

Sobot’s Voice/Call Center solution can further enhance employee performance. With features like intelligent IVR and real-time monitoring, your team can focus on delivering exceptional customer support while the system handles routine tasks.

Leverage Feedback Loops to Understand Customer Needs

Listening to your customers is key to delivering a customer-first approach. Feedback loops allow you to gather insights directly from your audience, helping you understand what they value most.

By analyzing feedback, you can identify trends and make informed decisions. For instance:

- Net Promoter Score (NPS) translates customer sentiment into actionable insights.

- Businesses using NPS often adapt strategies based on feedback trends, improving retention.

- Studies show companies can enhance their NPS by up to 10 points in a year, boosting profitability.

Customer feedback also inspires innovation. It helps you refine existing services or introduce new ones that align with customer expectations. For example, if customers frequently request faster loan approvals, you can prioritize streamlining that process.

Sobot’s omnichannel solution simplifies feedback collection. It integrates multiple communication channels, making it easy for customers to share their thoughts. With its unified workspace and analytics, you can track feedback trends and respond proactively.

Simplify Banking Processes for Enhanced Customer Experience

Complex banking processes frustrate customers. Simplifying these processes not only improves satisfaction but also strengthens loyalty.

Imagine being able to manage all your accounts in one place or getting instant loan approvals. These conveniences make banking easier and more enjoyable. Here’s how banks can simplify processes:

- Streamline financial transactions through open banking for quicker payments.

- Offer account aggregation services so customers can manage multiple accounts seamlessly.

- Use instant loan approvals to speed up borrowing.

Tealium’s Customer Data Platform (CDP) shows how integrating data from various sources creates a unified view of each customer. This approach enables personalized experiences, enhancing satisfaction and engagement.

Sobot’s solutions, like its AI-powered chatbots, take simplification to the next level. These chatbots handle repetitive queries, freeing up your team to focus on complex issues. With tools like these, you can deliver a seamless and efficient customer experience.

Foster a Customer-Centric Culture Across the Organization

Creating a customer-centric culture isn’t just a buzzword—it’s a game-changer for banks aiming to stand out. When your organization prioritizes customers at every level, you’re not just solving problems; you’re building lasting relationships. But how do you make this shift? It starts with embedding customer-first values into your company’s DNA.

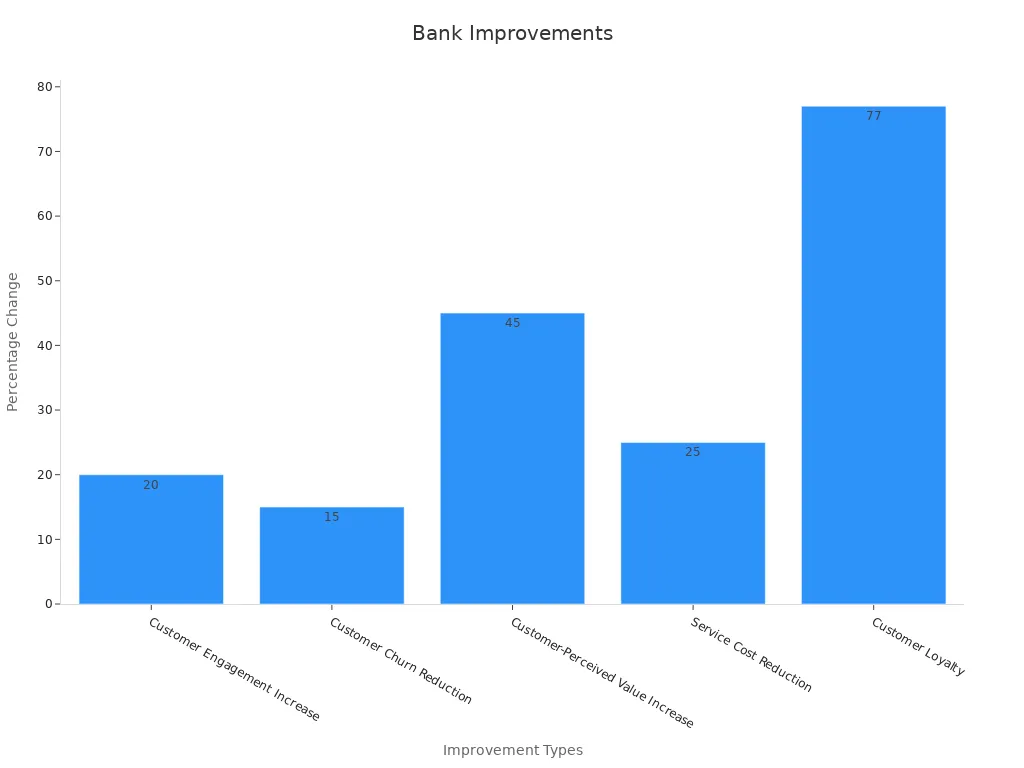

Here’s why it matters. Banks that embrace a customer-centric approach see measurable improvements across the board. Take a look at these numbers:

