Leading AI Chatbot Companies for Smart Investments

AI chatbots are revolutionizing customer service, making interactions faster, smarter, and more efficient. Today, 61% of consumers prefer quick responses from AI over waiting for human agents, and nearly 75% of U.S. business owners report improved customer experiences through instant messaging. These tools not only enhance satisfaction but also streamline operations, saving businesses time and money.

By 2025, the global chatbot market is expected to skyrocket, driven by advancements in artificial intelligence and growing demand. With retail spending on chatbots projected to rise from $12 billion in 2023 to $72 billion by 2028, investing in leading AI chatbot companies like Sobot could yield significant returns. The scalability and innovation of these solutions make them a smart choice for forward-thinking investors.

Top AI Chatbot Companies to Invest in 2025

OpenAI: Pioneering Generative AI with ChatGPT

OpenAI has revolutionized the chatbot industry with its flagship product, ChatGPT. This generative AI tool excels in handling customer inquiries quickly, reducing wait times and frustration. It operates 24/7, ensuring support is always available, even outside business hours. By personalizing interactions using customer data, ChatGPT makes customers feel valued and delivers consistent, accurate information. These features minimize human error and enhance customer satisfaction.

Investing in OpenAI offers you a chance to tap into a company that prioritizes innovation. Studies show that a mere 5% increase in customer retention can boost profits by 25% to 95%. ChatGPT’s ability to retain customers through superior service makes it one of the best AI chatbots in the market. As demand for artificial intelligence grows, OpenAI remains a leader in generative AI, making it a top choice for investors looking to capitalize on the future of AI chatbots.

Google DeepMind: Advancing AI with Gemini Chatbot

Google DeepMind’s Gemini Chatbot represents a significant leap in artificial intelligence. The latest version, Gemini 2.0, introduces groundbreaking features like native image and audio output, multimodal input support, and enhanced performance. These advancements enable the chatbot to handle complex tasks with ease.

Gemini 2.0 Flash outperforms its predecessor, 1.5 Pro, on key benchmarks at twice the speed. It supports inputs like images, videos, and audio, offering unparalleled versatility.

With its ability to generate natively mixed text and images, as well as multilingual text-to-speech audio, Gemini sets a new standard for AI chatbots. Google DeepMind’s commitment to innovation ensures that Gemini remains at the forefront of the industry. For those looking to invest in AI chatbot companies, this is a promising opportunity to benefit from cutting-edge technology and market leadership.

Microsoft (Azure AI): Integrating AI Chatbots into Enterprise Solutions

Microsoft’s Azure AI platform seamlessly integrates chatbots into enterprise solutions, making it a preferred choice for businesses worldwide. Azure AI chatbots enhance customer service by automating repetitive tasks, allowing human agents to focus on complex issues. This approach improves efficiency and reduces operational costs.

