Why Banks Must Focus on Improving Customer Experience

Customer experience drives loyalty and growth in the banking world today. Banks see that 70% of customers want personalized advice, while 89% use mobile banking across all age groups. Digital transformation shapes how customers interact, with AI-powered chatbots and mobile apps offering fast, round-the-clock service. Many customers now expect seamless service across all channels, and 91% of banks plan to integrate their channels soon. Sobot and Sobot AI help banks deliver a unified customer experience, meeting rising demands for convenience, personalization, and speed. Improving the customer experience in banking builds trust and creates lasting value.

Customer Experience in Banking

What It Means

Customer experience in banking covers every interaction a customer has with a bank, from opening an account to getting support or using digital services. It includes how easy it is to use mobile apps, how quickly questions get answered, and how well the bank understands each customer’s needs. The customer journey starts with the first contact and continues through every step, including problem-solving and ongoing relationship management.

Banks use both numbers and stories to understand customer experience. They look at scores like CSAT (Customer Satisfaction Score), CES (Customer Effort Score), and NPS (Net Promoter Score) to measure satisfaction, loyalty, and ease of service. They also gather feedback through interviews, focus groups, and online reviews. For example, AtomBank used AI to analyze feedback from many channels, which helped them cut call volumes by 69% and double their customer base. Tools like Sobot’s omnichannel platform help banks collect and manage this feedback, making it easier to spot pain points and improve the overall journey.

Note: Real-time data and personalization tools give banks a strong advantage. By mapping the customer journey, banks can find weak spots and make changes that boost satisfaction and loyalty.

Why It Matters

A great banking customer experience leads to higher loyalty, more referrals, and faster growth. Banks that focus on cx see a 55% increase in ROI and grow over three times faster than others. Customer-centric banks also achieve nearly double the recommendation rates and 1.9 times higher share of wallet. Metrics like first response time, average resolution time, and customer sentiment show how well a bank meets customer needs.

| Bank / Study | CX Initiative | Quantitative Outcome(s) |

|---|---|---|

| Banorte | WhatsApp virtual assistant | 300% more inquiries handled; $2M revenue in 1st month |

| Regions Bank | Omnichannel strategy | Top CX rankings; higher retention |

| McKinsey 2023 Study | Superior CX banks | 80% higher revenue growth vs competitors |

Banks that invest in digital engagement and omnichannel support, like those using Sobot’s solutions, see better customer experience and stronger business results. Improving cx is not just about satisfaction—it drives real growth and lasting relationships.

Benefits of Improving the Customer Experience in Banking

Retention and Loyalty

Improving the customer experience in banking builds strong relationships. When banks focus on customer satisfaction, they see higher retention and customer loyalty. Studies show that 73% of people are more likely to recommend a bank with a good loyalty program. Many customers want to manage loyalty programs on their phones, but only a few banks offer this feature. Personalization matters. Nearly 75% of customers say it is very important, and 57% would switch banks for better personalized services. Banks that use digital tools and modern loyalty programs keep more customers and attract new ones. For example, banks with omnichannel strategies achieve 20% higher retention rates. Sobot’s omnichannel platform helps banks deliver a seamless journey, making it easy for customers to stay engaged and satisfied.

Operational Efficiency

Banks that invest in improving the customer experience in banking also boost operational efficiency. Process redesign and automation cut down on wasted time and resources. For example:

- Credit departments that redesigned processes reduced application cycle times by 50%.

- Howard Bank used automation to cut account opening time to just 1 hour and 20 minutes.

- VTB Bank improved on-time account handling from 68% to 98% and quadrupled processing efficiency.

These changes lead to better staff training, faster onboarding, and higher service quality. Sobot’s AI-powered solutions automate routine tasks, unify customer data, and help banks respond quickly. This not only improves satisfaction but also reduces costs and increases productivity. Banks that use digital transformation see a 20% reduction in operational costs and a 15% improvement in customer satisfaction.

