Key Use Cases for Insurance Chatbots in 2025

Insurance chatbots powered by Sobot AI are set to revolutionize how you interact with insurance companies in 2025. These insurance chatbots assist with customer acquisition, policy advising, claims management, underwriting, customer engagement, fraud detection, and payment processing. Utilizing advanced AI, Sobot’s insurance chatbot answers questions, guides you through policy options, and helps you file claims efficiently. Available 24/7, these chatbots deliver fast and accurate service that significantly enhances the customer experience. Businesses benefit from up to 40% increased agent productivity and 30% reduced service costs, while customers enjoy quicker support and improved service. Sobot leads the way with smart, multilingual, and user-friendly insurance chatbot solutions designed to meet modern insurance needs.

Insurance Chatbots Overview

What Is an Insurance Chatbot

An insurance chatbot is a digital assistant that helps you interact with your insurance company. You can ask questions, get quotes, and manage your policy using this tool. Insurance chatbots use AI to understand your needs and give you fast answers. These chatbots work on websites, apps, and even messaging platforms like WhatsApp. Many insurance companies use chatbots to make customer service easier and faster for you.

Insurance chatbots play a big role in customer service. They reduce wait times, lower agent workloads, and help you get answers 24/7. You can use a chatbot to file claims, check policy details, or make payments at any time. Companies like Lemonade and Aetna have shown that chatbots can process claims in seconds and reduce call center volume by almost 30%.

How Insurance Chatbots Work

Insurance chatbots use AI and machine learning to talk with you in real time. When you type a question, the chatbot checks its knowledge base and gives you the best answer. If you need to file a claim, the chatbot guides you step by step. It can also collect your feedback and help you update your insurance plan. Chatbots connect with backend systems to keep your information up to date.

- Insurance chatbots handle routine questions, so human agents can focus on complex tasks.

- They work across many channels, giving you a smooth experience wherever you are.

- Chatbots help detect fraud by analyzing claims and flagging anything unusual.

- They support self-service, letting you manage your insurance without waiting for an agent.

Sobot Chatbot Features

Sobot offers advanced AI-powered chatbots for insurance companies. You get a multilingual chatbot that works 24/7 and supports self-service on channels like WhatsApp and SMS. Sobot’s chatbot uses a smart knowledge base to answer questions quickly and accurately. You can set up the chatbot with a simple point-and-click interface—no coding needed.

| Feature | Benefit for You |

|---|---|

| Omnichannel Support | Chat on your favorite platform |

| Multilingual | Get help in your language |

| 24/7 Availability | Access anytime |

| Self-Service | Manage policies on your own |

| AI-Powered | Fast, accurate responses |

Sobot’s chatbot helps insurance companies boost agent productivity by up to 70% and cut service costs by 50%. You get a better experience, and companies see higher efficiency. Industry reports show that 79% of insurance executives believe AI will change how you interact with insurance (Accenture).

Customer Acquisition

Lead Generation

Insurance chatbots help you find the right insurance faster. When you visit an insurance website, a chatbot can greet you and ask simple questions. You share your needs, and the chatbot collects your information. This process helps insurance companies find new customers who are interested in their products. Chatbots can qualify leads by checking if you meet certain requirements for insurance plans. You do not have to wait for a human agent. The chatbot works all day and night, so you can get help anytime.

Many people now prefer using chatbots. Studies show that 40% of internet users like talking to chatbots more than to human agents. Almost half of people are willing to buy insurance through a chatbot. These digital assistants make it easy for insurance companies to reach more customers and grow their business.

Onboarding

After you decide to get insurance, the onboarding process begins. Insurance chatbots guide you step by step. You answer questions about your needs, and the chatbot helps you fill out forms. The chatbot explains each part of the insurance policy, so you understand what you are buying. This makes the process simple and clear.

