Chatbots in Insurance Delivering Real Results for Companies

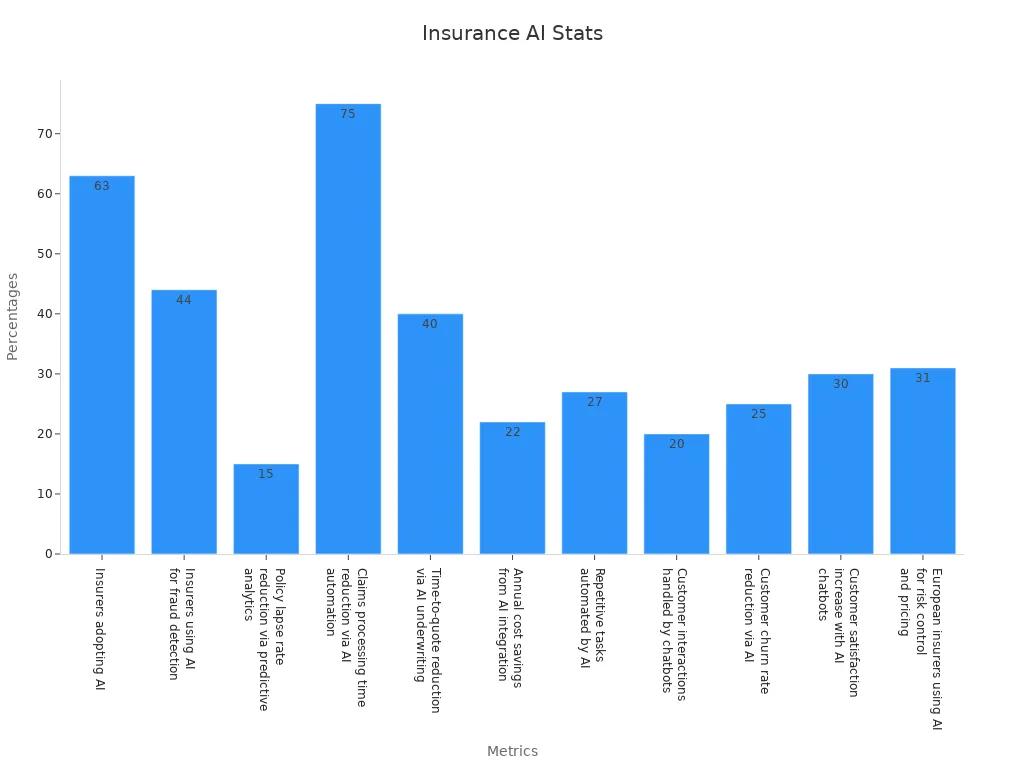

Chatbots in insurance have sparked a new era of customer service, producing measurable success for companies worldwide. Organizations see customer service costs drop by up to 40% and satisfaction rates climb 30%. The impact shines in real numbers:

| Benefit | Value |

|---|---|

| Customer service cost reduction | 30-40% |

| Customer satisfaction increase | 30% |

| Claims processing time reduction | Up to 75% |

| Customer interactions handled by chatbots | 20% |

Sobot leads this transformation with Sobot AI, helping insurers deliver round-the-clock customer service, boost efficiency, and achieve lasting success.

Chatbots in Insurance Today

Customer Service Evolution

Customer service in insurance has changed quickly. Companies now use chatbots in insurance to answer questions, solve problems, and guide customers every day. These chatbots work around the clock, giving instant help and making customer service faster and more reliable. Many leading insurers, like Lemonade and Allstate, have seen great results. For example, Lemonade’s AI chatbot helps customers buy policies and file claims with ease, leading to higher satisfaction and loyalty.

Today’s customer support chatbot can handle many tasks at once. This frees up human agents to focus on complex issues and creates more time for building relationships with customers.

