Why Automated Chatbots Are Vital for Insurance Success

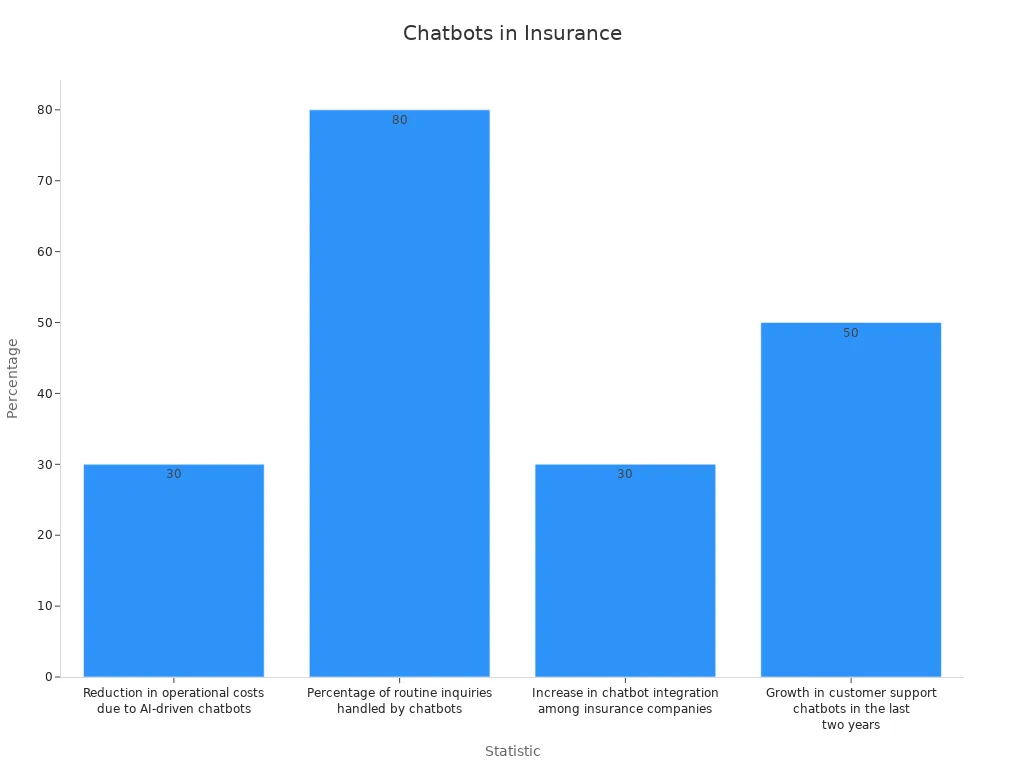

Automated chatbots for insurance are transforming the way customers interact with insurance services. They offer 24/7 support, delivering quicker responses and unmatched convenience. For instance, 44% of customers now prefer filing claims through an AI-powered bot rather than waiting for human assistance. With over 30% of insurance companies embracing chatbot technology, Sobot's automated chatbot for insurance is at the forefront of this evolution. These advanced solutions not only optimize processes but also elevate customer satisfaction. The rapid growth in chatbot adoption, which has surged by 50% in just two years, underscores their critical role in modernizing insurance operations.

Understanding Automated Chatbots for Insurance

What Is an Insurance Chatbot?

An insurance chatbot is a virtual assistant designed to simplify your interactions with insurance services. These chatbots use advanced technology to provide instant responses to your queries, whether you need help understanding policy details, checking claim statuses, or comparing coverage options. According to industry leaders like Botpress and Yellow.ai, insurance chatbots act as trusted advisors, guiding you through complex insurance processes with ease. They also collect information for complaints and escalate unresolved issues to human agents when necessary, as noted by Inbenta.

By automating routine tasks, insurance chatbots improve efficiency and reduce the workload on customer service teams. For example, a leading health insurance provider used a chatbot to streamline claims processing, cutting processing time by 30%. This demonstrates how these tools enhance both operational efficiency and customer experience.

Rule-Based vs. AI Chatbot in Insurance

Not all chatbots are created equal. Rule-based chatbots follow predefined scripts, making them suitable for answering simple FAQs. However, they struggle with complex or unexpected queries. In contrast, AI-driven chatbots in insurance adapt to varied inquiries and continuously learn from interactions. This makes them ideal for handling nuanced questions, such as explaining policy exclusions or providing personalized recommendations.