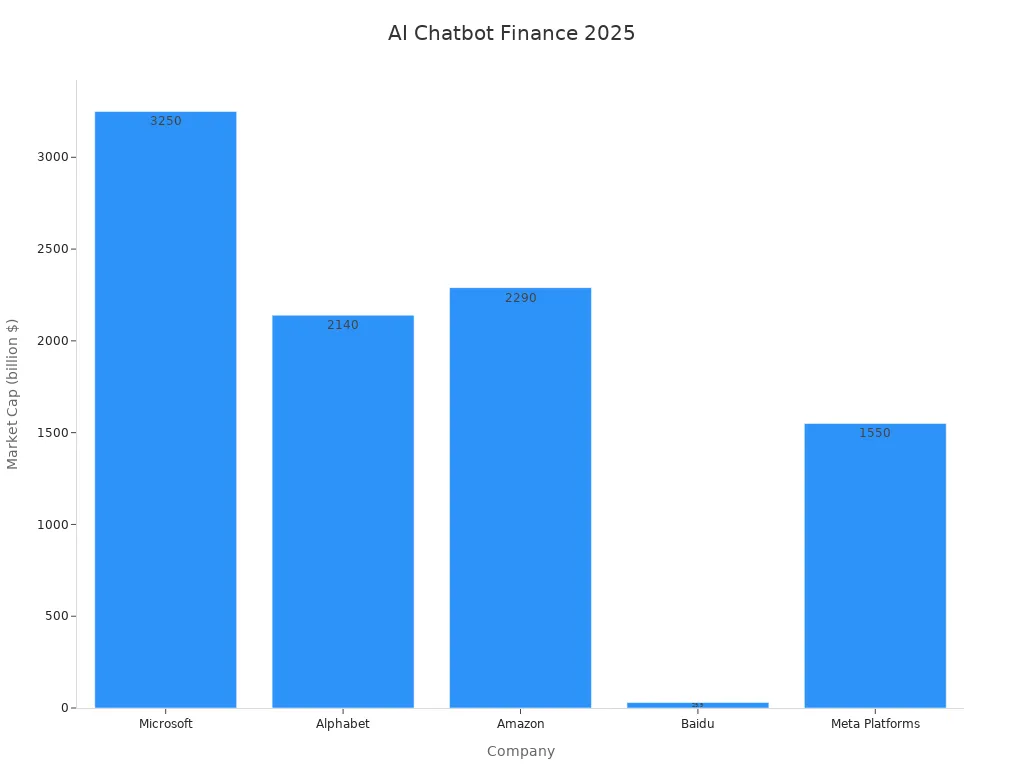

Microsoft’s diversified portfolio and strong market presence make it a reliable option for investors. According to recent financial metrics:

| Company | Ticker | Market Cap | Description |

|---|---|---|---|

| Microsoft | NASDAQ:MSFT | $3.25 trillion | Diversified global tech leader. |

| Alphabet | NASDAQ:GOOG, NASDAQ:GOOGL | $2.14 trillion | Global search leader and digital advertising giant. |

Microsoft’s focus on integrating artificial intelligence into enterprise solutions ensures scalability and adaptability, making it a top contender in the AI chatbot sector. By investing in Microsoft, you align with a company that combines innovation with financial stability, offering a balanced approach to AI stocks.

IBM Watson: Revolutionizing Customer Support with AI

IBM Watson has set a new benchmark in customer support by leveraging artificial intelligence to deliver exceptional service. Its advanced capabilities allow businesses to predict customer needs, resolve issues proactively, and improve satisfaction rates. You can rely on Watson to handle a significant volume of customer requests in real-time, which enhances operational efficiency and speeds up response times.

Here’s how IBM Watson is transforming industries:

- H&R Block uses Watson to access tax law material quickly, enabling advisors to provide accurate and timely advice.

- North Face implemented Watson as a personalized shopping assistant, boosting online sales and customer satisfaction.

- Watson’s predictive analytics help businesses forecast service needs, ensuring proactive issue resolution.

Watson also excels in automating responses to common inquiries. For example, the Ivy platform powered by Watson manages tasks like sharing WiFi passwords without human intervention. This automation reduces agent workload and ensures faster resolutions. With the ability to handle 90% of guest requests in real-time, Watson proves to be a game-changer in customer support.

By investing in IBM Watson, you align with a company that combines cutting-edge AI with proven results. Its ability to enhance customer experiences while streamlining operations makes it one of the best AI chatbots for businesses aiming to stay ahead in the competitive landscape.