A recent study shows that 88% of auto insurers, 70% of home insurers, and 58% of life insurers use or plan to use AI models, including chatbots, for customer service and support. The table below highlights this trend:

| Insurance Sector | Adoption Rate of AI/ML Models (%) | Key Use Cases of AI/Chatbots |

|---|---|---|

| Auto Insurance | 88% | Customer service chatbots, claims, marketing, fraud detection |

| Home Insurance | 70% | Customer support, claims, underwriting, pricing |

| Life Insurance | 58% | Customer service, policy issuance, risk classification |

Sobot’s AI-powered chatbots help insurers deliver personalized customer experiences and improve customer service quality. Sobot’s solutions support multiple languages and channels, making customer support simple and effective for everyone.

Claims Automation

Claims processing once took days or weeks. Now, chatbots in insurance speed up every step. They collect claim details, check documents, and update customers in real time. This automation leads to faster claims and happier customers.

A major insurer cut claim turnaround time by 50% after using AI chatbots for document checks and customer communication. Some companies have seen up to 70% faster claims processing. Customers now get updates instantly and can track their claims without waiting on hold.

Tip: Automated claims processing not only saves time but also reduces errors and improves trust.

Sobot’s chatbots help insurance teams automate claims, reduce manual work, and keep customers informed. This means better customer service, lower costs, and more satisfied policyholders. As more insurers adopt chatbots in insurance, the industry continues to move toward smarter, more efficient customer service.

Insurance Chatbot Implementation

Key Steps

Insurance companies today see the value of digital transformation. The journey to a successful insurance chatbot starts with a clear plan. Leaders in the industry follow a series of steps to ensure smooth adoption and strong results.

-

Assess Current Processes

Teams look at claims and customer service workflows. They find areas where an insurance chatbot can save time and reduce errors. -

Set Clear Goals

Companies define what they want to achieve. Some aim to cut claims processing time. Others want to boost customer satisfaction or lower costs. -

Choose the Right Technology

Decision-makers select AI tools that fit their needs. They look for chatbots with natural language processing and machine learning. -

Train Staff

Employees learn how to work with the new insurance chatbot. Training helps teams use the technology with confidence. -

Run Pilot Programs

Insurers test the chatbot in a small setting. They gather feedback and make improvements before a full rollout. -

Monitor and Improve

Teams track key metrics like efficiency, accuracy, and customer happiness. They use this data to make the chatbot even better. -

Promote a Culture of Innovation

Leaders encourage everyone to embrace new technology. This mindset helps the company grow and adapt.

Tip: Companies that follow these steps often see faster claims, happier customers, and lower costs.

Here is a table that shows the impact of these steps:

| Key Implementation Metrics | Statistic | Description |

|---|---|---|

| Customer Service Cost Reduction | 30% | Conversational AI reduces customer service costs by 30%, increasing ROI. |

| Underwriting Accuracy | Over 95% | AI tools achieve accuracy rates exceeding 95% in underwriting processes. |

| Claims Processing Manual Effort Reduction | Up to 80% | AI reduces manual effort in claims processing by up to 80%. |

| Insurance Chatbot Market Growth (CAGR) | 25.6% | The market is expected to grow at a 25.6% CAGR from 2023 to 2032. |

| AI Adoption Rate in Insurance Companies | 77% | 77% of insurers are adopting AI technologies in their value chain. |

| Productivity and Expense Improvement | Up to 40% | Potential productivity gains and expense reductions up to 40% by 2030. |

| Claims Processing Speed Improvement | 80% faster | AI-driven tools reduce claims processing time and errors. |

| Customer Support Availability | 24/7 | Chatbots provide round-the-clock support for routine inquiries and tasks. |

These numbers show why so many insurers now rely on an insurance chatbot for daily operations. Source: McKinsey, Allied Market Research

Sobot Chatbot Integration

Sobot stands out as a trusted partner for insurance companies. Its insurance chatbot brings advanced AI to every customer interaction. Sobot’s solution offers several features that make integration smooth and effective.