Here’s a quick comparison:

| Feature | Rule-Based Chatbots | AI-Driven Chatbots |

|---|---|---|

| Flexibility | Limited to predefined scenarios | Adapts to varied inquiries |

| Complexity Handling | Best for simple FAQs | Manages complex queries |

| Learning Ability | Static | Continuously learns |

| User Experience | Robotic | Engaging and natural |

| Scalability | Limited | Easily scales |

AI chatbots clearly outperform rule-based ones in delivering a seamless customer experience, making them a valuable asset in the insurance industry.

Why Automated Chatbots Are Essential for Insurers

Automated chatbots for insurance are indispensable in today’s fast-paced world. They operate 24/7, ensuring you can access support anytime. Unlike traditional methods, which are limited to business hours, chatbots handle multiple inquiries simultaneously, reducing wait times and improving satisfaction. According to McKinsey & Company, AI-driven chatbots can reduce operational costs by up to 30% while handling 80% of routine inquiries. This allows insurers to allocate human agents to more complex tasks.

Additionally, chatbots simplify processes like comparing plans, obtaining quotes, and managing policies. They also provide valuable insights into customer preferences, enabling insurers to offer tailored solutions. With tools like Sobot’s AI Chatbot, insurers can achieve up to a 70% productivity boost and save 50% on agent costs. These benefits highlight why automated chatbots are a cornerstone of modern insurance operations.

Key Benefits of Insurance Chatbots

24/7 Customer Support for Policyholders

Insurance chatbots provide round-the-clock assistance, ensuring you can access help whenever you need it. Unlike traditional customer support, which operates during fixed hours, chatbots remain available 24/7. This constant availability eliminates long wait times and missed opportunities for resolving issues. For example, 44% of customers now prefer using chatbots to file insurance claims, highlighting their convenience. By offering immediate responses, chatbots improve customer satisfaction and loyalty. Sobot’s AI-driven chatbot ensures seamless customer interactions across multiple channels, making it an essential tool for insurers.

Cost Reduction and Operational Efficiency

Automated chatbots for insurance significantly reduce operational costs. In 2022, businesses saved over $8 billion in customer interaction expenses by implementing chatbots. These tools handle routine inquiries, allowing human agents to focus on complex tasks. This shift not only enhances efficiency but also reduces the need for large customer service teams. Sobot’s chatbot, for instance, can cut agent costs by up to 50% while boosting productivity by 70%. With automation, insurers can achieve increased efficiency and allocate resources more effectively.

Enhanced Customer Experience and Self-Service

Insurance chatbots elevate the customer experience by offering personalized and efficient solutions. They guide you through processes like policy management, claims filing, and coverage comparisons. Better self-service options reduce the need for human intervention, leading to faster resolutions and shorter wait times. A leading health insurer reported a 30% reduction in claims processing time after deploying a chatbot. Sobot’s chatbot enhances customer self-service experiences with its multilingual support and intuitive interface, ensuring more engaged customers.

Lead Generation and Conversion Optimization

Insurance chatbots excel at engaging visitors and converting them into leads. By asking targeted questions, they qualify prospects and collect valuable information about their needs. One insurance company saw a 50% increase in lead conversion rates within six months of implementing a chatbot. Sobot’s chatbot takes this further by using proactive messaging and real-time assistance to boost conversions by 20%. This capability helps insurers improve client engagement and drive revenue growth.

Scalability for High-Volume Queries

Insurance chatbots handle thousands of interactions simultaneously without compromising quality. This scalability ensures prompt service during peak times, such as natural disasters or enrollment periods. Chatbots also reduce support costs by automating repetitive tasks. Sobot’s chatbot leverages cloud infrastructure to scale on demand, making it ideal for managing high volumes of claims and inquiries. This ability to adapt to fluctuating workloads ensures enhanced customer service and operational stability.

