Insurance Chatbot Use Cases and Implementation Steps

You can transform your insurance business with Sobot’s health insurance chatbot. Many insurance companies now leverage insurance chatbot use cases to automate customer support, streamline claims, and manage policies more efficiently. In fact, 74% of customers prefer chatbots for simple questions, and 64% value 24/7 service. A health insurance chatbot powered by Sobot AI can handle 30% of contact center jobs, saving billions in costs and boosting customer satisfaction. Sobot AI brings advanced health insurance chatbot technology, helping you deliver faster, more personalized customer service. As the insurance chatbot market grows, clear steps matter for successful deployment.

Insurance Chatbot Use Cases

Insurance chatbot use cases help you improve every part of your insurance business. You can use a health insurance chatbot to answer questions, process claims, manage policies, generate leads, and handle billing. Sobot’s AI-powered chatbot gives you 24/7 customer support, multilingual service, and automation across all channels. Let’s look at the most impactful insurance chatbot use cases for your company.

Customer Support

A health insurance chatbot can transform your customer support. You give your customers instant answers to common questions, such as policy details, coverage, and claim status. Sobot’s chatbot works 24/7, so your customers never have to wait for business hours. You can also serve people in their preferred language, making your service more accessible.

- AI-powered chatbots provide instant responses and are available 24/7, eliminating long wait times.

- These chatbots automate up to 80% of routine queries, freeing your agents to handle complex issues.

- Chatbots scale easily during peak times, so your customer support stays fast and reliable.

Did you know? 74% of customers prefer chatbots for simple questions, and 64% value 24/7 customer support. (source)

Claims Assistance

A health insurance chatbot makes claims processing faster and easier. You can guide customers through the claims process, collect documents, and even use image recognition to verify damage. Sobot’s chatbot automates routine steps, so your team can focus on more complex cases.

| Metric Description | Statistic Value |

|---|---|

| Reduction in claim settlement time | 30-50% decrease |

| Claims processing time improvement | From 5 days to under 1 hour |

| Increase in customer satisfaction rates | 30% increase |

| Share of customer interactions handled by chatbots | 20% |

| Reduction in claims processing time via AI automation | Up to 75% reduction |

| Automation of repetitive tasks in insurance | 27% automated |

You help customers file claims anytime, which increases satisfaction and loyalty. In fact, 87% of customers say that fast claims processing influences their decision to renew insurance. A health insurance chatbot can also detect fraud using AI, reducing losses for your business.

Policy Management

Managing policies becomes simple with a health insurance chatbot. Your customers can check policy details, update information, renew coverage, or request documents without waiting for an agent. Sobot’s chatbot connects with your systems, so changes happen in real time.

- 43% of customers prefer chatbots to apply for insurance.

- Chatbots automate policy updates, reminders, and renewals, reducing manual work for your team.

- You can offer personalized recommendations based on customer data.

This automation saves time and improves accuracy. Your customers get better service, and your team can focus on more important tasks.

Lead Generation

A health insurance chatbot helps you find and qualify new leads. You can engage website visitors, ask pre-qualifying questions, and collect contact details. Sobot’s chatbot works 24/7, so you never miss a potential customer.

Insurance chatbots support lead generation by gathering data to identify serious buyers. This saves your sales team time and increases conversion rates. You can also use multilingual support to reach more people. For example, Opay used Sobot’s omnichannel solution to increase conversion rates by 17% and boost customer satisfaction from 60% to 90%. (Opay case study)

Tip: Chatbots can increase customer loyalty by up to 60% with smooth transitions from bot to human agents.

Billing and Payments

A health insurance chatbot streamlines billing and payments. Customers can check balances, set up payment reminders, and resolve billing issues anytime. Sobot’s chatbot automates payment processing and reduces errors.

| Metric | Numerical Data | Impact Description |

|---|---|---|

| Number of users engaged | 125,300 users | Total chatbot conversations handled |

| Percentage of conversations automated | 25% | Portion of customer interactions handled by chatbot |

| Annual cost savings | $131,140 | Savings attributed to chatbot implementation |

| Claims processing time reduction | Up to 90% | Significant cut in processing cycle time |

| Fraud detection accuracy | 99.9% | High accuracy in identifying fraudulent claims |

| Cost reduction | 30% to 65% | Decrease in operational costs due to automation |

You save time and money by reducing manual work. Customers enjoy faster service and fewer mistakes. Automation also helps you detect fraud and reduce claim denials.

