How Customer Experience Impacts Modern Banking

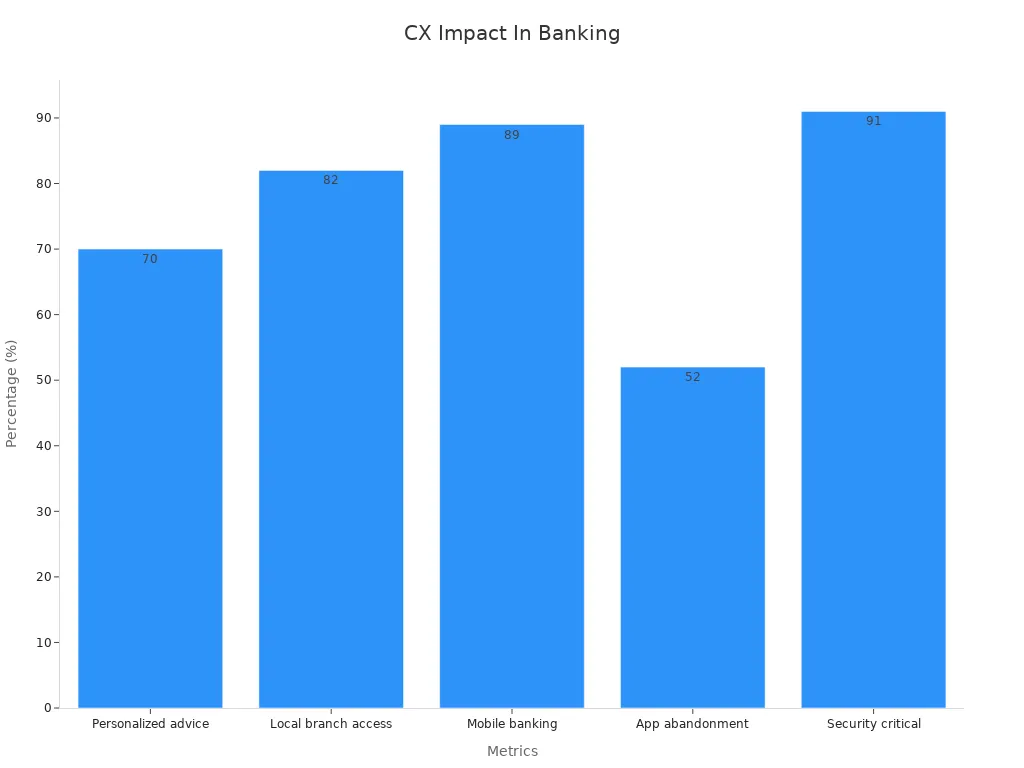

Customer experience shapes the future of modern banking. Banks that deliver seamless, personalized, and secure services see stronger customer loyalty and business growth. For example, 25% of customers switched banks last year to find better digital experiences, while banks with excellent customer experience generate 4.5 times more revenue than others. The following table highlights key statistics:

| Statistic | Explanation |

|---|---|

| 70% of consumers expect personalized advice | Customers want tailored solutions. |

| 89% use mobile banking | Digital access is now standard. |

| 52% abandon applications due to friction | Poor digital experience leads to loss. |

| 91% rate security as critical | Trust remains essential. |

Sobot and Sobot AI help banks deliver a better overall experience by unifying digital and physical channels. Readers can reflect on their own banking journeys to see how to improve customer experience in banking.

Customer Experience in Banking

What Is Customer Experience?

Customer experience in banking covers every interaction a person has with a bank or financial company. This includes discovering new services, opening accounts, using accounts for daily transactions, and getting help when needed. These interactions can happen in person, online, or over the phone. Trust, empathy, and security form the foundation of a strong banking customer experience. Banks must provide seamless, human-centered service at every touchpoint.

The customer journey in banking has several stages:

- Discovery and research: Customers look for clear information and transparency.

- Account setup: People expect easy and quick onboarding.

