Understanding Acceptance Factors for Chatbot in Insurance

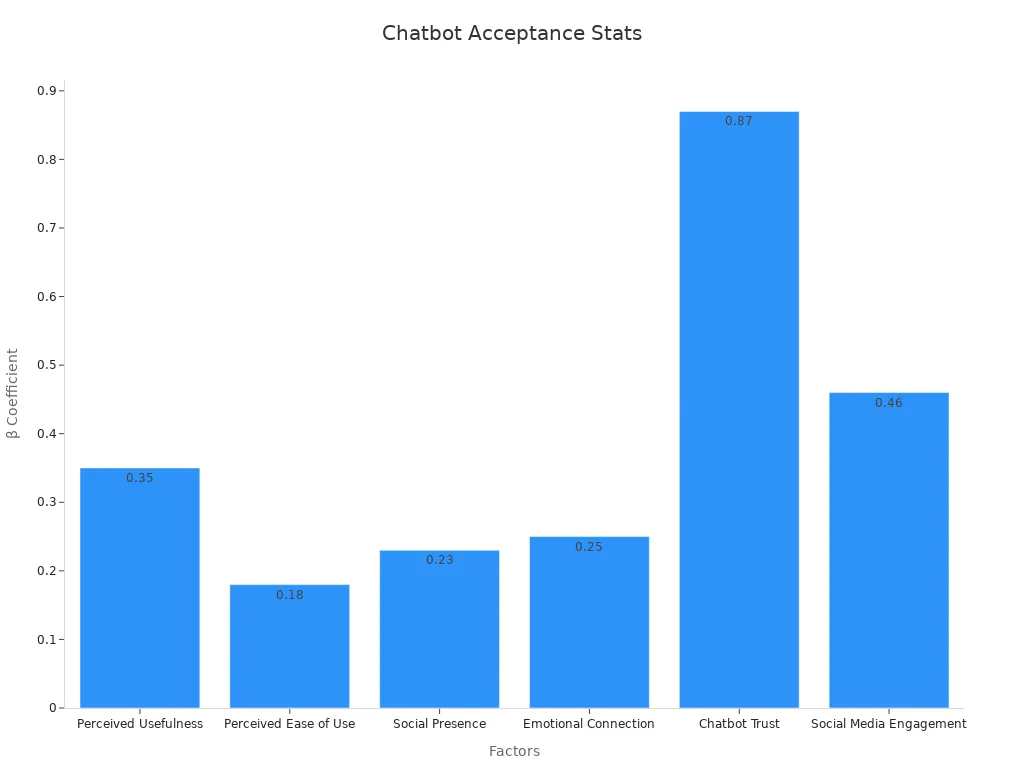

Key factors like trust, perceived usefulness, ease of use, and social influence shape the acceptance of a chatbot in insurance. The table below shows the strong positive effects these elements have on user engagement and trust:

| Factor | Standardized Path Coefficient (β) | Effect on Chatbot Trust / Behavior |

|---|---|---|

| Perceived Usefulness | 0.35 | Positively influences chatbot trust |

| Perceived Ease of Use | 0.18 | Positively influences chatbot trust |

| Social Presence | 0.23 | Positively influences chatbot trust |

| Emotional Connection | 0.25 | Positively influences chatbot trust |

| Chatbot Trust | 0.87 | Positively affects social media engagement |

The insurance sector faces challenges such as complex data, strict privacy rules, and rising cyber threats. Sobot AI helps address these obstacles, making customer service safer and more efficient for insurers and policyholders.

Chatbot in Insurance

Role in Customer Service

A chatbot in insurance acts as a digital assistant that interacts with customers through text or voice. These conversational bots handle routine questions, policy information, and claims updates. They help insurance companies deliver fast and accurate responses, which improves customer experience. Many insurers use chatbots to automate tasks like policy renewals, premium reminders, and claims status checks.

