Expert Analysis of Customer Experience Trends in Banking 2025

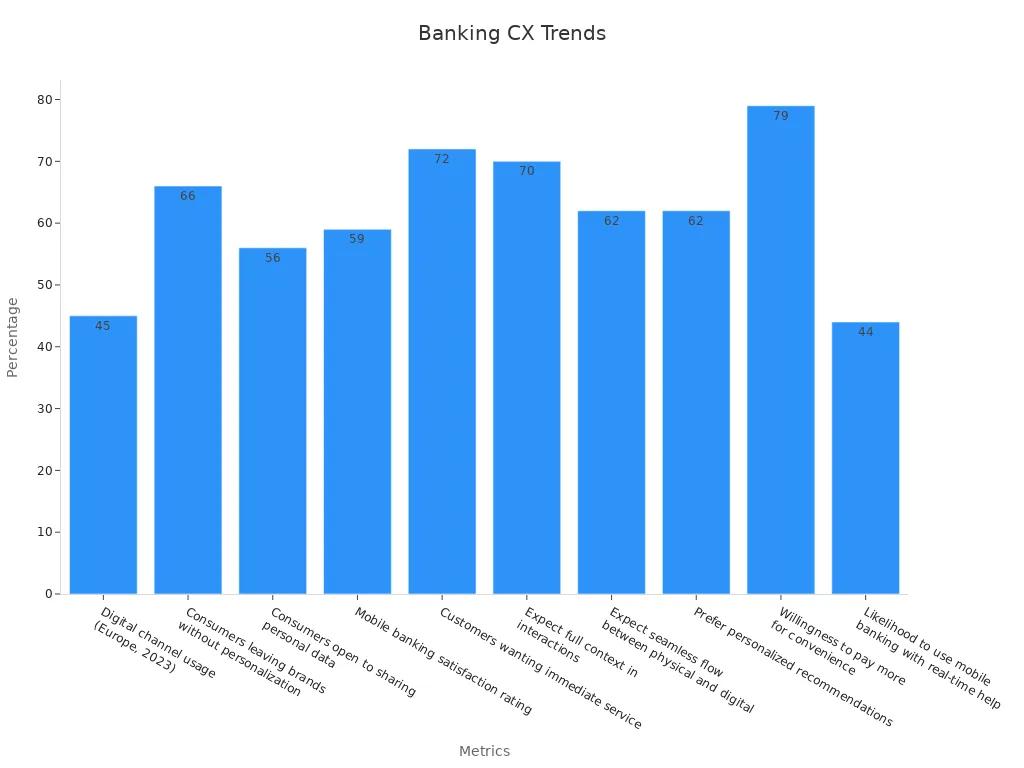

Customer experience trends in banking for 2025 show rapid change. Many customers now expect immediate service, seamless digital journeys, and personalized recommendations. Nearly 70% of customers want agents to have full context in every interaction, while 62% prefer smooth transitions between channels. Banks that focus on customer experience in banking see faster growth. Sobot AI helps banks deliver better experiences through omnichannel solutions and advanced automation.

Strong customer experience in banking now defines loyalty and competitiveness. Nearly half of banks lose customers if their digital service is slow or complex.

Customer Experience Trends in Banking

Defining Customer Experience in Banking

Customer experience in banking shapes how customers feel about their bank at every touchpoint. Banks measure this experience using several criteria. These include initial trust, perceived usefulness, service quality, and the effectiveness of multichannel strategies. Digital touchpoints, such as internet and mobile banking, play a major role. Customers expect seamless integration between online and offline channels. They want personalized services, convenience, and speed. Banks also track loyalty, retention, satisfaction, and adoption rates of digital services.

Banks that focus on customer-centricity see higher satisfaction and loyalty. They use customer persona analysis and manage their brand image to improve experience.

A recent study highlights five main areas for measuring customer experience in banking:

- Adoption of digital banking

- Sustained use of internet banking

- Effective management of multichannel banking

- Customer persona analysis

- Brand image maintenance

These factors help banks understand what matters most to customers and guide improvements.

Key Trends for 2025

Customer experience trends in banking for 2025 show a shift toward digital transformation and hyper-personalization. Neobanks lead the way by offering fast, mobile-first services. Traditional banks now invest in omnichannel solutions to keep up. Customers want instant support, easy navigation, and secure transactions.