A real-world example shows that chatbots can increase sales conversions by 11%. When customers use a chatbot to get a quote, they finish the process faster and with fewer mistakes. About 80% of users keep talking to the chatbot after starting the conversation. This means more customers complete their insurance sign-up.

Sobot Chatbot for Customer Acquisition

Sobot’s insurance chatbot gives you a smooth experience from the first hello to the final policy. You can chat in your own language and on your favorite app, like WhatsApp or SMS. The Sobot chatbot collects your details, answers your questions, and helps you choose the best insurance plan. You get instant replies, and the chatbot never sleeps.

Sobot’s chatbot boosts conversions by 20% with smart self-service and proactive messages. Insurance companies using Sobot see more leads and happier customers. The chatbot’s easy setup means insurance teams can start using it quickly, without coding. Sobot helps you get the insurance you need, while companies save time and money.

Policy Advising

Personalized Recommendations

Insurance chatbots help you find the best insurance plan for your needs. When you start a conversation with a chatbot, it asks questions about your lifestyle, budget, and what you want from your insurance. The chatbot uses this information to suggest policies that fit you. Many customers feel confused by complex insurance options. Chatbots make things simple by explaining each plan in easy words and showing you clear price breakdowns.

You get advice that matches your personal situation. For example, some ai-powered chatbots look at your medical history and suggest health insurance plans that help you stay healthy. Others use your driving habits to recommend car insurance. This kind of personalized advice helps you make smart choices. Studies show that 83% of customers feel satisfied when they use insurance chatbots for policy advice. You get answers fast, and you feel more confident about your decision.

- AI chatbots analyze your data to tailor insurance policies to your needs.

- Personalized recommendations increase customer satisfaction and loyalty.

- Chatbots help you compare plans and understand your options.

24/7 Support

You can talk to an insurance chatbot any time, day or night. This 24/7 customer support means you never have to wait for office hours. If you have a question about your insurance policy or want to change your coverage, the chatbot is always ready to help. You can use self-service tools to update your details, check your policy, or get instant answers.

Many customers like this self-service approach because it saves time. You do not need to call or email an agent. The chatbot gives you support on your favorite app, like WhatsApp or SMS. This makes insurance easy and stress-free.

Sobot AI-Powered Chatbots

Sobot’s ai-powered chatbot gives you instant, personalized insurance advice. You can chat in your own language and get help on any channel. Sobot’s chatbot uses a smart knowledge base to answer your questions and guide you through policy options. You can use customer self-service features to manage your insurance without waiting. Sobot’s chatbot supports self-service for policy changes, quotes, and more. Insurance companies use Sobot to improve customer support and boost customer satisfaction. You get fast, accurate help, and companies see better results.

Claims Management

Claims Filing

You want your insurance claims journey to be quick and easy. Chatbots now make this possible. When you need to file a claim, a chatbot guides you step by step. You answer simple questions, upload documents, and get instant feedback. This process removes confusion and speeds up the claims process. Many insurance companies use chatbots to collect all the details needed for claims management. You do not have to wait for an agent or fill out long forms. Chatbots use AI to check your information and spot missing details. This reduces errors and helps you get your claim processed faster.

- About 80% of insurance executives believe digital transformation, including claims automation, is essential for staying competitive.

- Salesforce reports up to 40% straight-through processing rates for some claim types, and experts expect this to reach 60-70% soon.

- Automation technologies like AI and machine learning help reduce claims processing times and errors.

Status Updates

You want to know what happens after you file your insurance claim. Chatbots keep you updated at every step. You can ask the chatbot for your claim status any time, day or night. The chatbot checks the system and gives you real-time updates. This means you do not have to call or email customer support. You get peace of mind because you always know where your claim stands. Chatbots also send you alerts if more information is needed or when your claim is approved. This makes the claims management process clear and stress-free.

