AI Chatbots for Finance Transform Operations in 2025

AI chatbots are reshaping the financial industry, bringing unprecedented automation, efficiency, and customer satisfaction. Imagine reducing your customer support costs by 30% while ensuring 95% of customer interactions are seamlessly managed by AI by 2025. These advancements are not just theoretical; they are happening now. Over 85% of financial institutions already use AI for fraud detection and operational improvements, while 50% rely on it to automate processes.

Sobot, a leader in AI-driven solutions, empowers businesses to harness this technology. Its chatbot automates routine queries, operates 24/7, and enhances productivity by up to 70%. With the financial chatbot market projected to hit $15 billion by 2025, adopting AI chatbots for finance like Sobot’s is no longer optional—it’s essential for staying competitive in this dynamic landscape.

Understanding AI Chatbots for Finance

What Are AI Chatbots?

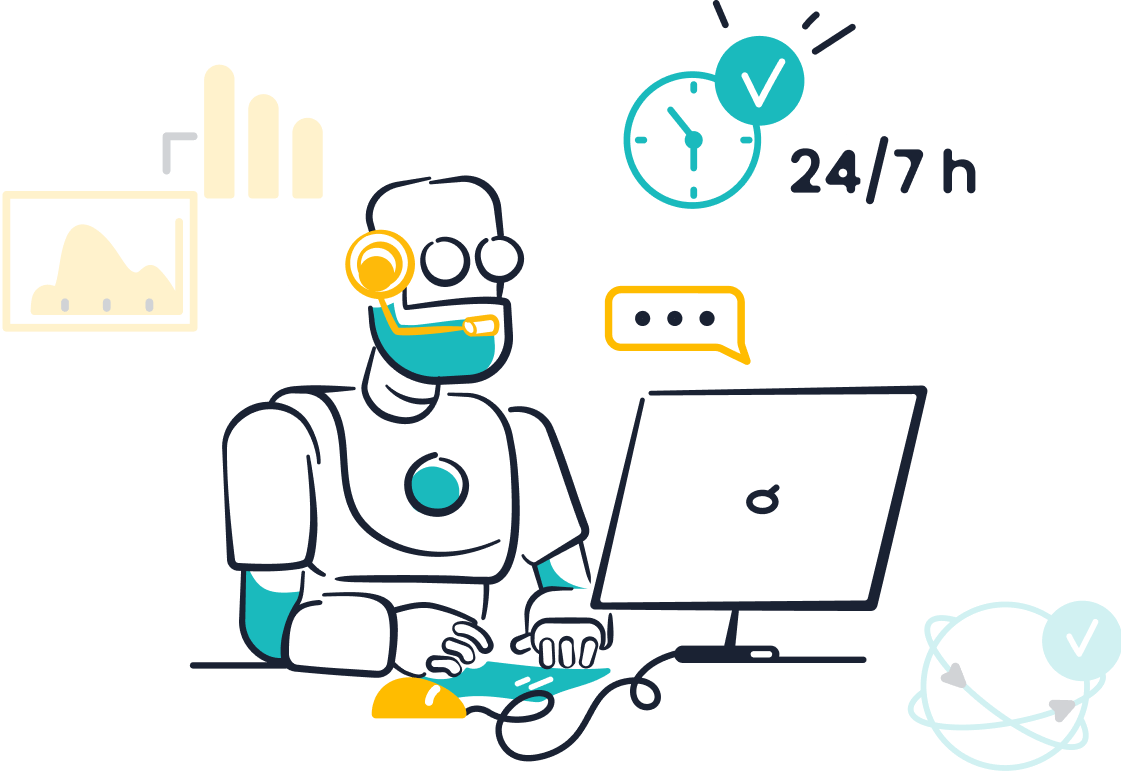

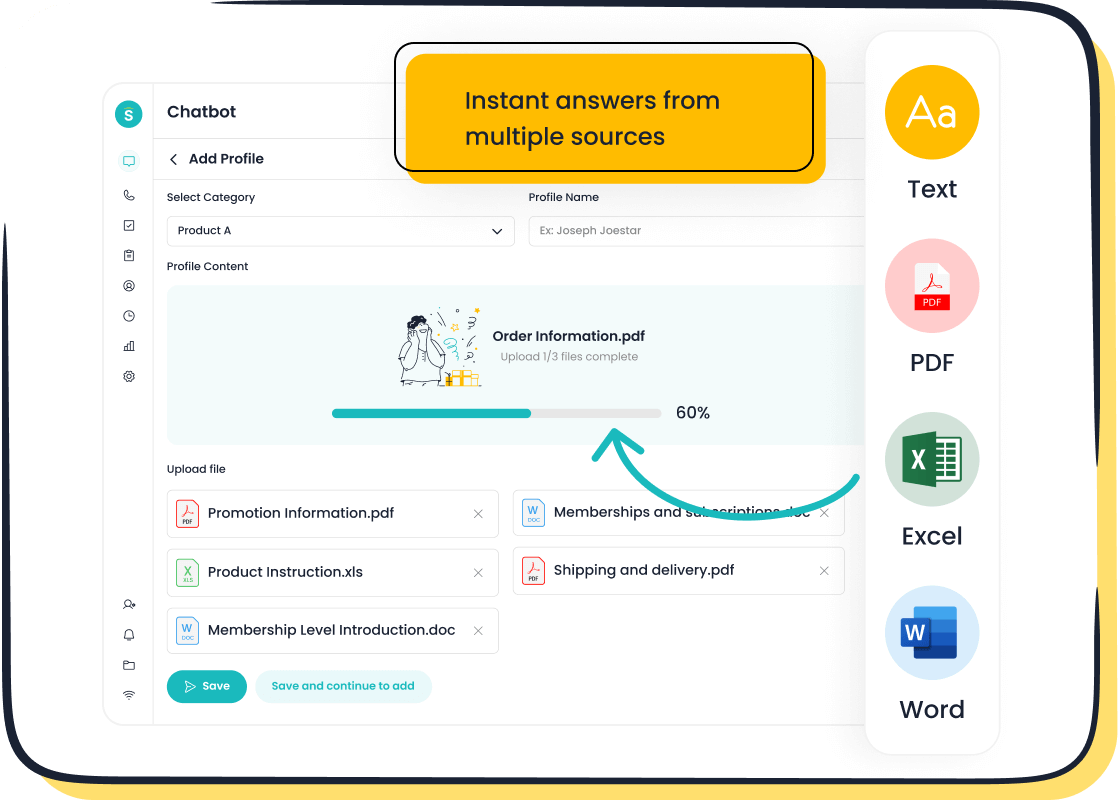

AI chatbots are software applications that simulate human conversations using artificial intelligence. They combine technologies like natural language processing (NLP), machine learning, and semantic search to understand user inputs and provide accurate responses. These chatbots analyze user queries, interpret intent, and deliver solutions in real time. For example, Sobot’s AI chatbot uses advanced neural network architectures to autonomously handle customer interactions, offering 24/7 multilingual support without requiring coding expertise.

Unlike traditional systems, AI chatbots continuously learn from interactions, improving their performance over time. They can handle tasks ranging from answering simple questions to managing complex financial transactions. This adaptability makes them indispensable for modern financial operations.

Why Financial Operations Need AI Chatbots

The financial sector faces increasing pressure to deliver faster, more efficient services while reducing costs. AI chatbots address these challenges by automating repetitive tasks, such as account inquiries and transaction tracking. They also enhance customer satisfaction by providing instant, accurate responses.

Consider this: by 2025, organizations using chatbots are expected to save $80 billion in customer service costs, according to Gartner. Additionally, financial institutions have reported up to a 40% improvement in operational efficiency after adopting AI chatbots. Sobot’s AI-driven chatbots, for instance, can handle 80% of customer queries autonomously, allowing your team to focus on more complex issues.