Sobot: Enhancing Customer Interactions with AI-Powered Chatbot Solutions

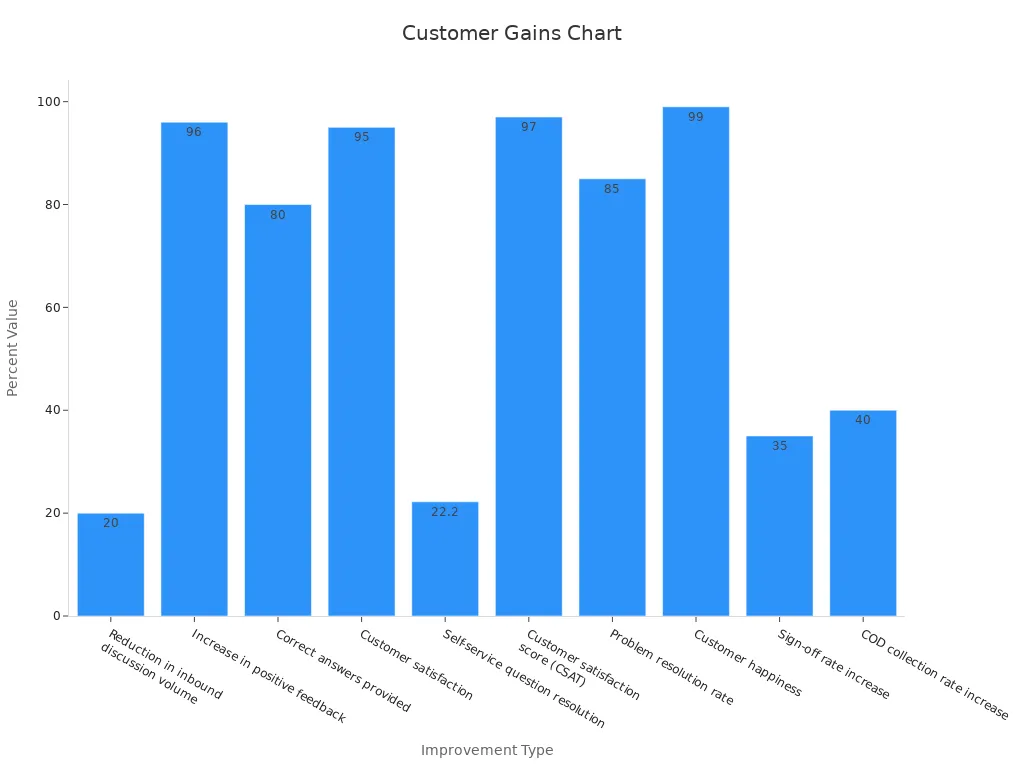

Sobot stands out among AI chatbot companies by offering innovative solutions that redefine customer interactions. Its AI-powered chatbot is designed to automate routine queries, improve efficiency, and boost customer satisfaction. With Sobot, you can achieve measurable improvements in your customer service operations.

Here’s a snapshot of Sobot’s impact:

| Improvement Type | Measurement |

|---|---|

| Reduction in inbound discussion volume | 20% reduction |

| Increase in positive feedback | 96% positive feedback |

| Customer satisfaction score (CSAT) | 97% CSAT score |

| Problem resolution rate | 85% of problems solved |

Sobot’s chatbot operates 24/7, ensuring your customers receive support anytime they need it. Its multilingual capabilities and no-coding-required setup make it accessible and user-friendly. By integrating with platforms like WhatsApp and SMS, Sobot provides seamless omnichannel support. Businesses using Sobot have reported a 35% increase in sign-off rates and a 40% rise in COD collection rates.

When you invest in Sobot, you’re choosing a solution that not only enhances customer satisfaction but also drives operational efficiency. Its proven track record and innovative features make it a top contender in the AI chatbot sector.

What Makes These AI Chatbot Companies Stand Out?

Innovation in AI and Natural Language Processing (NLP)

The leading AI chatbot companies excel by pushing the boundaries of artificial intelligence and NLP. Recent advancements like zero-shot and few-shot learning allow chatbots to grasp new concepts with minimal training, making them more efficient and adaptable. Enhanced context handling and better language generation ensure that conversations feel natural and coherent, even during complex interactions. These innovations improve customer engagement and satisfaction, giving businesses a competitive edge.

Companies like OpenAI and Google DeepMind have also introduced groundbreaking features to their chatbots. For instance, OpenAI’s generative AI capabilities enable personalized and accurate responses, while Google DeepMind’s Gemini Chatbot integrates multimodal input support, including text, images, and audio. These advancements not only enhance the precision of chatbot responses but also build trust by ensuring factual reliability through modules like Botium AI Trust.

Scalability and Adaptability of Chatbot Solutions

Scalability is a cornerstone of successful AI chatbot technology. These solutions are designed to grow alongside your business, handling high interaction volumes without performance degradation. Features like modular design and stateless architecture make it easy to update and integrate new functionalities without disrupting existing operations. For example, microservices distribute workloads across independent services, ensuring seamless performance even during peak usage.

AI chatbots also adapt to diverse markets with built-in multilingual capabilities, breaking down language barriers and supporting global communication. Whether you’re managing thousands of concurrent conversations or expanding into new regions, these chatbots provide the flexibility and reliability you need. By investing in scalable solutions, you ensure your business stays ahead in a rapidly evolving market.

| Key Components for Scalability | Description |

|---|---|

| Modular Design | Simplifies updates and feature integration. |

| Stateless Architecture | Ensures each interaction is independent, boosting reliability. |

| Microservices | Balances workloads for optimal performance. |

Market Leadership and Customer Trust

Market leaders in AI chatbot technology have earned their position by building trust and credibility. According to the 2025 Consumer Adoption of AI Report, 41% of consumers trust AI search results more than traditional paid ads, highlighting the growing confidence in artificial intelligence. Companies like IBM Watson and Sobot have established strong reputations by prioritizing data privacy and security, which are critical for fostering customer loyalty.

