What Are Business Assessment Outcomes and Why They Matter

Business Assessment Outcomes (BAO) represent the measurable results derived from evaluating a company's performance through key indicators. These outcomes play a pivotal role in modern business management. For instance, companies leveraging real-time data analytics have reported a 30% boost in operational efficiency, as highlighted in a 2022 McKinsey study. Furthermore, businesses tracking metrics like Customer Satisfaction Score (CSAT) and Net Promoter Score (NPS) have observed a 15% rise in customer loyalty.

BAO also enable organizations to refine their strategies using predictive analytics. By analyzing historical data, businesses can allocate resources effectively and adapt to evolving customer needs. Tools like Sobot's advanced contact center solutions exemplify how BAO can enhance customer interactions, streamline operations, and foster long-term success.

Understanding Business Assessment Outcomes (BAO)

What Are Business Assessment Outcomes?

Definition and purpose

Business Assessment Outcomes (BAO) are the measurable results derived from evaluating a company's performance across various dimensions. These outcomes provide actionable insights into operational efficiency, customer satisfaction, and financial health. By analyzing BAO, businesses can identify strengths, weaknesses, and opportunities for growth. For instance, organizations often use tools like data visualization and trend identification to interpret feedback and guide decision-making. A report analyzing regional research systems highlights how assessment policies in countries like the U.K. and Australia have significantly influenced institutional management and societal benefits. These examples underscore the importance of BAO in shaping strategies and achieving long-term objectives.

Real-world examples of BAO in action

In practice, BAO drive success across industries. For example, companies leveraging Big Data analytics outperform competitors in customer acquisition by 23 times. In healthcare, predictive analytics has improved patient outcomes and reduced costs by up to 20%. Retail giants like Amazon use BAO to predict customer preferences, enhancing satisfaction and boosting sales. Similarly, Sobot's Voice/Call Center empowers businesses to analyze call data, track trends, and optimize customer interactions. These real-world applications demonstrate how BAO enable organizations to adapt to market demands and deliver exceptional results.

The Role of BAO in Business Success

Evaluating performance and identifying gaps

BAO play a critical role in evaluating performance and uncovering gaps. Program assessment tools and statistical analysis help businesses interpret large datasets, identify inefficiencies, and align operations with strategic goals. For example, companies using these tools can pinpoint areas needing improvement, such as delivery times or customer service response rates. This data-driven approach ensures continuous improvement and fosters sustainable growth.