Note: Sobot’s health insurance chatbot can automate up to 30% of contact center jobs, saving costs and improving accuracy.

Benefits of Insurance Chatbots

24/7 Availability

You want your customers to get help anytime, not just during business hours. A health insurance chatbot gives you this power. With 24/7 support, your customers can check policy details, file claims, or ask questions whenever they need. This always-on service means no more waiting for office hours or standing in long phone queues. For example, Nationwide’s Online Response Assistant (NORA) has helped customers day and night for years, letting them reset passwords, get product info, and check claim status without calling. Many organizations now use chatbots for round-the-clock support. In 2022, 60% of U.S. healthcare groups used chatbot technology. Sobot’s health insurance chatbot ensures your customers never feel left out, no matter the time.

| Statistic / Example | Description |

|---|---|

| 60% | U.S. healthcare organizations using chatbots in 2022 |

| Up to 80% | Routine questions answered by chatbots |

| $2.4 million | Saved by OSF HealthCare in one year with chatbots |

Faster Responses

Speed matters in insurance. A health insurance chatbot answers questions in seconds, not minutes or hours. You help customers get instant replies about claims, coverage, or billing. Sobot’s chatbot can handle up to 80% of routine questions, so your team can focus on complex cases. This quick service keeps customers happy and reduces frustration. For example, Maya, a popular insurance chatbot, processes new policies in just 90 seconds and approves claims in under 3 seconds. Fast responses mean your customers trust you more and stay loyal.

Personalization

Every customer wants to feel special. A health insurance chatbot uses customer data to give personalized answers and recommendations. You can remind customers about renewals, suggest new plans, or help them update their details. Sobot’s chatbot connects with your systems to deliver tailored experiences. Personalization leads to better results. Companies have seen a 25% drop in churn rates in one year by using personalized chatbot interactions.

| Metric Description | Numerical Data | Impact on Customer Satisfaction |

|---|---|---|

| Reduction in churn rates | 25% decrease in 1 year | Improved retention and loyalty |

Cost Reduction

You save money when you use a health insurance chatbot. Automation handles up to 65% of customer inquiries, so you need fewer agents. Sobot’s chatbot also reduces IT maintenance costs by up to 40% with cloud-based solutions. Predictive analytics and process automation cut overhead by nearly 25%. These savings add up fast. OSF HealthCare saved $2.4 million in one year by using chatbots for front-office calls. You can lower your operational expenses and invest more in growing your business.

Tip: Automation lets you scale support without hiring more staff, making your health insurance chatbot a smart investment.

Insurance Chatbot Implementation Steps

Building an insurance chatbot for your business involves several important steps. Each step helps you create a chatbot that works well for your customers and your team. Here is a simple guide to help you get started.

Define Objectives

Start by deciding what you want your insurance chatbot to do. Clear goals help you measure success and stay focused.

- Match chatbot functions with your business goals.

- Design features for your target audience.

- Improve customer experience with self-service.

- Make sure you follow data security and privacy rules.

- Set up ways for customers to talk to a human if needed.

- Plan for proactive customer engagement, like reminders for renewals.

- Track key metrics such as response times and satisfaction.

- Use feedback and analytics to keep improving your chatbot.

Tip: Aligning your chatbot with business goals and customer needs leads to better results and higher satisfaction.

