Transform Banking Customer Experience Management Step by Step

Banks see measurable gains in customer satisfaction and business outcomes by using a step-by-step approach to banking customer experience management. Metrics like Net Promoter Score and Customer Satisfaction Score help track progress and show real improvements. Leading banks use omnichannel, AI, and automation to boost efficiency and personalize service. Sobot, a trusted provider of intelligent contact center solutions, empowers financial institutions to advance their digital transformation strategy. Sobot AI combines unified communication and automation, helping banks deliver seamless experiences across every channel.

Assess Current Experience

Customer Feedback

Banks start by gathering customer feedback at every stage of the banking customer journey. They use several proven methods to collect insights:

- Website and in-product surveys appear after key actions, capturing real-time opinions.

- Feedback buttons stay visible on digital platforms, letting customers share thoughts anytime.

- Email and link surveys reach customers after transactions or support interactions.

- Mobile app surveys pop up after specific actions, collecting mobile-specific feedback.

- Chat surveys run during or after live chat sessions, measuring satisfaction instantly.

- In-app messaging surveys trigger based on user behavior, ensuring feedback is timely.

- Surveys embedded in CRM tools automate feedback collection across the banking customer journey.

Banks improve response rates by timing surveys around important moments, such as after a loan approval or a support call. They keep surveys short and targeted, segmenting users by behavior to ensure feedback is relevant and actionable.

Data Collection

Efficient data collection forms the backbone of a successful banking customer journey. Banks rely on strong data governance policies and quality assurance to manage information from multiple sources. They use internal and external data to analyze customer behavior, manage risk, and guide decisions. Leading banks follow frameworks from the Federal Reserve System and NIST to ensure data security and compliance. Modern banks also use unified data platforms and cloud-based analytics to handle large volumes of information. Sobot’s omnichannel banking solutions unify data from voice, chat, email, and social media, making it easier to analyze and act on customer feedback throughout the banking customer journey.

Digital Channels

Digital channels play a key role in monitoring and improving the banking customer journey. Many top banks use advanced technologies to track and analyze customer experience. The table below shows how leading institutions benefit from digital integration:

| Bank / Institution | Digital Channel Integration / Technology Used | Metrics / Outcomes Supporting CX Monitoring and Analysis |

|---|---|---|

| JPMorgan Chase | AI-powered virtual assistants, biometric authentication | 20% decrease in fraud incidents; 10% increase in customer confidence |

| HSBC (First Direct) | Customer-centric culture, personalization | High customer satisfaction; low churn rates |

| CitiBank | Omnichannel strategy for online and branch transactions | 15% increase in satisfaction; 12% rise in cross-channel engagement |

| Bank of America | AI-driven virtual assistant 'Erica' | 35% increase in engagement; 10% reduction in service costs |

Sobot’s unified platform enables banks to monitor all digital channels in one place, supporting a seamless and consistent customer experience across the entire banking customer journey.

Map Customer Journey

Journey Stages

Banks achieve better results when they define clear stages in the banking customer journey. According to the Drive Research report, these stages include Awareness, Consideration & Application, Onboarding & Engagement, Active Usage & Relationship, and Retention & Advocacy. Each stage reflects a different part of the customer journey mapping process. Banks use market research methods like online surveys, interviews, and focus groups to understand how customers move through these stages. Today, 70% of banking customers expect banks to know their full context during interactions. Digital transformation adds new stages and touchpoints, such as mobile apps and chatbots, which banks must include in their customer journey mapping. Sobot’s financial solution helps banks map these stages across all channels, supporting a seamless omnichannel banking experience.

Touchpoints

Touchpoints are the moments when customers interact with a bank. These include online surveys, websites, mobile apps, contact center calls, and in-person visits. Mapping these touchpoints along the banking customer journey helps banks spot friction and improve experiences. For example, banks often use analytics to find frequent contact center calls about password resets. They then add self-service options to reduce these calls. Banks also collect feedback through CSAT surveys and use AI to analyze customer sentiment. Sobot’s unified platform brings all touchpoints together, giving banks a 360-degree view of each customer and supporting effective customer journey mapping.

