Steps to Automate Financial Tasks with Chatbots

Imagine having a tool that works round the clock, handles routine financial tasks, and never makes a mistake. That’s the magic of finance chatbots! These intelligent assistants automate processes, saving businesses time and money. In fact, they help financial institutions cut costs by automating tasks, while improving service quality. Sobot, a leader in AI-powered chatbot solutions, empowers businesses to achieve this efficiency effortlessly.

Benefits of Finance Chatbots for Automation

Enhanced Efficiency and Productivity

Imagine completing tasks in minutes that used to take hours. That’s what finance chatbots bring to the table. They streamline back-office operations, allowing you to focus on more strategic activities. For instance, automating routine processes can cut task completion time significantly, boosting overall efficiency. Tata Mutual Fund saw a 70% reduction in call volume after implementing a chatbot, which freed up their team to handle more complex issues. With chatbots, you can achieve more in less time, making your operations smoother and more productive.

Cost Reduction and Resource Optimization

Finance chatbots are like having an extra team member who works tirelessly without adding to your payroll. By automating labor-intensive processes, they help you save on operational costs. Juniper Research estimates that chatbots will save businesses over $8 billion annually by 2025. For banks, this figure jumps to $11 billion. These savings come from reduced staffing needs and fewer errors, allowing you to allocate resources more effectively. It’s a win-win for your budget and your team.

Improved Accuracy and Reduced Errors

Mistakes in financial tasks can be costly. Chatbots, powered by artificial intelligence, minimize these errors by handling tasks with precision. They don’t get tired or distracted, ensuring consistent accuracy. Financial institutions that use chatbots report significant reductions in error rates, which enhances both efficiency and trust. When you rely on chatbots, you can rest assured that your processes are running smoothly and accurately.

24/7 Availability for Customer Support

Your customers don’t always need help during business hours. That’s where finance chatbots shine. They’re available around the clock, ready to assist whenever needed. Did you know that 64% of users appreciate the 24/7 availability of chatbots? Plus, 29% of interactions happen outside regular hours. This constant availability ensures your customers get instant responses, improving their experience and satisfaction.

Personalized Financial Assistance and Insights

Finance chatbots don’t just answer questions—they offer tailored advice. By analyzing spending habits and user behavior, they provide personalized recommendations. For example, some chatbots create custom budgets or suggest investment options based on your financial goals. Tools like Emitrr and Rasa use AI to deliver insights that feel like they’re made just for you. This level of personalization keeps customers engaged and helps them make smarter financial decisions.

Financial Tasks That Can Be Automated with Chatbots

Accounts Management and Transaction Monitoring

Managing accounts and tracking transactions can be time-consuming. Chatbots simplify this by providing real-time updates on balances and transaction histories. They also allow you to execute transactions directly through a chat interface. Imagine asking, “What’s my account balance?” and getting an instant reply. These bots even send alerts for suspicious activities, helping you stay on top of potential fraud.

- Key Benefits:

- Immediate responses to account-related inquiries.

- Real-time fraud alerts to protect your finances.

- Personalized financial advice based on spending habits.

Financial Reporting and Data Analysis

Chatbots make financial reporting a breeze. They generate reports, analyze data, and flag issues before they escalate. This ensures compliance and reduces errors. As one expert noted:

By automating these tasks, you save time and gain insights that help you make smarter decisions.

Customer Service for Financial Queries

Chatbots excel at handling customer queries. They answer questions about balances, fund transfers, and more—instantly. About 65% of customers prefer chatbots for quick financial inquiries because they eliminate long hold times. This improves satisfaction and keeps your customers happy.