Sobot supports these trends with AI-driven chatbots and unified contact centers. These tools help banks deliver quick, accurate responses across channels. For example, Sobot’s platform lets banks manage calls, chats, and social messages in one place. This improves efficiency and customer satisfaction.

Banks also focus on data security and transparency. Customers trust banks that protect their information and provide clear communication. As digital transformation continues, banks must adapt to new expectations and use technology to enhance every customer interaction.

Hyper-Personalization

AI-Driven Personalization

Banks now use AI to deliver a personalized experience for every customer. AI-driven personalization analyzes customer data, such as transaction history and behavior patterns, to offer tailored recommendations and services. Research from McKinsey shows that companies excelling at personalization generate 40% more revenue than average players. AI tools, like chatbots and recommendation engines, help banks predict what customers need next. For example, Sobot’s AI-powered solutions allow banks to send real-time alerts, suggest relevant products, and provide personalized financial guidance. This approach increases engagement and loyalty, as customers feel understood and valued.

A recent study found that 72% of customers rate personalized experiences as highly important in banking decisions. Banks using advanced personalization see a 23% increase in satisfaction scores and up to a 20-point rise in Net Promoter Score (NPS). These improvements show that AI-driven personalization not only boosts customer satisfaction but also drives business growth. [Source: Accenture, KPMG, The Financial Brand]

AI-driven personalization empowers banks to deliver the right message at the right time, making every interaction meaningful.

Data and Customer Insights

Hyper-personalization relies on deep customer insights. Banks collect and analyze data from multiple sources, including digital channels and customer interactions. This data helps banks understand preferences, predict needs, and offer personalized services. Sobot’s unified contact center platform enables banks to gather and analyze customer data across voice, chat, and social media, supporting a seamless personalized experience.

| Type of Analytics | Key Metrics Used |

|---|---|

| Predictive Analytics | Credit risk accuracy, campaign response |

| Behavioral Analytics | Customer patterns, up-sell rates |

| Sentiment Analysis | Satisfaction scores, sentiment scores |

| Customer Analytics | Retention rates, journey mapping |

Banks using advanced analytics report a 15-25% increase in customer satisfaction and up to a 30% reduction in churn. For example, BBVA improved customer satisfaction by 19% after adopting analytics solutions. These results highlight the value of data-driven insights in delivering personalized experiences and building trust.

Omnichannel Banking Solutions

Seamless Customer Journeys

Banks today must deliver a seamless customer journey across all touchpoints. Customers expect to move between digital channels, such as mobile apps and websites, and in-person services without repeating information. For example, a customer might start a loan application on a smartphone and finish it on a desktop, keeping their progress and support consistent. This unified approach reduces frustration and builds trust.

Omnichannel banking connects every interaction, making the experience feel smooth and personal. Research shows that about 60% of banking customers use digital channels, with 80% of touchpoints happening digitally. However, many customers still want personal help for complex products. By mapping the customer journey, banks can find pain points and improve customer engagement. Automation and AI-powered chatbots help speed up service and provide real-time support. Security and clear communication also play a big role in building customer confidence.

Banks use key performance indicators to measure how well they deliver seamless experiences:

| KPI Name | What it Measures | Relevance to Seamless Customer Journey Implementation |

|---|---|---|

| Net Promoter Score (NPS) | Customer loyalty and likelihood to recommend | Shows overall satisfaction and loyalty |

| Customer Satisfaction Score (CSAT) | Satisfaction with specific interactions | Highlights satisfaction at key touchpoints |

| Customer Effort Score (CES) | Ease of completing banking tasks | Indicates how effortless the journey is for customers |

These KPIs help banks track and improve customer engagement and satisfaction.

Sobot Voice/Call Center Integration

Sobot’s omnichannel platform gives financial institutions a unified solution for managing customer interactions. The Voice/Call Center integrates live chat, ticketing, and customer messages, allowing agents to handle all inquiries from one workspace. This setup reduces response time by up to 80% and increases agent efficiency by 20%. Internal teams become more organized, which leads to faster answers for customers.