| Improvement Type | Metric/Impact |

|---|---|

| Revenue Increase | 10-30% increase due to personalization (BCG, 2022) |

| Operational Cost Reduction | 10-25% reduction due to personalization (BCG, 2022) |

| Customer Engagement Increase | 20% increase from advanced personalization (Accenture, 2023) |

| Customer Churn Reduction | 15% reduction from advanced personalization (Accenture, 2023) |

| Customer-Perceived Value Increase | 45% increase from personalized financial advice (Deloitte, 2022) |

| Service Cost Reduction | 25% reduction from AI assistants (Accenture, 2023) |

| Customer Loyalty | 77% more likely to feel positively after feedback action (Qualtrics XM Institute) |

| Customer Satisfaction | Industry-leading scores maintained for 16 years by TD Bank |

So, how can you foster this culture? Start by listening to your customers. Feedback loops, like surveys or social media interactions, help you understand what they value most. Then, act on that feedback. For example, if customers want faster loan approvals, streamline the process with automation.

Empowering your employees is another key step. Equip them with tools and training to deliver exceptional service. Sobot’s solutions, like its omnichannel platform, can unify customer interactions across channels, making it easier for your team to focus on what matters most—your customers. When your entire organization aligns around customer needs, you’ll see the results in loyalty, satisfaction, and even your bottom line.

Adopt Sobot's Voice/Call Center for Seamless Customer Support

When it comes to delivering seamless customer support, Sobot’s Voice/Call Center is a game-changer. Imagine a system that not only handles calls efficiently but also empowers your agents to provide exceptional service. That’s exactly what Sobot offers.

Here’s how it works. Sobot’s Voice/Call Center uses intelligent IVR (Interactive Voice Response) to route calls to the right agent or team. This reduces wait times by 20% and ensures customers get the help they need faster. AI-powered voicebots handle routine queries, freeing up your agents to focus on complex issues. The result? A 15–20% decrease in average handle times and a 25% reduction in post-call work.

Take a look at the benefits:

| Metric Description | Impact |

|---|---|

| Operational cost reductions | 20% to 30% by automating tasks and optimizing workflows |

| Lower average wait times | 20% reduction through AI-driven call routing systems |

| Reduced average handle times | 15–20% decrease with AI-powered chatbots for routine interactions |

| Decreased post-call work | 25% reduction by generating summaries and next steps automatically |

| Improved agent CSAT scores | 20% increase through AI-assisted coaching |

Sobot’s platform also integrates seamlessly with your existing systems, making it easy to get started. Whether you’re a small bank or a large financial institution, Sobot’s Voice/Call Center adapts to your needs. With features like global number availability and real-time monitoring, you can deliver consistent, high-quality support to customers anywhere in the world.

By adopting Sobot’s Voice/Call Center, you’re not just improving efficiency—you’re enhancing the overall customer experience. And when customers feel valued and supported, they’re more likely to stay loyal. Ready to transform your customer support? Sobot has you covered.

The Role of Technology in Enhancing Customer Experience in Banking

AI-Powered Chatbots for Instant and Accurate Support

Imagine asking a question about your account at midnight and getting an instant, accurate response. That’s the magic of AI-powered chatbots. These virtual assistants work 24/7, ensuring you never have to wait for help. They handle routine banking tasks like checking balances or resetting passwords, freeing up human agents to focus on complex issues.

Chatbots don’t just save time—they improve accuracy. By 2026, their success rates in banking are expected to exceed 90%. They also reduce downtime by 99%, making them a reliable tool for customer support. Banks using chatbots have seen resolution times drop from 8.5 minutes to just 3.2 minutes. Faster service means happier customers, and that’s a win for everyone.

Omnichannel Solutions for Unified Customer Interactions

Have you ever switched from chatting with a bank online to calling them, only to repeat your issue? That’s frustrating, right? Omnichannel solutions solve this problem by unifying all your interactions across channels. Whether you’re on social media, email, or a call, your bank knows your history and can pick up right where you left off.