The Role of AI-Driven Chatbots in Modern Finance

AI-driven chatbots are transforming the way financial institutions operate. They streamline customer service, improve fraud detection, and offer personalized financial advice. For example, Bank of America’s virtual assistant, Erica, helps customers manage transactions and track spending, significantly boosting satisfaction rates.

Sobot’s AI chatbot takes this a step further by integrating with omnichannel platforms like WhatsApp and SMS. This ensures seamless communication across multiple channels, enhancing both customer experience and operational efficiency. With features like sentiment analysis and proactive messaging, these chatbots not only resolve issues but also anticipate customer needs, driving engagement and loyalty.

In today’s competitive landscape, adopting AI chatbots for finance is no longer optional. It’s a strategic necessity for staying ahead.

Key Benefits of AI Chatbots in Financial Operations

Cost Efficiency and Automation

AI chatbots revolutionize financial operations by delivering unmatched cost savings and operational efficiency. They automate repetitive tasks like account inquiries, transaction tracking, and balance checks, freeing up your team to focus on complex issues. This automation not only reduces workload but also slashes costs. For instance, 82% of companies that adopted AI early reported a positive ROI. The process automation market is expected to grow from $13 billion in 2024 to $23.9 billion by 2029, showcasing the increasing reliance on AI for efficiency gains.

Sobot’s AI chatbot exemplifies this transformation. Operating 24/7, it autonomously handles up to 80% of customer queries, cutting expenses by up to 50%. Its multilingual capabilities and no-coding-required setup make it accessible and efficient for businesses of all sizes. By integrating Sobot’s chatbot, you can achieve significant cost savings while enhancing operational efficiency.

Enhanced Fraud Detection and Risk Management

AI chatbots play a pivotal role in fraud detection and security. They analyze transaction patterns in real-time, identifying suspicious activities before they escalate. Machine learning models continuously improve fraud detection accuracy, while automated alerts notify compliance teams of potential risks. For example:

| Evidence Description | Impact on Fraud Detection and Risk Management |

|---|---|

| AI analyzes transaction patterns | Detects suspicious activity in real-time |

| Machine learning models | Continuously enhance fraud detection accuracy |

| Automated alerts | Notify compliance teams about potential violations |

| AI-powered forensic tools | Assist in investigating fraudulent transactions |

| Biometric authentication | Improves identity verification and transaction security |

Sobot’s chatbot enhances fraud detection by retrieving critical customer data, such as KYC records, and cross-checking responses against stored identity parameters. Its advanced AI ensures secure interactions, giving you peace of mind while protecting your customers.

Personalized Financial Advice and Customer Engagement

AI chatbots redefine personalized financial advice by analyzing vast amounts of data in real-time. They provide tailored recommendations, such as suggesting savings strategies or clarifying complex financial products. This accessibility eliminates long wait times for advice, improving customer engagement and satisfaction.

Sobot’s AI chatbot excels in delivering personalized financial advice. It uses smart self-service and proactive messaging to boost conversions by 20%. By understanding individual financial histories, it offers real-time insights that help customers make informed decisions. This personalized approach not only enhances the customer experience but also builds long-term loyalty.

💡 Tip: Adopting AI chatbots like Sobot’s can transform your financial operations, ensuring cost savings, improved customer experience, and robust fraud detection.