These companies also stand out through their branding strategies and customer-centric approaches. For example, Sobot’s omnichannel solutions and multilingual chatbots enhance customer service, while IBM Watson’s predictive analytics ensure proactive issue resolution. By choosing to invest in these trusted brands, you align with companies that consistently deliver value and innovation.

Strategic partnerships and collaborations driving growth

Strategic partnerships are reshaping the way businesses grow, especially in the world of artificial intelligence. Instead of relying solely on building or buying new technologies, companies are now prioritizing collaborations to access cutting-edge capabilities. This shift is driven by the need to stay competitive while managing limited capital. For you, this means that investing in AI chatbot companies with strong partnerships can lead to significant returns.

Many enterprises are already engaging with cloud and core infrastructure partners. However, the focus is rapidly shifting toward data analytics and AI collaborations. These partnerships allow businesses to integrate advanced tools like generative AI into their operations without the heavy costs of in-house development. For example, Sobot’s collaboration with WhatsApp as an official Business Solution Provider highlights how partnerships can enhance customer engagement. By leveraging WhatsApp’s global reach, Sobot ensures seamless communication for businesses across industries.

Partnerships also drive innovation. When companies like OpenAI or Google DeepMind collaborate with other tech leaders, they create solutions that redefine customer interactions. These alliances enable chatbots to handle complex tasks, deliver personalized experiences, and operate across multiple platforms. For you, this means investing in companies that prioritize partnerships can offer access to groundbreaking technologies and scalable solutions.

The benefits of these collaborations extend beyond technology. They build trust and credibility, as businesses align with established brands. For instance, Sobot’s integration with platforms like Salesforce and Shopify demonstrates its commitment to providing comprehensive solutions. By choosing to invest in companies with strong partnerships, you position yourself to benefit from their growth and market leadership.

Strategic collaborations are the backbone of success in the AI industry. They ensure that companies remain adaptable, innovative, and ready to meet the demands of a rapidly evolving market. For investors like you, this is an opportunity to align with businesses that are shaping the future of artificial intelligence.

Key Factors to Consider When You Invest in AI Chatbot Companies

Scalability and Market Demand for AI Chatbots

Scalability is a critical factor when evaluating AI chatbot companies. Businesses today demand solutions that can handle increasing customer interactions without compromising performance. AI chatbots excel in this area, offering the ability to manage high volumes of queries efficiently. For example, direct-to-consumer (D2C) businesses rely on chatbots to meet growing customer expectations while minimizing staffing needs. This scalability ensures that companies can grow without incurring significant operational costs.

The market demand for chatbots continues to rise across industries like retail, finance, and even mental health. Retailers use chatbots to enhance customer experiences, while financial institutions rely on them for secure and efficient customer support. In mental health, chatbots provide accessible solutions for those seeking help. These diverse applications highlight the broad appeal and necessity of investing in AI chatbot companies.

Technological Innovation and R&D Investment

Technological innovation drives the success of AI chatbot companies. Advanced AI tools enable chatbots to perform complex tasks, such as creating personalized content and solving intricate problems. Companies that prioritize research and development (R&D) stay ahead by introducing groundbreaking features. For instance, generative AI enhances customer service by analyzing trends and preferences, leading to rapid product innovations.

Investing in companies with strong R&D capabilities ensures you benefit from cutting-edge technology. Virtual reality tools, for example, allow businesses to test product prototypes quickly, accelerating innovation. By choosing companies that focus on technological advancements, you align with leaders in artificial intelligence who consistently deliver value.