Payment Reminders and Invoice Management

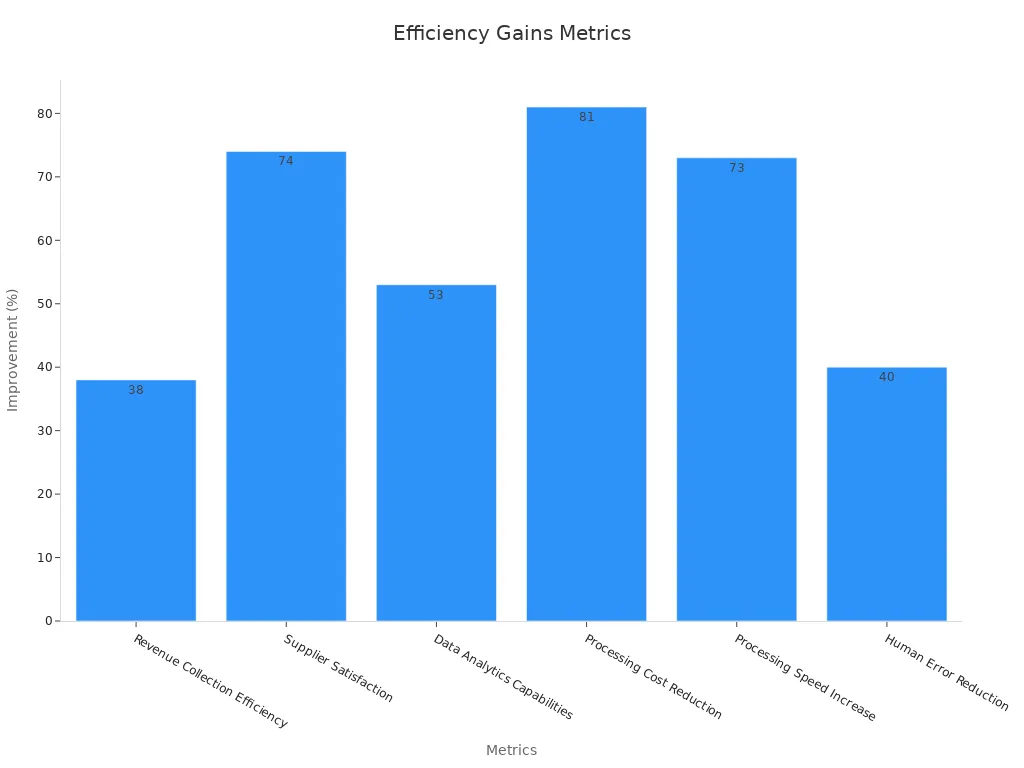

Forget late payments! Chatbots send reminders for upcoming bills and even automate invoice processing. This boosts revenue collection efficiency by 38% and reduces processing costs by 81%. Companies using AI tools also report a 90% drop in reconciliation errors.

Fraud Detection and Security Alerts

Fraud detection is critical, and chatbots are up to the task. They monitor transactions in real-time, reducing fraud detection time from hours to minutes. AI systems also cut false positives by 85%, ensuring legitimate transactions go through smoothly. This saves organizations millions in fraud-related costs while improving customer trust.

| Evidence Type | Description |

|---|---|

| Speed and Accuracy | Fraud detection time reduced to under 30 minutes, with 90% accuracy. |

| Reduction in False Positives | False positives reduced by 85%, improving customer experience. |

| Cost Savings | Fraud-related costs reduced by $1.76 million with AI tools. |

Step-by-Step Process to Automate Financial Tasks with Chatbots

Identify Financial Tasks Suitable for Automation

Start by pinpointing the financial tasks that consume the most time or are prone to errors. Look for repetitive, high-volume processes that can benefit from automation. For example:

- Repetitive tasks: Data entry and reconciliation.

- Time-consuming processes: Financial reporting and analysis.

- Error-prone areas: Fraud detection and risk management.

A North American bank automated cheque processing, reducing processing time by 76%. This freed up staff to focus on more strategic activities. Use a similar approach to identify tasks in your organization that could benefit from finance chatbots.

Select the Right Finance Chatbot (e.g., Sobot Chatbot)

Choosing the right chatbot is crucial. Look for features like 24/7 availability, multilingual support, and seamless integration with your systems. The Sobot AI Chatbot, for instance, offers omnichannel support and requires no coding to set up. It can handle routine queries, saving up to 50% on operational costs. By selecting a chatbot tailored to your needs, you’ll maximize efficiency and ROI.

Integrate the Chatbot with Financial Systems

Integration ensures your chatbot works seamlessly with existing tools like accounting software or CRM platforms. For example, Bank of America’s Erica chatbot streamlined operations by handling routine inquiries, allowing agents to focus on complex issues. Similarly, Sobot’s chatbot integrates effortlessly with platforms like Salesforce, ensuring smooth workflows.