24/7 Customer Support with Sobot's Chatbot

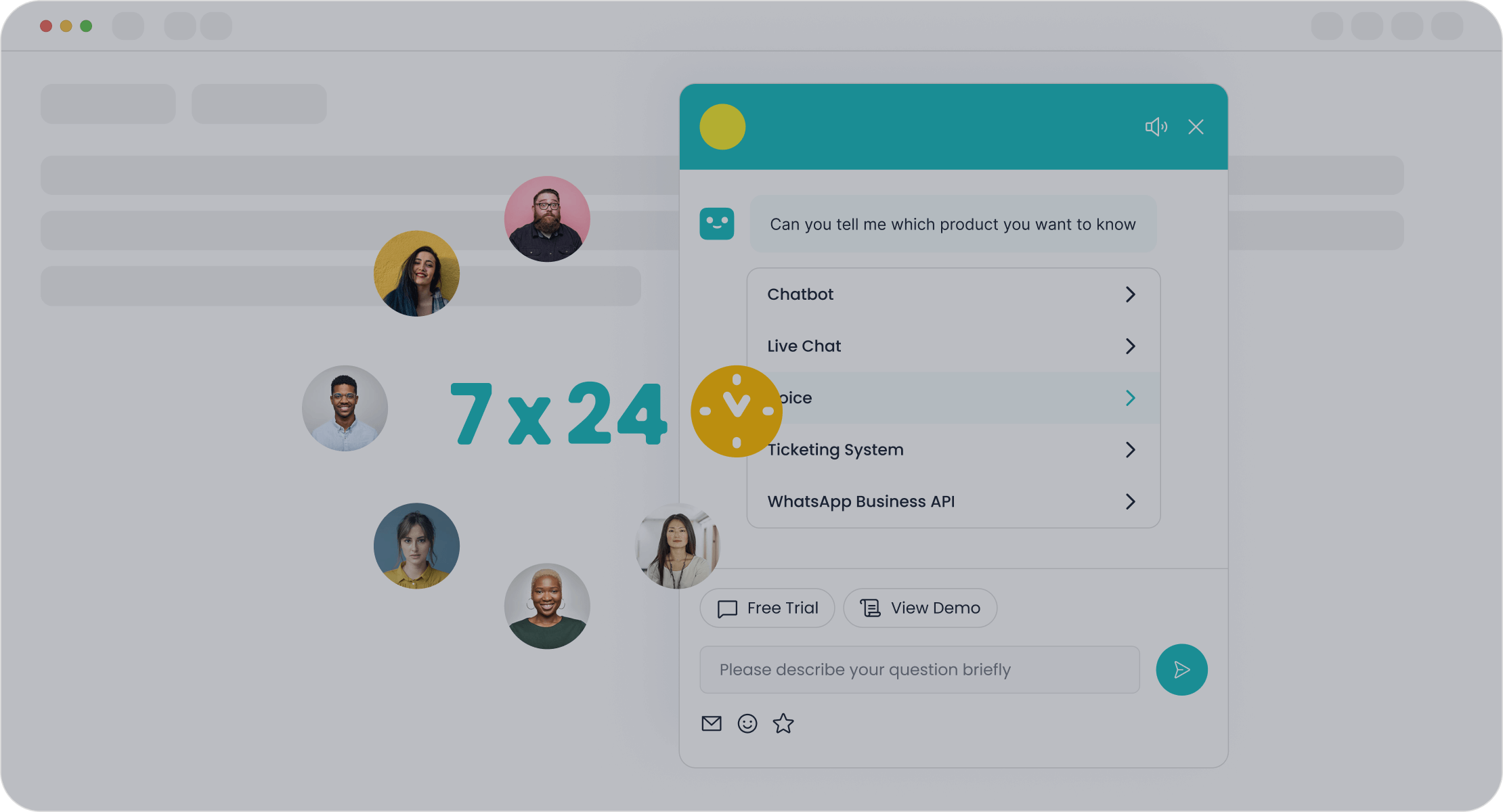

Imagine a world where your financial customer support never sleeps. With Sobot's chatbot, this is not just a possibility—it’s a reality. Offering 24/7 customer support, Sobot’s AI chatbots ensure your customers receive assistance whenever they need it, no matter the time or day. This constant availability not only enhances customer satisfaction but also positions your business as a reliable partner in the financial sector.

Sobot’s chatbot operates tirelessly, handling up to 80% of customer queries autonomously. This means your team can focus on complex issues while routine inquiries are resolved instantly. By automating these interactions, you can reduce costs significantly. Many businesses have reported saving up to 50% on customer service expenses after implementing AI chatbots. The cost-effectiveness of these systems is driving a market shift, making them indispensable for financial customer support.

Here’s how Sobot’s chatbot transforms your operations:

- Provides 24/7 support, ensuring no customer query goes unanswered.