Sobot supports communication across digital channels, phone, and social media. Customers can reach out through their preferred channel and receive consistent service. The platform’s AI-powered features automate routine tasks and provide real-time assistance, improving both speed and accuracy. Positive feedback from users highlights better operational efficiency and higher customer service performance after adopting Sobot’s omnichannel solution.

Omnichannel banking, powered by platforms like Sobot, helps banks deliver connected, secure, and satisfying experiences that drive customer engagement and loyalty.

Mobile-First Customer Experience

Mobile Banking Evolution

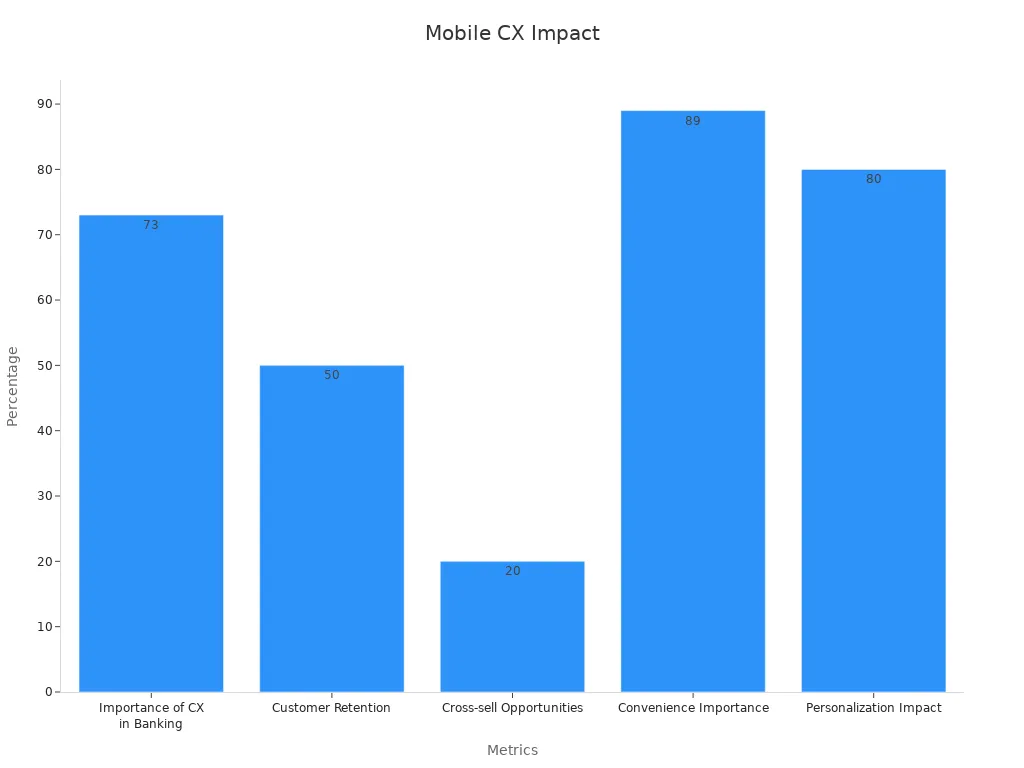

Mobile-first strategies now shape the future of digital banking experiences. Customers expect to access their accounts, transfer money, and receive support from their smartphones at any time. Over three-quarters of Americans have used mobile banking, showing that this channel has become essential. Banks use data from mobile apps to improve products and personalize services. Analytics and machine learning help banks understand customer needs and deliver a better digital experience.

Recent trends highlight several key developments:

- Real-time transactions and instant notifications meet the demand for speed.

- AI-driven analytics provide tailored advice and product recommendations.

- Mobile wallets and contactless payments offer more convenience.

- Voice-activated banking and augmented reality are emerging features.

