Reporting on Customer Experience Challenges and ROI Results

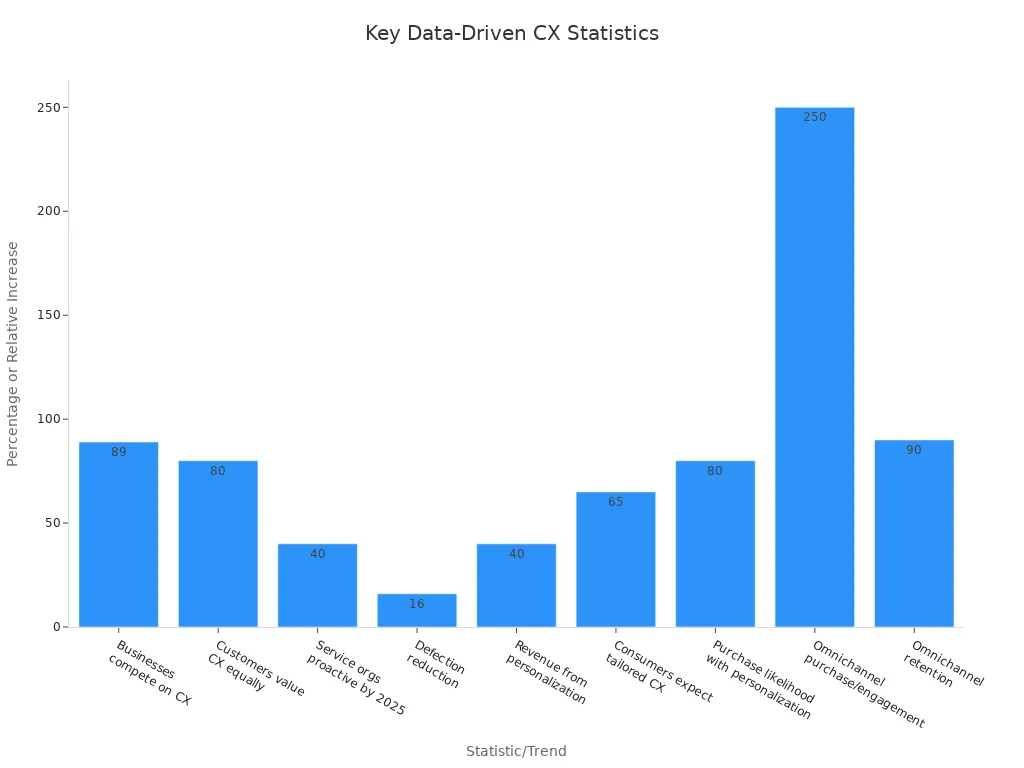

You face growing pressure to show the value of your customer experience initiatives. Modern contact centers now rely on data-driven proof to measure impact and solve customer experience challenges. Companies using Sobot and Sobot AI benefit from unified reporting, advanced analytics, and clear insights that drive real business impact. As the chart below shows, strong customer experience delivers measurable value and financial returns.

Customer Experience Challenges

Customer experience challenges can slow your progress and make it hard to show real business value. You need to understand these obstacles to improve your customer retention rate and drive better results.

Data and Attribution

You often face issues with data when trying to measure customer experience. Many organizations work in silos, which means each department collects different data and uses different metrics. This leads to a fragmented view of the customer journey. Without a unified approach, you struggle to see the full impact of your efforts on retention and satisfaction. Outdated or incomplete data can make it even harder to track the customer retention rate. You need strong tools and a clear strategy to bring all your data together. When you align teams and share insights, you create a seamless experience that supports higher retention.

Tip: Use a customer data platform to consolidate information from every channel. This helps you avoid the cost of poor customer experience and supports better decision-making.