Revenue Growth

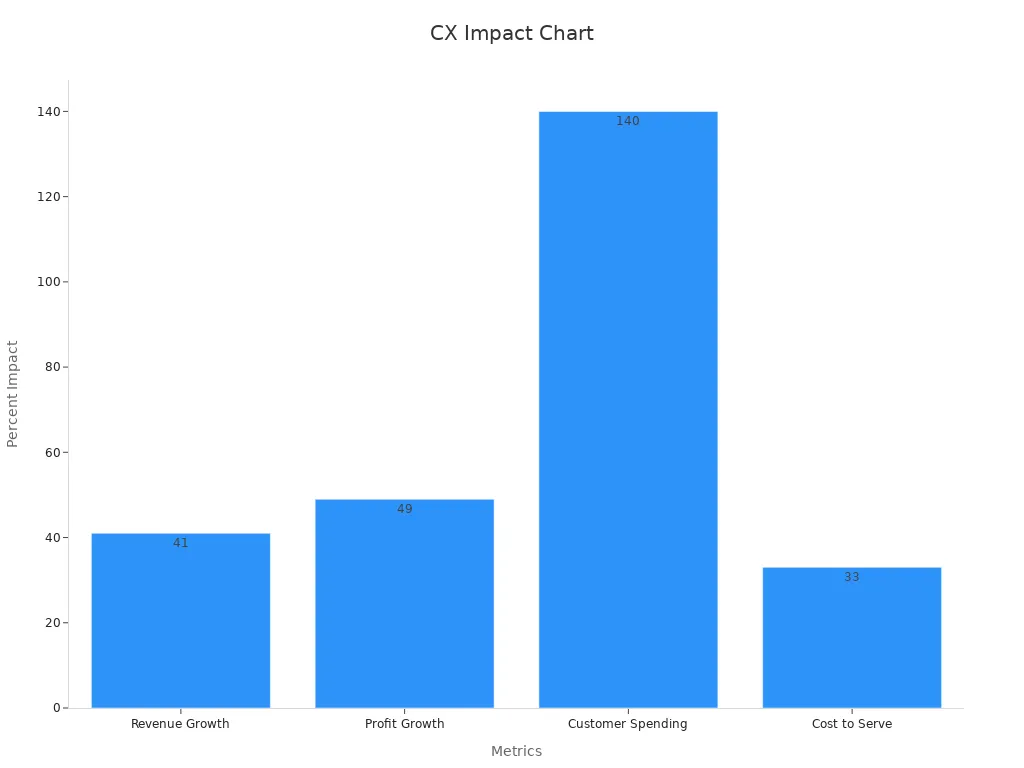

A positive customer experience drives revenue growth. Customers who enjoy their journey with a bank spend more and stay longer. The data is clear:

| Metric | Description | Impact on Revenue Growth |

|---|---|---|

| Customer Spending | Customers with best experiences spend 140% more | Higher spending drives revenue growth |

| Retention | 5% increase in retention boosts profits by 25% to 95% | Retention improvements translate to significant profit gains |

| CX Leaders | CX leaders have a 14 percentage point advantage in total growth rate | Consistent revenue growth correlation |

Banks that focus on cx see faster revenue and profit growth. Customer-obsessed organizations report 41% faster revenue growth and 49% faster profit growth. Sobot’s unified contact center solutions help banks deliver the kind of experience that keeps customers coming back, leading to higher customer retention and stronger financial results.

Tip: Improving the customer experience in banking is not just about satisfaction. It is a smart investment that pays off in loyalty, efficiency, and growth.

Challenges in Banking Customer Experience

Legacy Systems

Legacy systems create major obstacles for banks that want to improve customer experience. Many banks still use old technology that was not designed for today’s digital world. These systems often work in silos, which means data gets trapped in separate places. This leads to slow service, errors, and frustration for both customers and staff. Banks struggle to connect new tools, like mobile apps or AI chatbots, to these outdated systems. As a result, customers face delays and inconsistent experiences across channels.

- Legacy technology is siloed and not customer-focused.

- Automation is fragmented across branches, call centers, ATMs, and apps.

- Data silos and poor integration slow down service.

- Old systems are hard to update and expensive to maintain.

- Banks often add new layers on top, but this only hides the problem.

Banks need to modernize their infrastructure to deliver seamless cx. Moving to cloud-based platforms and adopting solutions like Sobot’s unified contact center can help banks break down silos and improve every customer interaction. Modern systems also support robust security measures, which are essential for protecting sensitive financial data.

