How to Find the Right Chatbot and Voicebot for Payments in 2025

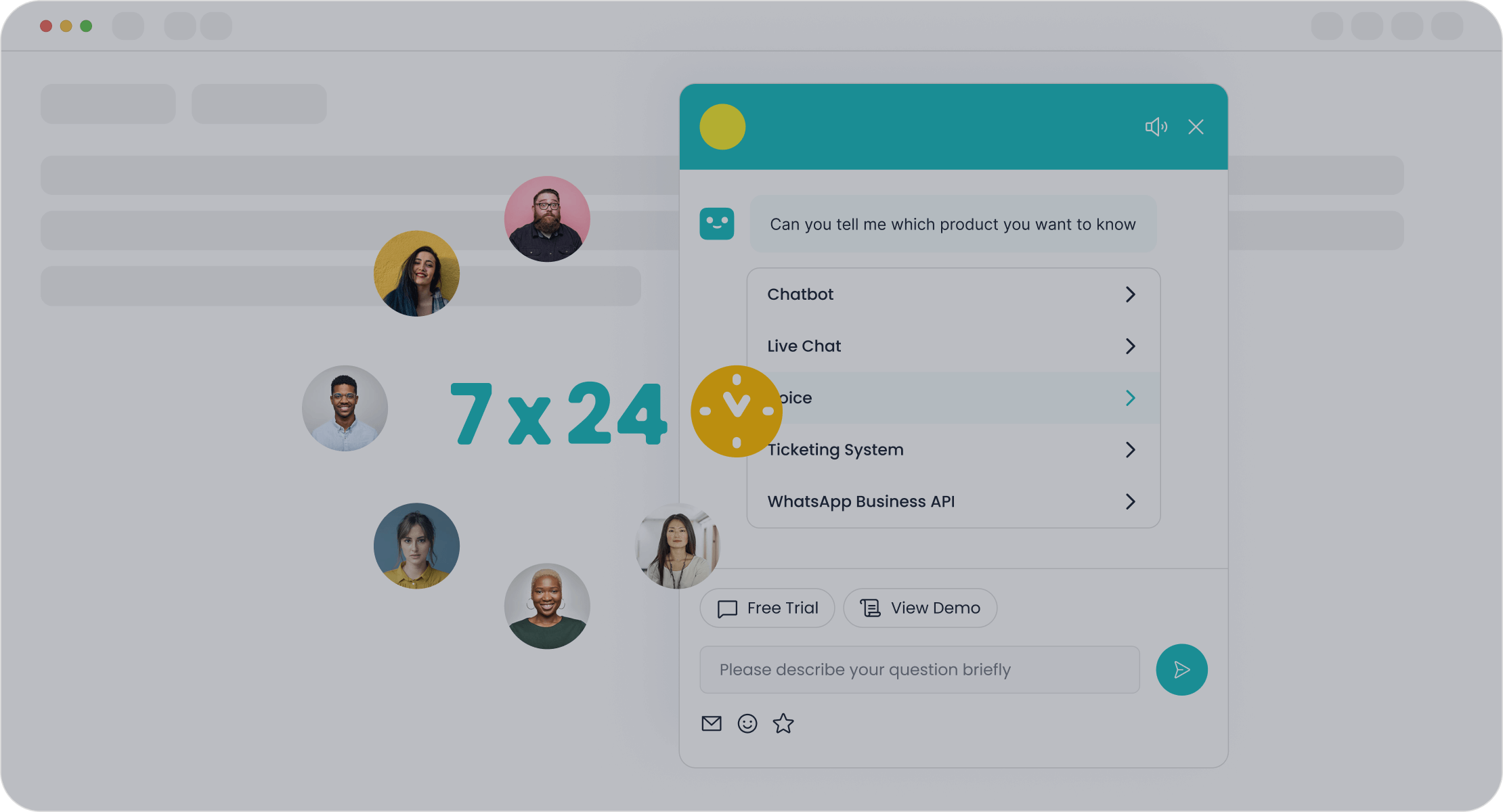

You want a chatbot and voicebot payment solution that keeps your customer safe and happy. Security matters—just one cyberattack can affect millions, as seen in past breaches involving payment card data. In 2022, over 98 million users interacted with bank chatbots, and this number keeps growing. Focus on solutions that handle high voice traffic, support fast response times, and deliver a smooth experience. Sobot AI gives you reliable voice and chatbot support, helping your customer get answers quickly while protecting their information. Always compare chatbot vs voice bot features to match your customer’s needs and industry standards.