Automation with Sobot

Sobot’s chatbot brings top efficiency to insurance claims management. You get 24/7 support in your language, on your favorite channel. Sobot’s chatbot automates claims filing, tracks your claim, and answers your questions instantly. Insurance companies see big gains in efficiency and customer satisfaction. Here is how Sobot’s chatbot improves claims management:

| Metric Category | Specific Metrics / Results | Details / Impact |

|---|---|---|

| Customer Experience | 65% increase in first-contact resolution rates | Faster claims resolution |

| 22% improvement in customer satisfaction scores | Happier customers during claims journey | |

| Operational Efficiency | 40% reduction in operational costs | Lower costs for insurance companies |

| 24/7 first notice of loss in 12 languages | Always available for claims support | |

| Reduced claims processing time from 7 days to 24 hours | Major efficiency gain | |

| Financial Impact | 3.2x ROI within 16 months | Strong financial return |

Sobot’s chatbot uses AI to automate routine tasks, cut costs, and boost efficiency. You get fast, accurate help, and insurance companies deliver better service. Industry research shows that 67% of insurance customers expect 24/7 support, but only 23% of providers offer it (J.D. Power 2023). Sobot closes this gap with reliable, multilingual chatbots that transform the claims management experience.

Underwriting

Data Collection

When you apply for insurance, data collection is the first step in underwriting. Chatbots help you share your information quickly and easily. You answer questions about your age, health, driving history, or property details. The chatbot collects this data and checks it for accuracy. AI-powered chatbots can pull information from documents, databases, and even public records. This speeds up the process and reduces mistakes.

- AI underwriting accelerates processing times by automating tasks and reducing policy approval durations.

- Automation leads to cost savings by reducing manual labor and operational expenses.

- Generative AI supports data collection by synthesizing information from many sources.

You get a smoother experience, and insurance companies get better data for decision-making.

Risk Assessment

After collecting your data, insurance chatbots use AI to assess risk. The chatbot reviews your answers and compares them to large datasets. AI tools look for patterns and predict how risky it is to insure you. This helps insurance companies set fair prices and offer the right coverage.

A recent study found that 54% of insurers use machine learning and predictive analytics in underwriting. By 2030, experts expect AI to automate most underwriting tasks. AI improves accuracy by eliminating human errors and enabling data-driven risk evaluations. You benefit from faster responses and more personalized insurance offers.

AI-driven underwriting software continuously refines risk models and personalizes underwriting to customer profiles, improving efficiency and satisfaction.

Sobot Integration

Sobot makes underwriting easier for both you and insurance companies. Sobot’s chatbot connects with CRM systems and knowledge bases. This integration lets the chatbot access your past interactions and policy details. You get instant, personalized answers about your insurance application.

Industry benchmarks show that AI platforms integrate with underwriting and CRM systems to provide real-time insights and automate data collection. Sobot’s flexible APIs and cloud-based deployment make integration simple and scalable. Insurance companies use Sobot to reduce manual work, speed up policy issuance, and improve risk evaluation accuracy. You experience a faster, more transparent underwriting process.

| Sobot Integration Benefits | How It Helps You |

|---|---|

| CRM Connection | Personalized responses |

| Real-Time Data | Faster application processing |

| AI Automation | Accurate risk assessment |

Customer Engagement

Proactive Messaging

Insurance chatbots help you stay connected with your insurance provider. These chatbots send you reminders about policy renewals, payment due dates, and important updates. You get personalized messages based on your insurance needs and past actions. For example, if you have not finished your application, the chatbot can send a gentle nudge to help you complete it. This proactive approach keeps you informed and makes your insurance experience smoother.

You also receive tips on how to use your insurance benefits or alerts about new products that match your profile. Proactive messaging increases engagement because you feel valued and supported. Insurance companies see higher customer satisfaction when they use chatbots to reach out before problems arise.

Retention

Keeping customers loyal is a top goal for every insurance company. Chatbots play a big role in this by making every customer interaction easy and helpful. When you get quick answers and useful information, you are more likely to stay with your insurance provider. Chatbots track your preferences and respond to your needs, which builds trust over time.