-

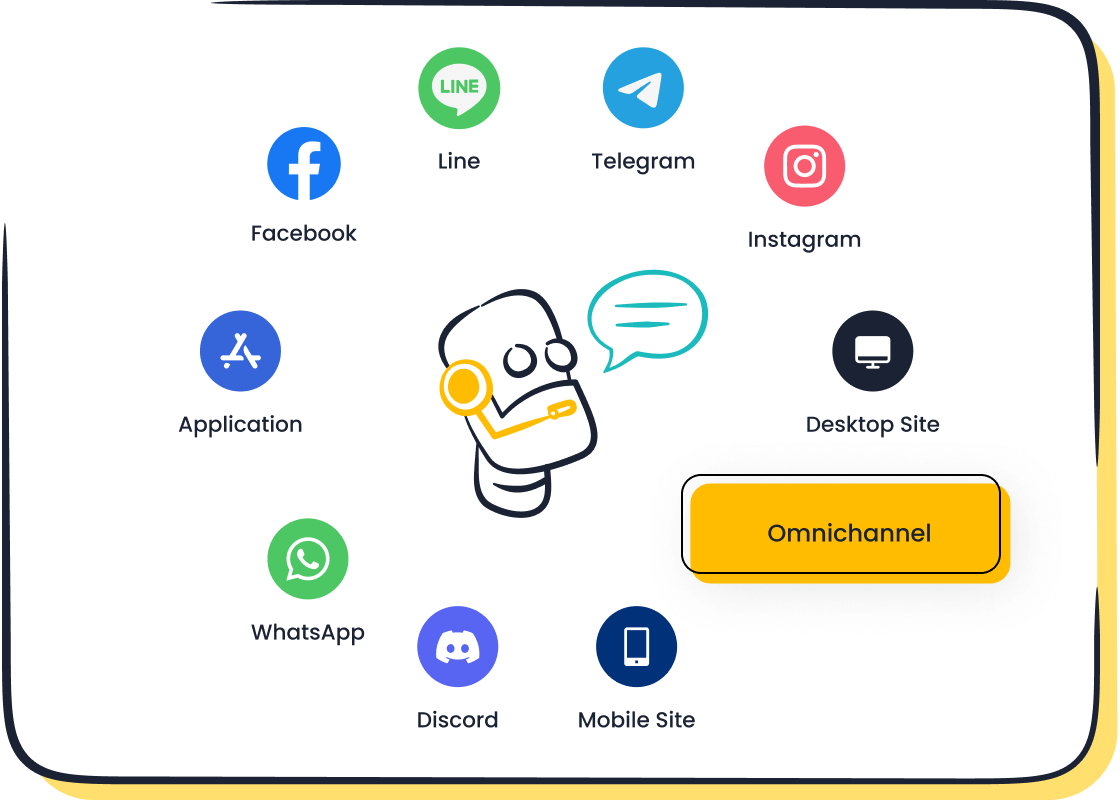

Omnichannel Support

Sobot’s insurance chatbot connects with customers on WhatsApp, SMS, and other channels. This ensures policyholders get help wherever they are. -

Multilingual Capabilities

The chatbot speaks many languages. Insurers can serve diverse customers without barriers. -

24/7 Availability

Sobot’s chatbot never sleeps. It answers questions, files claims, and updates customers at any hour. -

No Coding Required

Teams use a point-and-click interface to set up workflows. This makes the insurance chatbot easy to launch and update. -

Smart Automation

The chatbot handles routine queries, triages requests, and assists agents. This boosts productivity by up to 70% and cuts costs by as much as 50%. -

Customizable Workflows

Insurers tailor the chatbot to fit their unique needs. Sobot’s solution adapts to different products, policies, and customer journeys. -

Robust Reporting

Sobot provides detailed analytics. Leaders track performance and optimize the chatbot for better results.

A typical insurance chatbot implementation with Sobot follows these steps:

- Map out customer journeys and identify touchpoints for automation.

- Import knowledge bases from articles, PDFs, or spreadsheets.

- Design conversation flows using Sobot’s intuitive builder.

- Integrate with existing CRM and claims systems.

- Launch the chatbot across digital channels.

- Monitor performance and refine responses based on real data.

Note: Sobot’s insurance chatbot helps companies gain 30% more leads and boost conversions by 20%. The benefit extends to both customers and agents, creating a win-win for everyone.