Category Statistic / Description User Adoption (2022) Over 98 million users (~37% of U.S. population) engaged with bank chatbots Security Breach Example (2018) Cyberattack on Inbenta servers affecting 9.4 million data subjects, including 60,000 payment card details Financial Institutions Usage All top 10 largest commercial banks deployed chatbots

Payment Needs

Transaction Types

You need to understand which transaction types your customer prefers. Some customers use online credit card payments, while others choose electronic cash, checks, or small payments. Each type has unique features. For example, online credit card payments offer speed and convenience. Electronic cash can provide more privacy. Electronic checks work well for larger purchases. Small payments are common in gaming or digital content. Transaction processing systems help automate data capture and validation. These systems reduce errors and improve reliability for every customer. They also support faster and more accurate processing. In industries like retail, banking, and e-commerce, the right system can boost customer satisfaction. Studies show that customers trust some payment types more than others. For example, many people feel safer using Paypal than debit cards. This trust affects how your customer interacts with your payment system.

Volume

You must consider how many transactions your customer completes each day. High transaction volume can challenge your system. Chatbots and voicebots help manage this load. In 2023, chatbots processed over $100 billion in ecommerce transactions. About 41% of users trusted chatbots for payments. Voicebots also play a big role. Nearly 43% of voice device owners use them for shopping. As transaction volume grows, automation becomes more important. Processing large numbers of payments quickly keeps your customer happy. Sobot’s AI-powered chatbots handle millions of interactions daily, ensuring smooth processing even during peak times. The table below shows some key trends:

