What Does Customer Churn Analytics Reveal About Your Business

What if customer churn analytics could reveal the exact reasons why customers leave and help your business grow faster? Many companies see a 67% reduction in churn when they use analytics to identify at-risk customers and act early.

- Losing 50 out of 1,000 customers means a 5% churn rate, but tracking churn monthly or by cohort can uncover hidden issues.

- Predictive analytics spot high-risk customers before they leave, while customer feedback and exit surveys highlight key churn drivers.

Sobot enables business leaders to use these insights to keep more customers, boost revenue, and improve loyalty.

Customer Churn Analytics Basics

What Is Customer Churn?

Customer churn means the percentage of customers a business loses over a set period. Companies use churn rate to measure how many customers stop using their products or services. For example, if a business starts with 1,000 customers and loses 50 in a month, the churn rate is 5%. Churn can also show up as lost revenue, not just lost customers. Different industries see different churn rates. Subscription services like SaaS often have a churn rate between 5-7% each year, while e-commerce can see rates as high as 30%. The table below shows average annual churn rates by industry:

| Industry | Average Annual Churn Rate |

|---|---|

| SaaS | 5-7% |

| Telecom | 15-25% |

| E-commerce | 20-30% |

| Financial Services | 20-25% |

Why Analyze Churn?

Customer churn analysis helps businesses understand why customers leave. Tracking customer churn gives leaders the chance to spot problems early. Customer churn analytics uses several key metrics:

- Customer churn rate: Shows the percentage of customers lost.

- Gross revenue churn rate: Measures the revenue lost from churn.

- Revenue churn: Focuses on the money lost, not just the number of customers.

- Growth rate: Balances churn by showing how many new customers join.

Churn analysis matters because keeping customers costs less than finding new ones. Studies show that getting a new customer can cost 5 to 25 times more than keeping an existing one. Even a 5% increase in retention can boost profits by up to 95%. Churn analysis also uses customer satisfaction scores and net promoter scores to predict which customers might leave.

Sobot’s Approach

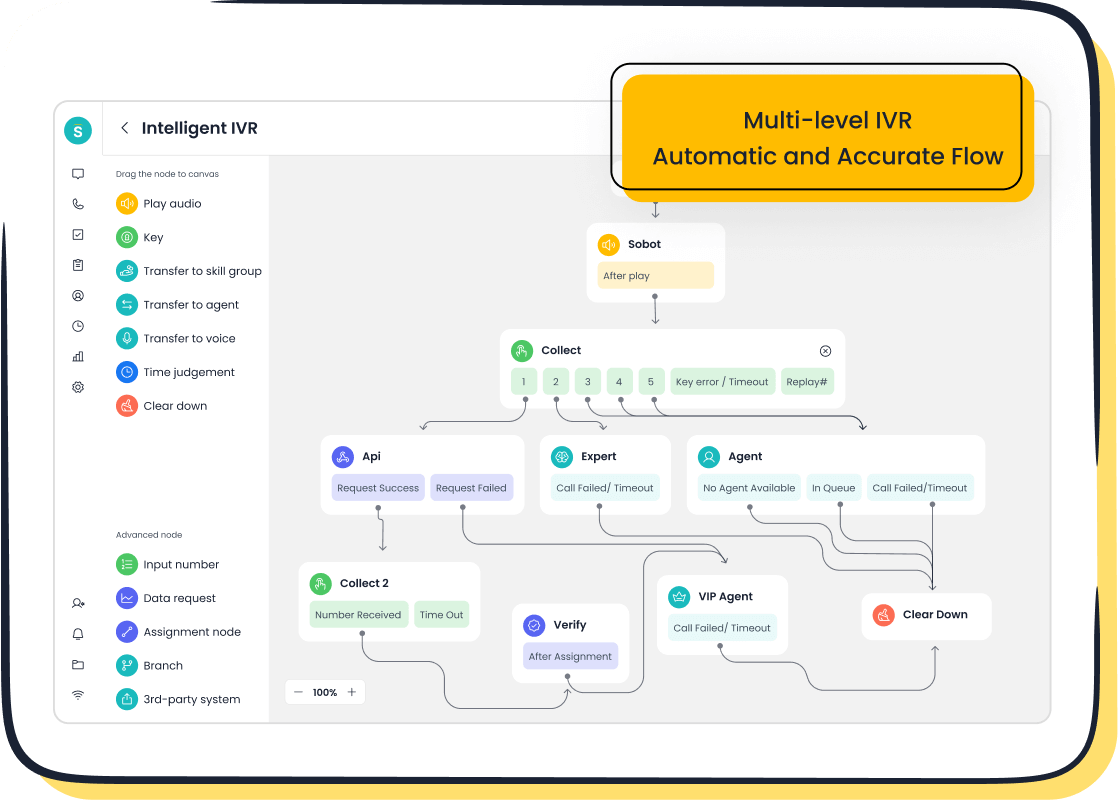

Sobot uses customer churn analytics to help businesses keep more customers. The platform collects data from every customer interaction, including calls, chats, and emails. Sobot’s analytics tools track churn signals, such as drops in usage or negative feedback. The system uses AI to predict which customers are at risk. Sobot’s approach to churn analysis includes:

- Real-time tracking of customer behavior across channels

- Automated alerts for at-risk customers

- Integration with CRM and support systems for a complete view

Sobot’s customer churn analysis helps companies act quickly to improve retention and grow their business, especially for those with subscriptions or high customer turnover.