Metric Selection

Choosing the right metrics is one of the most common customer experience challenges. You might see many options, such as Net Promoter Score (NPS), Customer Satisfaction Score (CSAT), and Customer Effort Score (CES). Each metric tells a different story. If you track too many metrics, you risk losing focus. If you pick the wrong ones, you miss important insights about retention. The best approach is to select metrics that match your business goals and help you take action. For example, tracking customer retention rate, average handle time, and customer lifetime value gives you a clear picture of loyalty and efficiency. Always ask yourself what you want to learn from the data and how it will help you improve customer experience.

Delayed Impact

Another major customer experience challenge is the delayed impact of your initiatives. When you invest in better service, you may not see results right away. Changes in customer behavior, retention, and revenue often take months to appear. Studies show that it can take 6 to 18 months to measure the true effect of customer experience improvements on ROI. This delay makes it hard to prove the value of your work quickly. You need patience and a long-term view to track the customer retention rate and other key metrics over time. Using real-time data and AI-powered tools can help you spot trends faster, but you must still plan for gradual change.

Measuring Customer Experience ROI

Measuring customer experience ROI helps you prove the value of your efforts and guides your next steps. You need a clear process to set goals, choose the right metrics, and collect reliable data. This approach ensures you can show how your work improves customer satisfaction, retention, and business results.

Setting CX Goals

You start by setting clear customer experience goals. These goals give you direction and help you focus on what matters most. To create effective goals, follow these steps:

- Assess your current performance. Gather data from reports, surveys, and benchmarking studies. Look for strengths and weaknesses in your customer journey.

- Define specific objectives. Decide what you want to achieve, such as reducing wait times or increasing self-service rates.

- Identify key performance indicators (KPIs). Choose KPIs that match your objectives, like average speed to answer or percentage of requests handled through automation.

- Set benchmarks and targets. Compare your performance to industry standards and set realistic goals with clear deadlines.

- Communicate your goals. Make sure everyone on your team understands the objectives and feels motivated to achieve them.

- Track and analyze progress. Use regular reviews to monitor your results and adjust your approach as needed.

Note: Align your customer experience goals with your business strategy. For example, if your company wants to boost retention, set a goal to improve customer satisfaction metrics or reduce churn.

You should also use the SMART framework—Specific, Measurable, Achievable, Relevant, and Time-bound—to make your goals actionable. For instance, aim to increase your customer satisfaction score from 80% to 90% within three months.

Choosing Metrics

Selecting the right metrics is essential for measuring customer experience ROI. The best metrics connect your customer experience efforts to business outcomes. Here are some of the most effective metrics:

- Net Promoter Score (NPS): Measures how likely customers are to recommend your brand.

- Customer Satisfaction Score (CSAT): Tracks how happy customers are with your service.

- Customer Effort Score (CES): Shows how easy it is for customers to get help.

- Customer Lifetime Value (CLV): Estimates the total value a customer brings over time.

- First Contact Resolution (FCR): Measures how often you solve issues on the first try.

- Average Handle Time (AHT): Tracks how long it takes to resolve customer requests.

- Churn Rate: Shows how many customers stop using your service.

- Digital Experience Score (DXS): Evaluates the quality of your digital channels.

Research shows that companies with high NPS or CSAT scores often see double the revenue growth compared to others. Improving CSAT can also increase retention, which boosts profits. Operational metrics like FCR and AHT help you lower costs and improve efficiency.

Tip: Focus on a mix of customer satisfaction metrics and operational metrics. This balance gives you a full view of your customer experience ROI.

Data Collection

Reliable data collection and analysis are the backbone of measuring customer experience ROI. You need accurate data to track progress and make informed decisions. Follow these best practices:

- Integrate your customer engagement tools with your CRM. This gives agents real-time access to customer history and preferences.

- Use feedback and sentiment analysis tools. Automated surveys after each interaction help you capture customer emotions and spot trends.

- Monitor key metrics like CSAT, NPS, FCR, and AHT. Real-time dashboards and alerts help you identify issues quickly.