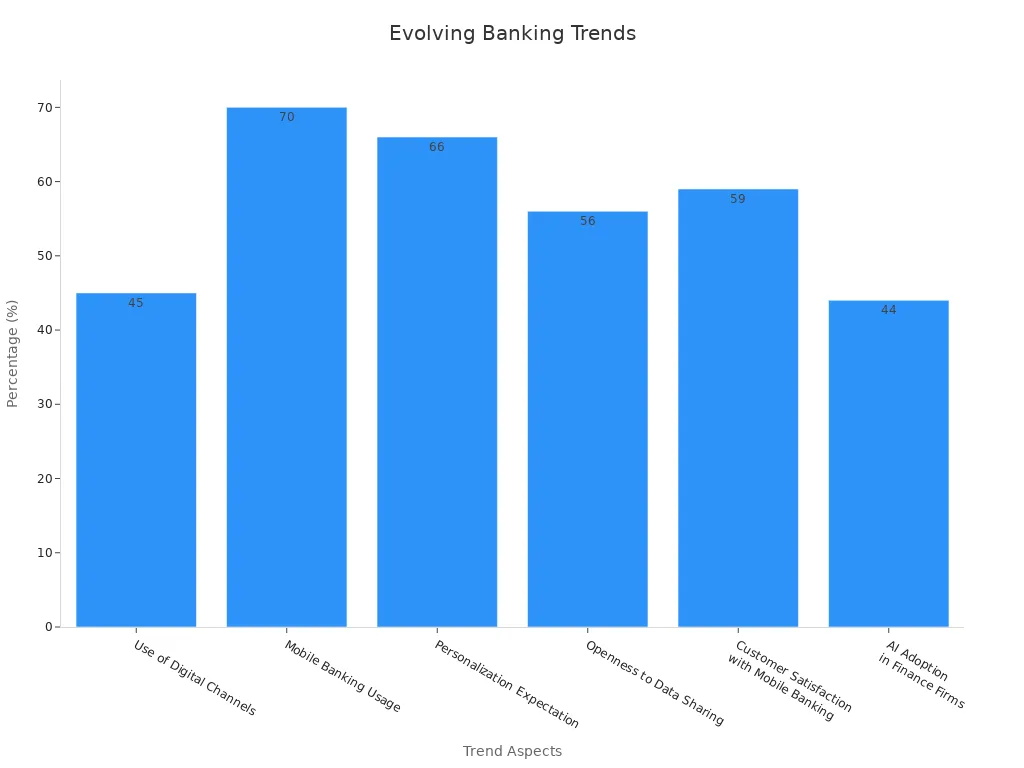

Evolving Expectations

Customer expectations change quickly in banking. People want fast, easy, and personalized service at all times. Nearly 80 million Americans will use digital banking by 2028, and 70% already do most banking on mobile apps. Customers expect 24/7 self-service, quick answers, and seamless experiences across all channels. However, 59% rate their mobile banking as only average, showing there is room for improvement.

| Trend Aspect | Data / Insight |

|---|---|

| Digital Banking Adoption | Nearly 80 million Americans expected to use digital banking by 2028 (about 25% of population) |

| Mobile Banking Usage | 70% of customers now do most banking via mobile apps |

| Personalization Expectation | 66% of customers expect personalized banking experiences |

| AI and Automation Investment | $1.68 billion global investment in generative AI for banking customer service by 2025 |

Banks must keep up with these trends to deliver great customer experience. Platforms like Sobot help banks provide personalized, omnichannel support and automate routine tasks, meeting rising customer demands.

Fintech Competition

Fintech companies raise the bar for customer experience in banking. They use advanced technology to offer fast, simple, and user-friendly services. Fintechs track key metrics like Net Promoter Score (NPS), Customer Satisfaction Score (CSAT), and Customer Effort Score (CES) to improve cx and build loyalty. For example, Virgin Money used customer insights to double its NPS and boost response rates by 13%. Fintechs also use AI-driven personalization and seamless onboarding to attract and keep customers.

| Metric | Description | Relevance to Customer Experience and Fintech Competition Impact |

|---|---|---|

| Net Promoter Score (NPS) | Measures customer satisfaction and loyalty by likelihood to recommend | Indicates customer retention and satisfaction, key for competitive advantage |

| Digital Adoption Rate | Percentage of customers using digital platforms | Reflects success of digital transformation and customer engagement |

| Payment Success Rate | Percentage of successfully processed transactions | Reflects reliability and seamless user experience |

Banks must innovate to stay ahead. By adopting solutions like Sobot’s AI-powered contact center, banks can improve customer experience, increase satisfaction, and compete with fintech leaders.