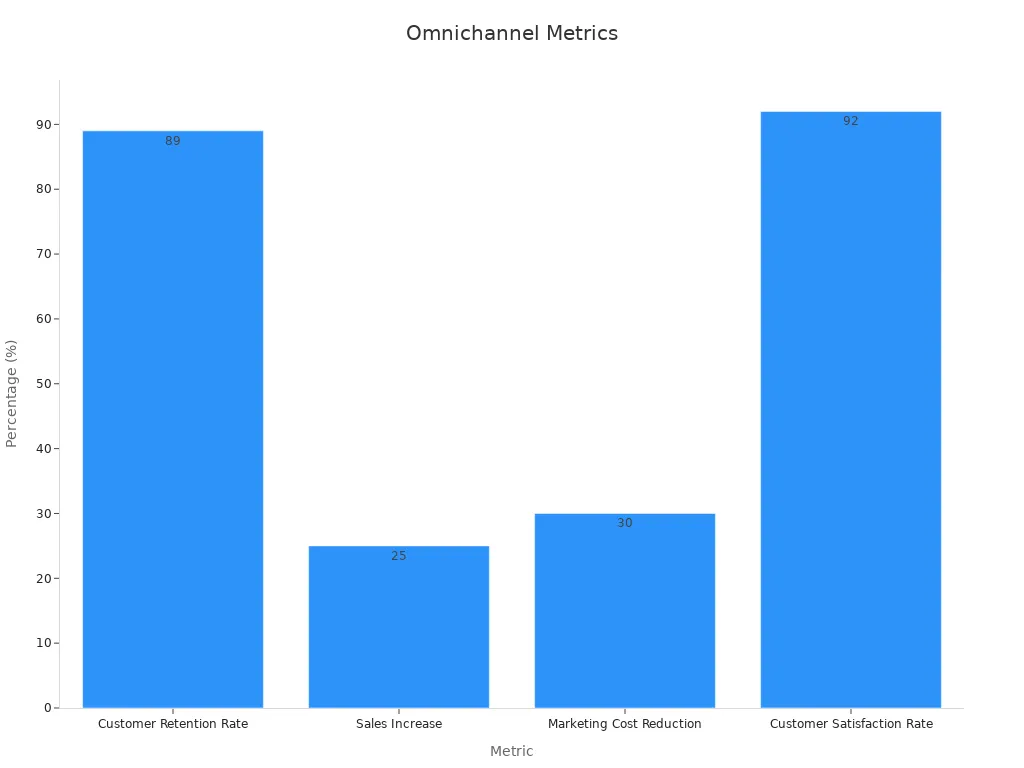

Companies that use omnichannel support see an 89% higher customer retention rate compared to those using only one channel. Customer satisfaction rates can reach 92% when you get consistent service across all platforms.

Tracking key metrics helps insurance companies improve retention. These include Customer Satisfaction (CSAT), First Response Time (FRT), and Net Promoter Score (NPS). High scores in these areas show that customers enjoy their insurance experience and want to stay.

| Metric | Value/Impact |

|---|---|

| Customer Retention Rate | 89% higher with omnichannel support |

| Customer Satisfaction Rate | 92% |

| Sales Increase | 25% |

| Marketing Cost Reduction | 30% |

| First Response Time (FRT) | Key engagement metric |

Sobot Omnichannel Support

Sobot gives you a seamless insurance experience by connecting all your favorite channels. You can talk to your insurance provider on WhatsApp, SMS, or live chat, and get the same high-quality service every time. Sobot’s chatbot uses AI to answer your questions quickly and accurately, no matter where you reach out.

Sobot’s reporting tools help insurance companies track engagement and improve customer interactions. By measuring open rates, response times, and satisfaction scores, companies can spot trends and fix issues before they affect you. This focus on data leads to better customer engagement and higher retention. Sobot’s omnichannel support ensures you always get the help you need, building loyalty and trust in your insurance provider.