- Daily engagement: Customers want real-time access, personalized insights, and helpful alerts.

- Support and problem resolution: Fast, empathetic, and omnichannel support is key.

- Loyalty and advocacy: Satisfied customers often recommend their bank to others.

Banks that focus on customer-centric approaches stand out in a crowded market. Research from PwC shows that customer experience is a key factor in financial decisions. Many banks now use digital tools, such as mobile banking apps, to make these interactions smoother and more convenient. Companies like Sobot help banks unify these channels, making it easier to deliver effective retail banking cx.

Why It Matters

Banking customer experience plays a major role in customer satisfaction and loyalty. The J.D. Power 2025 U.S. Retail Banking Satisfaction Study found that customer satisfaction at banks increased by 11 points from the previous year, even during economic uncertainty. Banks that build trust, offer convenience, and resolve problems quickly see higher loyalty and retention.

Key metrics help banks measure and improve customer experience:

- Net Promoter Score (NPS): Shows how likely customers are to recommend the bank.

- Customer Effort Score (CES): Measures how easy it is for customers to get help.

- Customer Satisfaction Score (CSAT): Tracks satisfaction with services.

- Customer Lifetime Value (CLV): Estimates the total value a customer brings over time.

Retaining customers costs much less than finding new ones. Increasing retention by just 5% can boost profits by 25% or more. Banks that use customer-centric approaches and tools like Sobot’s omnichannel solutions can improve these metrics and build lasting relationships. Credit unions often score higher in satisfaction, setting a benchmark for banks to follow. For more details, see J.D. Power’s study.

Key Drivers of Banking Customer Experience

Digital Innovation

Banks use digital innovation to improve customer experience and stay competitive. Many banks now offer advanced features like AI-powered chatbots, biometric authentication, and big data analytics. These tools help banks provide faster, safer, and more convenient services.

- FinTech companies push banks to adopt new technologies for convenience and speed.

- The COVID-19 pandemic made digital banking even more important for both banks and customers.

- Digital services such as electronic payments and online account management help banks build better relationships with customers.

- Technologies like blockchain and robotic process automation make banking safer and more efficient.

- Digital leadership and a culture of innovation help banks create better experiences for everyone.

Sobot supports banks with AI-driven contact center solutions, making it easier to manage customer interactions across channels.

Personalization

Personalized service helps banks keep customers happy and loyal. Banks that use customer data to offer tailored advice and products see higher satisfaction and profits. The table below shows how personalization improves retention and business results:

| Metric / Finding | Quantified Improvement / Statistic | Source / Study |

|---|---|---|

| Retention rate improvement from personalization strategies | 7-15 percentage points increase | Number Analytics blog |

| Year-over-year customer retention for banks with advanced personalization | 98% retention | Forrester, 2023 |

| Year-over-year customer retention for banks with limited personalization | 75% retention | Forrester, 2023 |

| Profit increase from a 5% retention increase | 25-95% boost in profits | Bain & Company analysis |

| Profit generated by customers receiving personalized experiences over 5 years | 2.4 times more profit | J.D. Power, 2022 |

Banks use platforms like Sobot to unify customer data and deliver more personalized service.

Convenience and Speed

Customers want banking to be quick and easy.

- 72% of people expect immediate service from their bank.

- Mobile banking apps let customers handle tasks without visiting a branch.

- Fast, reliable online and mobile banking platforms improve satisfaction.

- Big data and AI help banks process loans and payments faster.

- Banks that offer quick, convenient service attract and keep more customers.

Sobot’s omnichannel solutions help banks respond to customers faster and manage requests from different channels in one place.

Security and Trust

Security and trust are essential for a positive customer experience. When banks use advanced security tools, like AI-based fraud detection, customers feel safer. For example, Deutsche Bank improved trust by using AI to spot fraud quickly and accurately.

- Privacy and security features in mobile banking apps build trust.

- Customers want to know their personal and financial information is safe.

- A bank’s reputation and helpful support also increase trust.

- Regular updates about security measures make customers feel confident.