- Train your team on both technology and soft skills. Well-trained agents collect better data and deliver better service.

- Conduct regular quality assurance checks. Make sure your chatbots and IVR systems work as expected.

- Schedule group calibration sessions. Align your team on scoring standards to ensure consistent data.

Remember: Consistent data collection and analysis help you spot problems early and measure the impact of your customer experience initiatives.

When you combine strong goals, the right metrics, and reliable data, you create a solid foundation for calculating customer experience ROI. This process helps you show the financial impact of your work and supports continuous improvement.

Proving ROI of Customer Experience Initiatives

Linking CX to Financial Outcomes

You need to build real evidence that your customer experience initiatives drive financial results. Many industries have proven that better customer experience leads to higher revenue, stronger loyalty, and lower costs. When you connect your customer experience ROI to business outcomes, you show the true value of your work.

Here is a table that highlights how improved customer experience impacts financial performance across different sectors:

| Industry | Company/Example | CX Improvement Metric(s) | Financial Impact/Outcome |

|---|---|---|---|

| Banking | Bank of America | 15% increase in digital sales; 20% reduction in operational costs | Increased revenue and cost savings |

| Healthcare | Cleveland Clinic | 12% increase in patient satisfaction | Higher patient loyalty and referrals |

| Telecommunications | Verizon | 25% reduction in churn; 10% increase in ARPU | Billions in additional revenue |

| Hospitality | Marriott International | 30% increase in direct bookings | Boost in revenue from repeat customers |

| Automotive | Tesla | 80% customer retention rate | Strong customer loyalty driving rapid growth |

| Education | Southern New Hampshire University | 25% increase in enrollment | Improved student retention and financial performance |

| Real Estate | Zillow | 15% increase in lead conversion | Higher engagement and sales |

| Retail/Food Service | Starbucks | 7% increase in same-store sales | Increased sales linked to improved customer convenience |

| Airlines | Delta Airlines | 20% increase in customer satisfaction; 10% revenue growth | Higher passenger retention and premium ticket sales |

| Hospitality | Ritz-Carlton | High customer loyalty and premium pricing | Sustained revenue growth and profitability |

| General Business | Various (Forrester study) | CX leaders grow revenue 5.1x faster than laggards | Demonstrates broad financial impact of CX leadership |

| General Business | Various (Harvard Business Review) | 5% increase in retention | 25%-95% increase in profits |

| General Business | Various (Bain & Company) | Cost of acquiring new customer 5-7x higher than retention | Reducing churn protects revenue and increases profitability |

You can see that customer experience initiatives have a direct impact on business success. For example, a 5% increase in retention can boost profits by up to 95%. Companies that lead in customer experience grow revenue much faster than others. When you track metrics like customer lifetime value, churn rate, and customer satisfaction, you build real evidence that links your efforts to financial gains.

Using Control Groups

To build real evidence for your customer experience ROI, you need to isolate the impact of your initiatives. Control groups help you do this. You compare a group that receives the new customer experience initiative with a group that does not. This method shows the true impact of your changes.

Here is how you use control groups to measure ROI:

- Define the customer experience initiative you want to test.

- Identify the business metrics you expect to improve, such as customer satisfaction or retention.

- Set the duration for your study.

- Create two groups: one receives the new initiative, and the other continues with the current process.

- Track the same metrics for both groups during the study.

- Compare the results to see the difference.

- Calculate the financial impact by translating metric changes into monetary value.

- Use this real data to show the return on investment and build real evidence for your business case.

This approach proves that your customer experience initiatives cause the improvements, not just external factors. You can confidently present these results to stakeholders and secure support for future projects.