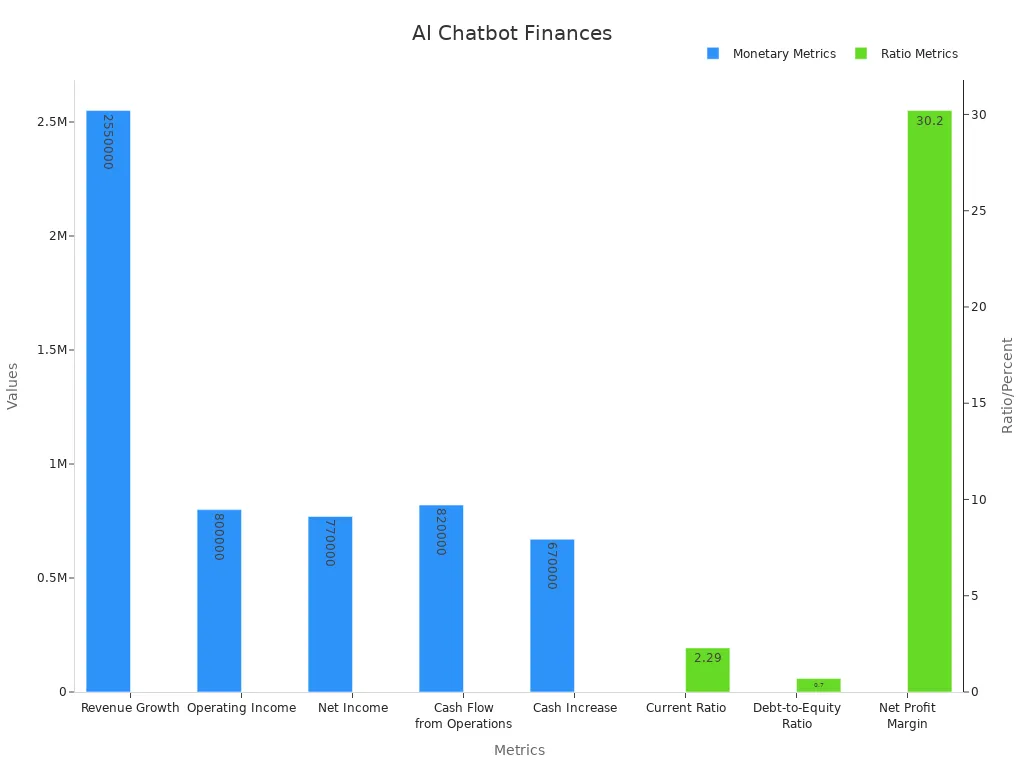

Financial Performance and Growth Trajectory

Financial metrics provide valuable insights into a company's stability and growth potential. Strong revenue growth and profitability indicate a company's ability to penetrate the market and sustain operations. For example, a company with $2,550,000 in revenue and a 30.2% net profit margin demonstrates excellent financial health. Positive cash flow from operations further highlights self-sustaining capabilities.

| Metric | Value | Explanation |

|---|---|---|

| Revenue Growth | $2,550,000 | Indicates strong sales performance and potential for future growth. |

| Net Profit Margin | 30.2% | Demonstrates excellent profitability and efficient cost management. |

| Cash Flow from Operations | $820,000 | Positive cash flow indicates self-sustaining operations. |

When you invest in AI chatbot companies with a clear growth trajectory, you position yourself for long-term profitability. These companies combine operational efficiency with innovative solutions, making them a smart choice for forward-thinking investors.

Industry trends and competitive landscape

The AI chatbot market is evolving rapidly, driven by advancements in artificial intelligence and growing demand for automation. You’ll notice that businesses across industries are adopting chatbots to enhance customer engagement and streamline operations. Retail and e-commerce lead the way, holding over 32.4% of the market share. These sectors rely on chatbots to improve customer loyalty and provide 24/7 service, which boosts satisfaction and reduces costs.

One of the key drivers in this market is the ability of chatbots to deliver cost-efficient solutions. By automating repetitive tasks, they free up human agents to focus on complex issues. This efficiency not only saves money but also improves response times. As a result, companies can handle higher volumes of customer interactions without compromising quality. For you, this means that investing in AI chatbot companies offers a chance to capitalize on a growing demand for smarter, faster customer service.

However, the competitive landscape presents challenges. Privacy concerns and data security issues remain significant barriers to adoption. Customers expect their data to be handled responsibly, and businesses must prioritize security to build trust. Additionally, maintaining human-like interactions is a challenge for many chatbots. Understanding nuances in communication requires advanced AI capabilities, which only a few companies have mastered.

Despite these challenges, the future looks promising. Integration with emerging technologies like blockchain and IoT offers exciting opportunities. These innovations can enhance chatbot capabilities, making them even more effective in delivering personalized experiences. Generative AI, for example, is transforming how chatbots interact with users, enabling them to provide more accurate and engaging responses.