Banks that invest in strong security and clear communication earn more loyalty from their customers.

How to Improve Customer Experience in Banking

Omnichannel Solutions

Banks today must connect with customers across many channels. Omnichannel solutions help banks provide a smooth and unified experience. Customers can start a task on one channel, like a mobile app, and finish it on another, such as a branch or a call center. This approach reduces frustration and builds trust.

Research shows that omnichannel integration improves many parts of customer experience. The table below highlights how different integration elements impact customer satisfaction:

| Integration Element | Customer Experience Dimensions Impacted | Nature of Impact |

|---|---|---|

| Promotions Integration | Relational, Sensorial | Significant positive impact |

| Price/Product Integration | Cognitive, Affective | Significant positive impact |

| Transaction Information | Cognitive, Affective | Significant positive impact |

| Information Access | Physical, Sensorial | Significant positive impact |

| Order Fulfilment | Affective, Cognitive | Significant positive impact |

| Service Integration | Affective, Physical, Relational | Significant positive impact |

Banks that use omnichannel solutions see higher customer retention and loyalty. Customers enjoy seamless, personalized, and convenient experiences at every touchpoint. Real-time support and self-service options allow customers to solve problems quickly, even outside business hours. Consistent service across all channels also helps banks collect better feedback and improve their services.

Sobot offers an all-in-one contact center platform that unifies voice, chat, email, and social media. This helps banks manage customer interactions in one place, making it easier to deliver a great experience. Research from PwC and Accenture shows that banks with strong omnichannel strategies achieve up to 50% higher retention rates and 20% more cross-sell opportunities than those using traditional methods (source).

AI and Automation

Artificial intelligence and automation have changed how banks serve customers. AI-powered chatbots and virtual assistants provide instant, 24/7 support. These tools answer questions, solve problems, and guide customers through tasks without long wait times.

- Banks using generative AI have improved customer service efficiency by 35%.

- Average handling time has dropped by 25-40%.

- First-contact resolution rates have increased by 15-30%.

- Service is now available around the clock, without needing more staff.

Automation also helps banks process routine tasks faster. This lets human agents focus on complex issues and proactive engagement. Predictive analytics allow banks to anticipate customer needs and offer personalized solutions. For example, Bank of America's AI assistant, Erica, now handles over 1 million inquiries daily, with accuracy rising from 85% to 95% in two years.

Sobot integrates AI-driven chatbots and automation into its contact center solutions. These features help banks respond quickly, reduce errors, and improve customer satisfaction. Automation also makes it easier for banks to collect and act on customer feedback, leading to continuous improvement.