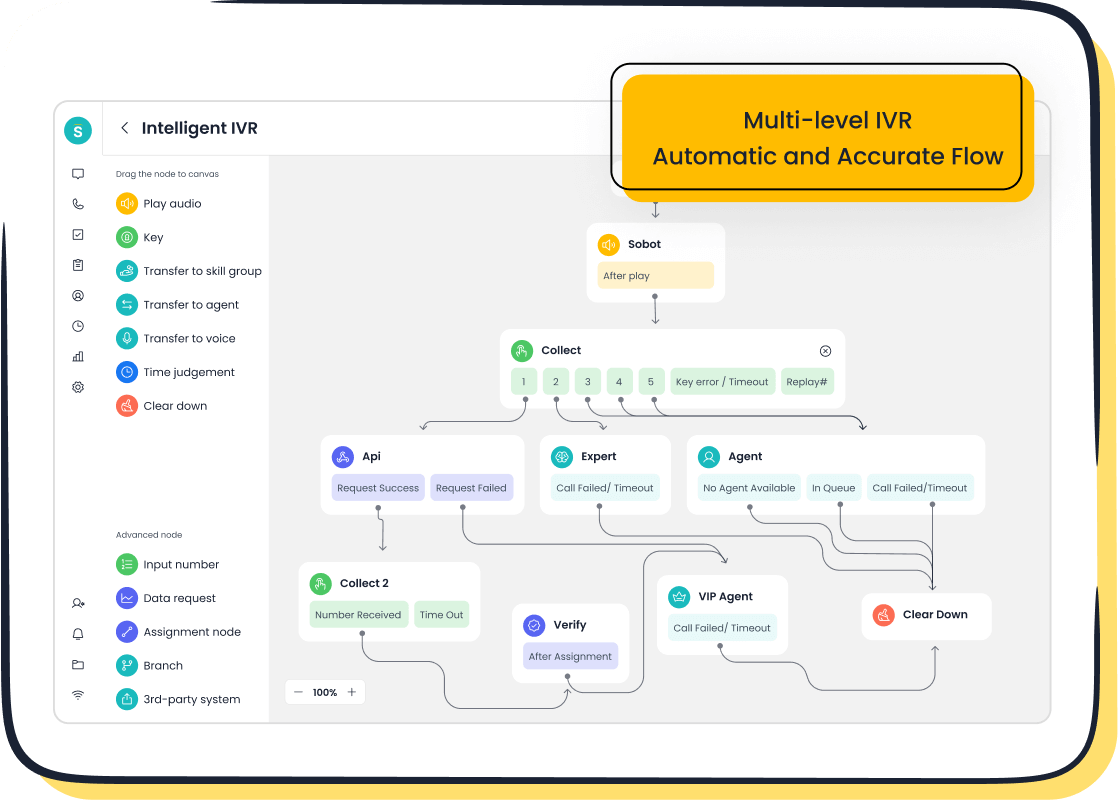

Supporting customer-centric strategies with tools like Sobot's Voice/Call Center

Customer-centric strategies thrive on accurate BAO. Sobot's Voice/Call Center exemplifies this by offering features like intelligent IVR, real-time monitoring, and AI-powered voicebots. These tools enable businesses to route calls efficiently, analyze customer interactions, and enhance service quality. By leveraging BAO, organizations can tailor their services to meet customer needs, build loyalty, and achieve higher satisfaction scores. For instance, Agilent, a leader in life sciences, achieved a sixfold increase in service efficiency and a 95% satisfaction rate using Sobot's solutions.

Key Financial Indicators for Evaluating Business Performance

Profitability Metrics

Gross profit margin

Gross profit margin measures the percentage of revenue remaining after deducting the cost of goods sold (COGS). This metric highlights production efficiency and helps businesses evaluate their pricing strategies. For example, a company with a gross profit margin of 50% retains half of its revenue after covering production costs. Industries like apparel often report higher gross margins, averaging 51.93%, while sectors like auto and truck manufacturing average 12.45%.

Tip: Businesses can improve gross profit margins by optimizing supply chains or reducing production costs. Tools like Sobot's Voice/Call Center can streamline operations, indirectly contributing to better financial outcomes.

Net profit margin

Net profit margin reflects a company's overall profitability after accounting for all expenses, taxes, and costs. It provides a clear picture of financial health. For instance, banks often achieve net profit margins exceeding 30%, while industries like real estate development may face negative margins, averaging -16.35%.

| Industry | Avg. Gross Profit Margin | Avg. Net Profit Margin |

|---|---|---|

| Bank (Money Center) | 100.00% | 30.89% |

| Auto & Truck | 12.45% | 3.53% |

| Real Estate Development | - | -16.35% |

Liquidity Metrics

Current ratio

The current ratio measures a company's ability to meet short-term obligations using its current assets. A ratio above 1 indicates good financial health. For example, a business with $2 million in current assets and $1 million in liabilities has a current ratio of 2. This metric helps stakeholders assess operational stability.

Quick ratio

The quick ratio offers a stricter liquidity measure by excluding inventory from current assets. It evaluates how well a company can cover liabilities with its most liquid assets. For instance, a quick ratio of 1.5 suggests that a business can pay off $1.50 for every $1 of liabilities, even without selling inventory.

| Liquidity Ratio | Definition | Formula | Implication |

|---|---|---|---|

| Current Ratio | Measures ability to pay short-term obligations with short-term assets | Current Assets ÷ Current Liabilities | A ratio above 1 indicates good short-term financial health. |

| Quick Ratio | Excludes inventory from current assets for a stricter measure | (Current Assets - Inventory) ÷ Current Liabilities | Provides a conservative view of liquidity position. |

Efficiency Metrics

Inventory turnover

Inventory turnover measures how efficiently a company manages its stock. A high turnover rate indicates strong sales or effective inventory management. For example, a retailer with an inventory turnover of 10 sells and replaces its stock ten times annually. This metric helps businesses avoid overstocking or understocking.

Accounts receivable turnover

Accounts receivable turnover evaluates how quickly a company collects payments from customers. A higher ratio signifies efficient credit policies and cash flow management. For instance, a ratio of 12 means the company collects its receivables 12 times a year, ensuring steady liquidity.