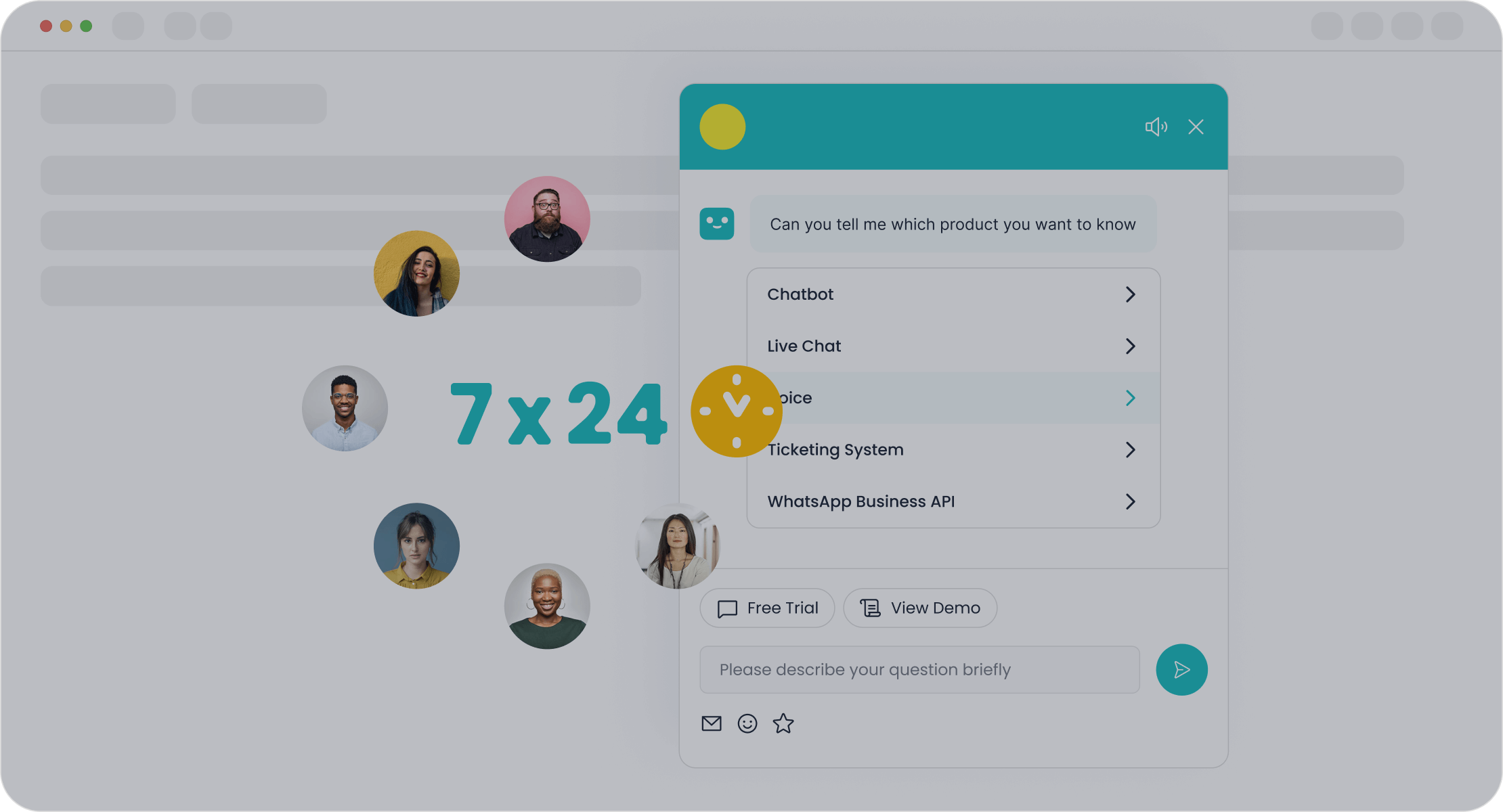

Choose a Platform

Pick a platform that fits your needs. Look for tools that are easy to use and offer strong features.

- Sobot’s no-code chatbot builder lets you set up workflows with a simple point-and-click interface.

- Omnichannel support means your chatbot can talk to customers on WhatsApp, SMS, and more.

- Make sure the platform supports multilingual service if you have customers who speak different languages.

- Choose a platform that offers strong security and reporting features.

Note: Sobot’s platform helps you launch a chatbot quickly, even if you have no coding experience. Learn more about Sobot Chatbot

Design Flows

Plan how your chatbot will talk to customers. Good conversation flows make it easy for users to get help.

- Map out common questions, like policy details or claim status.

- Use simple language and avoid jargon.

- Create clear menus and quick replies to guide users.

- Give instructions at the start so users know what to expect.

- Make sure users can easily reach a human agent if needed.

A well-designed flow helps users find answers fast and keeps them happy.

