Insurance Chatbots Driving Change in the Industry

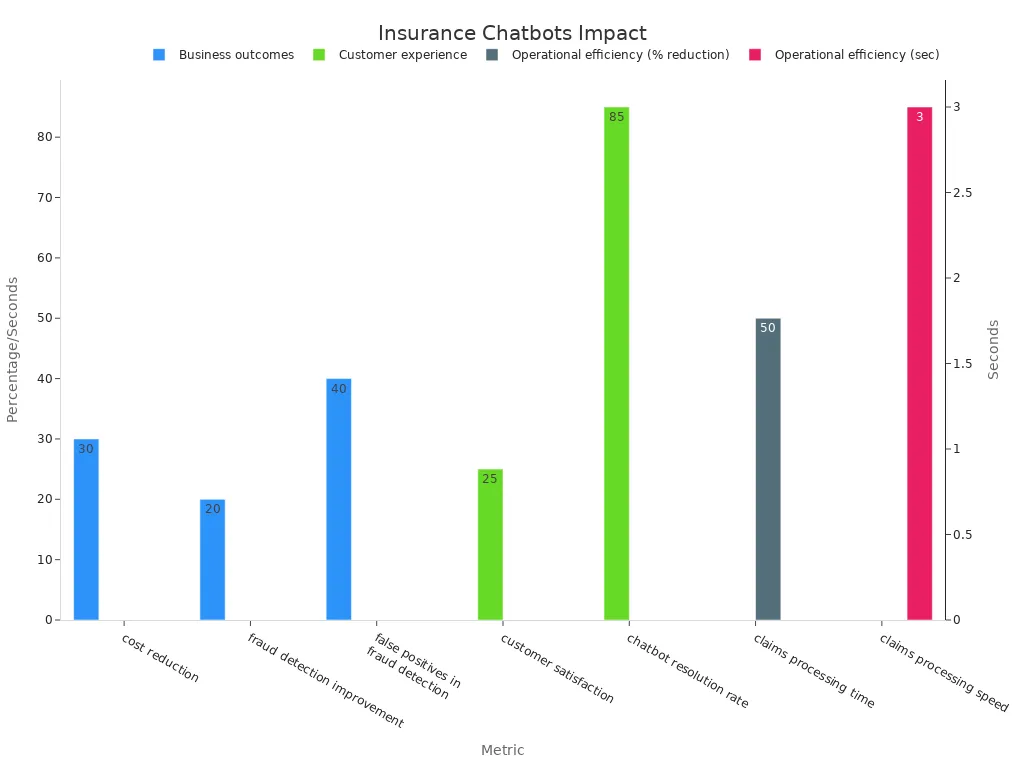

Insurance chatbots have sparked a digital transformation in the industry, driving faster claims, higher customer satisfaction, and measurable cost savings. Today, these AI tools resolve about 85% of queries without human help and can cut claims processing times by up to 50%, sometimes settling claims in just three seconds. Customer satisfaction rises by 25% with chatbot use, while operational costs drop by 30%. Sobot leads this change with Sobot AI, offering 24/7 support and personalized service for insurance and financial services.

Insurance Chatbots Overview

Core Functions

Insurance chatbots help insurance companies serve customers better and faster. These chatbots use ai chatbot technology to answer questions, guide users through claims, and provide policy information at any time. They interact with customers using text or voice, making it easy for people to get help without waiting. For example, some chatbots can process claims instantly, which saves time and reduces errors. Many insurance chatbots also help customers update their details, get quotes, and check claim status. This 24/7 support improves satisfaction and builds trust. Companies see higher productivity because chatbots handle routine tasks, letting agents focus on more complex issues.

Insurance chatbots can:

- Answer policy questions and provide quotes

- Guide customers through claims filing

- Update personal information

- Offer real-time claim status updates

- Schedule appointments and reminders

Industry Standards

Insurance chatbots must follow strict rules to keep customer data safe. Providers design these systems to meet regulations like GDPR, HIPAA, and CCPA. These standards require strong encryption, secure storage, and clear user consent. Chatbots must also let users access, correct, or delete their data. Regular audits and staff training help keep systems secure and compliant.