Practical Applications of AI Chatbots in Insurance

Claims Processing and Real-Time Updates

AI chatbots simplify claims processing by guiding you through each step. They collect and verify documents automatically, ensuring accuracy and saving time. For example, 44% of customers prefer using chatbots to file claims because of their speed and convenience. These bots also provide real-time updates, so you always know the status of your claim. This reduces stress and improves transparency. Many insurers, like GEICO, have adopted chatbots to streamline claims, resulting in higher customer satisfaction. By automating repetitive tasks, chatbots enhance efficiency and allow human agents to focus on complex cases.

Policy Management and Renewals

Managing your insurance policy becomes effortless with chatbots. They remind you about upcoming renewals and guide you through the process, preventing coverage lapses. Improved self-service capabilities mean fewer cases require human intervention, reducing wait times and enhancing your experience. For instance, Allstate uses chatbots to provide personalized policy information, making it easier for customers to manage their coverage. These bots also analyze your preferences to suggest tailored options, ensuring you get the most suitable insurance plan.

Customer Onboarding and Education

Chatbots make onboarding new policyholders faster and less stressful. They assist you with form completion, documentation, and answering inquiries. This interactive approach helps you understand insurance terms and coverage options better. For example, chatbots provide engaging education on policies, ensuring you make informed decisions. By streamlining interactions and offering personalized recommendations, they improve service delivery and set a strong foundation for a long-term relationship with your insurer.

Fraud Detection and Prevention

Insurance fraud costs billions annually, but chatbots help mitigate this risk. They screen claims in real-time, verify identities, and authenticate documents. Advanced features like behavior analysis and machine learning detect suspicious activities, ensuring fraudulent claims are flagged early. For example, chatbots use Optical Character Recognition (OCR) to identify inconsistencies in documents like invoices. By integrating with fraud detection systems, they cross-reference data instantly, reducing manual work and enhancing accuracy.

Personalized Recommendations and Upselling

AI chatbots analyze your profile to offer personalized insurance recommendations. This not only improves your satisfaction but also helps insurers increase revenue. For instance, chatbots identify upselling opportunities by understanding your needs and suggesting additional coverage options. Their ability to provide tailored solutions ensures you receive the best value while helping insurers grow their business. This level of personalization strengthens trust and loyalty in the insurance industry.

Overcoming Challenges in Chatbot Implementation

Balancing Automation with Human Interaction

Striking the right balance between automation and human interaction is crucial in the insurance industry. While automation can handle routine tasks like policy updates and payment processing, human agents are indispensable for emotionally sensitive situations, such as accident claims. Research shows that successful implementations automate 70% of routine interactions, leaving 30% for human agents to address complex issues.

To enhance customer satisfaction, seamless transitions between chatbots and human agents are essential. For instance, systems that maintain context during hand-offs ensure customers don’t need to repeat information. This approach not only improves efficiency but also builds trust. A study revealed that 60% of consumers prefer businesses offering smooth chatbot-to-human transitions. By combining automation with empathetic human support, insurers can deliver a superior customer experience.

| Evidence Type | Description |

|---|---|

| Automation of Routine Tasks | Automating tasks like policy changes and payment processing. |

| Human Involvement | Handling emotionally charged situations such as accident claims. |

| Seamless Transitions | Ensuring smooth hand-offs between chatbots and human agents. |

Ensuring Data Security and Privacy

Data security is a top priority in the insurance industry. Chatbots must adhere to strict privacy regulations, such as HIPAA and GDPR, to protect sensitive customer information. Robust data protection policies, regular software updates, and access controls are essential for safeguarding data.

Common threats include spoofing, tampering, and denial-of-service attacks. For example, spoofing can lead to unauthorized access, while tampering may alter critical data. Insurers can mitigate these risks by integrating advanced security measures into their chatbot systems. Sobot’s AI Chatbot, for instance, ensures compliance with global standards, providing a secure and reliable solution for automating customer interactions.

| Security Threats/Vulnerabilities | Description |

|---|---|

| Spoofing | Unauthorized access to chatbot systems. |

| Tampering | Alteration of data or messages. |

| Denial of Service | Disruption of chatbot services. |

| Elevation of Privilege | Gaining unauthorized access to higher-level functions. |

Training AI Models for Insurance-Specific Needs

Training AI models tailored to the insurance industry ensures chatbots deliver accurate and relevant responses. For example, Luko, an insurance provider, integrated AI for claims processing, improving accuracy from 40% to 70%. Similarly, a global auto insurer used annotated datasets for damage assessment, resulting in 17% savings in repair costs and a 32% reduction in follow-up calls.