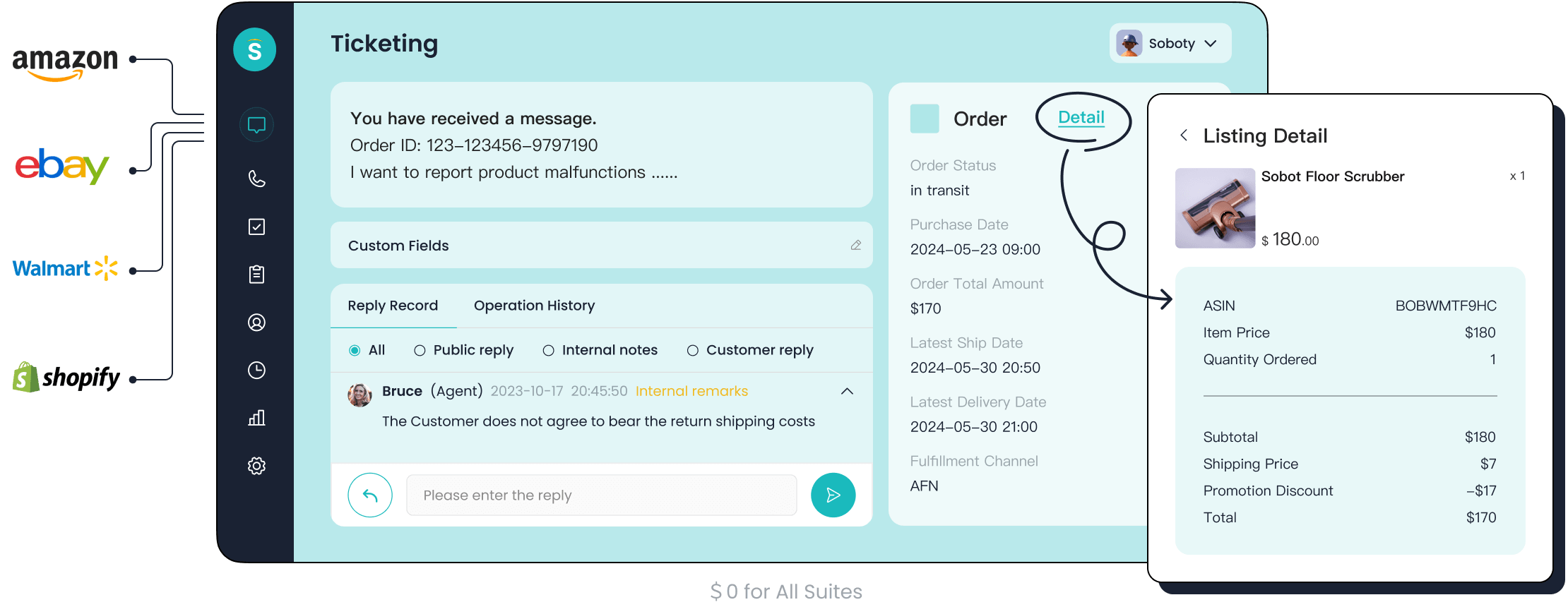

Sobot Ticketing System Example

You can see the power of customer experience initiatives in action with Sobot’s Ticketing System. Companies like Opay have used Sobot’s unified platform to transform their customer service and marketing. Opay faced challenges managing high volumes of customer interactions across channels. After implementing Sobot’s omnichannel solution and Ticketing System, Opay achieved remarkable results:

- Customer satisfaction jumped from 60% to 90%.

- Operational costs dropped by over 20%.

- Conversion rates increased by 17%.

- 60% of customers resolved issues independently using self-service options.

- WhatsApp Business integration led to an 85% message reading rate.

These results show the impact of using AI-powered tools and automation. Businesses using Sobot’s Ticketing System report up to 400% increases in productivity. Automation and AI save as much as 2.5 billion hours each year. Proactive customer service reduces churn by up to 30%, increases satisfaction by 25%, and improves retention by 20%. Even a small increase in retention can boost profits by up to 25%. Customer retention programs often deliver ROI between 400% and 1000%.