Banks that invest in mobile-first solutions see higher customer engagement and satisfaction. According to industry data, 89% of customers across all generations use mobile banking. Seamless integration between mobile apps, online portals, and branches enhances accessibility for everyone.

| Statistic / Insight | Description |

|---|---|

| Mobile Banking Usage | 89% of customers across all generations use mobile banking, indicating widespread adoption. |

| Omnichannel Integration | Seamless connection between mobile apps, online portals, and branches enhances accessibility. |

| Personalization via Mobile Data Analytics | Banks use mobile app data to tailor services, improving customer satisfaction and engagement. |

| Customer Engagement Benefits | Mobile-first strategies lead to higher retention, satisfaction, and cross-sell opportunities. |

| Necessity of Mobile Banking | Mobile apps are essential, not optional, for modern banking customer experience strategies. |

Security and Convenience

Security remains a top priority for mobile banking users. Financial services apps lead the way, with 44% passing strict security tests—higher than any other industry. Banks use strong authentication methods, such as biometrics and adaptive multi-factor authentication, to protect customer data. These innovations keep accounts safe while making the digital experience smooth and convenient.

Survey data shows that older customers value security most, while younger users focus on ease of use. Modern mobile banking apps balance both needs. Features like instant problem resolution and real-time alerts improve the overall experience. Sobot’s solutions support secure, mobile-first customer service by integrating advanced authentication and AI-powered support. This approach helps banks deliver a trusted, seamless digital transformation.

| Industry | Pass (%) | Warn (%) | Fail (%) |

|---|---|---|---|

| Financial Services | 44 | 31 | 25 |

| Social Networking | 0 | 26 | 74 |

| Productivity | 9 | 49 | 43 |

| Retail | 0 | 86 | 14 |

Mobile-first digital transformation in banking delivers a secure, convenient, and engaging experience for every customer.

AI and Automation in Customer Service

Chatbots and Virtual Assistants

AI-powered chatbots and virtual assistants now play a central role in banking customer service. These tools handle routine questions, schedule appointments, and provide instant answers. Banks use them to reduce queues and free up staff for complex issues. Robotic Process Automation (RPA) also automates repetitive tasks like data entry and compliance checks, which lowers errors and operational costs.

Many banks and credit unions have adopted AI-driven chatbots and automation tools. By 2024, about one-third of credit unions use RPA and chatbots to improve efficiency. These technologies help banks deliver secure, personalized, and proactive service. For example, Morgan Stanley’s AI chatbot supports financial advisors, making responses faster and more accurate.

Key performance metrics show the impact of chatbots and virtual assistants in banking:

| Metric Name | Description | Importance in Banking Customer Service Context |

|---|---|---|

| Average Conversation Duration | Measures how long users interact with the chatbot | Shows efficiency in resolving customer queries |

| Retention Rate | Percentage of users returning to the chatbot | Reflects satisfaction and ongoing engagement |

| Abandonment Rate | Users leaving before resolution | Indicates chatbot effectiveness and customer patience |

| Confidence/Accuracy Rate | How well the chatbot understands and responds | Ensures reliability in handling banking inquiries |

| Customer Satisfaction (CSAT) | User feedback on chatbot interactions | Measures overall service quality and customer happiness |

These metrics help banks track chatbot performance and improve customer experience.

Sobot’s AI-Powered Solutions

Sobot delivers advanced AI-powered solutions for banking customer service. Its chatbots and virtual assistants manage high volumes of inquiries across channels, including voice, chat, and social media. Sobot’s platform uses AI to automate routine tasks, provide real-time responses, and support hyper-personalization. This approach helps banks offer tailored recommendations and proactive support to customers.

Sobot’s unified workspace allows agents to view all customer interactions in one place. The system reduces response times by up to 80% and increases agent efficiency by 20%. Automated call summarization and smart routing ensure that customers receive fast, accurate help. Sobot’s AI also supports secure authentication and fraud detection, which builds trust and confidence.

AI and automation in banking drive efficiency, reduce wait times, and enable banks to deliver personalized, proactive service at scale.

Banks that use Sobot’s solutions see higher customer satisfaction, improved retention, and better operational efficiency. These benefits position banks to meet rising customer expectations and stay competitive in a digital world.

Trust, Transparency, and Data Security

Building Customer Trust

Banks recognize that customer trust forms the foundation of every successful relationship. Customers want to know their information stays safe and that banks act transparently. Recent research shows that trust, transparency, and data security play a critical role in the banking sector. Monitoring programs like the Open Data Inventory (ODIN) and Statistical Performance Indicators (SPI) track improvements in data coverage and openness. ODIN scores for data coverage rose from 43.0 in 2016 to 50.6 in 2022, while openness scores increased from 40.3 to 52.2. These improvements reflect a global push for greater transparency and reliability in financial data.