The AI chatbot market is competitive, but companies like Sobot stand out by offering scalable, secure, and innovative solutions. When you invest in this sector, you align with a technology that’s reshaping industries and creating new possibilities for growth.

| Category | Insights |

|---|---|

| Industry Segment | Retail and E-Commerce holds over 32.4% market share, enhancing customer interaction and loyalty. |

| Key Driver | Enhanced customer engagement and cost efficiency through 24/7 service and automation. |

| Growth Factor | Increased demand for automation and advancements in AI and machine learning technologies. |

| Restraint | Privacy concerns and data security issues affecting adoption. |

| Opportunity | Integration with emerging technologies like blockchain and IoT for improved customer experiences. |

| Challenge | Maintaining human-like interactions and understanding nuances in communication. |

The competitive landscape is fierce, but it’s also full of opportunities. By staying ahead of trends and focusing on innovation, you can make smart investment decisions in the AI chatbot market.

Benefits of Investing in AI Chatbot Companies

High growth potential in a rapidly expanding industry

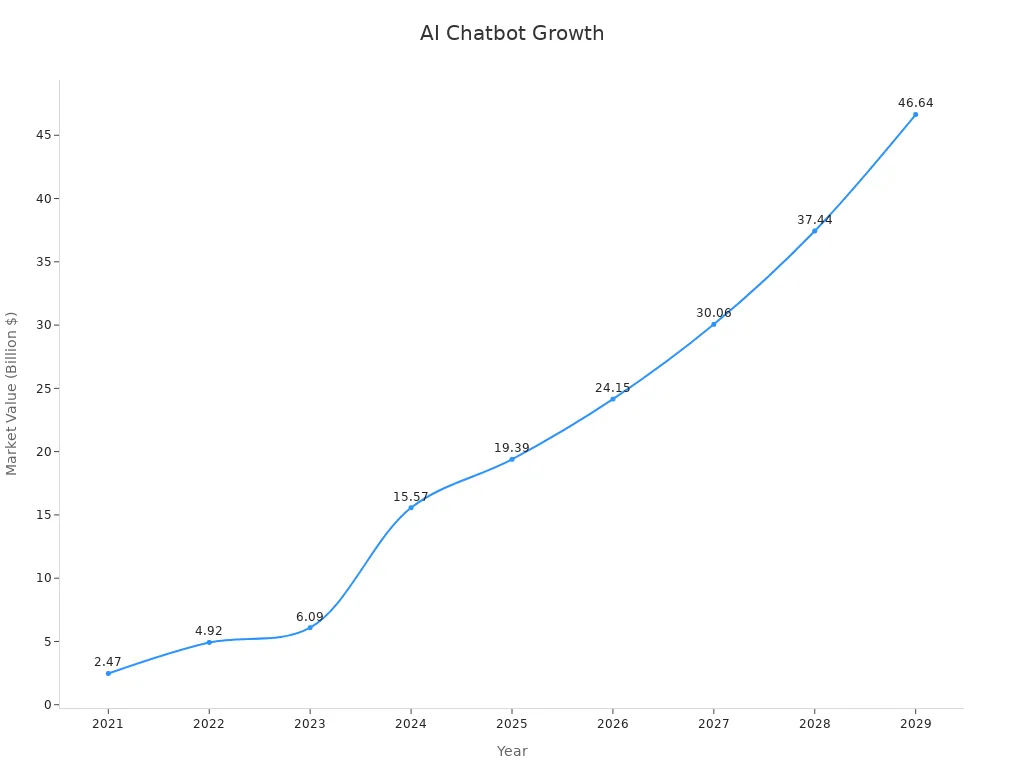

The AI chatbot market is growing at an unprecedented rate, offering you a chance to capitalize on its expansion. Businesses across industries are adopting chatbots to enhance customer service and streamline operations. This demand has fueled remarkable growth, as shown in the table below:

| Year | Market Value |

|---|---|

| 2021 | $2.47 billion |

| 2022 | $4.92 billion |

| 2023 | $6.09 billion |

| 2024 | $15.57 billion |

| 2025* | $19.39 billion |

| 2026* | $24.15 billion |

| 2027* | $30.06 billion |

| 2028* | $37.44 billion |

| 2029* | $46.64 billion |

This rapid growth, with a projected compound annual growth rate (CAGR) of 24.32%, highlights the immense potential of investing in AI chatbot companies. By entering this market now, you position yourself to benefit from its upward trajectory.