Key performance metrics show the value of a chatbot in insurance. Companies track error rates, escalation rates, resolution rates, handling time, customer satisfaction scores, and abandonment rates. These metrics help insurers measure how well the chatbot in insurance supports customers. For example, a lower error rate means customers get correct answers more often. A high resolution rate shows that the chatbot in insurance solves most issues without human help. Fast handling times and high customer satisfaction scores reflect a positive customer experience.

Insurance companies also benefit from reduced support costs. Chatbots automate routine inquiries, which means fewer agents are needed. This leads to lower expenses and higher efficiency. Seamless hand-offs to human agents ensure that complex cases get the attention they need, building trust and loyalty. Data security and privacy remain top priorities, as insurance data is sensitive.

Tip: Monitoring chatbot analytics and customer feedback helps insurers improve service quality and maintain compliance with privacy regulations.

Sobot Chatbot Features

Sobot’s chatbot in insurance stands out with its AI-powered, multilingual capabilities. It operates 24/7, providing instant support across channels like WhatsApp and SMS. Sobot’s chatbot in insurance uses a knowledge base built from articles, PDFs, and other documents, ensuring accurate replies. The no-code setup allows insurers to deploy and customize workflows easily.

Sobot’s chatbot in insurance also offers seamless integration with existing systems. It tracks key metrics, supports proactive messaging, and enables smooth escalation to human agents. These features help insurers enhance customer experience, reduce costs, and improve operational efficiency.

Acceptance of Chatbots

The acceptance of chatbots in insurance depends on several core factors. Trust and security, perceived usefulness, ease of use, and social influence all play a crucial role in shaping how policyholders and professionals view chatbot acceptance. Sobot’s AI-powered chatbot addresses these factors with advanced features, making it a reliable choice for insurers seeking to improve customer service and operational efficiency.

Trust and Security

Trust forms the foundation of chatbot acceptance in the insurance industry. Customers want to know their data remains safe and that the chatbot handles sensitive information responsibly. Recent global surveys show that over 80% of consumers trust insurers to manage data responsibly when using AI tools. However, only 39% of respondents trust insurers as much as banks or health companies. Security concerns remain high, with most people considering secure data management essential when choosing insurance products.

| Aspect | Key Findings |

|---|---|

| Survey scope | 2,880 consumers across 7 countries |

| Familiarity with GenAI | 70% know how companies use generative AI in chatbots |

| Trust in insurers' data handling | Over 80% trust insurers to handle data responsibly with AI tools |

| Importance of data security | Majority consider secure data management essential in insurance purchasing decisions |

| Trust comparison by industry | Banks: 50%, Health companies: 46%, Insurers: 39% |

| Incentives for data sharing | Nearly 50% would share health data for auto-fill; 40%+ for personalized advice or discounts |

| Generational differences | 87% Gen Z trust insurers vs. 75% Baby Boomers |

Sobot’s chatbot supports robust data privacy and security measures. The platform uses secure cloud infrastructure and complies with industry standards, helping insurers build trust with policyholders. Sobot also enables seamless integration with existing systems, ensuring that sensitive customer data remains protected throughout every interaction.

Note: Building trust through transparent communication about data handling and privacy policies increases the acceptance of chatbots among insurance customers.