- Reduces operational costs by automating repetitive tasks.

- Enhances customer satisfaction with instant, accurate responses.

For example, a financial institution using Sobot’s chatbot can guide customers through account inquiries, transaction tracking, or even fraud alerts without human intervention. Its multilingual capabilities ensure seamless communication with a diverse customer base, breaking language barriers effortlessly.

The chatbot’s integration with omnichannel platforms like WhatsApp and SMS further amplifies its effectiveness. Customers can reach you through their preferred channels, creating a unified and personalized experience. This level of accessibility and efficiency is what sets Sobot apart in the competitive landscape of financial customer support.

💡 Pro Tip: Adopting Sobot’s chatbot not only ensures 24/7 customer support but also boosts your team’s productivity by up to 70%. It’s a win-win for your business and your customers.

Overcoming Challenges in Adopting AI Chatbots

Addressing Data Privacy and Security Concerns

Data privacy and security remain top concerns for businesses adopting AI chatbots in financial services. With 68% of consumers globally worried about their online privacy, ensuring secure interactions is critical. Many customers struggle to understand how their data is collected and used, which can lead to mistrust. Additionally, 57% of consumers believe AI poses a significant threat to their privacy.

To address these concerns, you must prioritize robust security measures. AI chatbots like Sobot’s are designed with advanced application security solutions to protect sensitive data. They ensure data integrity and confidentiality, safeguarding customer information during interactions. By implementing such measures, you can alleviate privacy concerns and build trust with your customers.

💡 Tip: Transparency is key. Clearly communicate how your AI systems handle customer data to foster confidence in your financial services.

Integrating AI Chatbots with Legacy Systems

Legacy systems often hinder the seamless integration of AI chatbots. Outdated infrastructure can lead to data inconsistencies, communication breakdowns, and even security vulnerabilities. For example, Target Corporation faced significant challenges integrating AI with their ERP system, which they overcame by adopting a phased approach and engaging cross-functional teams.

To ensure smooth integration, start with a systems audit to identify compatibility issues. Implement AI chatbots like Sobot’s in stages, testing their performance at each step. Sobot’s no-coding-required setup simplifies deployment, making it easier to align with your existing systems. Additionally, its omnichannel capabilities ensure seamless communication across platforms like WhatsApp and SMS, enhancing customer support without disrupting operations.

Pro Tip: Involve stakeholders from IT, compliance, and customer support teams to streamline the integration process and address business needs effectively.

Building Customer Trust in AI-Driven Interactions

Trust is the foundation of successful AI-driven interactions. However, consumer attitudes toward AI vary widely. A YouGov survey revealed that while 52% of Indian consumers trust companies using AI, only 25% of Australians feel the same. This highlights the importance of understanding regional differences when implementing AI chatbots.

To build trust, focus on delivering consistent, personalized experiences. Sobot’s AI chatbot excels in this area by offering multilingual support and proactive messaging. These features ensure customers feel valued and understood, regardless of their location. Additionally, integrating AI chatbots with omnichannel platforms allows you to meet customers where they are, creating a seamless and reliable experience.

Note: Educate your customers about the benefits of AI chatbots and how they enhance financial services. Transparency and personalization go a long way in building loyalty.

Actionable Steps to Implement AI Chatbots Effectively

Identifying Business Needs and Use Cases

Before implementing AI chatbots, you need to identify the specific challenges your business faces. AI chatbots excel in areas like customer onboarding, feedback collection, and internal knowledge sharing. For example, they can guide new users through your financial products or collect real-time insights from customers, improving engagement and satisfaction.

Consider the metrics that matter most to your operations. High resolution rates and low fallback rates indicate effective chatbot performance. For instance, businesses using AI chatbots have reported a 20% increase in conversion rates and improved user engagement. By focusing on these use cases, you can align chatbot capabilities with your business goals.

💡 Tip: Start small. Test AI chatbots in one area, such as customer support, before expanding to other functions like marketing or recruitment.