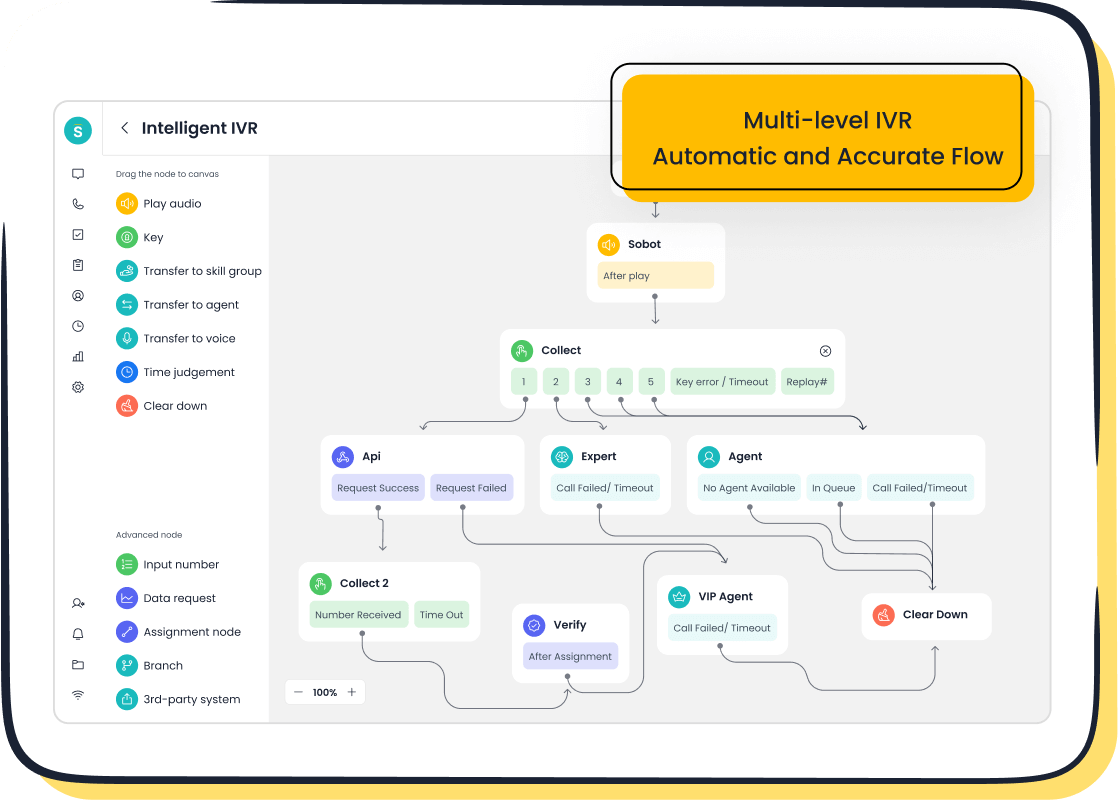

Sobot Voice/Call Center

A modern voice and call center is key to how to improve customer experience in banking. Sobot's Voice/Call Center provides a stable and intelligent platform for banks of all sizes. It offers features like smart call routing, AI-powered voicebots, and a unified workspace for agents.

Sobot's system has a 99.99% uptime and supports global telephony contacts, ensuring reliable service for customers everywhere.

Banks using Sobot's financial solution have seen strong results:

- Customer satisfaction rates increased by up to 90%.

- Agent productivity improved by 34%.

- Customer engagement rates rose by 41%.

The Opay story shows how to improve customer experience in banking with Sobot. Opay, a leading financial platform, faced challenges managing customer interactions across many channels. After adopting Sobot's omnichannel solution, Opay increased customer satisfaction from 60% to 90%, reduced costs by 20%, and boosted conversion rates by 17%. The intelligent IVR system allowed 60% of customers to resolve issues on their own, freeing agents to handle more complex requests.

Sobot's Voice/Call Center also makes it easy for banks to gather feedback and use it to improve services. With features like real-time monitoring, bulk outbound tasks, and seamless integration with CRM systems, banks can deliver faster, more personalized support. This approach helps banks achieve higher customer satisfaction and loyalty.

Tip: Banks that want to know how to improve customer experience in banking should consider unified platforms like Sobot. These solutions streamline support, enhance proactive engagement, and drive better business outcomes.

Benefits for Banks and Customers

Retention and Loyalty

Banks that focus on better service see stronger customer loyalty and higher customer retention. They use several metrics to track these improvements. The table below shows how banks measure success:

| Metric | Description and Impact on Customer Retention |

|---|---|

| Customer Satisfaction Surveys | Collect feedback to understand customer sentiment, identify issues, and measure loyalty improvements driven by experience strategies. |

| Churn Rate Analysis | Tracks the percentage of customers leaving, helping identify trends and reasons for departure to proactively improve retention. |

| Share of Deposits | Banks with better customer experience increased deposit share by 16.5%, while those with declining experience risk losing 12.5%. |

| Customer Engagement Levels | Measures how actively customers interact with banking services, reflecting loyalty and satisfaction. |

| Online Reviews and Feedback | Monitoring and responding to reviews builds trust and demonstrates care, positively influencing retention and brand reputation. |