- National Statistical Offices now act as data stewards, focusing on privacy and ethical data practices.

- Data partnerships between public and private sectors improve transparency and interoperability.

- Citizen engagement ensures data remains relevant and trustworthy.

- Open data principles create a cycle of trust and security in banking.

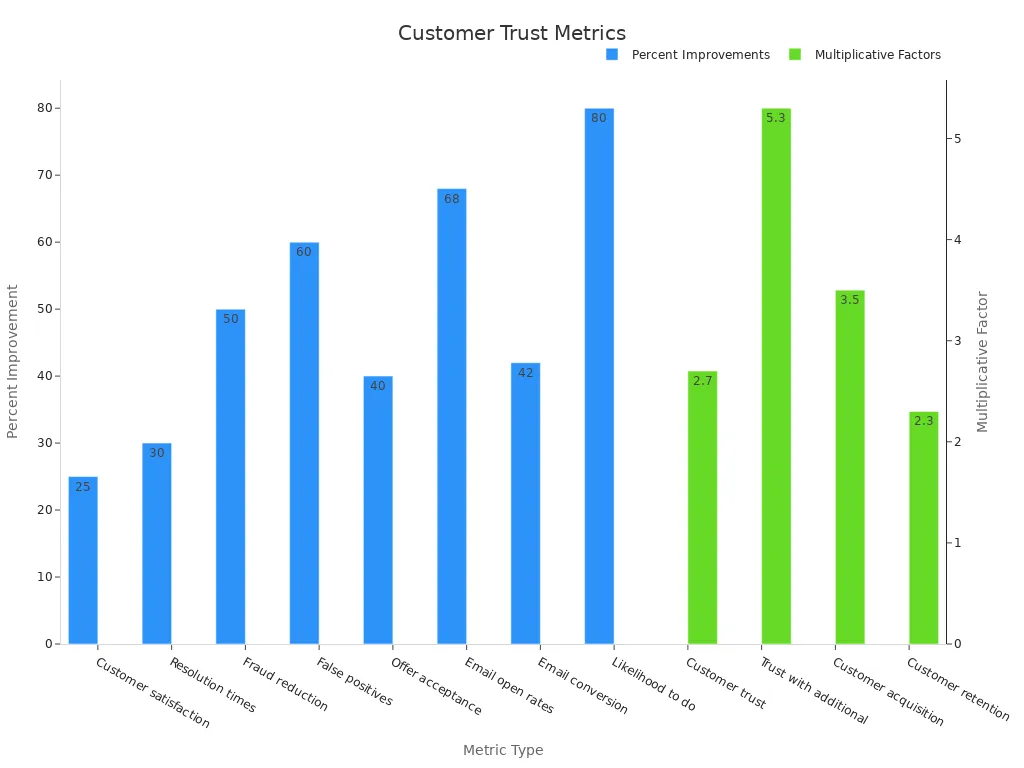

Banks use specific metrics to measure enhancements in customer trust. The table below highlights key improvements reported by leading financial institutions:

| Metric Type | Reported Improvement / Value | Source / Institution |

|---|---|---|

| Customer satisfaction scores | 25% increase for complex issues | USAA Technology Review, 2022 |

| Resolution times | 30% faster resolution times | USAA Technology Review, 2022 |

| Customer trust level | 2.7 times higher trust with accurate financial insights | Forrester Financial Services Customer Trust Index, 2023 |

| Fraud reduction | 50% reduction in fraud | HSBC Annual Report, 2022 |

| Customer retention rates | 2.3 times better retention | IDC Financial Services Predictions, 2023 |

Sobot helps banks build customer trust by offering secure, AI-powered contact center solutions. These tools ensure fast, accurate responses and protect sensitive information, which strengthens relationships and loyalty.