Selecting the Right AI Chatbot Platform (e.g., Sobot's Chatbot)

Choosing the right platform is crucial for success. Not all AI chatbots are created equal. Platforms like Sobot’s Chatbot offer advanced features such as multilingual support, 24/7 availability, and seamless omnichannel integration. These capabilities ensure your chatbot can handle diverse customer needs effectively.

Here’s a quick comparison of Sobot’s benefits:

| Feature | Sobot's Chatbot Benefits |

|---|---|

| Customer Experience | Enhances user satisfaction through effective service |

| Data Security | Complies with ISO27001, ISO9001, ISO14001, GDPR |

| Human-like Interaction | Provides a more engaging customer interaction |

| Focus on Security | Prioritizes customer data protection and privacy |

| Customer Service Effectiveness | Maximizes agent productivity and builds relationships |

By selecting a robust platform like Sobot, you can ensure your AI chatbot delivers measurable results, from cost savings to enhanced customer loyalty.

Pro Tip: Evaluate platforms based on scalability, ease of use, and compliance with financial regulations.

Ensuring Compliance with Financial Regulations

Compliance is non-negotiable in the financial sector. AI chatbots must adhere to regulations like GDPR and CCPA, which govern data collection and processing. Non-compliance can result in hefty fines and damage your reputation. To stay compliant, focus on three key areas:

- Transparent Data Collection: Inform users about how their data will be used.

- Consent Management: Obtain explicit consent before processing any personal information.

- Secure Data Storage: Use encryption and access controls to protect sensitive data.

Sobot’s AI chatbot simplifies compliance by automating regulatory updates and monitoring interactions for adherence to standards. It also supports features like biometric authentication, ensuring secure and trustworthy customer interactions.

💡 Note: Regularly update your chatbot with the latest regulatory data to maintain compliance and build customer trust.

Training Teams and Monitoring Chatbot Performance

Implementing an AI chatbot is only the first step. To maximize its potential, you need to train your team and continuously monitor the chatbot’s performance. Proper training ensures your staff understands how to collaborate with the chatbot, while performance monitoring guarantees optimal results.

Equip Your Team with the Right Knowledge

Your team must know how to work alongside AI chatbots effectively. Start by organizing training sessions that explain the chatbot’s capabilities and limitations. For example, Sobot’s AI chatbot offers a no-coding-required setup, making it easy for your team to design workflows and manage interactions. Teach your staff how to escalate complex queries from the chatbot to human agents seamlessly. This collaboration ensures customers receive accurate and timely support.

💡 Tip: Use role-playing exercises to simulate real-life scenarios. This helps your team practice handling chatbot escalations and builds confidence in using the system.

Monitor and Optimize Chatbot Performance

Monitoring your chatbot’s performance is crucial for long-term success. Track key metrics like response time, resolution rates, and customer satisfaction scores. For instance, businesses using Sobot’s chatbot have reported a 70% boost in productivity and a 20% increase in conversions. Regularly review these metrics to identify areas for improvement.

Leverage Sobot’s reporting tools to gain insights into customer interactions. These tools provide data on common queries, fallback rates, and user behavior. Use this information to update the chatbot’s knowledge base and refine its responses.

Pro Tip: Schedule monthly performance reviews. Analyze the data to ensure your chatbot aligns with your business goals and customer expectations.

By training your team and monitoring performance, you can unlock the full potential of AI chatbots like Sobot’s. This approach not only enhances customer satisfaction but also drives operational efficiency.

The Future of AI Chatbots in Financial Operations

Emerging Trends in AI Chatbot Technology

AI chatbot technology is advancing rapidly, reshaping how businesses operate. By 2027, 25% of organizations are expected to rely on chatbots as their primary customer service channel. This shift is driven by innovations like enhanced personalization, voice-enabled interactions, and improved emotional intelligence. For example, Bank of America’s Erica has evolved to provide proactive financial guidance, serving over 32 million users with more than 1 billion interactions.