Sobot’s proven track record in financial services shows its commitment to innovation and customer-centricity. With over 10,000 brands served and a system stability of 99.99%, Sobot empowers insurers to deliver seamless, secure, and scalable customer experiences. Learn more about Sobot’s insurance chatbot.

AI Chatbot Success Stories

Customer Engagement

Many companies in the insurance and financial sectors have seen remarkable growth in customer engagement after adopting AI chatbots. These ai chatbot success stories show how technology can transform the way people connect with their insurance providers. Sobot’s AI-powered chatbot helps insurers reach customers on their favorite channels, like WhatsApp and SMS, and in their preferred language. This approach makes every interaction feel personal and immediate.

A leading insurance company used Sobot’s chatbot to answer policy questions and send reminders. The result was a 25% increase in customer satisfaction scores and a 30% boost in first-contact resolution. Customers now receive instant answers, which keeps them happy and loyal. Sobot’s solution also helped the company gain 30% more leads, showing a clear path to higher ROI.

Customers expect quick responses. Studies show that 82% want immediate answers to sales questions, and 72% expect the same for service inquiries. If they do not get a reply within one minute, 60% will leave.

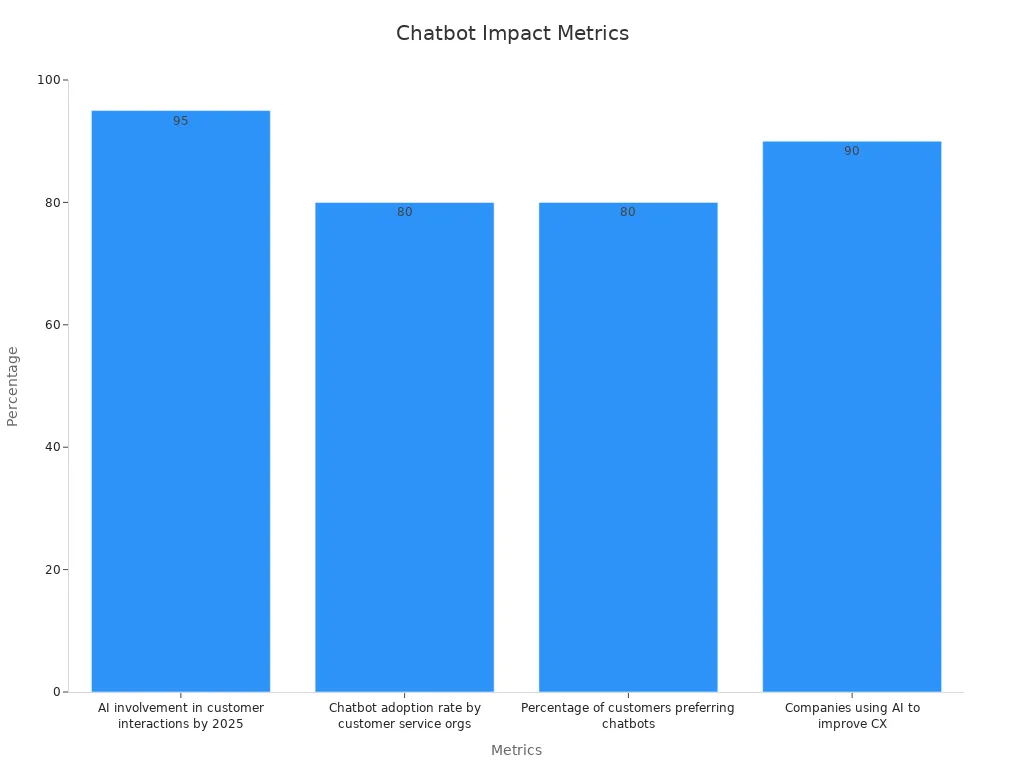

The table below highlights the impact of AI chatbots on customer engagement:

| Statistic | Value / Outcome |

|---|---|

| AI involvement in customer interactions by 2025 | 95% of all interactions (voice and live chat) |

| Chatbot adoption rate by customer service orgs | 80% |

| Percentage of customers preferring chatbots | 80% (if live agent option available) |

| Companies using AI to improve CX | 90% |

These ai chatbot success stories inspire other insurers to follow. Sobot’s clients often report higher Net Promoter Scores (NPS) and stronger customer loyalty. Notable examples include banks and payment companies that use Sobot to send secure updates and activate dormant customers with special offers. These results prove that AI chatbots drive engagement and deliver real success.