Key Insights from Churn Analysis

Root Causes of Churn

Customer churn analysis helps businesses discover why customers leave. Companies use several methods to find these root causes. They gather and study customer behavior, purchase history, and interaction data. This process helps spot patterns and connections linked to churn. Businesses also collect feedback through surveys to learn about customer pain points and reasons for leaving. Customer journey mapping shows each step a customer takes, making it easier to find where problems occur. Cohort analysis groups customers by shared traits or timeframes, revealing trends in churn rate among different segments.

Statistical analysis plays a big role in finding the main reasons for customer churn. Techniques like regression and hypothesis testing help businesses see which factors matter most. For example, a study found that payment methods have a strong link to churn. Customers using electronic checks had higher churn rates, while those with automatic credit card payments stayed longer. Contract type also matters. Month-to-month contracts often lead to higher churn, while longer contracts help keep customers. Service type, such as fiber optic internet, can also affect churn rate. By focusing on these factors, companies can create better retention strategies.

Tip: Companies should regularly review churn data from product usage, support tickets, and customer feedback. This approach gives a full picture of the customer journey and highlights areas for improvement.

At-Risk Customer Identification

Customer churn analytics uses data-driven models to spot customers who might leave soon. Machine learning algorithms assign a churn probability score to each customer. These models look at many factors, such as how often a customer uses a product, their feedback, and their purchase history. Early warning signs, like a drop in usage or negative reviews, help businesses act before customers churn.

Businesses segment customers by demographics, behavior, or value. This segmentation helps target the right customers with the right retention strategies. Companies also use customer lifetime value (CLV) to decide which customers to focus on. Omnichannel data, including calls, chats, and emails, gives a complete view of customer engagement. Automated systems can trigger actions, such as sending special offers or reaching out with support, when a customer shows signs of leaving.

- Churn analytics and predictive modeling help businesses predict churn and act early.

- Monitoring early warning signs, such as declining usage, allows for quick intervention.

- Personalizing engagement based on data insights increases the chance of keeping customers.

Customer Behavior Patterns

Churn analysis reveals clear patterns in customer behavior before they leave. Tracking how often customers use a product or service helps spot declining engagement. When customers use fewer features or interact less, it often signals a higher risk of churn. Increased support requests and negative feedback also point to dissatisfaction.

Companies analyze transactional data, such as renewal rates and purchase history, to find churn signals. Cohort analysis groups customers by signup date or behavior, showing which groups are most likely to churn. Predictive analytics and machine learning use these patterns to assign risk scores and help businesses focus on the most at-risk customers.

- Reduced usage frequency and feature utilization signal possible churn.

- More support interactions and negative feedback often come before a customer leaves.

- Time-to-churn analysis helps companies know when customers are most likely to leave, so they can act quickly.

By understanding these patterns, businesses can improve customer engagement and retention. Customer churn analysis gives companies the tools to predict churn and take action before it happens.

Impact on Retention and Business Growth

Revenue and Loyalty

Churn analytics gives companies a clear view of how customer behavior affects revenue and loyalty. When businesses track churn rate, customer retention, and revenue churn rate, they can see which actions lead to higher profits. Bain & Company found that a 5% increase in customer retention can boost profits by 25% to 95%. Companies like Starbucks and Amazon use loyalty programs and personalized engagement to increase repeat purchase rates and revenue. For example, Starbucks saw a 40% revenue increase from loyalty members, while Amazon Prime members spend 133% more than non-members. Loyal customers are five times more likely to buy again and four times more likely to refer friends. These patterns show that focusing on retention and reducing churn leads to higher revenue and a stronger customer base.

| Statistic / Metric | Example / Evidence | Impact on Retention and Revenue Growth |

|---|---|---|

| Starbucks Rewards Program | 40% revenue increase from loyalty members | Personalized loyalty programs boost revenue |

| Amazon Prime Members | Spend 133% more than non-members | Loyal customers drive higher revenue |

| Spotify Premium Subscriber Retention | Retains over 75% of premium subscribers | Personalization reduces churn, improves retention |

| Returning Customers Revenue Contribution | 40% of total revenue from 8% of visitors | Retained customers have a big impact on revenue |