| Metric / Trend Description | Value |

|---|---|

| Ecommerce transactions via chatbots | $100 billion+ |

| Chatbot users trusting chatbots for transactions | 41% |

| Voice device owners using voicebots to shop | 43% |

Customer Demographics

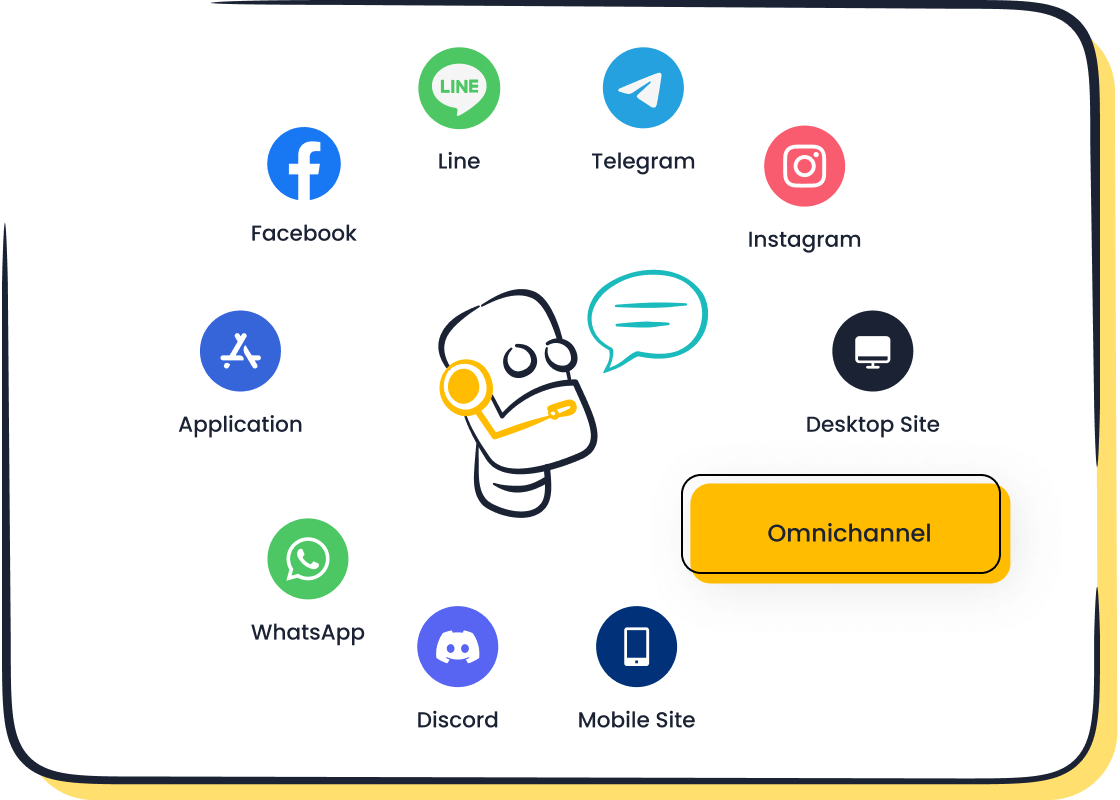

Your customer’s age, location, and habits shape their payment needs. Younger customers often prefer digital wallets or mobile payments. Older customers may stick with credit cards or checks. Customers in urban areas use voicebots and chatbots more often. In rural areas, some customers still rely on traditional banking. Understanding these differences helps you choose the right solution. Sobot’s omnichannel platform adapts to every customer, offering support across WhatsApp, SMS, and more. Multilingual chatbots make it easy for every customer to get help in their language. When you match your payment system to your customer’s habits, you improve satisfaction and loyalty.

Chatbot and Voicebot Security

When you choose a chatbot and voicebot for payments, you must focus on security. Payment systems handle sensitive information every second. You need to protect your customers’ data and keep their trust. Sobot’s solutions use advanced AI and strong security measures to keep your payment processing safe. Let’s look at the key areas you should check.

Data Security

Data security forms the backbone of any payment system. You must protect customer data during every step of processing. Sobot uses end-to-end encryption for all voice and chatbot interactions. This means your customer’s information stays safe whether it is moving or stored. Encryption methods like AES-256 and secure protocols such as TLS help block hackers from stealing data.

Note: Laws like GDPR and CCPA require companies to use strong encryption and access controls. These rules have helped reduce data breaches and fraud in digital payments. When you follow these standards, you show your customers that you value their privacy.

Here are some standard data security practices you should expect in any payment bot system:

- Use of encryption for data at rest and in transit.

- Tokenization to replace sensitive payment details with unique tokens.

- Regular security audits and vulnerability assessments.

- Secure website platforms with updated software and firewalls.

Sobot’s regular audits and compliance with global standards help you meet these benchmarks. You can learn more about Sobot’s financial solution here.

Authentication

Authentication makes sure only the right people access your payment system. You want your chatbot and voicebot to verify users before any transaction. Sobot supports multi-factor authentication (MFA) and role-based access control. These features add extra layers of protection.

- Many banks now use voice recognition to confirm a customer’s identity. For example, HSBC’s voicebot reduced fraud by 50% in one year by using biometric voice recognition.

- Sobot’s bots can request multiple pieces of information, such as account numbers or personal details, and cross-check them with your CRM data.

- Limiting the number of authentication attempts helps stop brute force attacks.

You should always balance security with ease of use. If your authentication process is too hard, customers may leave. Sobot’s AI-driven bots keep the process smooth and secure.

Fraud Prevention

Fraud prevention is a top priority in payment processing. You need systems that spot and stop suspicious activity fast. Sobot’s AI-powered bots use machine learning and behavioral analysis to detect fraud in real time. These bots watch for unusual patterns, such as large transfers or repeated failed logins.

Tip: Multi-factor authentication, regular monitoring, and strong encryption all help reduce fraud. PCI DSS compliance also sets clear rules for protecting cardholder data.