| Regulation/Standard | Description | Relevance to Insurance Chatbots |

|---|---|---|

| GDPR | Protects personal data, requires consent and security | Ensures lawful data handling and privacy |

| CCPA | Gives rights to access and delete data | Chatbots must support user rights in California |

| HIPAA | Protects health information | Needed for chatbots handling health data |

| ISO/IEC 27001 | Security management framework | Guides data protection and risk management |

Sobot Chatbot Features

Sobot offers a powerful AI chatbot for insurance and financial services. The Sobot chatbot works across many channels, including WhatsApp and SMS. It supports multiple languages and operates 24/7. Sobot’s chatbot can answer common questions, help with claims, and provide instant replies using a smart knowledge base. Businesses can set up the chatbot without coding, using a simple point-and-click interface. Sobot’s solution helps companies save costs, boost conversions, and improve customer satisfaction by automating routine tasks and providing real-time support.

Insurance Chatbots in Customer Service

Customer Experience

Insurance chatbots have changed how customers interact with insurers. These AI tools give people instant answers to questions about policies, coverage, and claims. Customers can reach out at any time, day or night, and get help without waiting for an agent. GEICO’s virtual assistant, Kate, is one example. Kate helps users check policy details and get vehicle care tips through a mobile app, which reduces call center volume and improves satisfaction. Research shows that 87% of customers say fast and easy claims process affects their decision to renew insurance. Customer service chatbots like Sobot provide 24/7 support across channels such as WhatsApp and SMS, making it easy for customers to get help when they need it. This constant availability leads to higher customer experience scores and greater loyalty.

Claims Processing

The claims process often causes stress for policyholders. Insurance chatbots make this easier by guiding users step-by-step through submitting claims, uploading photos, and tracking progress. Lemonade’s AI Jim can settle claims in seconds, showing how automation speeds up the process and reduces errors. Sobot’s AI chatbot uses smart automation to collect claim details, check documents, and provide real-time updates. This reduces manual work for agents and helps customers get faster results. AI chatbots also use machine learning to spot patterns and flag possible fraud, which protects both the insurer and the customer. Studies show that automation can make claims processing 30% faster and cut costs by up to 40% (source).

Policy Management

Managing insurance policies can be complex, but chatbots simplify the process. Customers can update personal details, change beneficiaries, or request new quotes with just a few clicks. PolicyBazaar saw a 10% increase in customer satisfaction after adding chatbots for policy management. Sobot’s chatbot helps users renew policies, set reminders, and compare plans, all without waiting for human help. These tools also send proactive alerts about renewals or missing documents, reducing lost leads and improving conversion rates. By automating routine tasks, insurance chatbots free up agents to focus on more complex needs, which boosts efficiency and accuracy.

Real-Life Use Cases

Lead Generation

Insurance companies use chatbots to find and qualify new customers. For example, one leading insurance carrier saw a 30% increase in qualified leads in just four days after using AI agents to automate follow-ups and add leads to their CRM. Many agencies report a 35% growth in conversions from social media inquiries when using chatbots on WhatsApp and Messenger. Health insurance providers have doubled their qualified leads by offering personalized policy recommendations through AI chatbots. Companies also see faster response times, with some reducing wait times from hours to under one minute. On average, insurance firms using chatbots experience a 23% improvement in lead-to-conversion ratios and save about $0.60 per chatbot interaction. Sobot’s AI chatbot helps insurers capture more leads by providing instant answers and guiding users through quote requests, all while integrating seamlessly with CRM systems.

Automated Support

Automated support powered by chatbots transforms customer service in insurance. Lemonade’s chatbot Maya processes new policies in 90 seconds and approves claims in under three seconds. Jim, another Lemonade bot, handles over 20,000 claims each year without human help. Aetna’s chatbot Ann provides 24/7 support, reducing call center volume by 29%. Tokio Marine Insurance’s chatbot manages 70% of inbound queries across multiple platforms with no human involvement. These real-life use cases show that chatbots can handle onboarding, claims, payments, and fraud detection quickly and accurately. Sobot’s AI chatbot offers similar benefits, using natural language processing and multilingual support to resolve routine questions and free up agents for complex tasks.