Competitive Advantage

Companies that use churn analytics gain a strong edge in the market. By identifying at-risk customers early, they can act fast to reduce churn and improve retention rate. Predictive analytics and customer journey mapping help businesses spot friction points and fix them before customers leave. In the telecom industry, data analytics and predictive modeling led to a 15% reduction in churn over six months. SaaS companies improved customer satisfaction by 20%, and retail businesses increased retention by 25% after revamping onboarding processes. These results show that using churn analytics not only helps keep customers but also drives revenue growth and sets a business apart from competitors.

| Industry | Company Strategy | Quantitative Outcome |

|---|---|---|

| Telecom | Data Analytics & Predictive Modeling | 15% reduction in churn over 6 months |

| SaaS | Enhanced Customer Engagement | 20% improvement in customer satisfaction |

| Retail | Revamped Onboarding Process | 25% increase in customer retention |

Sobot Voice/Call Center Benefits

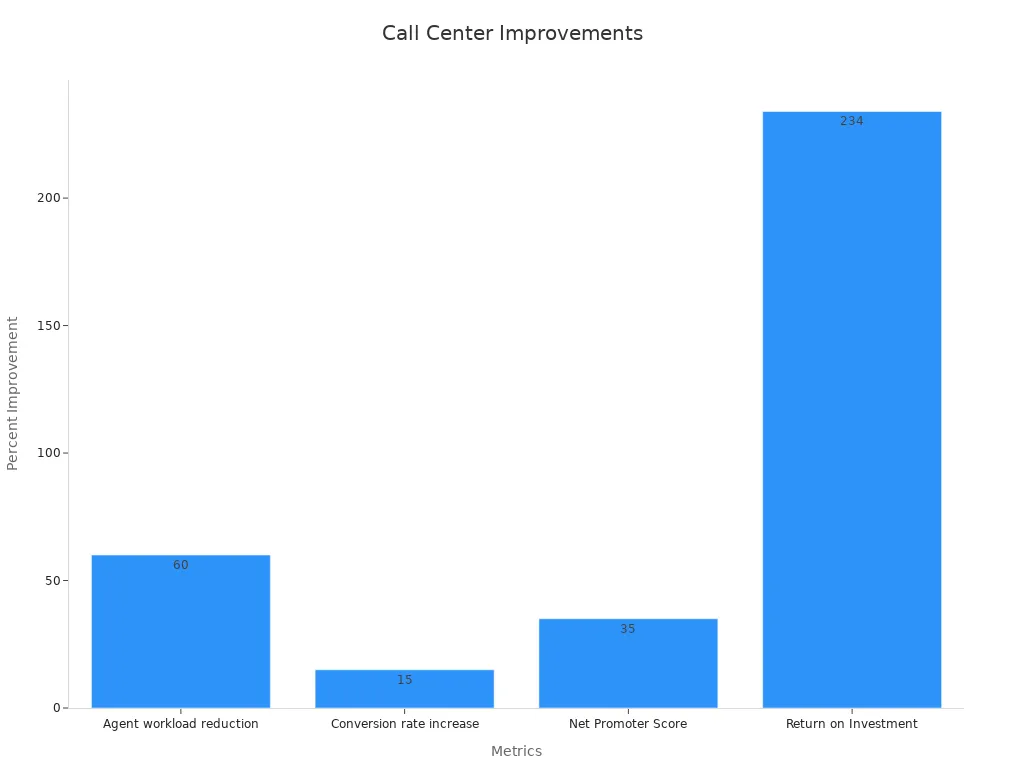

Sobot’s Voice/Call Center solution helps businesses reduce churn and increase revenue by improving customer interactions. The platform uses AI to automate routine tasks, which lowers agent workload by 60%. Companies see a 15% increase in conversion rates and a 35% improvement in Net Promoter Score. With AI and human collaboration, resolution time drops to under one minute. Sobot’s system also delivers a 234% return on investment. These improvements mean customers get faster, more accurate support, leading to higher retention and lower revenue churn rate.

Note: Sobot’s analytics-driven approach helps businesses track key metrics like churn rate, revenue churn rate, and customer retention, making it easier to spot trends and act quickly.

How Customer Churn Analytics Works

Data Collection

Churn analysis starts with collecting customer data from many sources. Companies gather information from product usage, purchase history, support tickets, and web activity. Sobot’s AI-powered platform brings all this data together in one place. The system connects with voice, chat, email, and social media channels. This omnichannel approach gives a full view of each customer’s journey. Data cleansing and standardization make sure the information is accurate and ready for analysis. Real-time integration with Sobot’s Voice/Call Center allows businesses to track every call and message. This unified data source helps companies spot trends and patterns that lead to churn.