Tip: Tailoring touchpoints to different customer types increases satisfaction and loyalty.

Pain Points

Banks identify pain points by mapping the banking customer journey and analyzing where customers face challenges. The table below shows common pain points at each stage:

| Phase of Customer Journey | Common Customer Pain Points |

|---|---|

| Awareness | Lack of awareness about offers and benefits |

| Consideration | Confusing website navigation, insufficient information |

| Decision | Long, complex application processes |

| Purchase | Redundant data entry, waiting for approval |

| Post-Purchase Experience | Technical issues, lack of personalized assistance |

| Loyalty | Generic communications, unclear benefits |

| Recommendation | Poor user experience, limited feedback options |

Banks often find disjointed experiences across channels and outdated authentication processes. Sobot’s financial solution addresses these pain points by integrating all channels and providing consistent, secure communication throughout the banking customer journey.

Set CXM Goals

Measurable Objectives

Banks achieve success in customer experience management by setting clear, measurable objectives. These goals help teams track progress and stay focused on results. Common objectives include improving Net Promoter Score, reducing customer churn, and increasing digital engagement. For example, a bank may aim to boost its Net Promoter Score by 10% within six months. Teams use customer-centric metrics to measure satisfaction at every touchpoint. Sobot’s unified analytics dashboard allows banks to monitor these metrics in real time, making it easier to adjust strategies and reach targets. Setting specific goals ensures that every action supports the overall customer experience strategy.

Business Alignment

Aligning customer experience management with business strategy drives growth and loyalty. Studies show that customer-centric banks outperform competitors in profitability and retention. Key steps include investing in digital infrastructure, using data-driven insights, and balancing digital with physical channels. Banks also focus on cybersecurity and transparent communication to build trust. Staff training remains essential for delivering high-quality service. Sobot’s financial solution helps banks integrate digital and physical touchpoints, supporting a seamless customer experience strategy. By aligning CXM goals with business objectives, banks create a strong foundation for long-term success.

Note: Customer-centric strategies lead to higher satisfaction, loyalty, and profitability. (Verhoef et al., 2015)