Sobot’s analytics and unified platform help you build real evidence for your customer experience ROI. You can track key metrics like CSAT, NPS, first response time, resolution rate, and customer effort score. The platform gives you real data and insights that prove the value of your customer experience initiatives. You can show stakeholders exactly how your efforts drive business success and financial impact.

Tip: Use Sobot’s analytics dashboards to monitor your customer experience initiatives in real time. Share these results with your team and leadership to build real evidence and support continuous improvement.

Reporting on Customer Experience ROI

Partnering with Finance

You need to work closely with your finance team to validate the ROI of your customer experience initiatives. When you share clear data and align on key metrics, you build trust and make your results more credible. Finance teams want to see how your efforts connect to real business outcomes. Use a structured approach to present your data and make collaboration easier.

Here is a table that shows how you can align your metrics with finance:

| Metric / Aspect | Description / Use in Collaboration with Finance Departments |

|---|---|

| Customer Satisfaction (CSAT) | Share CSAT scores and analyze how changes in satisfaction impact revenue by linking churn rates and average spend per customer. |

| Net Promoter Score (NPS) | Identify promoters and detractors, helping quantify customer loyalty and its financial impact. |

| Churn Rate | Calculate lost revenue from customers leaving, enabling finance to validate cost savings from improved experience. |

| Customer Lifetime Value | Quantify the expected revenue per customer, supporting ROI calculations on investments in customer experience. |

| Average Transaction Size | Provide data on customer spend patterns, useful for linking customer experience improvements to revenue changes. |

| Cost of Customer Support | Include costs like support teams and quality assurance programs, which finance can use to assess investments and savings. |

| Quality Assurance Data | Track agent performance and customer interactions, allowing teams to quantify improvements and link them to financial outcomes. |

| ROI Formula | (Benefits – Investments) / Investments; use this formula jointly with finance teams to validate ROI based on shared data. |

When you use this approach, you make it easier for finance to see the value of your work. You also create a shared language for discussing the impact of customer experience on business results.

Actionable Insights

You need to give your leaders more than just numbers. Actionable insights help them make smart decisions and drive real change. Executives want to see both the story behind the data and clear steps for improvement. Focus on what matters most and make your insights easy to understand.

- Combine quantitative metrics like NPS, CSAT, and CES trends with real customer quotes for a complete view.

- Identify the main drivers behind customer satisfaction or dissatisfaction.

- Track trends over time to spot new issues or improvements.

- Prioritize recommendations so leaders know where to focus first.

- Contextualize insights by showing their impact and priority.

- Make sure your insights are timely, so leaders can act quickly.

- Link your findings to business outcomes such as retention, churn, and operational efficiency.

- Connect customer feedback to other areas like product, marketing, or logistics, and suggest next steps.

- Highlight long-term trends and strategic impacts, such as brand perception and the effectiveness of CX initiatives.

Tip: Actionable insights should be clear, timely, and focused on what will drive the most value for your business.

Sobot’s analytics and dashboards help you turn data into actionable insights. The platform uses AI to track key metrics, analyze customer behavior, and predict churn. You can see real-time results, spot trends, and launch targeted campaigns to improve retention. For example, OPPO used Sobot’s analytics to reduce churn by 25%. These tools help you make informed decisions and show the impact of your efforts.

Executive Reporting

You need to tailor your reports for different audiences, especially executives. Leaders want to see the big picture and understand how customer experience drives business success. Use best practices for measuring customer experience ROI to make your reports clear and impactful.

- Customize your reports for each role. Give location managers daily dashboards with customer comments. Provide mid-managers with monthly summaries. Share strategic updates with executives.

- Offer clear action plans for daily, weekly, and monthly timeframes. Make sure everyone knows their responsibilities.

- Link your customer experience initiatives to the company’s main strategy. Show how each role contributes to the overall goals.

- Use executive communications to keep CX programs visible. Share regular updates and training.

- Quantify and showcase the financial impact of your improvements. For example, combine customer and employee insights to prove business value.