Churn Signals

Churn analysis looks for warning signs that a customer might leave. Analysts monitor behavior such as fewer logins, less product use, or more support complaints. Payment issues and switching to competitors also signal risk. Sobot’s analytics tools use machine learning to find these patterns in the data. The system tracks key metrics like churn rate, customer lifetime value, and engagement scores. Companies segment customers by risk level and value, so they can target the right people with retention offers. Continuous monitoring of these signals helps businesses act before customers churn.

Tip: Watch for sudden drops in usage or negative feedback. These changes often mean a customer is thinking about leaving.

Predictive Models

Churn analysis models use AI and machine learning to predict churn. These models look at past customer behavior and current trends. Sobot’s platform uses advanced algorithms like Light Gradient Boosting Machine and Random Forest. These models assign a churn probability score to each customer. The system explains which factors drive the risk, such as call count or contract type. Companies use these scores to focus on customers most likely to churn. In real-world tests, these models have shown high accuracy. For example, one model correctly identified 79% of customers who later canceled their service. Sobot’s real-time analytics and Voice/Call Center integration help businesses respond quickly to at-risk customers. This proactive approach turns churn analysis into a powerful tool for retention.

Turning Insights into Action

Proactive Retention Strategies

Companies use customer churn analysis to move from reacting to problems to preventing them. By tracking early warning signs, such as reduced product usage or missed onboarding steps, businesses can act before customers leave. Many organizations now refine their ideal customer profiles and map the customer journey to spot drop-off points. For example, HubSpot lowered its monthly churn rate from 3.2% to 2.1% by using predictive analytics to identify at-risk customers. Sobot’s platform automates these workflows, sending alerts and personalized offers when customers show signs of disengagement. This approach helps reduce customer churn and improve retention by focusing on the first 90 days, when customers are most likely to leave.

Companies that distinguish between voluntary and involuntary churn can tailor their retention efforts more effectively. Early interventions, such as onboarding checklists or targeted support, help keep customers engaged.

Personalization in Customer Support

Personalized support plays a key role in managing customer churn. Businesses use analytics to understand each customer’s needs and deliver tailored experiences. Real-time personalization, such as dynamic recommendations or targeted messages, increases customer engagement and satisfaction. For instance, companies like The Thinking Traveller saw a 33% rise in inquiries after using predictive analytics to anticipate customer needs. Sobot’s AI-driven solutions enable agents to access unified customer data, allowing for quick, relevant responses. This level of personalization not only improves retention but also boosts revenue by making customers feel valued.

Operational Optimization

Operational optimization uses churn analysis to streamline processes and improve retention. Companies measure key metrics like Customer Lifetime Value, Net Promoter Score, and Customer Effort Score to find friction points. Sobot’s solutions automate routine tasks, freeing agents to focus on complex issues. The OPPO success story shows how integrating Sobot’s chatbot and ticketing system led to an 83% chatbot resolution rate and a 57% increase in repurchase rate. By combining real-time analytics with automated workflows, businesses can reduce churn, improve retention, and enhance the overall customer experience.

Customer churn analytics gives every business a clear path to growth. Companies that use these insights see higher profits, better risk management, and stronger customer loyalty. The table below shows how analytics can reduce churn by up to 33% and increase profits by as much as 95%.

| Benefit Area | Key Statistics and Impact |

|---|---|

| Customer Churn Reduction | Up to 33% reduction in churn (Gartner, 2021) |

| Customer Retention | 62% higher retention rates (Aberdeen Group, 2022) |

| Customer Lifetime Value | 3.5x greater lifetime value (Forrester, 2022) |

| Profit Increase from Retention | 25% to 95% profit increase from a 5% retention boost (Harvard Business Review, 2021) |

Sobot’s solutions help businesses improve contact and support. Explore Sobot’s Voice/Call Center to see how analytics can transform your results.

FAQ

What is the main benefit of using customer churn analytics?

Customer churn analytics helps businesses find out why customers leave. Companies can use this information to keep more customers, increase profits, and improve customer satisfaction.

How does Sobot collect customer data for churn analysis?

Sobot gathers data from calls, chats, emails, and social media. The platform brings all this information together, making it easy to track customer behavior and spot churn risks.

Can Sobot’s Voice/Call Center help reduce churn?

Yes! Sobot’s Voice/Call Center uses AI to automate tasks and provide fast support. This leads to happier customers and lower churn rates.

What industries can benefit from Sobot’s churn analytics?

Sobot serves retail, finance, gaming, education, and more. Any business that wants to keep customers and grow can benefit from churn analytics.

How quickly can a business see results with Sobot?

Most businesses notice improvements in customer retention and satisfaction within a few months of using Sobot’s solutions.

See Also

Best Call Center Analytics Tools To Use In 2024

Comparing The Leading Voice Of Customer Software Solutions

Best Ten Voice Of Customer Platforms To Try In 2024