Personalization

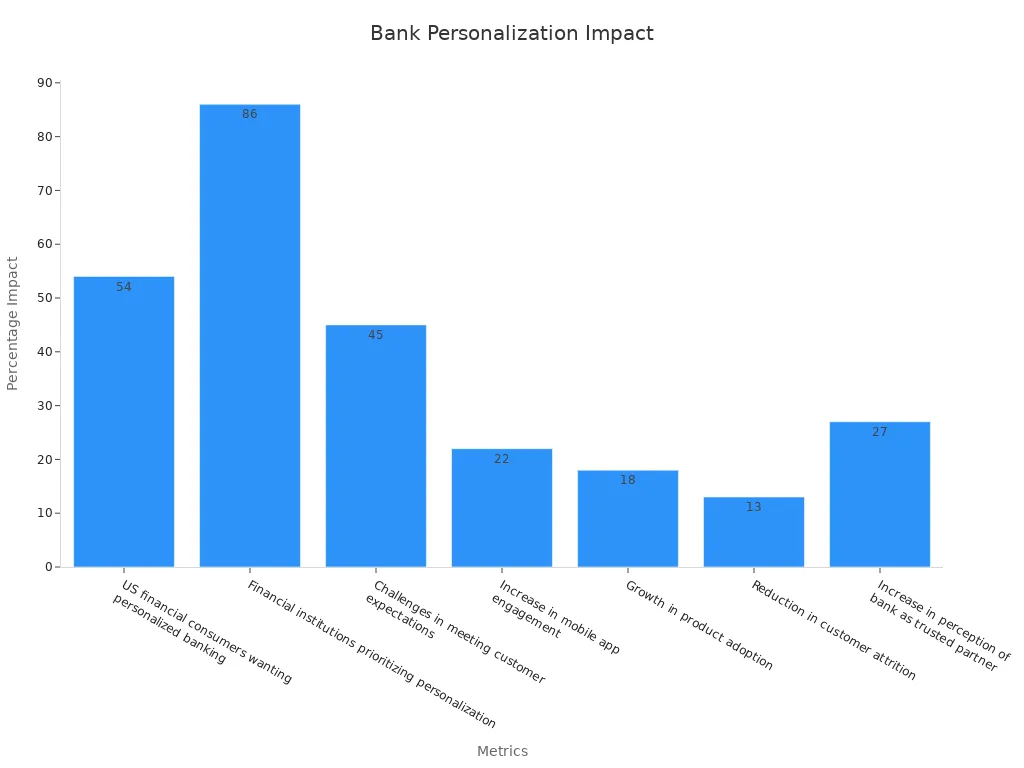

Personalization stands at the heart of a customer-centric approach. Research shows that 54% of US financial consumers want a personalized experience, and 86% of financial institutions make personalization a top priority in their digital strategies. Personalized offers increase product adoption by 18% and reduce customer attrition by 13%. Sobot’s AI-powered platform enables banks to deliver tailored messages and services across all channels, helping them meet rising expectations.

| Metric / Outcome | Value / Impact | Description / Source |

|---|---|---|

| US financial consumers wanting personalized banking | 54% want personalized experiences | MX Research |

| Financial institutions prioritizing personalization | 86% prioritize personalization in digital strategy | Mastercard Services, 2023 |

| Increase in mobile app engagement | 22% increase | Forrester, 2023 |

| Growth in product adoption | 18% growth | Forrester, 2023 |

| Reduction in customer attrition | 13% reduction | Forrester, 2023 |

Optimize Processes

Internal Alignment

Banks achieve process optimization by fostering a customer-centric culture that breaks down internal silos. Cross-functional teams, built through agile transformation, encourage collaboration and transparency. Leadership alignment ensures everyone works toward shared goals. Centralized data management gives all teams access to reliable information, supporting coordinated decisions. This unified approach helps banks deliver a seamless customer journey and improves operational efficiency. Sobot’s unified workspace consolidates customer data and interactions, making it easier for teams to stay aligned and focused on customer-centric outcomes.

- Agile practices like Scrum and Kanban increase transparency and reduce miscommunication.

- Lean management prioritizes high-value work, limiting wasted resources.

- Leadership modeling accountability motivates employees to suggest improvements.

Note: A customer-centric culture thrives when teams share information and work together, leading to better customer experiences and lower operational costs.

Employee Training

Employee training forms the backbone of a customer-centric culture in banking. Leading banks invest in programs that empower staff with up-to-date knowledge and interpersonal skills. Training ensures consistent, high-quality service across all channels, including call centers and branches. The table below highlights successful training strategies:

| Bank Name | Training Focus and CX Strategy | Outcomes |

|---|---|---|

| Virgin Money | Customer feedback and employee empowerment | 27% fewer monthly complaints |

| Metro Bank | AI tools and active listening for a customer-centric culture | 5% revenue growth, 3 million customer accounts |

| Chevron Federal Credit Union | AI-powered analytics for personalized service | Improved CX and personalization |

| First National Bank | Journey mapping and AI feedback analysis | Better meets customer needs |

Sobot supports employee training by providing intuitive tools and automation, helping staff deliver a consistent, customer-centric experience.

Ownership

Clear ownership and accountability drive a customer-centric culture in banks. Empowered employees make decisions that improve customer experiences and build loyalty. For example, Zappos’ focus on employee empowerment led to higher satisfaction and memorable service. Forrester research shows that a one-point improvement in the CX Index can add $123 million in revenue for large banks (WNS). Sobot’s unified platform assigns tasks and tracks performance, ensuring every team member takes responsibility for their part in the customer journey. This approach streamlines processes and supports a customer-centric culture at every level.