Train Staff to Collaborate with Chatbots

Your team plays a vital role in making automation successful. Train them to work alongside chatbots, focusing on tasks that require human expertise. For instance, while the chatbot handles routine queries, your staff can tackle complex customer issues. This collaboration boosts productivity and ensures a balanced workload.

Monitor and Optimize Chatbot Performance

Once your chatbot is live, continuous monitoring is essential. Track metrics like user engagement, customer satisfaction, and operational efficiency. For example:

| Performance Indicator | Description |

|---|---|

| User Engagement | Measures how actively users interact with the chatbot. |

| Customer Satisfaction | Assesses how well the chatbot meets user needs. |

| Operational Efficiency | Evaluates the chatbot’s ability to handle queries effectively. |

Regularly analyze these metrics to identify areas for improvement. Optimization ensures your chatbot continues to deliver value over time.

Challenges in Implementing Finance Chatbots and Solutions

Addressing Data Privacy and Security Concerns

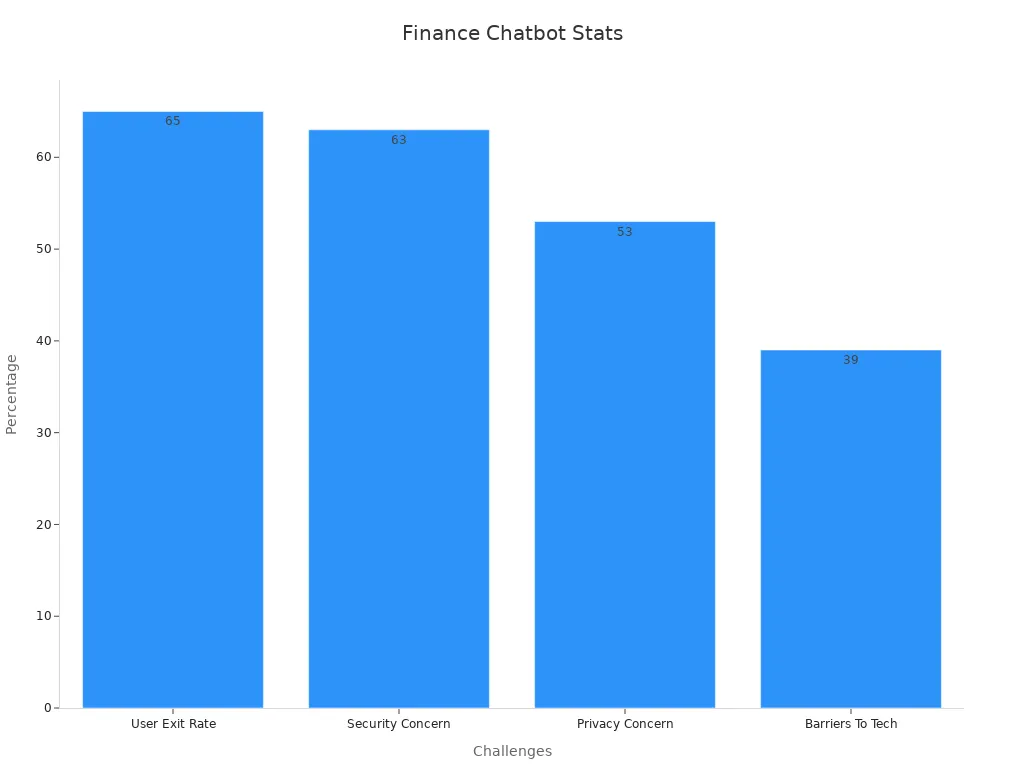

When it comes to finance chatbots, data privacy and security are top concerns. You’re dealing with sensitive financial information, so protecting it is non-negotiable. In fact, 63% of users worry about security, and 53% are concerned about privacy. These fears can become barriers to adopting new technologies.

To tackle these challenges, you can implement strategies like encryption to safeguard data during transmission and storage. Authentication ensures only verified users access the chatbot, while regular security audits help identify vulnerabilities. These measures build trust and keep your customers’ information safe.

Overcoming Integration Issues with Legacy Systems

Integrating chatbots with older systems can feel like fitting a square peg into a round hole. Legacy systems often lack the flexibility needed for seamless integration. This can slow down implementation and create inefficiencies.