Here are some best practices for fraud prevention in chatbot and voice payment systems:

- Use machine learning to flag risky transactions.

- Monitor networks for suspicious activity.

- Reduce chargebacks by verifying cardholder identity.

- Keep software and plugins updated to block new threats.

Sobot’s proven track record with financial clients like Opay shows how effective these measures can be. Opay improved customer satisfaction from 60% to 90% and cut costs by 20% after using Sobot’s unified platform. This success came from strong security, seamless processing, and smart AI.

When you pick a chatbot and voicebot for payments, always check for end-to-end encryption, PCI compliance, and regular audits. Sobot’s solutions give you these protections, helping you build trust and keep your customers safe.

Regulatory Compliance

Meeting regulatory requirements is essential when you select a chatbot or voicebot for payments. You must protect your customers and your business from legal and financial risks. Let’s look at the main areas you need to understand.

PCI DSS

PCI DSS stands for Payment Card Industry Data Security Standard. This standard protects cardholder data during payment transactions. You need to make sure your chatbot or voicebot follows these rules. If you do not, you could face heavy fines or lose the right to process payments. The table below shows some important facts about PCI DSS and other key regulations:

| Regulatory Standard | Key Compliance Requirements | Penalties for Non-Compliance |

|---|---|---|

| PCI DSS | End-to-end cardholder data encryption; secure authentication methods | Fines from $5,000 to $100,000 per month; $50 to $90 per compromised cardholder |

| GLBA | Data breach protection; disclosure of shared customer data | Up to $100,000 fine per institution; $10,000 per occurrence for individuals; possible imprisonment up to 5 years |

| GDPR | Explicit customer consent for data collection; right to data deletion | Fines reaching millions of dollars; e.g., $60 million fine on Morgan Stanley for oversight failure |

| CCPA | Transparency in data gathering; user notification and opt-out options | Fines up to $7,500 for willful breaches; $2,500 for accidental breaches |

Sobot’s financial solutions use end-to-end encryption and secure authentication to help you meet PCI DSS requirements. This keeps your payment data safe and your business protected.

Data Privacy Laws

Data privacy laws like GDPR and CCPA set strict rules for how you collect, store, and use customer data. You must get clear consent from users and give them control over their information. Many businesses struggle with these laws. The cost of a data breach keeps rising, with the average reaching $4.45 million in 2023 (source). Phishing and online payment fraud remain common, affecting hundreds of thousands each year. Most Americans do not fully understand how companies use their data, and many distrust how AI handles personal information.

- The number of businesses facing million-dollar breaches grew from 27% to 36% in one year.

- Only about half of organizations increase security after a breach.

- Over 70% of Americans have limited knowledge of data privacy laws.

Sobot’s platform supports compliance with global privacy laws by offering strong encryption, access controls, and clear data management policies.

Local Regulations

Local rules can change how you design and use payment bots. Each state or country may have unique requirements. For example, chatbots can answer questions about specific state laws, like meal limits for healthcare workers in New York. They can also provide instant guidance on local policies, such as fraud alerts or training rules in New Jersey.

- Chatbots can adapt to local rules and provide accurate, up-to-date information.

- Integration with regulatory documents helps bots deliver detailed, location-specific advice.

Sobot’s AI chatbots can be customized to meet local regulations, making it easier for you to stay compliant wherever you operate.

Sobot Chatbot Integration

Choosing the right chatbot or voice chatbots for payments means you need seamless integration with your current systems. Sobot’s solution stands out because it connects easily with your tools and channels. You get a unified experience for both your team and your customers. This section explains how Sobot’s integration features help you deliver fast, secure, and reliable payment support.

API Support

You want your bot to connect with your payment gateways, CRM, and other business tools. Sobot offers strong API support, making it easy to link your chatbot or voice bot to different platforms. With API-driven integration, you can add new payment methods or update features without major changes. This flexibility keeps your payment system agile and ready for new technology. Sobot’s AI bots use APIs to automate payment tracking and reporting. This led to a 35% increase in productivity and fewer payment delays for clients. You also get real-time updates and error reduction, which means your support team can solve problems faster.