Implement Omnichannel Solutions

Sobot Voice/Call Center

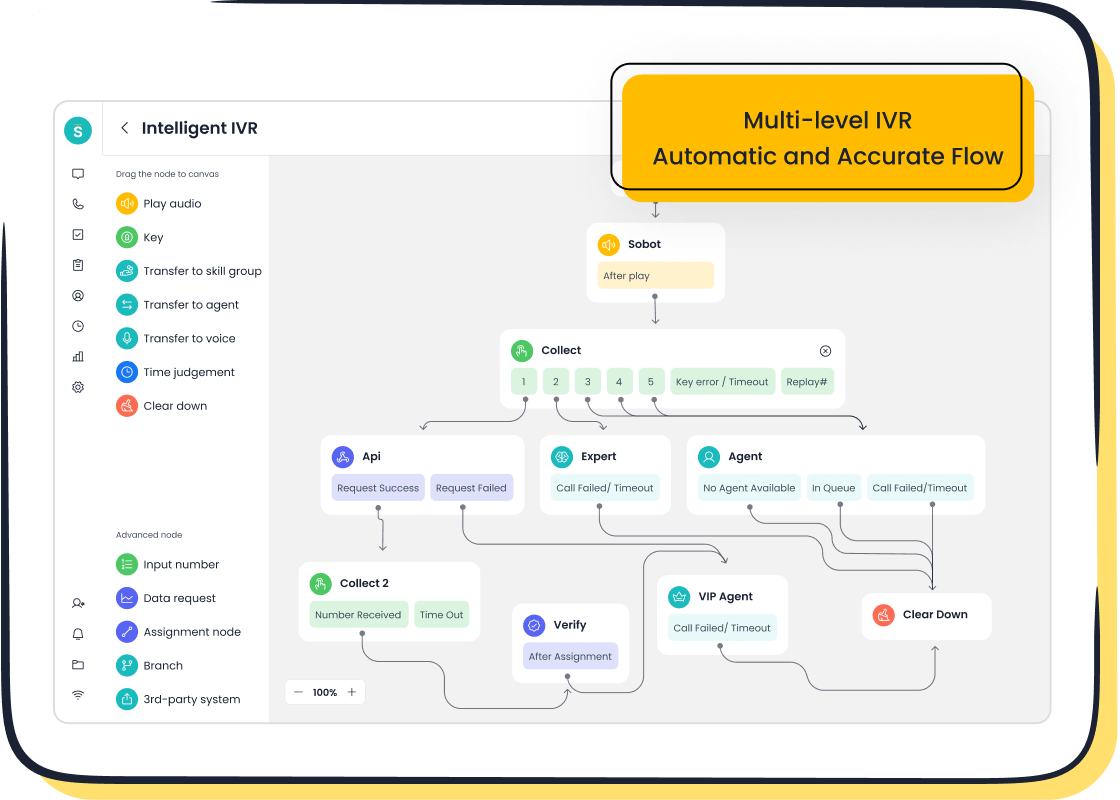

Banks transform customer service by adopting Sobot’s Voice/Call Center. This platform delivers intelligent IVR, smart call routing, and global support. Intelligent IVR systems use voice biometrics to reduce verification times by 50%, making authentication faster and more secure. Fraud detection improves by 30%, which protects both banks and customers. For example:

- A regional Kansas City bank processes 20,000 customer verifications weekly with voice biometrics, saving agent time.

- Sentiment analysis in IVR detects frustration and escalates calls, reducing complaints by 30%.

Sobot’s solution uses caller input, account data, and agent skills to route calls efficiently. This approach reduces wait times and increases first call resolution. Skills-based routing ensures that customers reach the right expert, improving satisfaction and operational efficiency. Sobot’s global network and 99.99% uptime guarantee reliable service for banks of all sizes.

Self-Service

Self-service options, powered by AI chatbots, have become essential in modern banking. Research shows that interactive, human-like chatbots increase user trust and loyalty. In field tests, 57% of users reported improved financial situations after using AI chatbots. These tools provide a judgment-free environment, especially valuable for users discussing sensitive financial topics. Sobot’s AI-powered chatbots offer 24/7 support, helping customers manage accounts, reset passwords, and receive personalized financial guidance. Human oversight and the option to connect with live agents further build trust. Opay, a leading financial platform, used Sobot’s omnichannel solution to boost customer satisfaction from 60% to 90% and cut costs by 20%. This success highlights the impact of self-service and automation in omnichannel banking.