In finance, chatbots are becoming smarter and more versatile. They now integrate with voice assistants, interpret visual data, and detect user emotions. These advancements allow chatbots to deliver more human-like and empathetic interactions. Sobot’s AI chatbot leads the way with features like multilingual support, sentiment analysis, and seamless omnichannel integration. These capabilities ensure your business stays ahead in delivering exceptional customer experiences.

Predictions for AI Chatbot Adoption in Finance

The adoption of AI chatbots in finance is set to skyrocket. By 2025, the financial chatbot market is projected to reach $15 billion, reflecting the growing demand for automation and efficiency. Companies like Walmart and Hunt Companies already use AI to optimize expense management and liquidity forecasting, saving time and reducing errors.

AI chatbots will play a critical role in automating financial reporting, fraud detection, and compliance. For instance, 58% of organizations now use AI for automated data extraction in financial reporting. Sobot’s chatbot enhances these processes by providing real-time insights and secure interactions, helping you stay compliant while improving operational efficiency.

Staying Ahead with Sobot's AI Chatbot Solutions

To thrive in this competitive landscape, you need cutting-edge solutions. Sobot’s AI chatbot offers unmatched efficiency, automating up to 80% of customer queries and boosting productivity by 70%. Its advanced features, like proactive messaging and real-time intent recognition, drive customer engagement and loyalty.

Sobot’s chatbot also integrates seamlessly with platforms like WhatsApp and SMS, ensuring your customers can reach you anytime, anywhere. By adopting Sobot’s solutions, you can reduce costs, enhance customer satisfaction, and position your business for sustainable growth.

💡 Pro Tip: Don’t wait. Embrace Sobot’s AI chatbot today to future-proof your financial operations.

AI chatbots are revolutionizing financial operations by automating tasks, enhancing customer service, and driving efficiency. They are no longer just tools; they are strategic assets. For example, banking chatbots are projected to save approximately $7.3 billion in operational costs by 2023, while customer inquiry resolution rates could improve by up to 90%. These advancements demonstrate the transformative power of AI in finance.

By adopting Sobot's chatbot, you can deliver exceptional experiences to your customers. Its 24/7 availability, multilingual support, and seamless omnichannel integration ensure every interaction is efficient and personalized. Imagine reducing costs by 50% while improving customer satisfaction. This is not just a possibility—it’s a reality with Sobot.

The financial sector is evolving rapidly. To thrive, you must embrace AI chatbots. They are essential for meeting the growing demands of your customers and staying ahead in a competitive market. Start your transformation today with Sobot’s innovative solutions.

FAQ

How can AI chatbots improve customer engagement in finance?

AI chatbots provide instant responses, personalized advice, and proactive messaging. They analyze customer behavior to anticipate needs, creating meaningful interactions. For example, Sobot’s chatbot boosts increased customer engagement by 20%, helping your business build loyalty and drive business growth.

Are AI chatbots secure for financial transactions?

Yes, AI chatbots like Sobot’s prioritize security. They use encryption, biometric authentication, and real-time fraud detection to safeguard sensitive data. These features ensure your business complies with regulations while protecting customer information.

Can AI chatbots handle multilingual customer support?

Absolutely! Sobot’s AI chatbot supports multiple languages, enabling seamless communication with diverse customers. This feature helps your business expand globally and cater to varied demographics, driving business growth.

How do AI chatbots reduce operational costs?

AI chatbots automate repetitive tasks, cutting expenses by up to 50%. Sobot’s chatbot operates 24/7, handling up to 80% of queries autonomously. This efficiency allows your business to allocate resources effectively and focus on strategic initiatives.

What industries benefit most from AI chatbots?

AI chatbots benefit industries like finance, retail, and gaming. In finance, they streamline customer service, fraud detection, and personalized advice. Sobot’s solutions have helped businesses like Opay achieve a 90% customer satisfaction rate and reduce costs by 20%.

See Also

10 Leading Websites Implementing Chatbots This Year

Enhancing E-commerce Customer Experience With Chatbots

2024's Best 10 Chatbots For Your Website

Increasing Efficiency With AI-Powered Customer Service Tools