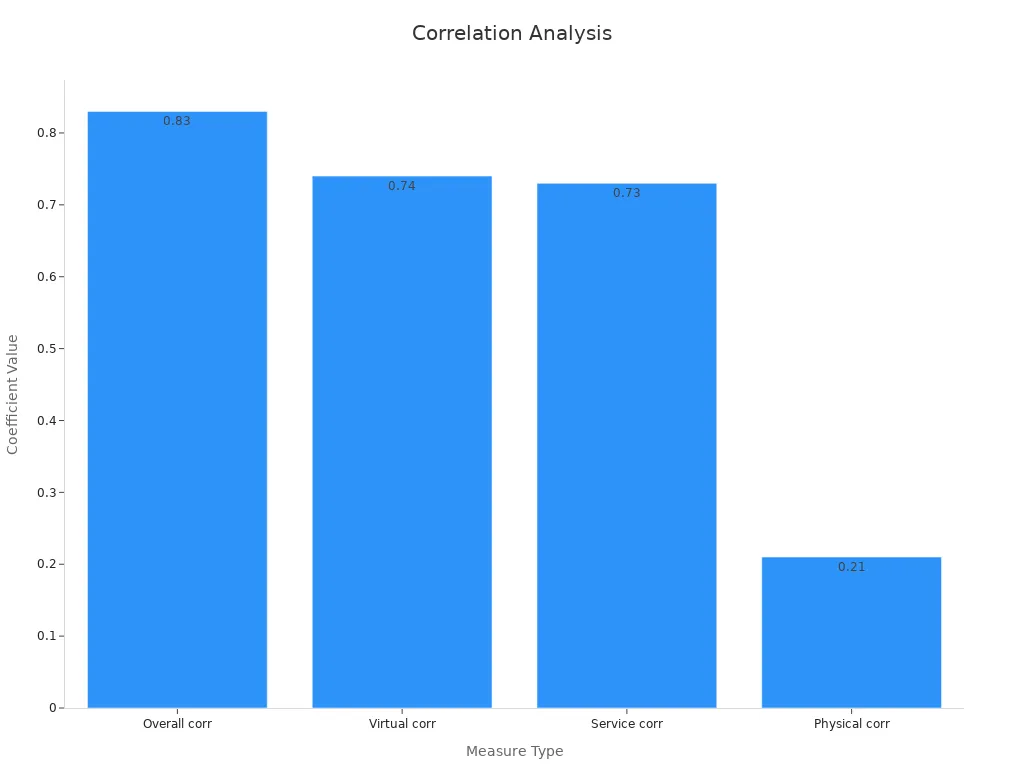

Statistical studies confirm a strong link between better service and loyalty. The chart below shows how different types of interactions affect loyalty in banks.

Operational Efficiency

Banks improve operational efficiency by using technology and tracking key performance indicators. They monitor metrics like average call handling time, first-call resolution rate, and digital adoption. Sobot’s contact center solutions help banks automate workflows and manage calls, which boosts productivity and reduces costs. Many banks report productivity gains of 15% to 25% after using AI-driven tools. They also see faster loan processing and better customer support. Real-time monitoring and benchmarking help banks stay ahead and keep improving.

- Cost-to-income ratio shows how well a bank controls costs.

- Digital adoption metrics track how many customers use online services.

- Customer satisfaction and net promoter scores reflect service quality and efficiency.

Case studies show that banks using digital tools, like Sobot’s unified platform, reduce appointment times and improve customer service rankings.

Revenue Growth

Banks that invest in better service see real financial gains. A one-point increase in the Customer Experience Index can bring in an extra $123 million for a large bank (Forrester). Direct banks can earn $92 million more with the same improvement. Most customers are willing to pay more for convenience and quality service. Sobot’s AI-powered personalization helps banks move from reactive to proactive service, which builds stronger relationships and supports growth. Banks that focus on customer needs attract new customers and increase acquisition rates, leading to higher revenue.