Customizing AI models involves feeding them with industry-specific data, such as policy terms, claim procedures, and customer preferences. This process enhances the chatbot’s ability to understand complex queries and provide precise solutions. By leveraging advanced AI training techniques, insurers can significantly improve operational efficiency and customer satisfaction.

| Example | Description | Result |

|---|---|---|

| Luko | Integrated AI for claim processing | Improved accuracy from 40% to 70% |

| Global auto insurer | Annotated datasets for damage assessment | 17% savings in repair costs, 32% reduction in follow-up calls |

Integrating Chatbots with Existing Systems

Integrating chatbots with existing insurance systems ensures seamless operations. Successful integration involves connecting chatbots with legacy systems, enabling them to retrieve and utilize data effectively. For instance, validating customer information with existing databases ensures accurate responses.

Testing chatbot functionality across platforms is equally important. This process identifies technical glitches and ensures consistent performance. Sobot’s chatbot excels in this area, offering seamless integration with various systems while maintaining high accuracy. By prioritizing compatibility and performance, insurers can maximize the benefits of chatbot automation.

| Metric/Consideration | Description |

|---|---|

| Seamless Integration | Connecting chatbots with legacy systems without disruptions. |

| Access to Data Sources | Ensuring chatbots retrieve and utilize data from business applications effectively. |

| Accurate Responses | Providing precise and helpful information through natural language understanding. |

Best Practices for Deploying Sobot's Chatbot in Insurance

Setting Clear Objectives and Use Cases

Defining clear objectives is the first step to successfully deploying Sobot's AI-powered chatbot in the insurance industry. Start by identifying the specific challenges you want to address. For example, do you aim to enhance customer self-service, reduce support costs, or improve claims processing? Each goal will shape how you configure the chatbot.

Consider real-world use cases to guide your implementation. Health insurers have used chatbots to streamline claims, achieving a 30% reduction in processing time. Property insurers have deployed them for policy inquiries, leading to better customer engagement. By focusing on measurable outcomes, such as increased efficiency or improved customer satisfaction, you can ensure the chatbot delivers maximum value.

Leveraging AI-Driven Features for Better Results

AI-driven chatbots like Sobot's offer advanced features that transform customer interactions. These bots analyze user data to provide personalized customer experiences, such as tailored policy recommendations or real-time claim updates. For instance, one insurer reported a 40% reduction in claims processing time after implementing AI-driven solutions.