Platform Compatibility

Your customers use many channels—mobile apps, web portals, and voice systems. Sobot’s omnichannel solution gives you seamless integration across all these platforms. You can support payments on WhatsApp, SMS, and even IVR voice calls. This flexibility lets your customers choose the channel that fits their needs. Businesses that offer multi-channel payment access see faster processing and higher satisfaction. Sobot’s AI-powered bots work on every channel, so you never miss a payment request. The table below shows why platform compatibility matters:

| Benefit | Impact |

|---|---|

| Multi-channel payment support | Faster payments, less friction |

| Self-serve options | Lower costs, higher customer satisfaction |

| Enhanced security | Better compliance, fraud prevention |

Scalability

As your business grows, you need a bot that can handle more voice and payment requests. Sobot’s AI solution scales with your needs. You can process millions of interactions daily without losing speed or accuracy. For example, Opay unified its customer contact with Sobot, which led to a 25% increase in satisfaction and a 17% boost in conversion rates. Sobot’s bots use automation and real-time tracking to manage high volumes. You get reliable support, even during peak times. This makes Sobot a future-ready choice for chatbot vs voice bot needs.

Sobot’s seamless integration, strong API support, and platform compatibility help you deliver secure, efficient, and scalable payment support. You can trust Sobot’s AI-powered bots to keep your payment system running smoothly as your business grows.

Customer Experience

Conversational Design

You want every customer to feel understood and valued during each interaction. A well-designed bot uses natural language processing (NLP) to create smooth, human-like conversations. When a bot responds quickly and with a friendly tone, your customer feels more comfortable sharing payment details. Studies show that customer satisfaction scores can rise by 25% after adding chatbots to payment systems. Churn rates drop, and more customers confirm their issues get resolved. The table below highlights what drives user satisfaction in payment chatbots:

| User Satisfaction Factor | Measurement Method | Key Findings |

|---|---|---|

| Responsiveness and Conversational Tone | Survey of 958 US users, 7-point Likert scale | Positive predictors of customer satisfaction in chatbot services, especially in banking contexts. |

| Anthropomorphic Design Cues | Experiment with 153 participants, 7-point Likert scale | Increased user compliance and satisfaction; users apply social expectations even knowing it’s a chatbot. |

| Information Quality and Service Quality | Survey of 370 chatbot users, 7-point Likert scale | Both positively impact user satisfaction and continued use intentions. |

A bot with a natural, conversational style builds trust and improves the overall customer experience. Sobot’s AI-powered chatbots use advanced NLP and voice technology to deliver fast, accurate, and natural responses, making every interaction feel personal.

Accessibility

You need to make sure every customer can access your payment bot, no matter their ability or device. Good accessibility means your bot works on mobile, desktop, and voice channels. Sobot’s omnichannel platform supports customers on WhatsApp, SMS, and voice calls, so everyone gets the help they need. Voice AI customer service lets people use speech to complete payments, which helps users who may struggle with typing or reading. Customer service automation also ensures 24/7 support, so your customer never waits for help. Analytics and quality checks help you improve accessibility and customer service over time. When you focus on accessibility, you boost customer satisfaction and create a better user experience for everyone.