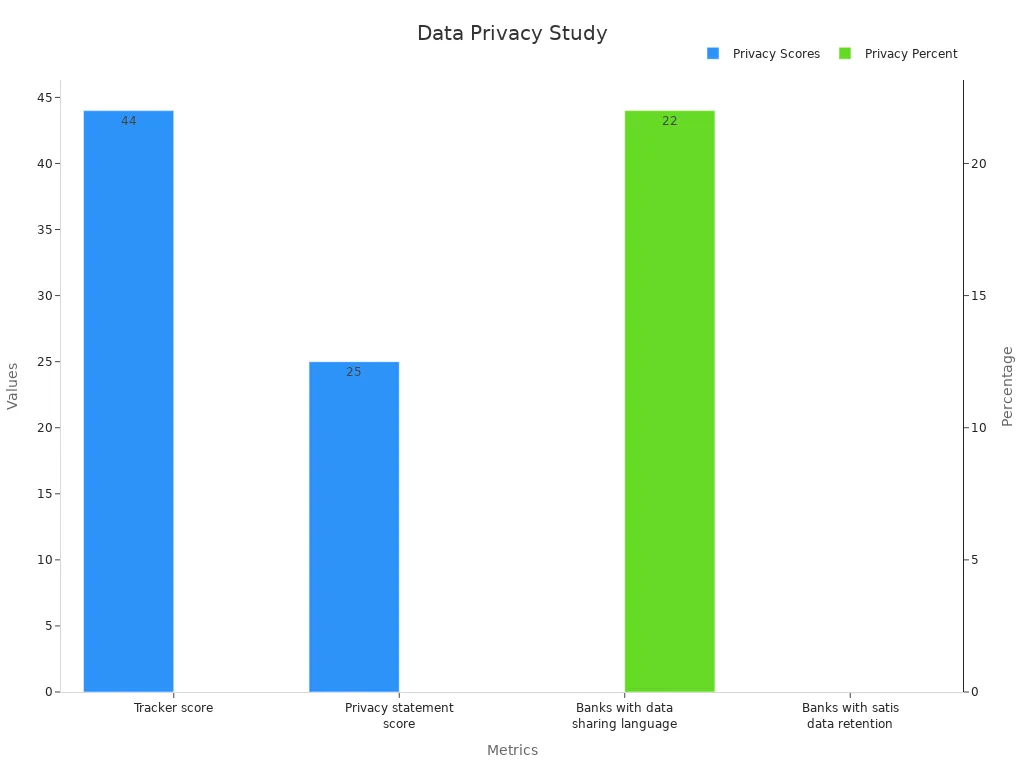

Data Privacy in Banking

Data privacy remains a top concern for every customer. Banks must protect personal information and follow strict privacy standards. The banking sector has made significant progress in adopting security protocols. For example, 93% of banks now use SPF for email security, and 87% have adopted DKIM. DMARC adoption stands at 70%, making banking one of the leading sectors in email protection.

| Category | Metric | Banking Sector Data | Comparison / Notes |

|---|---|---|---|

| Email Security | SPF adoption | 93% | Near 100% adoption |

| DKIM adoption | 87% | High adoption | |

| DMARC adoption | 70% | 2nd highest among sectors | |

| Privacy | Tracker score (out of 45 points) | 44 | Among top scorers |

| Privacy statement score (out of 55) | 25 | Needs improvement on data sharing language |

Sobot’s financial solutions support banks in meeting privacy and security requirements. The platform uses encrypted data transfer and advanced authentication to keep customer information safe. By prioritizing data privacy, banks can maintain customer trust and meet regulatory demands.

Case Study: Opay and Sobot

Challenges in Customer Experience

Opay, a leading financial service platform, faced major challenges in improving customer experience. The company served millions of users across Nigeria and other emerging markets. Opay needed to manage a high volume of customer inquiries from different channels, such as social media, email, and voice calls. The team struggled to keep up with requests and provide fast, accurate support. Many customers wanted quick answers and seamless service, but the old system made it hard to track issues and resolve them on time.

Opay’s main goals included raising customer satisfaction, reducing costs, and increasing conversion rates. The company also wanted to offer a unified experience for every customer, no matter which channel they used.

Sobot’s Impact and Results

Sobot provided Opay with an all-in-one contact center solution. The platform unified customer interactions from social media, email, and voice into a single workspace. This change helped agents respond faster and more efficiently. Sobot’s intelligent IVR system allowed 60% of users to solve problems on their own, which reduced the workload for agents. The WhatsApp Business integration enabled Opay to send targeted messages, achieving an 85% message reading rate.