Note: Efficiency metrics like inventory and accounts receivable turnover directly impact operational performance. Businesses using Sobot's solutions can enhance these metrics by leveraging real-time data analytics and automated workflows.

Non-Financial Indicators and Their Impact on Customer Service

Customer Satisfaction and Retention

Net Promoter Score (NPS)

Net Promoter Score (NPS) measures how likely customers are to recommend a brand to others. This metric provides a clear picture of customer loyalty and satisfaction. Businesses with high NPS often experience stronger customer retention and increased referrals. For example, companies with an NPS above 70 are considered industry leaders in customer satisfaction. Tools like Sobot's Voice/Call Center can help businesses track NPS by analyzing customer interactions and identifying areas for improvement.

| Non-Financial Indicator | Description |

|---|---|

| Net Promoter Score | Measures the likelihood that customers will recommend a brand to others. |

| Retention Rate | Reflects the portion of customers who remain loyal over a specific period, indicating service quality. |

Customer churn rate

Customer churn rate indicates the percentage of customers who stop using a company's services within a given timeframe. A low churn rate signifies strong customer retention and satisfaction. SaaS companies aim for retention rates above 90%, while retail businesses target 60-70%. For instance, a monthly retention rate of 95% is considered excellent, as seen in companies like Buffer. By leveraging tools like Sobot's AI-powered solutions, businesses can reduce churn by addressing customer concerns proactively.

Employee Engagement and Productivity

Employee satisfaction surveys

Employee satisfaction surveys gauge workforce morale and engagement levels. Engaged employees are 21% more profitable and 17% more productive than their disengaged counterparts. They also deliver better customer service, leading to higher satisfaction rates. Sobot's unified workspace fosters employee productivity by streamlining workflows and reducing repetitive tasks, enabling teams to focus on meaningful interactions.

Turnover rates

Turnover rates measure the percentage of employees leaving an organization within a specific period. High turnover often disrupts operations and impacts customer service quality. Companies with engaged employees typically experience lower turnover, ensuring consistent service delivery. For example, businesses using Sobot's integrated solutions can enhance employee satisfaction, reducing turnover and improving overall productivity.

| Metric | Engaged Workforce | Disengaged Workforce |

|---|---|---|

| Profitability Increase | 21% | N/A |

| Productivity Increase | 17% | N/A |

Operational Performance

Delivery times

Delivery times directly influence customer satisfaction and trust. Timely deliveries enhance brand reputation and foster loyalty. Metrics like on-time rates, which measure the percentage of products delivered as promised, are critical. For instance, companies achieving on-time rates above 95% often report higher customer satisfaction. Sobot's real-time monitoring tools enable businesses to track delivery performance and address delays efficiently.

Quality control metrics

Quality control metrics assess the percentage of defective products or services. A low defect rate reflects high operational standards and positively impacts customer perceptions. For example, businesses with defect rates below 1% often lead their industries in customer satisfaction. Sobot's data analytics capabilities help organizations monitor quality metrics, ensuring consistent service excellence.

Tip: Combining operational performance metrics with customer feedback can provide a comprehensive view of service quality, enabling continuous improvement.

Why Business Assessment Outcomes Matter for Customer Service

Strategic Planning and Goal Setting

Aligning outcomes with long-term objectives

Business Assessment Outcomes (BAO) provide a structured approach to aligning business activities with long-term objectives. By analyzing historical data, companies can set realistic performance goals and track progress effectively. For instance, methodologies like Monte Carlo Simulation and Distribution Fitting allow businesses to predict potential outcomes and benchmark their performance against industry standards.

| Methodology | Description |

|---|---|

| Distribution Fitting | Analyzes historical data to create performance benchmarks based on peer comparisons. |

| Monte Carlo Simulation | Models potential outcomes to assess the probability of achieving performance targets. |

| Historical Data Analysis | Uses past performance data to set achievable goals grounded in industry trends. |

These tools ensure that businesses remain focused on their strategic vision while adapting to market dynamics.

Prioritizing resources effectively

BAO enable organizations to allocate resources where they are most needed. Statistical analyses, such as T-tests, help identify areas requiring improvement. For example:

- A paired T-test can evaluate the impact of new training programs on employee productivity.

- Trend analysis highlights inefficiencies in customer service workflows, guiding resource allocation.