The solution? Choose chatbots designed for compatibility. For example, Sobot’s chatbot integrates smoothly with platforms like Salesforce, ensuring workflows stay uninterrupted. By prioritizing compatibility, you’ll avoid headaches and ensure your chatbot works harmoniously with existing tools.

Managing Employee Resistance to Change

Change isn’t always easy, especially for employees. Resistance can derail your chatbot implementation. In fact, over 70% of change programs fail due to employee pushback. By 2022, only 38% of employees were open to organizational change, compared to 74% in 2016.

To overcome this, involve your team early in the process. Offer training sessions to show how chatbots simplify their workload. Highlight the benefits, like reduced repetitive tasks, to ease concerns. When employees see the value, they’re more likely to embrace the change.

Ensuring Chatbot Accuracy and Reliability

A chatbot’s performance hinges on accuracy and reliability. If it gives incorrect responses or fails to resolve issues, customers will lose trust. Metrics like deflection rate, resolution rate, and CSAT scores help measure its effectiveness.

| Metric | Description |

|---|---|

| Deflection Rate | Percentage of customers not requiring human assistance after chatbot interaction. |

| Resolution Rate | Measures the effectiveness of the chatbot in resolving customer inquiries. |

| Customer Satisfaction (CSAT) | Indicates how satisfied customers are with the chatbot's performance. |

| Quality Assurance (QA) Score | Evaluates the chatbot's responses for accuracy and relevance. |

Regular monitoring and optimization ensure your chatbot stays sharp. Tools like the CLASSic Framework assess cost, latency, accuracy, stability, and security, helping you maintain high standards.

Real-World Examples of Finance Chatbot Success

Case Study: Opay’s Use of Sobot Chatbot for Customer Service

Opay, a financial service platform, transformed its customer service with Sobot’s chatbot. Before using the chatbot, Opay struggled to manage customer inquiries across multiple channels. This led to delays and lower satisfaction rates. By adopting Sobot’s omnichannel solution, Opay unified its communication channels, including social media, email, and voice. The chatbot handled routine queries, allowing agents to focus on complex issues.

The results were remarkable. Customer satisfaction jumped from 60% to 90%. Operational costs dropped by 20%, and conversion rates increased by 17%. The chatbot also enabled 60% of customers to resolve issues independently. This case shows how finance chatbots can improve efficiency and customer experience while reducing costs.

Automating Invoice Management with AI Chatbots

Managing invoices manually can be tedious and error-prone. AI chatbots simplify this process by automating data entry, validation, and approval workflows. They also flag duplicate invoices and provide insights into invoicing patterns. This not only saves time but also ensures accuracy.

Here’s a breakdown of the improvements AI chatbots bring to invoice management:

| Improvement Type | Description |

|---|---|

| Enhanced Efficiency | Automates data entry and speeds up workflows. |

| Increased Accuracy | Validates data to reduce errors and ensure compliance. |

| Streamlined Workflows | Routes invoices for approval, minimizing delays. |

| Advanced Analytics | Identifies trends and potential fraud. |

| Duplicate Detection | Flags duplicate invoices to reduce fraud risks. |

With these capabilities, chatbots make invoice management faster, more accurate, and less stressful for your team.

Fraud Detection and Prevention Using Finance Chatbots

Fraud detection is a critical task for financial institutions. Finance chatbots excel in this area by monitoring transactions in real-time. They identify suspicious activities and alert you instantly. For example, ICICI Bank’s chatbot, iPal, guides customers through transactions while handling multiple conversations. This ensures a seamless experience and enhances trust.

Here’s how chatbots contribute to fraud prevention:

| Company | Chatbot Name | Functionality | Outcome |

|---|---|---|---|

| ICICI | iPal | Guides customers through transactions, handles multiple conversations | Enhances customer service by providing instant support and a seamless experience |

By using chatbots, you can detect fraud faster, reduce false positives, and protect your customers’ finances.