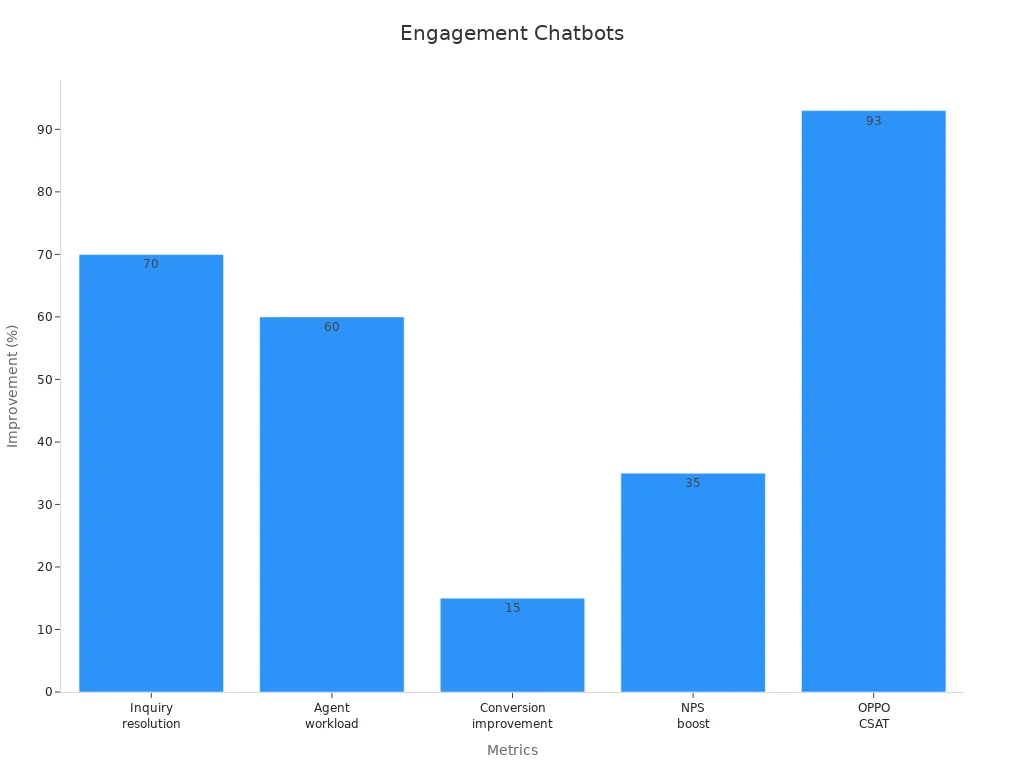

Multichannel Engagement

Insurance chatbots now connect with customers across many channels, such as WhatsApp, SMS, and web chat. This approach improves engagement and satisfaction. Companies like Zurich Insurance and Kotak Life use omnichannel chatbots to resolve up to 70% of inquiries and boost customer satisfaction to 85%. Sobot’s omnichannel solution integrates chatbots, voicebots, and WhatsApp Business API, centralizing all customer interactions. Brands like J&T Express and OPPO have seen a 35% increase in sign-off rates and a 93% customer satisfaction score by using Sobot’s platform. The table below highlights key improvements from multichannel engagement:

| Metric / Case Study | Improvement / Result |

|---|---|

| Inquiry resolution rate | 70% of inquiries resolved |

| Conversion increase | 3x increase in conversions |

| Agent workload reduction | 60% reduction in agent workload |

| Net Promoter Score (NPS) boost | 35% increase |

| OPPO | 93% Customer Satisfaction (CSAT) |

These real-life use cases prove that insurance chatbots, including Sobot’s solutions, drive better results in lead generation, automated support, and multichannel engagement.

Insurance Chatbot Case Studies

Claims Automation

Insurance companies have seen major improvements by using chatbots to automate claims. Many case studies show that automation speeds up claims processing and reduces errors. For example, generative AI can read and summarize claims documents, helping adjusters make decisions faster. Some insurers now process claims in hours instead of weeks. One Australian insurer saved teams up to 6 hours each week by automating routine claims tasks. This allowed staff to focus on more complex cases and improved overall productivity.

The table below highlights measurable improvements from claims automation:

| Performance Indicator | Measurable Improvement |

|---|---|

| Claims Processing Time | Reduced by up to 68% (e.g., from 8 days to <3) |

| Customer Satisfaction | Increased by 22% |

| Operational Costs | Decreased by 35% |

| Agent Productivity | Improved by 40% |

| Renewal Processing Time | Reduced by 75% (auto insurance case) |

| Self-Service Renewal Rate | Increased from 22% to 58% |

| Customer Service Call Volume | Decreased by 30% |

| Customer Retention | Improved by 12% |

| Return on Investment (ROI) | Achieved full ROI within 9 months |

Note: Intelligent automation streamlines the entire claims process, from intake to settlement. This reduces manual errors and helps customers get faster service.