Perceived Usefulness

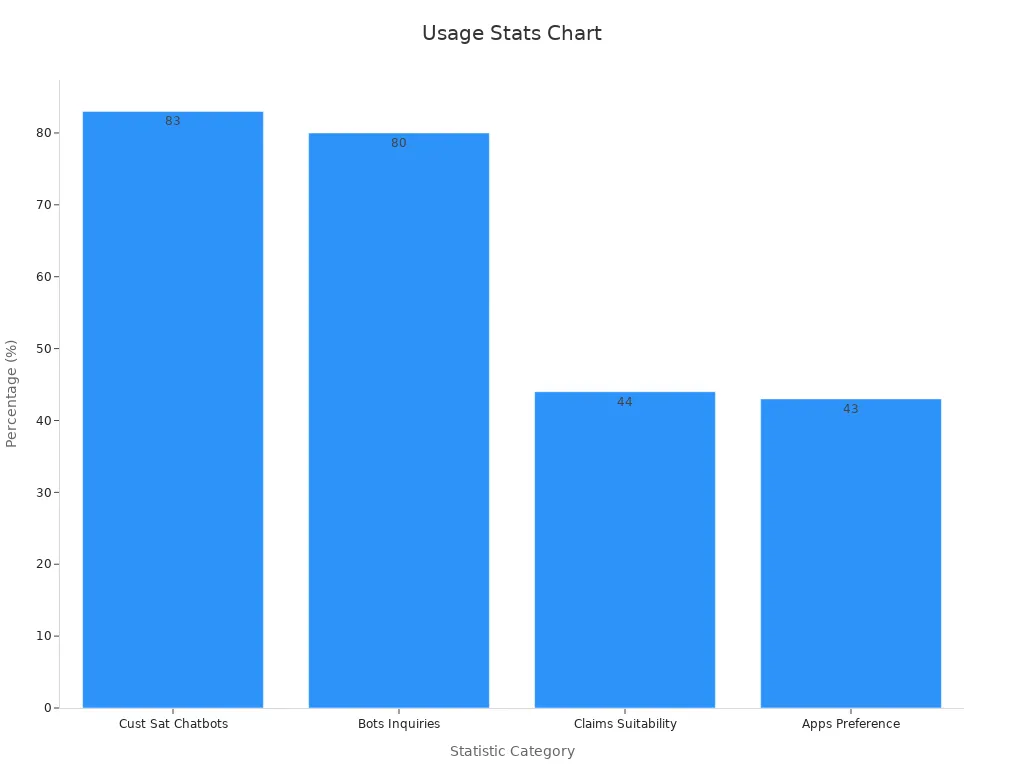

Perceived usefulness directly impacts chatbot acceptance. Customers expect chatbots to solve problems quickly and provide accurate information. In insurance, chatbots now handle 80% of inbound inquiries and manage over 95% of user conversations. Satisfaction rates reach 83%, showing that most clients find chatbots valuable for claims processing and insurance applications.

| Statistic Description | Value |

|---|---|

| Customer satisfaction with chatbot interactions in insurance | 83% |

| Chatbots handling inbound inquiries in insurance services | 80% |

| AI bots managing user conversations | Over 95% |

| Clients finding bots suitable for claims processing | 44% |

| Clients preferring bots for insurance applications | 43% |

Sobot’s chatbot enhances perceived usefulness by providing 24/7 support, multilingual capabilities, and instant access to policy information. For example, a policyholder can check claim status or update personal details at any time, reducing wait times and improving satisfaction. Sobot’s proactive messaging and real-time intent assistance also help insurers boost conversions and streamline customer journeys.

Ease of Use

Ease of use remains a top driver for the acceptance of chatbots. Insurance customers prefer simple, transparent, and fast interactions. Automated AI processes deliver these qualities while maintaining a human touch. Consistency and reliability, achieved through data-driven automation, further build trust and encourage chatbot acceptance.

- Insurance customers prioritize simplicity, transparency, and speed in their interactions.

- Automated AI processes help deliver these qualities without losing the necessary human touch.

- Consistency and reliability, achieved through data-driven automation, build customer trust.

- The chatbot achieved a 92% customer satisfaction rating.

- Users reported quick query resolution and easy communication.

- Features like clear error messages, accessibility options, and immediate feedback improved user experience.

- The system reduced average resolution time by 60% and handled 75% of routine queries automatically, demonstrating efficiency linked to simple, effective design.