Businesses that prioritize effective omnichannel experiences see huge benefits. Customer satisfaction rates increase 23-fold, and revenue growth triples compared to competitors. Big names like Starbucks and Nike have mastered this approach, offering seamless transitions between platforms. For banks, this means fewer dropped conversations and more loyal customers.

Sobot’s multi-channel support platform makes this even easier. It integrates voice, email, and social media into one workspace, ensuring your experience is smooth and consistent.

Data Analytics for Predictive Insights and Personalization

What if your bank could predict your needs before you even ask? Data analytics makes this possible. By analyzing your transaction history and spending patterns, banks can offer personalized services like tailored loan advice or savings plans.

Predictive analytics doesn’t just improve personalization—it drives results. JPMorgan Chase reduced customer churn by 15% using targeted retention strategies. Capital One boosted marketing effectiveness by 40% with predictive models. Banks can even anticipate life events, like offering mortgage options after wedding expenses.

This level of personalization builds trust and loyalty. When your bank understands you, it feels less like a business and more like a partner in your financial journey.

Mobile Banking Apps for Convenience and Accessibility

Mobile banking apps have completely changed how you interact with your bank. They bring the bank to your fingertips, offering convenience and accessibility like never before. You no longer need to visit a branch or wait in long lines. With just a few taps on your phone, you can check your balance, transfer money, or even pay bills.

These apps are available 24/7, giving you the freedom to manage your finances anytime, anywhere. This is especially important for people with busy schedules. In fact:

- 97% of millennials already use mobile banking apps, showing how much trust and engagement these services have gained.

- Over half of surveyed users (53%) say they prioritize full-time access to banking services.

The convenience doesn’t stop there. Mobile banking apps often come with features like budgeting tools, spending alerts, and even personalized financial advice. These tools help you stay on top of your finances without any hassle.

Banks that invest in mobile apps see happier customers. Why? Because these apps make banking simple and stress-free. They also reduce the need for in-person visits, saving you time and effort.

Sobot’s omnichannel solutions can enhance mobile banking experiences even further. By integrating customer support features like live chat or AI-powered chatbots into apps, banks can ensure seamless interactions. This means you get help when you need it, without switching platforms.

Sobot's Voice/Call Center: Revolutionizing Customer Service in Banking

When you think about calling your bank, you might picture long wait times and endless transfers. Sobot’s Voice/Call Center changes that. It’s designed to make your experience smooth and efficient, ensuring you get the help you need without the frustration.

Here’s how it works. Sobot’s intelligent IVR (Interactive Voice Response) system routes your call to the right person or team. This reduces wait times by 20% and ensures your issue gets resolved faster. AI-powered voicebots handle routine questions, freeing up agents to focus on more complex problems.

The benefits don’t stop there. Sobot’s platform offers real-time monitoring and analytics, helping banks improve their service quality. Agents can access a unified workspace, making it easier to manage calls and customer information. This leads to faster resolutions and happier customers.

For example, imagine calling your bank to report a lost card. With Sobot’s system, your call gets routed instantly, and the agent already has your details on hand. This level of efficiency not only saves time but also builds trust.

Sobot’s Voice/Call Center is more than just a tool—it’s a game-changer for banks looking to enhance customer support. By adopting this solution, banks can deliver seamless interactions that keep customers coming back.

Benefits of Excellent Customer Service in Banking

Increased Customer Loyalty and Retention

When you feel valued by your bank, you’re more likely to stick around, right? That’s the power of excellent customer service. It builds trust and keeps you coming back. Banks that focus on your needs and offer personalized experiences create a strong bond with you. For instance:

- Personalized rewards programs encourage you to stay loyal.

- Financial education empowers you, making you more confident in managing your finances.

- Proactive engagement, like fraud alerts or tailored advice, shows your bank cares about you.

Here’s the kicker: banks that prioritize customer satisfaction see incredible results. Research shows that increasing customer retention by just 5% can boost profits by 25-95%. Plus, highly satisfied customers are 87% more likely to buy additional products and refer others. That’s a win-win for both you and the bank.

Positive Brand Reputation and Word-of-Mouth Referrals

Think about the last time you recommended a service to a friend. Chances are, it was because you had a great experience. When banks deliver exceptional customer service, they don’t just earn your trust—they also gain your advocacy. You’re more likely to share your positive experiences with others, boosting the bank’s reputation.

A strong reputation isn’t just about looking good. It attracts new customers and strengthens relationships with existing ones. Studies show that satisfied customers provide 5.8 times more referrals than unhappy ones. So, when your bank goes above and beyond for you, it’s not just helping you—it’s building a community of loyal advocates.