Operational Efficiency

AI chatbots do more than just engage customers. They also help companies work smarter and save money. Sobot’s chatbot automates routine tasks, answers common questions, and supports agents. This leads to faster service and lower costs. Many insurers have seen their average response time drop from two hours to less than one minute.

The table below shows how AI chatbots improve operational efficiency:

| Metric | Outcome / Statistic |

|---|---|

| Reduction in average response time | From 2 hours to less than 1 minute |

| Percentage of routine queries handled | Up to 80% without human intervention |

| Annual operational cost savings | Up to $300,000 |

| Labor hours saved | 2.5 billion hours |

| Increase in customer satisfaction rates | Up to 25% |

| Customer satisfaction (CSAT) scores | 85% or higher |

| Expected AI handling of customer interactions by 2025 | 95% of all interactions (voice and text) |

| Increase in first-contact resolution | Significant improvement |

| Market growth projection | $10–15 billion in 2025 to $46–47 billion by 2029 (CAGR 24–30%) |

Sobot’s ai chatbot success stories include a global financial services provider that reduced manual claims processing by 80%. The company saved up to $300,000 each year and improved ROI by streamlining workflows. Agents now focus on complex cases, while the chatbot handles routine requests. This shift leads to higher productivity and better service for everyone.

Notable examples from Sobot’s client base show that automation can boost conversions by 20% and cut expenses by half. These results encourage more insurers to invest in AI chatbots for long-term success.

Sobot’s platform stands out for its reliability and scalability. With over 10,000 brands served and a system stability of 99.99%, Sobot delivers consistent results. These ai chatbot success stories prove that technology can help insurers achieve their goals, improve ROI, and create lasting value for customers and teams.

Measuring Success

ROI Metrics

Insurance companies want to see clear results from their chatbot investments. They look for strong roi to prove their decision brings real value. Many leaders use specific metrics to measure roi and track success. These metrics help them understand how chatbots like Sobot drive growth and efficiency.

- Conversion Rate: Shows how many users complete actions such as requesting quotes or signing up for policies.

- Click-Through Rate: Measures how often users engage with links shared by the chatbot.

- Cost per Conversation: Compares the cost of chatbot interactions to those handled by human agents, showing cost savings.

- User Interaction Rate and Session Length: Reveal how engaged customers feel during chatbot sessions.

- Escalation Rate: Tracks how often the chatbot needs to transfer a conversation to a human agent.

Many companies report a reduction in Average Handle Time by 62.5%, dropping from 8 minutes to just 3. This improvement means agents can help more customers in less time. Financial leaders also use Payback Period, Net Present Value, and Internal Rate of Return to evaluate roi. They calculate roi using the formula: (Net Benefit / Total Costs) * 100. Continuous monitoring of KPIs like Bot Containment Rate and First Contact Resolution ensures ongoing success. Sobot provides clear chatbot roi examples, showing how insurers save money and boost productivity. These chatbot roi examples inspire others to follow the same path to success.

Customer Satisfaction

Customer satisfaction stands at the heart of every insurance company’s mission. Chatbots play a big role in reaching this goal. Sobot’s chatbot helps companies deliver fast, friendly, and accurate service. Leaders use key performance indicators to measure how well the chatbot improves customer happiness.

| KPI Name | Description | Relevance to Customer Satisfaction Improvement |

|---|---|---|

| Customer Satisfaction Score | Measures how happy customers feel after chatbot interactions. | Shows direct approval of chatbot service. |

| Resolution Rate | Percentage of issues solved by the chatbot alone. | Proves chatbot can solve problems and reduce customer effort. |

| First Call Resolution Rate | Tracks if the chatbot solves the issue on the first try. | Reduces frustration and builds trust. |

| Call Deflection Rate | Percentage of queries handled without human help. | Shows smooth automation and better experiences. |

| Customer Effort Score | Measures how easy it is for customers to get help. | Lower scores mean less effort and more satisfaction. |

| Return on Investment | Compares financial gains to costs, proving operational efficiency. | Shows how roi benefits both the company and customers. |

Sobot’s clients often see CSAT scores rise above 85%. Customers enjoy quick answers and easy solutions. These results prove that chatbot success leads to happier policyholders and lasting loyalty.