Sobot’s chatbot features a no-code, point-and-click interface, making it easy for insurers to deploy and customize workflows. Customers benefit from clear instructions, accessible design, and immediate feedback. For instance, a user can renew a policy or get premium reminders in just a few clicks, increasing overall satisfaction and supporting the acceptance of chatbots.

Social Influence

Social influence shapes how quickly people adopt new technology, including chatbots in insurance. Studies show that encouragement from peers, family, or professional networks increases the likelihood of chatbot acceptance. In one study, social influence emerged as a significant factor in the adoption of digital insurance solutions, especially among persons with disabilities. This finding highlights the importance of positive word-of-mouth and visible success stories in driving the acceptance of chatbots.

Sobot’s chatbot supports omnichannel communication, allowing insurers to engage customers across platforms like WhatsApp and SMS. When policyholders see friends or colleagues using chatbots successfully, they feel more confident trying the technology themselves. Insurers can also promote chatbot features through educational campaigns, testimonials, and community engagement, further boosting chatbot acceptance.

Tip: Insurers should encourage satisfied customers to share their positive experiences with chatbots. Social proof can accelerate the acceptance of chatbots across different user groups.

The acceptance of chatbots in insurance depends on trust, usefulness, ease of use, and social influence. Sobot’s advanced features and customer-centric approach help insurers address these factors, making chatbot acceptance a reality for modern insurance providers.

Policyholders' Acceptance

User Groups

Policyholders' acceptance of chatbots in insurance varies across different user groups. Professionals in the insurance industry often show higher acceptance of chatbots due to their familiarity with digital tools and workflows. Ordinary policyholders, such as individuals and families, may have mixed feelings. Some prefer digital channels for simple tasks, while others still value human interaction for complex issues.

Recent surveys highlight several trends:

- Covid-19 accelerated digital adoption, especially for research and simple service episodes.

- Strictly offline interactions have declined and have not rebounded.

- Most policyholders now use a hybrid approach, combining digital and offline channels.

- Digital self-serve tools face slow adoption when failure rates are high, reaching up to 31% in US auto insurance.

- Simple tasks like bill payment delight customers more when handled digitally.

- Complex needs, such as claims or advice, often require a mix of digital and human support.

| Aspect | Key Findings |

|---|---|

| Digital channel adoption | Digitally active customers increased by over 60% in four years |

| Mobile adoption growth | Mobile use increased by more than 70% in the past year |

| Demographic variation | Millennials are heavy mobile users |

| Customer openness | Customers across markets are open to new technologies like voice assistants |

| Loyalty scores | Digital-only users give lower loyalty scores than multichannel users |

| Channel preferences | Many customers remain hybrid users |

| Regional differences | Chinese life insurance customers show higher satisfaction with digital channels |

| Offline channel use reasons | Customers find offline channels more personalized and easier to use |

These findings show that policyholders' acceptance depends on their comfort with technology and the type of service needed. Sobot’s chatbot supports both digital and hybrid experiences, making it easier for all user groups to interact with their insurer.

Insurance Literacy

Insurance literacy plays a key role in policyholders' acceptance of chatbots. People with higher insurance literacy understand terms, processes, and products better. They feel more confident using digital tools for tasks like policy updates, claims, or premium payments. These users often adopt chatbots quickly and use them for a wide range of services.

On the other hand, policyholders with low insurance literacy may hesitate to use chatbots. They might worry about making mistakes or misunderstanding information. For these users, clear instructions and easy-to-follow workflows are essential. Sobot’s chatbot addresses this need by offering simple, step-by-step guidance and instant access to a knowledge base. This approach helps bridge the gap for users with varying levels of insurance knowledge.

Tip: Insurers can improve policyholders' acceptance by providing educational resources and clear chatbot instructions.

Digital Skills

Digital skills also influence policyholders' acceptance of chatbots. Users with strong digital skills navigate online platforms and mobile apps with ease. They appreciate the speed and convenience of chatbot interactions. Millennials and younger generations, who use mobile devices frequently, show higher acceptance of chatbots in insurance.