The results were clear:

| Metric | Before Sobot | After Sobot | Improvement |

|---|---|---|---|

| Customer Satisfaction | 60% | 90% | +30% |

| Operational Costs | 100% | 80% | -20% |

| Conversion Rate | 0% | 17% | +17% |

Sobot’s solution led to a 30% increase in customer satisfaction and a 20% reduction in costs. Opay also saw a 17% rise in conversion rates. These outcomes show the power of Sobot’s platform in improving customer experience and operational efficiency. For more details, see Opay’s customer story.

Future of Customer Experience Trends

Evolving Expectations

Customer experience in banking continues to evolve as technology and customer demands change. By 2028, nearly 80 million Americans are expected to use digital banking, showing rapid growth in digital adoption. Customers now expect banks to understand their specific needs, with over 60% seeking hyper-personalized service. More than 65% of consumers want tailored experiences, and 80% are more likely to buy from brands that offer personalized interactions. Omnichannel consistency remains critical, as 90% of customers expect seamless experiences across all channels. However, many companies still struggle to deliver this level of service.

- 44% of finance firms already use AI to personalize customer experience.

- Investments in generative AI for banking customer service are projected to reach $1.68 billion by 2025.

- Hybrid models that combine AI and human expertise are becoming more common, improving both efficiency and empathy.

- Open banking and API integration are making it easier for banks to offer new services and connect with third-party providers.

- New technologies like voice-activated payments and blockchain-based systems are gaining traction, promising more convenience and security.

Banks must keep up with these trends to meet rising expectations and avoid losing customers to competitors after a single poor experience. Sobot’s omnichannel solutions help banks deliver unified, personalized service across every touchpoint, supporting these evolving demands.

Continuous Improvement

Continuous improvement drives success in customer experience. Banks collect real-time feedback through NPS surveys, social media, and support interactions to identify pain points. They set clear KPIs, such as satisfaction scores and conversion rates, to track progress. Automation of routine tasks, like onboarding and account management, increases convenience and reduces errors. Educating frontline teams ensures consistent delivery of improved service.

| Continuous Improvement Strategy | Measurable Banking Performance Outcome |

|---|---|

| Superior Customer Experience (CX) | 80% higher revenue growth compared to competitors |

| Digital Onboarding and Automation | $2M revenue generated in first month via automated credit apps |

| AI-powered Virtual Assistants | 300% increase in handled inquiries per month |

| Omnichannel Integration and Proactive Messaging | Higher customer retention and satisfaction rates |

| Automation of Routine Tasks | Reduced manual appointment coordination time |

| Enhanced Digital Access | Improved customer convenience and satisfaction |

| Combined CX Strategies | Boosted operational efficiency and lowered costs |

Sobot’s AI-powered platform supports continuous improvement by automating routine tasks and providing real-time analytics. This approach helps banks adapt quickly, deliver better experiences, and stay ahead in a fast-changing market. As customer expectations rise, ongoing innovation and investment in customer experience will remain essential for long-term growth.