Integrate Systems

Connect your insurance chatbot to your existing systems. Integration helps your chatbot give real-time answers and automate tasks.

| Metric | Outcome after Integration |

|---|---|

| Conversion rate on quotes | Increased by 11% |

| Missed live chats | Decreased |

| Average agent handling time | Reduced from 16.5 to 10 minutes |

| Customer interaction rate with bot | 80% of users interact with the bot |

Sobot’s chatbot connects with tools like Salesforce and Shopify, making it easy to manage customer data and automate workflows.

Train and Test

Teach your chatbot how to answer questions and handle different situations. Testing helps you find and fix problems before launch.

- Use real customer questions to train your chatbot.

- Check accuracy, containment rate, and error rate.

- Monitor customer satisfaction scores (CSAT).

- Use dashboards to spot issues quickly.

- Update your chatbot based on feedback and analytics.

Continuous training and testing help your chatbot stay accurate and helpful.

Launch and Monitor

Go live with your insurance chatbot and watch how it performs. Monitoring helps you spot trends and make improvements.

- Use analytics to track performance and customer engagement.

- Collect data on lead quality and claims processing.

- Watch for areas where customers need more help.

- Use feedback to improve your chatbot over time.

- Free up your agents to handle complex issues.

Regular monitoring ensures your chatbot keeps getting better and delivers value to your business.

Essential Features for Insurance Chatbots

Omnichannel Support

Omnichannel support lets you connect with customers on their favorite platforms. With ai chatbots, you can answer questions on WhatsApp, SMS, email, and social media. This approach gives your customers more choices and makes help easy to find. Sobot’s chatbot brings all these channels together in one place, so you never miss a message.

- Chatbots can cut phone calls, emails, and live chats by 70%.

- They help your team focus on important tasks instead of routine questions.

- 24/7 support means customers get help anytime, not just during office hours.

| Utilization Statistic | Benefit Highlighted |

|---|---|

| 44% of customers prefer chatbots for claims | Simplifies claims processing and improves customer satisfaction |

| $8B+ saved in customer interaction costs | Significant cost reduction through automation |

| 70% reduction in calls and emails | Reduces agent workload, allowing focus on complex tasks |

| 24/7 real-time support | Enables continuous customer service across channels |

You can see how ai chatbots make your insurance business more efficient and responsive.

Multilingual Capabilities

Insurance serves people from many backgrounds. Ai chatbots with multilingual skills help you reach everyone. Sobot’s chatbot can talk to customers in their own language, making your service more welcoming and easy to use.

- Multilingual chatbots increase access for all customers.

- Natural language processing helps ai chatbots understand and reply in many languages.

- Customers feel valued when they get answers in their language.

This feature builds trust and loyalty. You can serve a wider audience and make sure no one feels left out.

AI and Automation

Ai chatbots use smart technology to handle tasks quickly and accurately. They can process claims, answer questions, and check policy details without human help. Sobot’s ai chatbots use automation to speed up claims and reduce mistakes.

- Some ai chatbots settle claims in seconds.

- Automation lowers costs by handling many claims at once.

- Ai chatbots check information for accuracy and spot fraud.

- They collect and update customer data, keeping records current.

You get faster service, fewer errors, and happier customers. Ai chatbots also free your agents to solve complex problems.

Security and Compliance

Insurance companies must protect customer data. Ai chatbots need strong security to keep information safe. Sobot’s ai chatbots follow strict rules to protect privacy and meet industry standards.

- Secure chatbots keep customer details private.

- They help with customer verification and safe transactions.

- Compliance features make sure your business follows laws and regulations.

You can trust ai chatbots to handle sensitive data and keep your business safe. This builds confidence with your customers and regulators.

Best Practices for Insurance Chatbot Success

Customer Experience Focus

You should always put customer experience at the center of your insurance chatbot strategy. When you focus on customer needs, you build trust and loyalty. Key metrics like Net Promoter Score (NPS), Customer Satisfaction (CSAT), and Customer Effort Score (CES) help you measure how well your insurance chatbot serves users. For example, Zurich Insurance’s chatbot handles 70% of inquiries automatically, which reduces call volumes and improves efficiency. Lemonade’s AI bot increased quote generation by 140%, showing how a customer-focused approach can drive business growth.