Trends and Challenges

Rise of Fintech and Digital Banks

Fintech companies and digital banks are changing how people use financial services. Many banks now focus on deposit growth, customer acquisition, and cost reduction. Competition from fintechs pushes banks to modernize and improve customer experience. Studies show that fintech services like PayPal and mobile banking apps influence how customers interact with banks. Age and education affect trust and use of these new services. Some people still prefer traditional banks for security, but younger customers often choose digital options for speed and convenience. Bank employees see the need for training as automation grows. As more customers use smartphones for banking, banks must adapt to meet new expectations. Customer insights from satisfaction surveys help banks understand these changes and adjust their strategies.

- Banks compete with fintechs and neobanks to offer better digital experiences.

- AI, data analytics, and customer-centric design shape new banking services.

- The human experience remains central, with banks focusing on both user and employee needs.

AI and Customer Service

Artificial intelligence is transforming customer service in banking. Banks use AI-powered chatbots, predictive analytics, and virtual assistants to answer questions and solve problems quickly. Research shows that AI adoption increases customer satisfaction by about 15% and reduces transaction times by 25%. For example, banks like Wells Fargo and Bank of America use AI assistants to give personalized support. Most bank leaders see AI as a key tool for improving service and efficiency. However, many customers still value human help, so banks combine AI with personal service. Sobot’s AI-driven contact center solutions help banks respond faster and collect feedback to improve service quality.

Tip: Banks that use AI can handle more requests, offer 24/7 support, and provide better experiences for customers.

Data Privacy

Data privacy is a top concern for banks and their customers. People want to know their personal and financial information is safe. High-profile data breaches, like the Capital One incident in 2019, show how important strong security is for trust. Banks use tools like multi-factor authentication and encryption to protect data. Regulations such as GDPR and CCPA require banks to handle data responsibly. Studies confirm that privacy and security are key to building trust in digital banking. Customers feel safer when banks keep their information confidential. Sobot’s secure contact center solutions help banks protect customer data and maintain trust.

| Aspect | Example/Detail | Impact on Trust |

|---|---|---|

| Data Breaches | Capital One breach (2019) | Lowered trust, regulatory fines |

| Fraud Incidents | Bank of America Zelle fraud (2023) | Raised concerns about security |

| Regulatory Compliance | GDPR, CCPA | Reassures customers |

| Security Measures | Encryption, real-time fraud detection | Builds trust |

Customer experience in banking stands as a key driver of loyalty, efficiency, and growth. Studies show banks that focus on customer experience report up to a 20% rise in satisfaction and a 10-15% increase in revenue. Technologies like biometric authentication and digital onboarding boost trust and speed. Sobot’s unified contact center helps banks deliver seamless, secure service. Banks that invest in customer experience in banking gain a strong advantage. Continuous improvement and innovation remain essential for meeting rising expectations in modern banking.

FAQ

What is customer experience in banking?

Customer experience in banking means how people feel when they use bank services. It covers every step, from opening an account to getting help. Good customer experience in banking leads to higher satisfaction and loyalty.

Why does customer experience in banking matter for banks?

Customer experience in banking helps banks keep customers. Studies show banks with strong customer experience in banking see up to 20% higher satisfaction and 10-15% more revenue (Forrester).

How can banks improve customer experience in banking?

Banks can use digital tools, like Sobot’s omnichannel contact center, to make service faster and easier. AI chatbots, mobile apps, and secure systems help banks deliver better customer experience in banking.

What role does security play in customer experience in banking?

Security builds trust in customer experience in banking. People want their money and data safe. Banks use encryption, real-time fraud detection, and secure platforms like Sobot to protect customers.

How does Sobot support customer experience in banking?

Sobot offers a unified platform for voice, chat, and social media. Banks use Sobot to improve customer experience in banking by providing quick support, smart routing, and secure communication. Sobot’s solutions help banks boost satisfaction and efficiency.

See Also

Artificial Intelligence Agents Transform Customer Support Services

Ways Chatbots Enhance Satisfaction For Online Shoppers

Comparing Leading Voice Of Customer Software Solutions