Competitive Advantage in a Crowded Market

The banking industry is crowded, but exceptional customer service can make a bank stand out. Imagine a bank that treats you like an individual, not just an account number. That’s what gives them an edge.

Here’s how banks gain a competitive advantage:

- Customer Experience (CX): Combining digital tools with in-person services creates a seamless experience for you.

- Personalization: Tailored services, like customized loan options, make you feel valued.

- Advanced Analytics: AI and machine learning help banks respond to your needs faster.

Banks that focus on building relationships and offering consistent service across all channels thrive in today’s market. They don’t just meet your expectations—they exceed them. And when that happens, you’re more likely to choose them over competitors.

Higher Revenue Through Satisfied Customers

Have you ever wondered how your satisfaction as a customer impacts a bank’s revenue? It’s more significant than you might think. When you’re happy with the service you receive, you’re more likely to stick around, recommend the bank to others, and even explore additional products. This ripple effect directly boosts a bank’s bottom line.

Let’s break it down. Satisfied customers don’t just stay loyal—they also spread the word. Positive experiences often lead to referrals, bringing in new customers. On top of that, when you trust your bank, you’re more likely to use their other services, like loans or investment options. This creates a win-win situation: you get better financial solutions, and the bank enjoys higher revenue.

Here’s a quick look at how customer satisfaction drives revenue growth:

| Key Findings | Description |

|---|---|

| Customer Satisfaction | Higher satisfaction leads to positive word-of-mouth, attracting more customers. |

| Service Quality | Better service quality directly increases customer satisfaction. |

| Revenue Impact | Satisfied customers contribute to higher sales and overall revenue. |

Banks that prioritize your satisfaction see measurable results. For example, studies show that a 5% increase in customer retention can boost profits by up to 95%. That’s because loyal customers are more likely to engage with the bank’s services over time. Plus, they’re less expensive to retain compared to acquiring new ones.

So, the next time you enjoy a seamless banking experience, remember—you’re not just benefiting yourself. You’re also helping your bank grow. And when banks invest in keeping you happy, everyone wins.

Outstanding customer service in the banking industry isn’t just a nice-to-have—it’s a must. Personalization, proactive communication, and trust-building are the cornerstones of a great customer experience. When banks focus on these elements, they see real results, like higher loyalty and increased revenue.

Adopting customer-centric strategies and leveraging technology, like Sobot’s omnichannel solutions, can transform how you serve your customers. For example:

| Bank | Strategy/Technology Used | Benefits |

|---|---|---|

| KeyBank | Analytic solutions and technology for competitive advantage | Assurance of long-term presence in banking, improved customer engagement |

| Societe Generale | Hybrid cloud infrastructure, AI, and ML for digital transformation | Optimized IT spending, enhanced data security, improved customer service through virtual assistant (SoBot) |

These strategies lead to better customer experiences, cost savings, and improved operational efficiency. By prioritizing innovation and trust, you can stay ahead in the competitive banking landscape.

Remember, when you put your customers first, success follows.

FAQ

What is the importance of customer service in banking?

Customer service builds trust and loyalty. When your bank listens to you and solves your problems quickly, you feel valued. This connection keeps you coming back and encourages you to recommend the bank to others. Great service isn’t just helpful—it’s essential for long-term success.

How does Sobot’s Voice/Call Center improve banking customer service?

Sobot’s Voice/Call Center reduces wait times and handles routine queries with AI-powered voicebots. It routes calls intelligently, ensuring faster resolutions. Agents get a unified workspace, making it easier to assist you. This system enhances efficiency and keeps your experience smooth and stress-free.

Can banks use AI to personalize customer experiences?

Absolutely! AI analyzes your data to offer tailored advice, like savings tips or loan options. It predicts your needs and sends proactive updates. This personalization makes banking feel less transactional and more like a partnership, improving satisfaction and loyalty.

What are omnichannel solutions, and why do they matter?

Omnichannel solutions unify communication across platforms like email, social media, and calls. You won’t have to repeat yourself when switching channels. This seamless experience saves time and builds trust, ensuring your interactions with the bank are consistent and hassle-free.

How secure are Sobot’s solutions for banking?

Sobot prioritizes security with encrypted data transfer and global network support. Its systems meet a 99.99% uptime standard, ensuring reliability. Features like fraud prevention alerts and two-factor authentication keep your information safe, giving you peace of mind.

See Also

Transforming Support With AI-Powered Customer Service Agents

2024's Leading Customer Service Software Solutions Ranked

Comparative Analysis of Leading Voice of Customer Tools

Essential Practices for Effective Call Center Quality Management