Customer Satisfaction

Chatbot case studies reveal that customer satisfaction rises when insurers use AI-powered chatbots. Customers get instant answers and updates about their claims or policies. This reduces frustration and builds trust. For example, some insurers saw a 22% increase in satisfaction scores after launching chatbots. Automated updates and self-service options help customers feel in control of their insurance experience.

Many companies also report fewer customer service calls. When chatbots handle routine questions, agents can spend more time helping with complex issues. This leads to better service and happier customers. Companies that use chatbots often see higher customer retention and more positive feedback.

Sobot Chatbot Case Studies

Sobot has helped many insurance and financial companies achieve real-life results with its AI chatbot solutions. Sobot’s chatbot automates claims intake, provides instant policy information, and supports customers in multiple languages. For example, Sobot’s clients have seen up to a 70% increase in agent productivity and a 50% reduction in service costs. One insurance provider using Sobot’s omnichannel chatbot reported a 35% boost in Net Promoter Score (NPS) and a 93% customer satisfaction rate.

Sobot’s chatbot also improves lead generation by guiding users through quote requests and integrating with CRM systems. This helps insurers capture more leads and convert them into customers. Sobot’s easy-to-use, no-code setup allows companies to deploy chatbots quickly and start seeing benefits right away. These case studies show how Sobot’s solutions deliver measurable improvements in efficiency, satisfaction, and business growth.

Best Practices for Insurance Chatbots

Integration

Insurance chatbots work best when they connect smoothly with existing digital systems. Companies like State Farm use AI-driven chatbots to manage customer inquiries, claims, and policy updates. This approach led to a 30% drop in call center workloads and faster response times. Insurance chatbots should link with CRM systems, knowledge bases, and communication channels such as websites, mobile apps, and WhatsApp. Sobot’s chatbot integrates with multiple platforms, making it easy for insurers to offer support across channels. A seamless hand-off to human agents is also important. Research shows that 60% of customers stay loyal when chatbots can transfer them smoothly to a person. Integration with analytics tools helps companies track chatbot performance and improve service.

Tip: Use a hybrid model that combines AI-driven and rule-based chatbots for the best results.

Compliance

Insurance chatbots must protect customer data and follow strict industry rules. They use encryption and authentication to keep information safe. Automated audit trails record every customer interaction, helping companies meet regulations like GDPR and HIPAA. AI monitors chatbot responses to ensure they follow industry standards. Sobot’s chatbot supports secure data handling and meets global compliance needs. These steps build trust with customers and reduce the risk of data breaches.

- Insurance chatbots use encryption to prevent unauthorized access.

- Automated logs help meet regulatory requirements.

- AI checks chatbot replies for compliance.

User Experience

A great user experience makes insurance chatbots more effective. Clear communication reduces confusion. About 68% of customers feel more loyal to companies with transparent processes. Insurance chatbots should guide users step-by-step, offer real-time updates, and provide easy forms. Sobot’s chatbot uses intuitive design and 24/7 support to help customers manage policies, file claims, and get answers quickly. Features like centralized dashboards and self-service tools empower users. Research shows that 74% of people stay with companies that offer simple digital tools. Insurance chatbots also support multiple languages and channels, making service accessible to everyone.

Note: Instant responses and easy navigation increase satisfaction and lead conversion rates.