Security

Security and compliance remain top priorities for banks adopting omnichannel solutions. Banks require secure, reliable digital experiences across all channels, including branches, ATMs, and online services. The shift to hybrid cloud and omnichannel banking increases the need for technologies that capture and store network data for threat detection and compliance audits. Solutions like Riverbed IQ and Aternity DEM provide full telemetry and automated troubleshooting, ensuring stable, high-performing environments. Sobot’s platform supports encrypted data transfer and meets industry standards for data privacy, helping banks deliver secure, compliant communication at every touchpoint.

Enhance Customer Experience Management

Personalization Tools

Banks use advanced personalization tools to transform banking customer experience management. AI and data analytics help banks understand customer needs and predict behaviors. For example, Bank of America’s virtual assistant Erica gives customers personalized financial advice and spending insights. JPMorgan Chase uses predictive analytics to offer custom credit card and loan products, which improves customer loyalty and cross-selling. BBVA’s mobile app provides real-time, tailored product suggestions and alerts, increasing engagement and revenue. According to MMA Global, 44% of banks now scale AI to personalize experiences, leading to higher loyalty and satisfaction. Sobot’s AI-powered platform enables banks to deliver these personalized services across all channels, supporting a seamless customer journey.

Automation

Automation drives efficiency in customer experience management. Banks that automate routine tasks see faster service and lower costs. For instance, digitizing core processes can reduce operational costs by 31% and boost revenue per employee by 42% (Accenture, 2022). JPMorgan Chase cut processing times by up to 93% through automation. Straight-through processing rates above 90% lead to 27% higher profitability per customer (PwC, 2023). Sobot’s unified workspace and automation tools help banks streamline workflows, reduce errors, and improve customer experience management outcomes.

Human Touch

While AI and automation improve speed and accuracy, human agents remain vital for empathy and trust. BNP Paribas shows how combining AI tools with skilled advisors allows banks to handle complex, sensitive issues with care. Human agents recognize emotions, manage escalations, and build strong relationships. As Anmol Agarwal notes, AI can detect emotion, but only humans deliver true empathy. Customers value real conversations, especially when facing difficult situations. Sobot’s platform supports seamless transitions between digital and human support, ensuring every customer feels heard and valued. This balance strengthens customer loyalty and trust in banking customer experience management.

Measure and Improve

CX Metrics

Banks rely on clear metrics to track customer experience improvements. Common measures include Net Promoter Score (NPS), Customer Satisfaction Score (CSAT), and Customer Effort Score (CES). These scores help banks understand how customers feel at each stage of the customer journey. Banks also use Customer Retention Rate and Customer Lifetime Value to see how well they keep and grow relationships. Benchmarking these metrics against industry standards or past performance helps banks spot gaps and set goals. Sharing real-time data with frontline teams encourages quick action and better service. Sobot’s analytics dashboard brings all these metrics together, making it easy for banks to monitor trends and act on insights.

Feedback Loops

Structured feedback loops drive ongoing customer experience improvements. Leading companies like Amazon and Netflix collect feedback through surveys, reviews, and digital channels. They analyze this data to find trends and fix pain points. Banks can use similar methods by gathering feedback after key interactions and sharing results with teams. Closing the loop means telling customers how their input led to changes, which builds trust and customer loyalty. Sobot’s reporting tools help banks collect, analyze, and respond to feedback quickly, ensuring every voice counts.

Tip: Regularly update customers about improvements made from their feedback to boost engagement and satisfaction.

Continuous Optimization

Continuous optimization keeps banks ahead in a fast-changing market. Top banks use open communication and consistent service across all channels to build trust. Responsive support and proactive AI-driven alerts improve customer retention. For example, Wells Fargo improved marketing ROI by 38% using data-driven strategies, while Bank of America’s virtual assistant, Erica, delivers personalized advice to millions. Sobot supports these efforts with real-time analytics and automation, helping banks adapt quickly and deliver seamless experiences that strengthen customer loyalty.