Diversification opportunities in the tech sector

Investing in AI chatbots also diversifies your portfolio within the tech sector. Unlike traditional investments, chatbots offer resilience to market shocks due to their widespread applications. For instance:

- The Global Megatrends Selection (GMS) strategy demonstrates better diversification than broader indices like MSCI ACWI.

- Principal Component Analysis (PCA) reveals that only 34% of GMS's performance depends on top components, compared to 75% for ACWI.

This diversification reduces risk and ensures stability, making AI chatbot companies a smart addition to your investment strategy.

Long-term profitability driven by AI adoption

Artificial intelligence is transforming industries, and chatbots are at the forefront of this revolution. By automating processes, chatbots enhance efficiency and reduce costs. For example, 74% of organizations report a return on investment within one year of adopting AI initiatives. Additionally, 86% have seen revenue growth of 6% or more due to AI.

Generative AI further accelerates profitability by enabling businesses to innovate faster and adapt to market demands. This adaptability ensures sustained growth, making AI chatbot companies a reliable choice for long-term profitability.

Enhanced customer service capabilities across industries

AI chatbots are transforming customer service across industries, making interactions faster, smarter, and more personalized. Whether you’re in retail, finance, gaming, or education, these tools can revolutionize how you engage with your customers. By automating repetitive tasks, chatbots free up your team to focus on complex issues, ensuring faster resolutions and happier customers.

In retail, chatbots enhance customer engagement by providing instant answers about product availability, order tracking, and returns. Imagine a shopper browsing your website at midnight. Instead of waiting for business hours, they can get immediate assistance, boosting their satisfaction and increasing the likelihood of a purchase. In fact, businesses using AI-powered chatbots report a 20% increase in conversions.

Financial services also benefit from chatbots. They handle routine inquiries like account balances or transaction histories, allowing your agents to focus on high-value tasks. With generative AI, these chatbots can even provide personalized financial advice, building trust and loyalty among your clients.

Gaming companies use chatbots to resolve player issues quickly, ensuring uninterrupted gameplay. Meanwhile, in education, chatbots assist students by answering questions about courses, schedules, and assignments. This 24/7 availability ensures that learners always have the support they need.

When you invest in AI chatbot solutions, you’re not just improving customer service. You’re creating a seamless experience that builds trust and loyalty. Artificial intelligence ensures that your business stays ahead of the competition, delivering exceptional service across all touchpoints.

Tip: Investing in AI chatbots now positions your business for long-term success in a rapidly evolving market.

Risks of Investing in AI Chatbot Companies

Market volatility and increasing competition

The AI chatbot industry is growing rapidly, but this growth comes with significant risks. Market volatility can make it challenging for you to predict returns on your investments. Revenue fluctuations and intense competition among companies can impact profitability. For example, new entrants with innovative solutions can disrupt established players, making it harder for businesses to maintain their market share.

Here’s a breakdown of key metrics that highlight these risks:

| Metric | Description |

|---|---|

| Annual Revenue | Indicates the total income generated by businesses in the industry. |

| Revenue Volatility | Measures the fluctuations in revenue over time, indicating market stability. |

| Industry Concentration Level | Assesses how many companies dominate the market, affecting competition. |

| Barriers to Entry Level | Evaluates how difficult it is for new competitors to enter the market. |

| Buyer Power Level | Reflects the influence buyers have on pricing and terms. |

| Supplier Power Level | Indicates the control suppliers have over pricing and availability. |

As competition increases, companies must innovate constantly to stay relevant. This dynamic can lead to higher operational costs, which may reduce profitability for investors like you.

Regulatory challenges in AI and data privacy

Investing in AI chatbot companies also involves navigating complex regulatory landscapes. AI systems rely on large amounts of sensitive data, raising privacy concerns. Governments worldwide are introducing stricter data protection laws, which can increase compliance costs for businesses. For instance:

- Facial recognition technology has sparked debates, leading to tighter regulations.

- Ambiguity around liability and accountability in AI can deter investment.

- Regulators emphasize governance and risk management, impacting investor confidence.