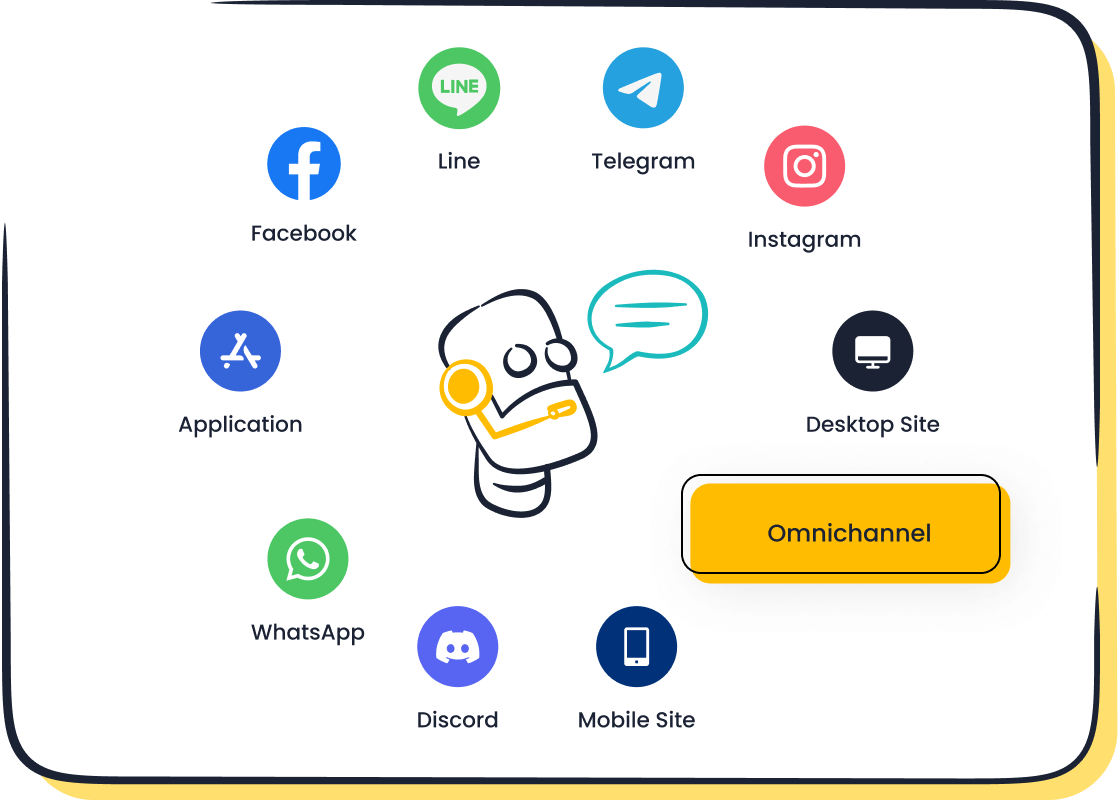

To maximize results, take advantage of Sobot's multilingual capabilities and omnichannel support. These features allow you to engage customers across self-service channels like WhatsApp and SMS. By leveraging these tools, you can create a seamless and efficient customer support system.

Regular Monitoring and Optimization

Continuous monitoring ensures your chatbot performs at its best. Track key metrics like resolution rates, customer satisfaction scores, and error rates. For example, insurers who regularly optimize their chatbots report a 30% increase in customer satisfaction. Use customer feedback and quality assurance testing to identify areas for improvement.

Sobot's chatbot simplifies this process with robust reporting tools. These tools help you analyze operational efficiency and refine conversation flows. Regular updates and optimizations keep your chatbot aligned with evolving customer needs.

Seamless Integration with Omnichannel Solutions

Integrating your chatbot with existing systems is crucial for a smooth deployment. Sobot's chatbot excels in connecting with legacy platforms, enabling automated data collection and accurate responses. For example, insurers can use the chatbot to validate customer information or assist with generating insurance quotes.

Omnichannel integration enhances the customer experience by providing consistent support across all platforms. Whether customers interact via live chat, email, or self-service channels, they receive the same high-quality assistance. This approach not only improves efficiency but also strengthens customer loyalty.

Automated chatbots, like Sobot's AI Chatbot, are revolutionizing the insurance industry. They reduce costs, improve efficiency, and enhance customer satisfaction. For example, chatbots handle up to 80% of routine inquiries, cutting operational costs by 30%. With over 30% of insurers adopting this technology, their role in modernizing insurance is undeniable.

| Statistic Description | Value |

|---|---|

| Reduction in operational costs due to AI-driven chatbots | Up to 30% |

| Percentage of routine inquiries handled by chatbots | Up to 80% |

| Increase in chatbot integration among insurance companies | Over 30% |

| Growth in customer support chatbots in the last two years | 50% increase |

By addressing challenges and following best practices, you can unlock the full potential of chatbots to transform your insurance operations.

FAQ

How do automated chatbots for insurance improve customer satisfaction?

Automated chatbots for insurance provide 24/7 support, reducing wait times and resolving queries instantly. For example, Sobot’s chatbot boosts customer satisfaction by offering multilingual, real-time assistance.

Can chatbots handle complex insurance queries?

Yes, AI-driven chatbots like Sobot’s adapt to complex queries. They analyze customer intent and provide accurate responses, such as explaining policy exclusions or suggesting tailored coverage options.

Are automated chatbots for insurance secure?

Absolutely! Chatbots like Sobot’s comply with global data privacy standards, including GDPR. They use encryption and access controls to protect sensitive customer information from unauthorized access.

💡 Tip: Learn more about Sobot’s secure and efficient chatbot solutions here.

See Also

Enhancing Customer Satisfaction Through Effective Chatbot Integration

Key Advantages of Implementing Chatbots on Your Website

Steps to Develop a Successful Chatbot for Your Site