However, some policyholders lack confidence in digital environments. They may struggle with app navigation or fear data privacy risks. For these users, a user-friendly chatbot interface is crucial. Sobot’s chatbot features a no-code, point-and-click design, making it accessible for users with all skill levels. Multilingual support and omnichannel access further enhance policyholders' acceptance by removing language and platform barriers.

Insurers should offer training, tutorials, and support to help all policyholders build digital confidence. This strategy increases the acceptance of chatbots and ensures that more people benefit from digital insurance services.

Challenges for Chatbot in Insurance

Data Privacy

Data privacy stands as a top concern for insurance chatbots. Insurance companies handle sensitive personal and financial information. Security vulnerabilities such as spoofing, denial of service, and information disclosure can threaten both data privacy and system integrity. Insecure authentication may lead to data breaches and loss of user trust. Messaging platforms like Facebook Messenger sometimes lack strong security, increasing the risk of attacks. Experts recommend thorough security and privacy checks before deploying chatbots. Sobot addresses these risks by using secure cloud infrastructure and following industry standards. The platform supports end-to-end encryption and strong access controls, helping insurers protect customer data and maintain trust.

Integration Issues

Many insurers rely on legacy systems that make chatbot integration difficult. These older systems often cause slow claims processing, siloed data, and high maintenance costs. For example, Alpha Insurance faced delays and high costs until it used middleware and APIs to connect new AI tools with its legacy systems. Middleware acts as a bridge, translating data and managing transactions between old and new platforms. Companies like Prudential Insurance and AXA Group improved flexibility and customer service by using middleware to link mainframe systems with modern apps. Sobot’s chatbot offers seamless integration with existing insurance systems, reducing disruption and supporting smooth digital transformation.

Technical Limitations

Technical limitations can affect chatbot performance in insurance. Chatbots may struggle with complex queries or unusual customer requests. Security threats such as malicious input and user profiling can also impact system reliability. Studies show that insurance chatbots have received less research attention than banking chatbots, leaving gaps in targeted security frameworks. Sobot’s AI-powered chatbot uses a robust knowledge base and advanced automation to handle routine queries efficiently. The platform provides regular updates and optimization tools, helping insurers overcome technical barriers and deliver consistent service.

Ethical Concerns

Ethical concerns shape how insurers use chatbots. Customers expect transparency about how their data is used and stored. They also want fair and unbiased responses from automated systems. Loss of trust due to ethical lapses can hinder chatbot adoption. Sobot helps insurers address these concerns by supporting transparent communication and compliance with privacy regulations. The platform enables clear audit trails and customizable privacy settings, allowing insurers to meet both legal and ethical standards.

Note: Addressing these challenges is essential for successful chatbot deployment in insurance. Sobot’s secure, compliant, and easily integrated solutions help insurers build trust and deliver better customer experiences.

Improving Acceptance of Chatbots

Building Trust

Trust is the foundation of chatbot acceptance in insurance. Insurers can build trust by ensuring data privacy, using secure cloud infrastructure, and complying with regulations. Sobot’s chatbot supports end-to-end encryption and strong access controls, which help protect sensitive information. Empathetic communication also increases trust. Studies show that chatbots expressing empathy boost both affective and cognitive trust, leading to higher satisfaction. Regular updates and transparent privacy policies further reassure users. The Insurance Chatbot Market report highlights that regulatory compliance and technological advancements drive trust and adoption, with the market expected to reach $4,498 million by 2033 (source).

Enhancing Usability

Usability improvements play a key role in driving chatbot acceptance. Insurers should focus on clear navigation, easy prompts, and multimodal communication, such as adding voice or image support. Sobot’s chatbot features a no-code, point-and-click interface, making it simple for all users. Personalization, accessibility, and multilingual support also enhance usability. Metrics like System Usability Scale (SUS) scores and engagement rates help measure success. Studies show that users rate personalization and interactive design as top priorities, which increases engagement and acceptance.