As artificial intelligence evolves, the potential for misuse grows. Ensuring that AI respects individual rights is critical for maintaining trust. Regulatory oversight is essential, but it can also slow down innovation, affecting the growth potential of your investments.

Overvaluation risks in a fast-growing sector

The rapid growth of the AI chatbot market has led to concerns about overvaluation. Many companies in this sector have valuations that far exceed their earnings, creating a potential bubble. For example, Palantir Technologies has a price-to-earnings (P/E) ratio of around 45x, suggesting that much of its growth potential is already priced in.

Overvaluation can make it difficult for you to achieve significant returns. When market corrections occur, overvalued stocks often experience sharp declines. This risk underscores the importance of carefully evaluating a company’s financial health and growth trajectory before you invest.

Note: While the AI chatbot industry offers exciting opportunities, understanding these risks will help you make informed decisions and protect your investments.

Technological obsolescence and innovation cycles

The AI chatbot market evolves rapidly, and staying ahead of technological obsolescence is crucial when you invest in this sector. Innovation cycles in artificial intelligence are shorter than ever, making it essential for companies to continuously adapt and improve their offerings. Without innovation, even the most advanced chatbots can quickly become outdated.

History offers clear examples of how technological stagnation leads to obsolescence. Microsoft's Clippy, once seen as a groundbreaking virtual assistant, is now remembered as a cultural meme. Similarly, early versions of Siri and Alexa failed to meet user expectations due to their limited capabilities. These tools, once celebrated, lost relevance because they couldn't keep up with advancements in artificial intelligence and user demands.

In the AI chatbot industry, companies that fail to innovate risk losing market share. Customers expect chatbots to provide seamless, human-like interactions. They also demand features like multilingual support, omnichannel integration, and real-time assistance. Generative AI has raised the bar even higher by enabling chatbots to deliver personalized and context-aware responses. Businesses that don't embrace these advancements may struggle to retain users.

When investing in AI chatbot companies, you should prioritize those with a strong focus on research and development. Companies like Sobot, which integrate cutting-edge technologies and adapt to market trends, are better positioned to thrive. Sobot’s AI-powered chatbot, for instance, uses advanced automation and multilingual capabilities to meet diverse customer needs. This adaptability ensures long-term relevance and competitiveness.

By choosing innovative companies, you align with businesses that not only survive but lead in a fast-changing market. Investing in adaptable and forward-thinking AI chatbot solutions minimizes risks associated with technological obsolescence and maximizes your potential for growth.

The top AI chatbot companies, including Sobot, OpenAI, and Google DeepMind, are transforming industries with their innovative solutions. Sobot stands out with its AI chatbot solution, offering multilingual support, 24/7 availability, and seamless omnichannel integration. These features make it a leader in the growing AI market.

When investing, focus on scalability, innovation, and the rising AI demand. These factors ensure your investments align with market trends and deliver long-term returns. Take action now to capitalize on the expanding AI chatbot industry and secure your place in this lucrative market.

FAQ

What is the main advantage of investing in AI chatbot companies?

AI chatbot companies offer high growth potential in a rapidly expanding market. Their innovative solutions, like conversational AI, enhance customer service and operational efficiency. By investing in these companies, you position yourself to benefit from technological advancements and increasing market demand.

How do AI chatbots improve customer satisfaction?

AI chatbots provide instant, accurate responses 24/7. They handle repetitive queries, freeing agents to focus on complex issues. This efficiency reduces wait times and enhances customer experiences, leading to higher satisfaction and loyalty.

Are AI chatbot solutions scalable for growing businesses?

Yes, AI chatbot solutions are highly scalable. They adapt to increasing customer interactions without compromising performance. Features like multilingual support and omnichannel integration ensure seamless operations as your business grows.

What industries benefit most from AI chatbots?

Industries like retail, finance, gaming, and education benefit significantly. AI chatbots streamline customer interactions, improve engagement, and reduce costs. For example, retail businesses use them to boost conversions, while financial services rely on them for secure, efficient support.

How can I evaluate the best AI chatbot companies for investments?

Focus on scalability, innovation, and market demand. Look for companies with proven results, strong R&D capabilities, and a clear growth trajectory. Brands like Sobot stand out with their advanced conversational AI and customer-centric solutions.

See Also

Essential Tips for Selecting Top Chatbot Software

Best 10 Chatbots for Websites to Use in 2024

Leading 10 Websites Utilizing Chatbots This Year