Multilingual Support

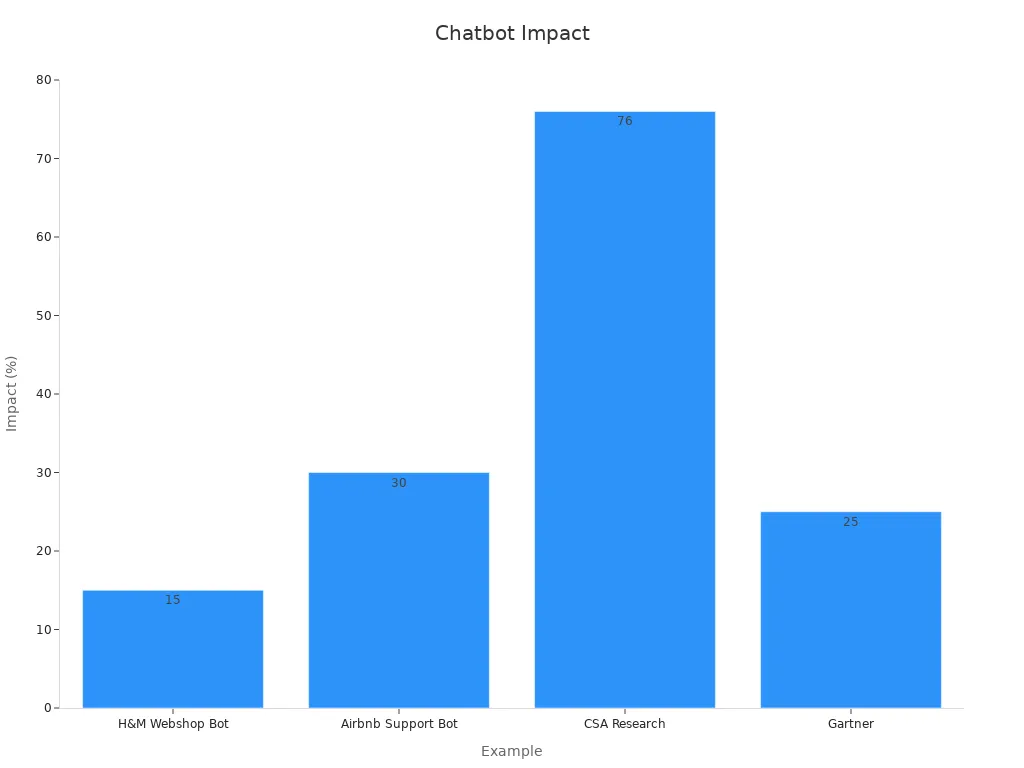

Your customers come from many backgrounds and speak different languages. Multilingual support is key for expanding your payment solution and improving customer engagement. Research shows that 76% of consumers prefer brands that interact in their native language. Businesses using multilingual bots see higher conversion rates and better customer experience. For example, H&M increased sales by 15% with a localized chatbot. Sobot’s AI chatbots offer real-time, natural conversations in multiple languages, breaking down barriers and making every interaction smooth. The chart below shows how multilingual capabilities drive chatbot performance and customer satisfaction:

With Sobot, you can automate customer service in any language, reduce costs, and support global growth. Multilingual NLP and voice features help you deliver a seamless, natural user experience for every customer, everywhere.

Vendor Trust and Support

Certifications

Certifications show you that a vendor takes payment security and customer service seriously. When you choose a chatbot or voicebot for payments, look for vendors with industry-recognized certifications. The CPFPP (Certified Payments Fraud Professional Program) stands out as a key credential. It proves that the team understands payment fraud prevention and builds trust in the payment landscape. Vendors with PCI DSS compliance and Qualified Security Assessors (QSAs) on staff follow strict security standards. These certifications mean the vendor uses structured processes to protect your data and deliver reliable service. Sobot meets global standards and works with certified professionals to ensure your payment system stays secure and compliant.

Reviews

You should always check reviews and feedback before choosing a payment solution. Reviews from other businesses give you real-world insights into customer service quality and support reliability. Look for vendors with high ratings for service, fast response times, and strong support during critical issues. Many companies use a checklist to verify vendor trust:

- Check insurance and tax compliance documents.

- Review credit scores and financial statements.

- Investigate compliance with legal and industry standards.

- Ask for references from past clients.

- Monitor vendor status for any changes.

- Request regular audits and process reviews.

- Use multi-factor authentication for vendor payment changes.

- Choose vendors that use automation for accuracy and fraud detection.

Sobot’s clients, such as Opay, report higher satisfaction and improved customer service after switching to Sobot’s unified platform. You can find more customer stories on Sobot’s website.