Solutions for Better Customer Experience

Digital Transformation

Banks today must embrace digital transformation to deliver outstanding customer experience. Customers expect real-time, personalized service. In fact, 67% of consumers want banks to provide instant and tailored support. Digital tools like AI-powered chatbots and cloud computing help banks meet these demands. These technologies allow banks to offer 24/7 support, reduce fraud by up to 50%, and cut operational costs by as much as 30%.

Digital transformation also improves customer experience management. Banks that invest in automation and cloud platforms see faster response times and higher satisfaction. For example, digital banking users now make up 77% of checking accounts, showing strong digital customer engagement across all age groups. Mobile payments have grown from 22% to 34% in just one year, and digital chat activity has jumped from 5% to 64% participation. These trends prove that digital transformation drives customer experience transformation and supports a strong cxm strategy.

| Performance Metric | Description / Trend |

|---|---|

| Return on Assets (ROA) | Shows correlation between digital outcomes and bank performance. |

| Efficiency Ratios | Measure operational efficiency gains from digital initiatives. |

| Digital Spend Trends | Digital channels now account for 26% of total IT spend. |

| Active Digital Banking Users | 77% of checking accounts are now digital. |

| Mobile Deposit Adoption | Increased from 52% to 54% in 2024. |

| Mobile Payments Activity | Grew from 22% to 34% year-over-year. |

| Cross-Sell Product Growth | High performers added 1.34 new products per digital user. |

| Adoption of Emerging Technologies | 42% deployed machine learning; over 50% will deploy generative AI by end of 2024. |

| Digital Chat Activity | Rose from 5% in 2022 to 64% in 2024. |

Banks that modernize their systems can launch new features faster, reduce manual errors, and improve customer satisfaction. Sobot’s financial solution helps banks automate workflows, unify customer data, and deliver secure, scalable service. This approach supports a robust cxm strategy and ensures banks stay ahead in a fast-changing market.

Note: Digital transformation is not just about technology. It is about creating integrated customer experiences that drive loyalty, satisfaction, and growth.

Omnichannel Support with Sobot

Omnichannel support is key to delivering a seamless customer experience. Customers want to connect with their bank through any channel—phone, chat, email, or social media—and receive consistent, fast service. Sobot’s omnichannel platform makes this possible. It unifies all customer contact points into one workspace, so agents can respond quickly and efficiently.

Research shows that omnichannel messaging increases customer response rates by 25% and conversions by 30%. Banks with strong omnichannel strategies see 2.5 times higher retention rates. AI chatbots now handle 80% of customer inquiries, freeing up agents for more complex tasks. Sobot’s Voice/Call Center and financial solution provide banks with a stable, AI-driven platform that supports global telephony, smart call routing, and real-time analytics. This leads to faster resolution times, a 60% reduction in agent workload, and a 35% improvement in Net Promoter Score.

| Company | Customer Satisfaction (CSAT) | Efficiency / Other Metrics |

|---|---|---|

| Samsung | 97% CSAT | - |

| OPPO | 93% CSAT | - |

| Opay | 90% CSAT | - |

| Agilent | N/A | 6x increase in customer service efficiency |

| Sobot | N/A | <1 min resolution time, 60% agent workload reduction, 15% conversion increase, 35% NPS improvement |

Studies confirm that integrated omnichannel solutions improve customer satisfaction and loyalty. Sobot’s platform helps banks deliver consistent, personalized service across every channel, supporting a winning cxm strategy and driving customer experience transformation.

Tip: Seamless channel integration and personalisation are critical for building trust and convenience in banking.

Personalization and Automation

Personalization and automation set leading banks apart in customer experience management. Customers want banks to understand their needs and offer relevant solutions. Personalized marketing automation lets banks send targeted messages based on customer behavior. For example, a bank can offer travel rewards cards to frequent travelers, increasing cross-sell opportunities and customer engagement.

Predictive analytics help banks identify customers at risk of leaving. By analyzing data, banks can offer personalized support or incentives to improve retention. Automated feedback tools collect customer satisfaction data after each interaction, helping banks spot areas for improvement and enhance the overall experience.