Fraud Detection

Suspicious Activity Alerts

You want your insurance to stay safe from fraud. Chatbots help you by watching for suspicious activity. When you file a claim, the system checks for signs of fraud. For example, if someone tries to file the same claim twice, the chatbot can spot it right away. You get alerts if something unusual happens with your insurance account. This quick response helps stop fraud before it causes problems.

Did you know? The FBI estimates that insurance fraud costs over $40 billion each year in the United States (FBI Insurance Fraud). Fast alerts from chatbots help reduce these losses.

Data Analysis

Insurance companies use data analysis to find fraud. Chatbots collect and review large amounts of information from claims, payments, and customer profiles. AI tools look for patterns that do not match normal behavior. For example, if a claim comes from a new location or uses strange details, the system flags it for review. You benefit because your insurance provider can act quickly to protect your policy.

- Insurance fraud detection uses machine learning to spot risky claims.

- AI can check thousands of claims in seconds, saving time and money.

- You get safer, more reliable insurance service.

Sobot Security

Sobot gives you strong protection with advanced security features. The Sobot chatbot uses AI to scan for fraud in real time. It follows strict rules to keep your insurance data safe and private. Sobot’s platform meets industry standards for data security and privacy. You can trust that your information stays protected. Insurance companies using Sobot see fewer fraud cases and faster fraud detection. Sobot’s reporting tools help you and your provider track suspicious activity and respond quickly.

Tip: Always review your insurance account for updates or alerts. Sobot’s chatbot makes it easy to stay informed and secure.

Payment Processing

Premium Collection

Insurance chatbots make premium collection simple and fast. You can pay your insurance bill anytime, day or night. The chatbot guides you through each step, so you never miss a payment. You get reminders before your premium is due. If you have questions about your payment, the chatbot answers right away. This process helps you avoid late fees and keeps your policy active.

Many insurance chatbots work across different platforms. You can pay through a website, mobile app, or even messaging apps like WhatsApp. This flexibility means you choose the channel that fits your life. Chatbots use secure systems to protect your payment information. You get peace of mind knowing your data stays safe.

Billing Support

You may have questions about your insurance bill. Insurance chatbots help you understand charges, payment schedules, and policy details. If you see something you do not understand, just ask the chatbot. It gives you clear answers and helps you fix any issues. You can also update your billing information or set up automatic payments with just a few clicks.

Insurance chatbots deliver consistent, error-free responses. You get reliable support every time you reach out. Chatbots scale to handle many requests at once, so you never wait long for help.

Here are some ways insurance chatbots support billing:

- Provide 24/7 answers to billing questions

- Send reminders for upcoming payments

- Help set up or change payment methods

- Explain charges and resolve disputes

Sobot Automation

Sobot’s insurance chatbots take payment processing to the next level. You get seamless integration with your favorite channels, including WhatsApp, SMS, and web chat. Sobot’s chatbot operates 24/7, so you never see a “we’re closed” message. You can pay premiums, check your balance, and update billing details anytime.

Many leading banks and insurers use chatbots for payment support. For example:

- Capital One’s Eno chatbot lets you pay bills and check balances 24/7.

- Bank of America’s Erica chatbot handled over 1 billion interactions by 2022, showing the power of always-on support.

- U.S. Bank’s Smart Assistant helps with payments and account updates using voice or text.

Over 98 million users engaged with bank chatbots in 2022, proving that automated payment support is now the norm (source). Sobot’s insurance chatbots use AI to deliver fast, accurate, and secure payment processing. You enjoy a smooth experience, and insurance companies save time and money.