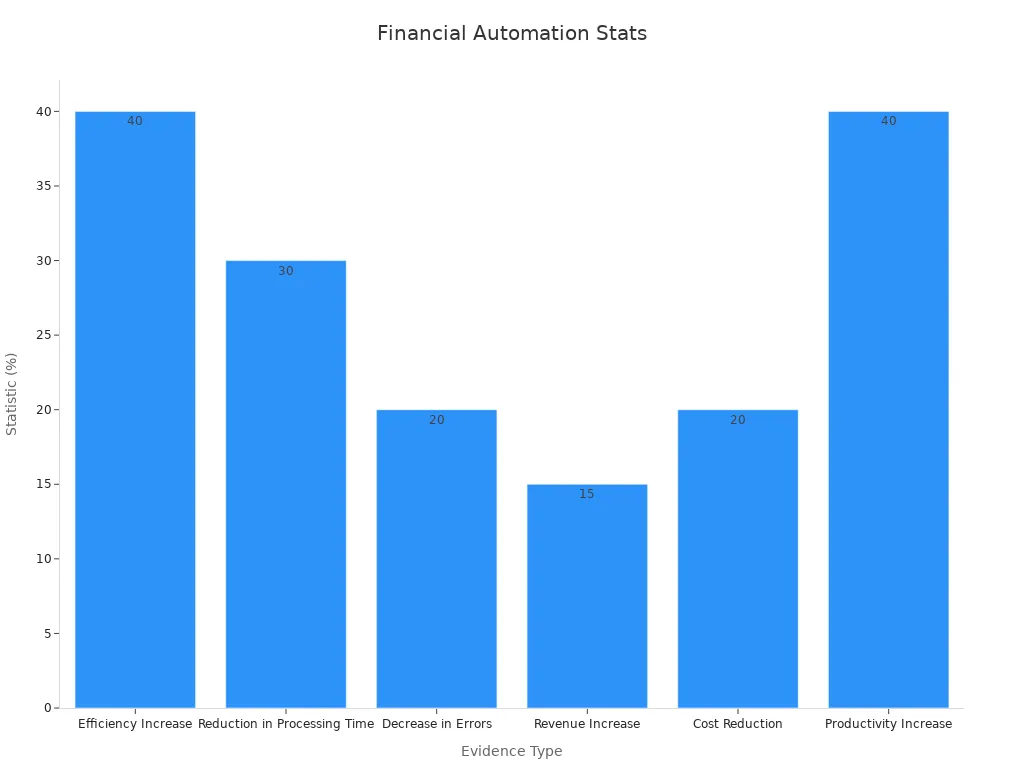

Automating financial tasks with chatbots transforms how businesses operate. You save time, reduce costs, and improve accuracy. For example, automation can boost efficiency by up to 40% and cut errors by 20%. These benefits free you to focus on growth and innovation.

| Evidence Type | Statistic/Result | Description |

|---|---|---|

| Efficiency Increase | Up to 40% | Automation enhances efficiency in financial tasks. |

| Reduction in Processing Time | 30% | A mid-sized company reduced processing time significantly. |

| Decrease in Errors | 20% | Automation minimizes errors in financial processes. |

| Revenue Increase | 15% | Data-driven insights lead to higher revenue. |

| Cost Reduction | 20% | Operational costs drop with automated processes. |

| Productivity Increase | 40% | Advanced tools improve productivity levels. |

Choosing the right chatbot is key. The Sobot Chatbot offers unmatched features like 24/7 availability, multilingual support, and seamless integration. It’s a game-changer for businesses aiming to stay competitive.

Now’s the time to embrace finance chatbots. They’re not just tools—they’re partners in your success. Start automating today and unlock your business’s full potential!

FAQ

What makes the Sobot Chatbot unique?

The Sobot Chatbot stands out with its 24/7 availability, multilingual support, and no-coding-required setup. It’s customizable and integrates seamlessly with platforms like Salesforce. 🚀

Can chatbots handle sensitive financial data securely?

Yes! Finance chatbots like Sobot use encryption and authentication to protect sensitive data. Regular security audits ensure your information stays safe and private. 🔒

Do I need technical skills to set up a chatbot?

Not at all! Sobot’s point-and-click interface makes setup simple. You can design workflows without writing a single line of code. 😊

See Also

Simple Ways to Use Chatbots on Your Website

Tips for Selecting the Ideal Chatbot Software

Step-by-Step Guide to Integrating a Chatbot