Future of Chatbots in Insurance

Trends

The insurance industry stands on the edge of a digital revolution. Companies now use ai-driven chatbots to deliver 24/7 personalized support. These chatbots help customers file claims, manage policies, and get advice in real time. Experts predict that by 2025, AI will handle 85% of all customer service engagements in insurance. The market for AI in insurance is growing fast, with forecasts showing a jump from $16.23 billion in 2023 to $76.78 billion by 2030, at a CAGR of 33.5% (source).

Key trends shaping the future include:

- More insurance companies invest in AI, with 90% planning to increase spending.

- Natural Language Processing (NLP) makes chatbots smarter and more helpful.

- Insurers use advanced analytics for better risk assessment and fraud detection.

- Real-world examples, like Lemonade’s chatbots, show how AI speeds up policy signups and claims.

- Companies like Sobot lead the way by offering multilingual, omnichannel chatbots that fit any workflow.

The future belongs to insurers who embrace automation, data, and customer-centric technology.

Best Practices

Successful insurance providers follow proven steps when adopting chatbots. They use chatbots across many channels, such as WhatsApp and voice assistants, to reach customers where they feel most comfortable. These chatbots combine AI with dynamic knowledge bases to automate sales, claims, and service.

Best practices include:

- Start with simple tasks and expand as customers grow more comfortable.

- Use data to personalize every interaction and make customers feel valued.

- Watch customer behavior and adjust chatbot roles for the best results.

- Integrate chatbots into the company’s digital strategy for a seamless experience.

- Choose solutions like Sobot that offer easy setup, strong analytics, and secure communication.

Tip: Insurers who listen to their customers and adapt quickly will build trust and loyalty for years to come.

Insurance companies now see real success with chatbots. Many teams report customer service costs dropping by 40%. Sobot’s chatbot leads this change, helping brands reach new levels of customer service success. Agents spend more time on complex needs, while chatbots handle routine customer service. Sobot’s proven results show that success in customer service is possible for every insurer. Companies ready for the next step can start with Sobot and build a future of customer service success.

FAQ

What are the main benefits of chatbots in insurance?

Chatbots in insurance help companies reduce customer service costs by up to 40%. They also improve customer satisfaction by 30% and speed up claims processing by 75%. Sobot’s AI chatbot delivers these results with 24/7 support and multilingual service.

How do chatbots in insurance improve customer engagement?

Chatbots in insurance provide instant answers and personalized support. Sobot’s chatbot helps insurers reach customers on WhatsApp, SMS, and more. Companies using Sobot report a 25% increase in customer satisfaction and a 30% boost in first-contact resolution.

Can chatbots in insurance handle complex claims?

Most chatbots in insurance manage routine claims and collect information. Sobot’s AI chatbot can triage requests and assist agents, making claims faster and more accurate. Human agents handle complex cases, while chatbots manage simple tasks.

Is it easy to set up a chatbot for insurance companies?

Yes! Sobot’s chatbot uses a point-and-click interface. Teams can launch workflows without coding. The chatbot integrates with CRM and claims systems, making setup fast and simple. Most insurers see results within weeks.

How secure are chatbots in insurance for customer data?

Sobot’s chatbots in insurance follow strict data privacy standards. The platform supports public and private cloud deployment. Insurers trust Sobot to protect sensitive information and ensure compliance with industry regulations. Learn more about Sobot’s security here.

Tip: Chatbots in insurance create safer, faster, and more reliable customer experiences every day.

See Also

Ways Chatbots Enhance Customer Experience In E-commerce

The Best Ten Chatbots To Use On Websites 2024

Leading Ten Websites Employing Chatbots This Year