Service and Updates

Ongoing service and regular updates keep your payment chatbot secure and effective. Payment solutions must follow standards like PCI DSS, which require frequent software updates and strong security practices. Regular updates help fix vulnerabilities and protect against new threats. This ongoing maintenance builds trust and keeps your customer service running smoothly. Sobot provides continuous service improvements, security patches, and 24/7 support. This approach ensures your chatbot or voicebot always meets the latest security requirements and delivers reliable service. Investing in a vendor that values regular updates and strong support helps you protect payment transactions and maintain customer satisfaction.

Tip: Always ask your vendor about their update schedule and support options. Reliable service and proactive support make a big difference in your customer service experience.

Future-Proofing

AI Advancements

You want your payment system to stay ahead. AI voice bot solutions lead the way in digital payments. AI now detects fraud in real time, using biometric authentication and behavioral analytics. This keeps your customers safe. AI also speeds up payment processing and reduces errors. You see cost savings because AI lowers fraud losses and operational costs. AI voice bot solutions help you offer new payment models, like blockchain and cryptocurrency. Many companies, such as PayPal and Stripe, use AI to reduce fraud and improve user experience. AI voice bot solutions give you real-time analytics, so you can make better decisions and offer personalized payment options. AI adoption grows fast among small businesses because the tools are easy to use and cost-effective. You can trust Sobot’s advanced conversational ai to deliver natural, secure, and efficient payment support.

- AI improves security with real-time fraud detection and biometric authentication.

- AI automates tasks, making payment processing faster and more accurate.

- AI voice bot solutions enable new payment models and better customer experiences.

- AI provides real-time insights for risk assessment and personalized offers.

- AI voice bot solutions support collaboration between banks and fintechs for innovation.