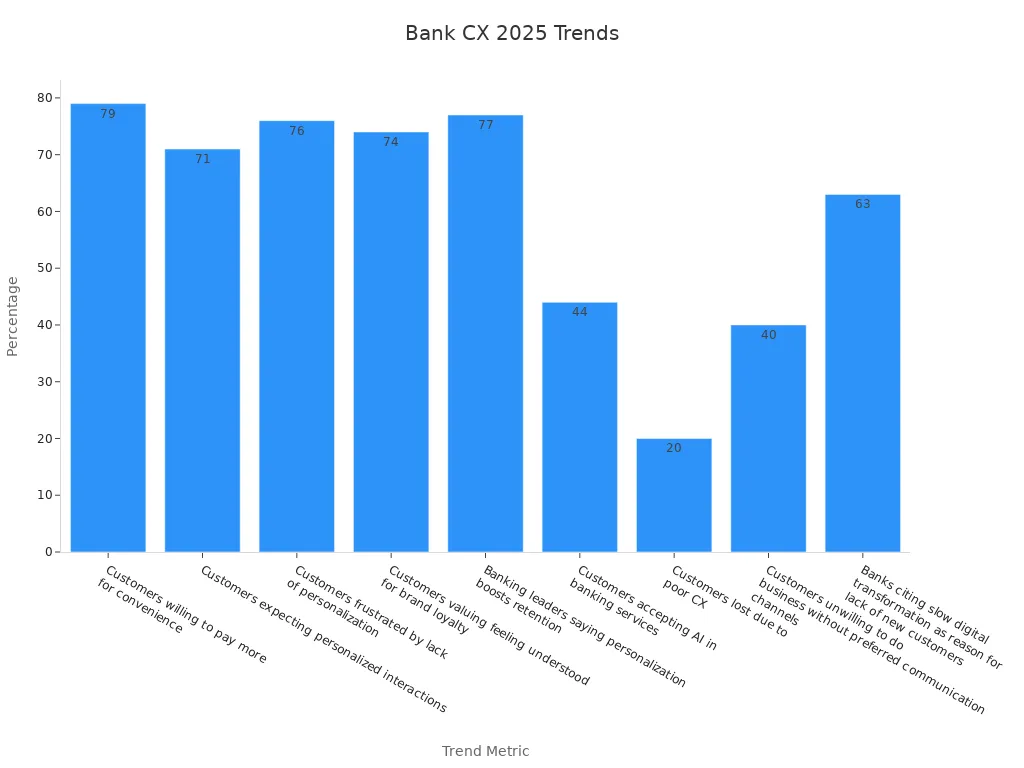

Banks in 2025 face rising expectations for customer experience in banking. Most customers want convenience, personalization, and seamless digital journeys. The table below shows how these trends shape the industry:

| Key Trend Metric | Statistic | Source |

|---|---|---|

| Customers willing to pay more for convenience | 79% | CX Network |

| Customers expecting personalized interactions | 71% | McKinsey & Company |

| Customers frustrated by lack of personalization | 76% | McKinsey & Company |

| Customers valuing feeling understood for brand loyalty | 74% | Survey of 1,000 US residents |

| Banking leaders saying personalization boosts retention | 77% | Survey of banking leaders |

| Customers accepting AI in banking services | 44% | GFT |

| Customers lost due to poor CX | 20% | 10x Banking |

| Customers unwilling to do business without preferred communication channels | 40% | Salesforce |

| Banks citing slow digital transformation as reason for lack of new customers | 63% | 10x Banking |

Sobot’s AI-powered solutions help banks deliver personalized, secure, and efficient service. Data-driven case studies from HSBC and Barclays show that real-time analytics and automation improve customer experience in banking and drive loyalty. As technology evolves, banks that invest in platforms like Sobot will lead the way. The future of customer experience in banking depends on innovation, data, and a commitment to meeting customer needs. To learn more about transforming your bank’s customer experience, visit Sobot’s official website.

FAQ

What is customer experience in banking, and why does it matter?

Customer experience in banking refers to how customers feel during every interaction with a bank. Studies show that 76% of customers leave banks after poor experiences. Banks that improve customer experience in banking see higher loyalty and faster growth. Source: McKinsey.

How does Sobot help banks improve customer experience in banking?

Sobot provides AI-powered contact center solutions. These tools unify calls, chats, and social messages. Banks using Sobot reduce response times by up to 80%. Sobot’s platform supports seamless communication, which boosts customer experience in banking and increases satisfaction.

What role does AI play in customer experience in banking?

AI analyzes customer data and predicts needs. Banks use AI chatbots to answer questions instantly. This technology personalizes services and reduces wait times. Sobot’s AI-driven solutions help banks deliver proactive support, which enhances customer experience in banking.

How do omnichannel solutions impact customer experience in banking?

Omnichannel solutions connect all customer touchpoints. Customers can switch between mobile, web, and phone without repeating information. Sobot’s omnichannel platform ensures consistent service. This approach improves customer experience in banking and builds trust.

Is data security important for customer experience in banking?

Yes, data security is critical. Over 90% of customers say they trust banks that protect their information. Sobot uses encrypted data transfer and advanced authentication. Secure systems help banks maintain trust and deliver a safe customer experience in banking.

Tip: Banks that invest in secure, AI-powered platforms like Sobot lead in customer experience in banking.

See Also

Discover The Leading Cloud Contact Centers For 2025

Comprehensive Review Of Best Contact Center Solutions 2024

Best Cloud Contact Center Services Evaluated For 2024