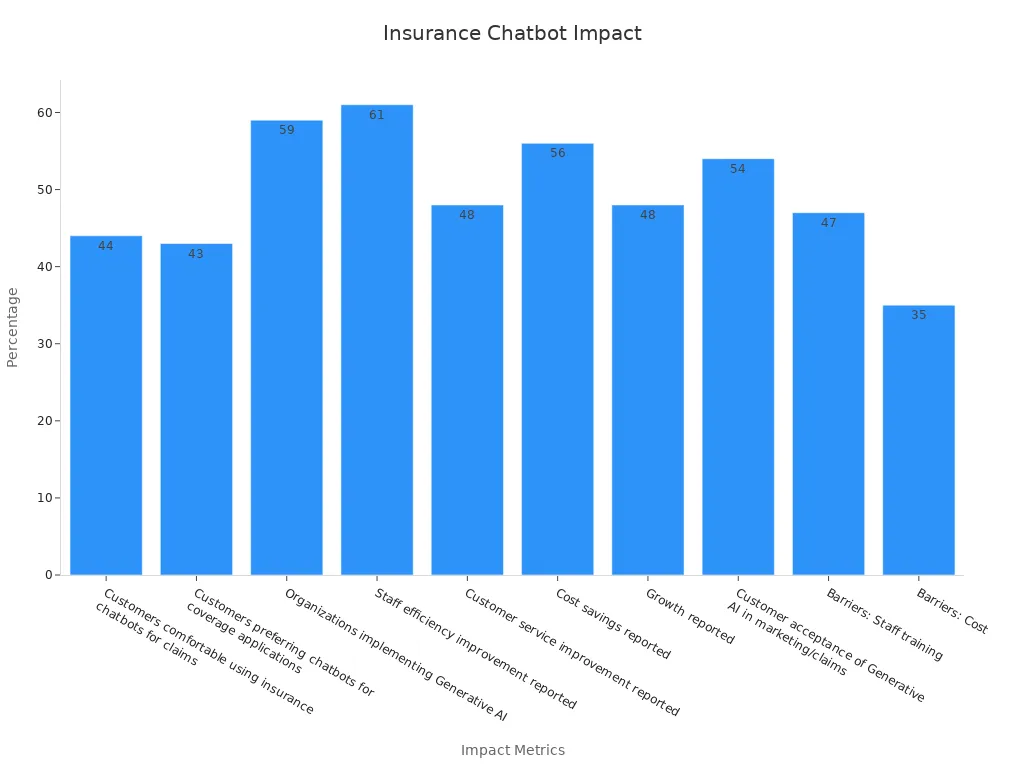

Insurance chatbots have changed the insurance industry. Many companies now use these tools to improve customer service, speed up claims, and save money. The table below shows how insurance chatbots drive innovation and success:

| Metric / Impact Area | Statistic / Percentage |

|---|---|

| Customers comfortable using insurance chatbots for claims | 44% |

| Customers preferring chatbots for coverage applications | 43% |

| Organizations implementing Generative AI | 59% |

| Staff efficiency improvement reported | 61% |

| Customer service improvement reported | 48% |

| Cost savings reported | 56% |

| Growth reported | 48% |

Sobot leads with AI-powered insurance chatbots that help insurers boost productivity and customer satisfaction. Many organizations report 40-60% gains in customer service productivity and 20-30% faster document processing. Insurance chatbots like Sobot’s offer 24/7 support, personalized service, and easy integration. As more insurers adopt these solutions, the industry will see even greater innovation and growth. Insurance chatbots will continue to shape the future of insurance, making service faster and more reliable for everyone.

FAQ

What are insurance chatbots and how do they work?

Insurance chatbots use artificial intelligence to answer questions, guide users, and process claims. They work 24/7 on channels like WhatsApp or SMS. Sobot’s chatbot uses a smart knowledge base to give instant replies and help customers manage policies.

How do insurance chatbots improve customer service?

Insurance chatbots provide fast answers and support at any time. They reduce wait times and help customers file claims or update policies. Sobot’s chatbot can boost agent productivity by 70% and cut service costs by 50%. Learn more.

Are insurance chatbots secure and compliant?

Yes. Insurance chatbots follow strict rules like GDPR and HIPAA. They use encryption and secure storage to protect data. Sobot’s chatbot meets global compliance standards and supports safe customer interactions.

Can insurance chatbots handle multiple languages?

Insurance chatbots like Sobot’s support many languages. This helps companies serve customers from different regions. Multilingual support improves satisfaction and makes insurance services more accessible.

What results do companies see after using insurance chatbots?

Companies report a 25% rise in customer satisfaction and a 30% drop in costs after using insurance chatbots. Sobot’s clients have seen a 35% boost in Net Promoter Score and a 93% customer satisfaction rate.

Tip: Insurance chatbots help insurers grow by making service faster, easier, and more reliable.

See Also

Artificial Intelligence Transforms Customer Support Experience

Ways Chatbots Enhance Satisfaction For Online Shoppers

Key Advantages Of Using Chatbots On Websites