- Use visuals like line charts, pie charts, and bar charts to make data easy to understand.

- Translate metrics into business stories. Explain why the numbers matter and how they support business goals.

- Align reporting frequency with business needs. Use daily dashboards for urgent issues and monthly reports for long-term trends.

- Include competitive benchmarking to set clear goals and highlight opportunities.

Sobot’s dashboards make executive reporting simple. You can track key metrics, visualize trends, and share real-time updates. The platform integrates with your CRM and supports omni-channel reporting, giving you a full view of the customer journey. AI-powered analytics help you spot risks, predict churn, and personalize experiences. These features help you communicate the value of your customer experience initiatives and drive better results.

Note: When you tailor your reports and focus on actionable insights, you help your leaders see the true impact of customer experience on business growth.

Continuous Improvement in Customer Experience

Feedback Loops

You drive customer experience improvements by building strong feedback loops. When you collect feedback, analyze it, and act on it, you show customers that their voices matter. This process helps you spot confusing features or gaps in your service. You can then make targeted changes that create value for customers and reduce churn. For example, companies that use feedback loops often see higher loyalty because they address complaints quickly and communicate updates. Feedback loops also support data-driven decisions, so you avoid guessing what customers want. By acting on feedback, you keep your products and services aligned with customer needs. This cycle of listening and improving helps you build customer loyalty and encourages repeat business.

Aligning with Business Strategy

You need to connect your customer experience strategy to your company’s main goals. Start by mapping your customer experience initiatives to business outcomes like revenue growth, retention, and brand reputation. Secure leadership support by showing how your work impacts key performance indicators. Create champions in each department to keep everyone focused on customer experience improvements. Use customer profiles and empathy mapping to understand real needs. When you break down silos and encourage teamwork, you make sure every department works toward the same goals. Companies like Amazon and Starbucks succeed because they align customer experience with business strategy, using data and technology to personalize service and track progress. This approach helps you create lasting loyalty and measurable value.

Culture of Accountability

You build a culture of accountability by empowering your team to take ownership of customer outcomes. Companies like Zappos and Chick-fil-A show that strong cultures lead to exceptional service and high loyalty. When you hire for attitude and train for skill, you create a team that cares about customers. Leaders who set clear expectations and lead by example build trust and fairness. Research shows that employees are more likely to report problems and suggest improvements when they trust their leaders. This culture encourages everyone to focus on creating value for customers and delivering on promises. Over time, accountability becomes part of your daily work, helping you build customer loyalty and drive business success.

You drive customer experience success by focusing on evidence-based reporting. Companies that prioritize CX see faster growth, higher retention, and stronger loyalty. Sobot’s Ticketing System gives you AI-powered tools and unified data, making it easier to measure and report real results. When you adopt a data-driven approach, you personalize experiences, reduce costs, and build lasting relationships. Start using smart solutions to turn insights into action and keep your business ahead.

FAQ

How can you measure the ROI of customer experience initiatives?

You track key metrics like customer satisfaction, retention, and cost savings. Use Sobot’s analytics dashboard to compare results before and after changes. This approach helps you see the financial impact of your efforts.

What metrics should you include in your CX reports?

Focus on Net Promoter Score (NPS), Customer Satisfaction Score (CSAT), churn rate, and average handle time. These metrics give you a clear view of customer loyalty, service quality, and operational efficiency.

How does Sobot’s Ticketing System help with reporting?

Sobot’s Ticketing System unifies data from all channels. You get real-time analytics, automated reports, and clear visualizations. This system makes it easy to share results with your team and leadership.

Why is it important to partner with your finance team?

You build trust and credibility when you align your data with finance. This partnership ensures your ROI calculations match business goals. Finance teams help validate your results and support your CX investments.

See Also

Comparing The Best Voice Of Customer Software Solutions

Effective Strategies For Managing Call Center Quality

How AI Agents Are Transforming Customer Support Today