Best Practices and Challenges

Data Security

Banks must protect customer data at every step of the customer journey. Strong data security builds trust and keeps operations running smoothly. The table below shows key standards and best practices in banking:

| Category | Examples / Details | Purpose / Importance |

|---|---|---|

| Global Cybersecurity Standards | PCI DSS, ISO/IEC 27001, SWIFT CSP | Protect payment and financial data with strict controls and encryption. |

| Local Laws and Directives | SOX, GLBA, FINRA, PSD 2, BSA, NIS2, DORA | Ensure compliance, prevent fraud, and maintain resilience. |

| Best Practices | Layered security, encryption, least privilege, multi-factor authentication, user monitoring | Reduce breach risks and verify user identities. |

| Risk Management | Regular risk assessments and audits | Find and fix vulnerabilities. |

| Organizational Measures | Data Protection Officer (DPO) | Oversee data protection and compliance. |

| Consequences of Compliance | Avoid disruptions, lawsuits, fines, and reputational damage | Maintain trust and business continuity. |

Sobot supports banks with encrypted data transfer, secure cloud deployment, and compliance-ready solutions. These features help banks meet global and local security requirements.

Omnichannel Consistency

Banks deliver a seamless experience when they keep information and service consistent across all channels. Leading banks show how to do this well:

- Citibank lets customers start a loan application on a mobile app and finish it in a branch without repeating steps.

- Wells Fargo gives the same account details and services at ATMs, in apps, and in branches.

- HSBC uses real-time data updates for instant support and advice.

- Bank of America’s AI assistant, Erica, offers help across digital platforms and social media.

- DBS Bank trains staff and uses advanced tools for unified support, including video calls.

These examples show that unified data, consistent branding, and trained staff improve satisfaction and loyalty. Sobot’s omnichannel platform brings all customer interactions into one workspace, making it easy for banks to provide a smooth customer journey.

Regulatory Compliance

Banks must follow strict rules to protect customers and prevent financial crimes. Key regulations include Anti-Money Laundering (AML), Consumer Protection, and data privacy laws. Countries have their own rules, such as the Bank Secrecy Act in the US and the Financial Services and Markets Act in the UK. Best practices include clear policies, regular training, and strong internal controls. The Capital One case, where the bank paid $390 million for failing to report suspicious activities, shows the high cost of non-compliance. Fines, lost trust, and business disruption can result from weak compliance. Sobot helps banks stay compliant with tools for secure communication, audit trails, and data management, supporting a safe and trusted banking environment.

Banks achieve measurable improvements by following a structured, step-by-step approach to customer experience management. Real-world examples, such as HSBC Mexico’s virtual queue system and UBL’s feedback solutions, show how optimizing each customer journey touchpoint leads to higher satisfaction and efficiency. Sobot’s intelligent omnichannel platform empowers banks to streamline workflows and deliver secure, personalized service. Financial institutions can start their transformation today by exploring Sobot’s financial solutions or requesting a demo.

FAQ

What is the first step in transforming banking customer experience management?

Banks begin by assessing their current customer experience. They collect feedback through surveys, digital channels, and in-app tools. Sobot’s omnichannel platform helps unify this data, making it easier to identify strengths and areas for improvement.

How does Sobot support omnichannel banking?

Sobot provides a unified workspace for voice, chat, email, and social media. This integration allows banks to manage all customer interactions in one place. Sobot’s platform ensures consistent service and faster response times across every channel.

Why is data security important in banking customer experience management?

Data security protects sensitive customer information and builds trust. Banks must follow standards like PCI DSS and ISO/IEC 27001. Sobot’s solutions use encrypted data transfer and secure cloud deployment, helping banks meet strict compliance requirements.

What role does automation play in improving banking operations?

Automation streamlines routine tasks, reduces errors, and speeds up service. For example, banks using Sobot’s automation tools see faster ticket resolution and improved customer satisfaction. Automation also frees staff to focus on complex issues.

How can banks personalize the customer journey?

Banks use AI and analytics to understand customer needs and predict behaviors. Sobot’s platform enables personalized messages and offers at every stage of the customer journey. This approach increases engagement and loyalty.

See Also

How To Successfully Deploy Omnichannel Contact Center Systems

Artificial Intelligence Agents Transform The Future Of Customer Support

Comparing The Best Voice Of Customer Software Solutions Today

Essential Best Practices For Managing Call Center Quality Effectively

Comprehensive Guide To Choosing Omnichannel Software For Call Centers