This data-driven approach ensures that businesses maximize their return on investment while maintaining operational efficiency.

Enhancing Customer Experience with Sobot

Tailoring services to customer needs

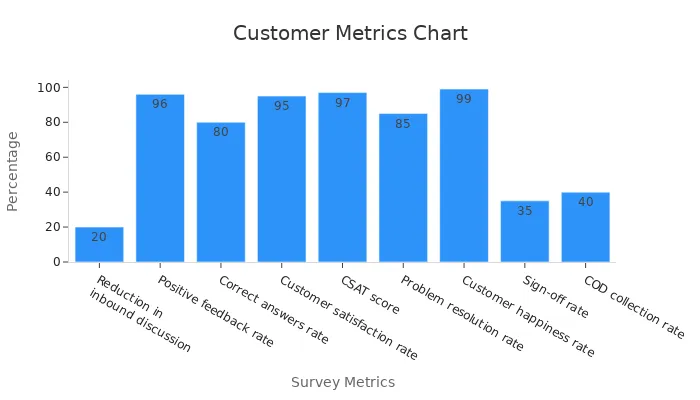

Personalized customer experiences are essential for building trust and satisfaction. Sobot's Voice/Call Center empowers businesses to analyze customer interactions and tailor services accordingly. Metrics like Net Promoter Score (NPS) and Customer Satisfaction Score (CSAT) demonstrate the effectiveness of such tailored approaches.

| Metric | Value |

|---|---|

| Customer satisfaction rate | 95% |

| CSAT score | 97% |

| Problem resolution rate | 85% |

| Customer happiness rate | 99% |

Sobot's intelligent solutions also enable customers to resolve 22.2% of their inquiries independently, reducing inbound discussions by 20%. These capabilities enhance customer satisfaction and operational efficiency.

Building long-term customer loyalty

BAO play a pivotal role in fostering loyalty. By leveraging tools like Sobot's AI-powered Voicebot, businesses can address customer concerns proactively, ensuring a seamless experience. Agilent, for example, achieved a 95% satisfaction rate and a sixfold increase in service efficiency by integrating Sobot's solutions. Such outcomes highlight the importance of using BAO to build lasting customer relationships.

Data-Driven Decision-Making

Reducing risks through informed choices

Data-driven decision-making (DDDM) minimizes risks by providing actionable insights. For instance, banks using DDDM have increased output by 10.5%, with an additional 4.43% boost from investments in data analytics. This approach allows businesses to identify potential risks and implement proactive measures, ensuring stability and growth.

Identifying opportunities for growth

BAO help businesses uncover growth opportunities through comprehensive assessments. Companies using Big Data analytics are 23 times more likely to outperform competitors in acquiring new customers. Additionally, incorporating these analytics can lead to a 10% increase in profitability. By evaluating market attractiveness and aligning opportunities with strategic goals, businesses can achieve sustainable growth.

How to Leverage Business Assessment Outcomes Effectively

Setting Clear Goals and Benchmarks

Defining measurable objectives

Setting measurable objectives is essential for leveraging Business Assessment Outcomes (BAO). Clear goals provide a roadmap for aligning business activities with strategic priorities. For example, conducting quarterly customer satisfaction surveys allows businesses to measure performance against customer expectations. This practice ensures that objectives remain customer-focused and actionable. Tom Siebel, a renowned business leader, emphasizes the importance of using Key Performance Indicators (KPIs) to measure every critical aspect of a business. By defining specific targets, organizations can allocate resources effectively and foster a culture of accountability.

Tracking progress over time

Tracking progress ensures that businesses stay on course to achieve their objectives. Regular performance reviews, supported by BAO, help identify trends and areas for improvement. For instance, setting benchmarks for Net Promoter Score (NPS) or Customer Satisfaction Score (CSAT) enables companies to monitor customer loyalty and satisfaction. Tools like Sobot's Voice/Call Center simplify this process by providing real-time analytics and performance tracking. These insights empower businesses to make data-driven adjustments, ensuring continuous improvement.

Using Technology and Tools Like Sobot's Voice/Call Center

Implementing business intelligence software

Business intelligence (BI) software plays a pivotal role in analyzing BAO. Emerging technologies, such as AI-powered analytics and composable BI systems, enhance data exploration and decision-making. Cloud-based BI platforms offer scalability and flexibility, making them ideal for businesses of all sizes. Sobot's Voice/Call Center integrates seamlessly with BI tools, enabling organizations to analyze call data, track trends, and optimize customer interactions. These capabilities improve operational efficiency and support strategic planning.