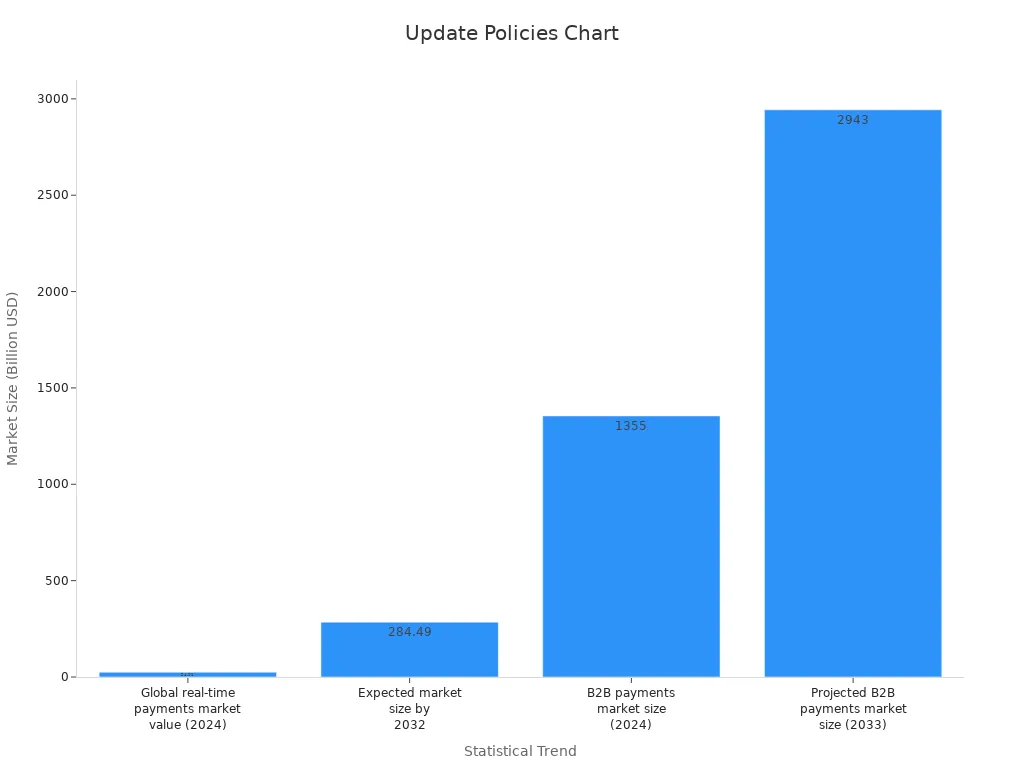

Update Policies

You need regular updates to keep your payment system secure and competitive. AI voice bot solutions rely on strong update policies to stay effective. The global real-time payments market reached $24.91 billion in 2024. Experts expect it to grow to $284.49 billion by 2032, with a 35.4% annual growth rate. These numbers show that regular updates help payment systems scale and stay relevant. Update policies also support new features, better security, and compliance with changing laws. Sobot’s AI voice bot solutions receive frequent updates, so you always have the latest security and natural language features. Regular code audits and updates help you meet new regulations and keep your system running smoothly.

| Statistical Trend | Value | Implication for Update Policies Effectiveness |

|---|---|---|

| Global real-time payments market value (2024) | $24.91 billion | Shows strong adoption of advanced payment systems. |

| Projected CAGR (2025-2032) | 35.4% | Indicates rapid growth and need for regular updates. |

| Expected market size by 2032 | $284.49 billion | Proves that updates keep systems competitive. |

Roadmap

You want a clear roadmap for your AI voice bot solutions. Future-proofing means planning for new technologies and regulations. You should look for solutions that support open banking, API integration, and compliance with rules like PSD2, GDPR, and the EU AI Act. AI voice bot solutions must balance innovation with security and user convenience. Sobot’s roadmap includes regular updates, new natural language features, and support for more payment channels. You can expect Sobot to keep improving its AI voice bot solutions, making them smarter, more secure, and more natural. This approach helps you stay ready for changes in the payment industry and meet your customers’ needs.

- Plan for open banking and API integration.

- Follow new regulations for fairness and transparency.

- Use AI voice bot solutions that adapt to new security threats.

- Choose vendors like Sobot that invest in natural language and voice technology.

- Stay informed about trends in AI, voice, and payment innovation.

You want every customer to trust your voice payment system. Start by checking if the voice solution protects customer data and meets security rules. Make sure the voice bot works with your customer’s favorite channels. Test if the voice system helps each customer finish payments fast. Sobot gives you a voice solution that keeps every customer safe and happy. Use a checklist to compare voice features and ask Sobot for advice. Stay updated on voice trends to give your customer the best experience.

FAQ

What makes a chatbot or voicebot secure for payments?

You need strong security for payment bots. Look for end-to-end encryption, PCI DSS compliance, and regular audits. Sobot uses these features to protect your data. According to IBM, the average cost of a data breach reached $4.45 million in 2023 (source).

How do I know if a chatbot or voicebot supports my payment methods?

Check if the chatbot or voicebot offers API support and platform compatibility. Sobot integrates with major payment gateways and supports omnichannel payments. You can process transactions on WhatsApp, SMS, and web platforms, making payments easy for your customers.

Can a chatbot or voicebot handle high payment volumes?

Yes, advanced bots like Sobot process millions of transactions daily. For example, Sobot’s AI-powered chatbots manage over 6 million online communications and 3 million phone calls per day. This ensures your payment system stays reliable, even during busy times.

Does Sobot support multilingual payment interactions?

Sobot’s chatbot and voicebot solutions offer multilingual support. You can serve customers in their preferred language. Research shows 76% of consumers prefer brands that communicate in their native language. This feature helps you expand your payment services globally.

How often should I update my chatbot or voicebot payment solution?

You should update your payment chatbot or voicebot regularly. Frequent updates keep your system secure and compliant. Sobot provides ongoing updates and security patches. This helps you meet new regulations and protect your customers’ payment data.

See Also

How To Select The Ideal Chatbot Software Solution

Steps To Build A Chatbot That Boosts Website Success

The Best Ten Chatbots For Websites In 2024