Financial institutions that use iterative data analysis and refine their personalization strategies see better results. Sobot’s AI-powered chatbots and unified workspace enable banks to deliver a personalized customer experience at scale. The platform automates routine tasks, manages tickets, and provides 24/7 support, ensuring high satisfaction and efficient customer experience management.

Banks that focus on personalisation and automation create lasting value. They build loyalty, improve satisfaction, and drive growth through a strong cxm strategy.

Case Study: Opay and Sobot

The Challenge

Opay faced a growing demand for better customer experience as its user base expanded across Nigeria and other markets. Customers wanted fast, reliable support on every channel, including social media, email, and phone. The company struggled to manage high volumes of inquiries and deliver consistent service. Fragmented systems made it hard to track customer issues and slowed down response times. Opay needed a solution that could unify all customer interactions and improve satisfaction. The team also wanted to boost customer engagement for marketing and retention.

The Solution

Opay chose Sobot’s omnichannel platform to transform its customer experience management. Sobot integrated social media, email, and voice channels into one workspace. Agents could now handle all customer requests without switching systems. Sobot’s intelligent IVR system allowed customers to solve many issues on their own, reducing wait times. The platform also enabled Opay to use WhatsApp for targeted marketing, reaching customers with personalized messages. Sobot’s unified approach helped Opay automate routine tasks, track customer data, and deliver fast, personalized support.

Sobot’s financial solution gave Opay the tools to improve customer satisfaction and streamline operations. The platform’s AI-powered chatbots and analytics made it easy to spot trends and address pain points.

The Results

Opay saw a dramatic improvement in customer experience after adopting Sobot. Customer satisfaction jumped from 60% to 90%. The unified platform reduced operational costs by over 20%. Conversion rates increased by 17%. The intelligent IVR system allowed 60% of customers to resolve issues without agent help. WhatsApp marketing achieved an 85% message reading rate. These results show how a strong focus on customer experience leads to real business growth.

| Solution Type | Case Study Example | Impact Metrics and Outcomes |

|---|---|---|

| Omnichannel Platform | Opay + Sobot | 90% satisfaction, 20% cost reduction, 17% conversion increase, 60% self-service resolution |

| AI-powered Chatbots | Bank of America's Erica | 20% cost reduction, 15% satisfaction increase |

| Customer Journey Mapping | Citibank | 25% satisfaction increase, 15% fewer complaints |

Companies that invest in customer experience management, like Opay, see higher satisfaction, lower costs, and stronger growth.

Banks that invest in better customer experience see real, lasting results. The table below shows how personalization and digital tools help banks keep more customers and grow faster:

| Outcome | Result |

|---|---|

| Customer retention | 20% higher |

| Churn reduction | 10-15% lower |

| Product adoption growth | 18% increase |

Unified solutions like Sobot make it easy for banks to deliver seamless, secure service. Prioritizing customer experience leads to stronger loyalty, higher profits, and long-term success.

FAQ

What is customer experience in banking?

Customer experience in banking means how people feel when they use a bank’s services. It covers every step, from opening an account to getting help. Banks that improve customer experience in banking see higher loyalty and faster growth. Learn more.

How does Sobot help banks improve customer experience in banking?

Sobot gives banks an all-in-one contact center. It unifies calls, chats, and emails. Sobot’s AI-powered tools automate tasks and provide fast answers. Banks using Sobot see higher customer satisfaction and better customer experience in banking.

Why should banks invest in customer experience in banking?

Banks that invest in customer experience in banking keep more customers and grow profits. Studies show a 20% higher retention rate and up to 95% more profit. Satisfied customers trust their banks and recommend them to others.

Can automation improve customer experience in banking?

Yes! Automation speeds up service and reduces mistakes. Sobot’s chatbots and smart routing help banks answer questions 24/7. This makes customer experience in banking smoother and more reliable.

What results can banks expect from better customer experience in banking?

Banks see real results. For example, Opay improved customer satisfaction from 60% to 90% after using Sobot. Banks also cut costs and increase conversion rates. Better customer experience in banking leads to stronger loyalty and business growth.

See Also

How Artificial Intelligence Transforms Customer Support Services

Top Ten Strategies To Improve Live Chat Experience

Ways Chatbots Enhance Satisfaction In Online Shopping