Best Practices 2025

AI and Automation

You can get the most value from insurance chatbots by using advanced AI and automation. AI helps chatbots understand your questions and give you accurate answers. In 2025, you should look for chatbots that use domain-specific AI models. These models know insurance terms and can explain them in simple words. Sobot’s chatbot uses AI to handle regular questions, file claims, and even spot fraud. You get fast help, and insurance companies save time. Automation lets chatbots work 24/7, so you never have to wait for support. Companies that use AI-powered chatbots see up to 70% higher productivity and 50% lower service costs.

Tip: Choose chatbots that use analytics to learn from every conversation. This helps improve the customer experience over time.

Integration

For a smooth experience, your chatbot should connect with other systems. Deep integration means the chatbot can check your policy, update your claim status, or process payments without switching apps. Sobot’s no-code setup makes it easy for insurance teams to connect the chatbot with CRM, billing, and claims systems. You get real-time updates and can manage your insurance in one place. Research shows that omnichannel deployment and seamless integration help meet user needs and boost satisfaction. You should also look for chatbots that follow strict security rules, like GDPR and PCI DSS, to keep your data safe.

| Best Practice Category | Description |

|---|---|

| Deep system integration | Connect chatbots with policy and claims systems for real-time updates. |

| Security and compliance | Use encryption and follow regulations to protect your data. |

| Omnichannel deployment | Support web, mobile, WhatsApp, SMS, and voice for better accessibility. |

Human Touch

Even with the best AI, you sometimes need to talk to a real person. The best chatbots make it easy to switch to a human agent when needed. Sobot’s chatbot keeps your conversation history, so you do not have to repeat yourself. This context-preserving handoff improves your experience and reduces frustration. You should also look for chatbots that use friendly language and offer quick-link buttons for common tasks. Adding a human touch helps build trust and keeps you coming back.

Note: Companies that combine AI with live agent support see higher customer satisfaction and loyalty (source).

Insurance chatbots help you with customer acquisition, policy advising, claims, underwriting, engagement, fraud detection, and payments. You get fast answers, better support, and a smooth experience. Sobot’s AI-powered, omnichannel solution boosts customer satisfaction and agent efficiency. By 2025, AI will handle most customer interactions. See how Sobot stands out:

| Metric / Feature | Value / Benefit |

|---|---|

| Resolution Rate | Over 60% customer issues solved by chatbot |

| Sales Improvement | 30% more customer sales with AI-driven outreach |

| Omnichannel AI | Seamless customer support across all channels |

You can explore Sobot’s solutions or request a demo to improve your customer service.

FAQ

What are insurance chatbots?

Insurance chatbots are AI-powered tools that help you get answers, file claims, and manage policies. You can use them on websites, apps, or messaging platforms. Insurance chatbots work 24/7 and give you fast, accurate support.

How do insurance chatbots improve customer service?

Insurance chatbots answer your questions instantly. You do not have to wait for an agent. For example, Sobot’s insurance chatbots handle over 70% of routine queries, which helps agents focus on complex issues. This leads to higher satisfaction and faster service.

Are insurance chatbots secure for handling personal data?

Yes, insurance chatbots like Sobot use strong security measures. They follow industry standards to protect your information. Sobot’s insurance chatbots use encryption and comply with privacy rules, so your data stays safe.

Can insurance chatbots help with claims and payments?

Absolutely! Insurance chatbots guide you through claims filing and payment steps. You get reminders for due dates and real-time claim updates. Sobot’s insurance chatbots automate these tasks, making your experience smooth and error-free.

Why should insurance companies choose Sobot for their chatbots?

Sobot’s insurance chatbots offer multilingual support, easy setup, and omnichannel communication. You can chat on WhatsApp, SMS, or web. Sobot’s insurance chatbots boost productivity by up to 70% and cut service costs by 50%. Learn more at Sobot’s website.

Tip: Insurance chatbots can increase customer satisfaction and help you get support anytime you need it.

See Also

Leading Websites Utilizing Chatbots Effectively In 2024

Simple Steps To Add Chatbot Examples On Websites

Best Chatbot Solutions For Websites In The Year 2024