Automating data collection and analysis

Automation streamlines the process of collecting and analyzing BAO. Advanced tools, like Sobot's AI-powered Voicebot, automate routine tasks, reducing manual effort and minimizing errors. For example, Sobot's solutions enable businesses to achieve a 97% Customer Satisfaction Score and resolve 22.2% of inquiries independently. Automation not only saves time but also provides actionable insights, helping businesses identify growth opportunities and mitigate risks.

Continuous Monitoring and Improvement

Regularly reviewing outcomes

Continuous monitoring ensures that BAO remain relevant and actionable. Statistical methods, such as paired T-tests, help businesses evaluate the impact of new initiatives by comparing pre- and post-implementation metrics. For example, companies that regularly review their performance data report a 54% increase in customer satisfaction. Sobot's real-time monitoring tools facilitate this process by providing up-to-date insights into operational performance and customer interactions.

Adapting strategies based on insights

Adapting strategies is crucial for maintaining a competitive edge. Continuous improvement methodologies, supported by BAO, enable businesses to refine their processes and optimize resource allocation. Key benefits include reduced costs, enhanced quality, and improved employee morale. For instance, businesses using Sobot's solutions can streamline workflows and address inefficiencies, fostering long-term growth and customer loyalty.

Business Assessment Outcomes (BAO) serve as a cornerstone for evaluating performance and achieving business success. By integrating financial and non-financial indicators, companies gain a comprehensive understanding of their operations, enabling better decision-making and strategic planning. For instance, combining profitability metrics with customer satisfaction scores provides insights into both financial health and customer loyalty.

Key Benefits of BAO Integration:

- Enhances decision-making by incorporating diverse data sources.

- Identifies risks and opportunities through non-financial metrics.

- Strengthens stakeholder trust by addressing social and environmental impacts.

Tools like Sobot's Voice/Call Center exemplify how businesses can leverage BAO to improve customer service and operational efficiency. With features like real-time analytics and intelligent call routing, Sobot empowers organizations to adapt to market changes and foster long-term growth. Companies utilizing advanced analytics, as noted by McKinsey, are twice as likely to excel in customer loyalty and profitability, underscoring the transformative power of BAO.

FAQ

What are Business Assessment Outcomes (BAO)?

Business Assessment Outcomes (BAO) are measurable results derived from evaluating a company's performance using key indicators. These outcomes help businesses identify strengths, weaknesses, and opportunities for growth. For example, companies using BAO often achieve higher customer satisfaction and operational efficiency through data-driven strategies.

How can Sobot's Voice/Call Center improve BAO?

Sobot's Voice/Call Center enhances BAO by providing real-time analytics, intelligent call routing, and AI-powered voicebots. These features streamline customer interactions, reduce response times, and improve service quality. For instance, businesses using Sobot have reported a 95% customer satisfaction rate and a sixfold increase in efficiency.

Why are non-financial indicators important in BAO?

Non-financial indicators, such as Net Promoter Score (NPS) and employee engagement, provide insights into customer satisfaction and operational health. These metrics complement financial data, offering a holistic view of business performance. Companies tracking NPS often experience stronger customer loyalty and retention.

How does automation support BAO analysis?

Automation simplifies BAO analysis by reducing manual effort and minimizing errors. Tools like Sobot's AI-powered solutions automate data collection and analysis, enabling businesses to identify trends and opportunities quickly. For example, Sobot's Voice/Call Center helps resolve 22.2% of inquiries independently, improving efficiency and decision-making.

What industries benefit most from BAO?

Industries like retail, financial services, and life sciences benefit significantly from BAO. For example, Agilent, a leader in life sciences, achieved a sixfold increase in service efficiency using Sobot's solutions. BAO help these industries optimize operations, enhance customer satisfaction, and drive growth.

See Also

Around-The-Clock Chat Support Enhances Business Growth

Top Strategies for Effective Call Center Quality Management

Enhancing Call Center Efficiency Through Effective Monitoring

Essential Guide for Call Center Quality Assurance Tools

Comparing Live Chat Advantages Over Traditional Email Support