Gen AI chatbots, like Sobot, improve satisfaction by offering 24/7 support, instant responses, and multi-channel access. These features make it easier for customers to get help anytime. Data shows that 66% of people are willing to share personal data for more personalized insurance services. Personalization and easy access lead to higher retention and stronger relationships. You can use Sobot’s analytics to track these metrics and keep improving your insurance chatbot experience.

Performance Monitoring

You need to monitor your insurance chatbot’s performance to get the best results. Tracking the right metrics helps you spot issues and optimize your chatbot. Important metrics include:

- Bot Experience Score

- Bot Automation Score

- Cost per Automated Conversation

- Agent Experience Score

- False Positive Rate

- Bot Repetition Rate

- Positive Feedback Rate

- Natural Language Understanding (NLU) Rate

- Interaction Volume

- Bounce Rate

- Conversation Length

- Handle Time

- Problem Resolution Rate

- Customer Satisfaction Rate

Sobot’s reporting tools let you see these metrics in real time. You can use this data to improve automation, reduce costs, and boost customer satisfaction. Regular reviews help you adapt your insurance chatbot to changing needs and regulations.

Compliance and Privacy

You must protect customer data and follow all rules when using an insurance chatbot. Regulations like GDPR, CCPA, and HIPAA set strict standards for data privacy and security. Sobot’s insurance chatbot follows these rules by using encryption, access controls, and regular audits.

| Aspect | Description |

|---|---|

| Regulations | GDPR, CCPA, HIPAA, SOX, FCRA—require data protection, consent, and transparency |

| Standards | ISO/IEC 27001, ISO/IEC 27701, ISO 9001, NIST SP 800-53—focus on security and quality |

| Best Practices | Analyze requirements, design secure systems, train with real data, monitor and update often |

| Challenges | Data privacy, bias, user trust, regulatory changes—mitigated by strong controls and updates |

| Benefits | 24/7 service, accurate responses, cost savings, compliance across regions |

You should update your insurance chatbot as laws change and always inform users about data use. This builds trust and keeps your business safe. Sobot’s secure platform helps you meet these needs with ease.

You can transform your insurance business with an insurance chatbot. Use cases like customer support, claims, and policy management show real results. Sobot Chatbot helps you boost efficiency and cut costs. The market for AI-driven insurance chatbots is growing fast, with 74% of customers preferring quick service and 80% reporting satisfaction.

| Market Insight | Data |

|---|---|

| Market Size Projection | $2.6 billion by 2030 |

| Cost Reduction Potential | Up to 40% lower fees by 2030 |

| Customer Preference | 74% prefer chatbots for quick service |

Start your journey with Sobot and keep improving your insurance chatbot for long-term success.

FAQ

What is an insurance chatbot?

An insurance chatbot is an AI-powered tool that helps you answer questions, process claims, and manage policies. You can use it to automate customer support and reduce costs. Sobot’s insurance chatbot works 24/7 and supports multiple languages. Learn more here.

How does an insurance chatbot improve customer service?

You get instant answers with an insurance chatbot. It handles up to 80% of routine questions, so your team can focus on complex cases. Sobot’s insurance chatbot gives you 24/7 support and helps boost customer satisfaction by up to 30%.

Is it hard to set up an insurance chatbot?

No, you can set up Sobot’s insurance chatbot without coding. The platform uses a point-and-click interface. You can design workflows, connect channels, and launch your insurance chatbot quickly. Sobot also offers easy integration with tools like Salesforce.

What features should I look for in an insurance chatbot?

You should look for these features:

- Omnichannel support

- Multilingual capabilities

- AI automation

- Security and compliance

Tip: Sobot’s insurance chatbot includes all these features and helps you serve customers across WhatsApp, SMS, and more.

Can an insurance chatbot help with lead generation?

Yes, an insurance chatbot can collect leads 24/7. You can engage website visitors, ask pre-qualifying questions, and gather contact details. Sobot’s insurance chatbot helped Opay increase conversion rates by 17%. Read the Opay case study for more details.

See Also

Simple Ways To Add Chatbot Examples On Websites

Ways Chatbots Improve Customer Satisfaction In E-commerce

Key Advantages Of Using Chatbots On Your Website