Expanding Capabilities

Expanding chatbot capabilities supports higher chatbot acceptance. Sobot’s chatbot offers 24/7 availability, omnichannel support, and integration with existing systems. These features allow insurers to automate claims, payments, and customer education. Advanced chatbots now use natural language, personalized offers, and proactive messaging. As chatbots evolve to include technologies like IoT and blockchain, they become more context-aware and proactive. This evolution leads to better customer experience and greater acceptance across the insurance sector.

- Chatbots save over $1.3 billion in insurance costs by 2023.

- They handle high volumes of queries, freeing agents for complex tasks.

- Enhanced features improve operational efficiency and user satisfaction.

Leveraging Feedback

Continuous improvement relies on customer feedback. Sobot’s chatbot collects feedback after each interaction, using surveys or Net Promoter Score (NPS) tools. This data helps insurers adapt chatbot behavior and meet user expectations. Post-interaction surveys let customers rate their experience and suggest improvements. Analyzing this feedback fine-tunes chatbot performance, strengthens loyalty, and drives ongoing chatbot acceptance.

Tip: Regularly review feedback and update chatbot workflows to align with customer needs.

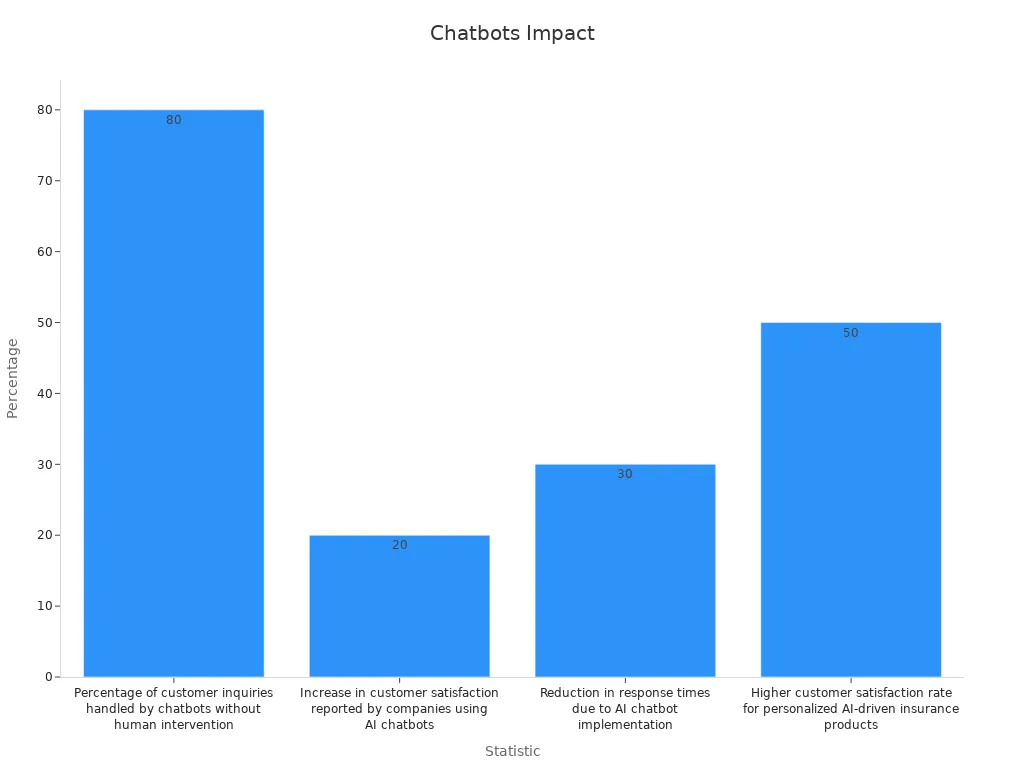

Key factors such as trust, perceived usefulness, ease of use, and social influence drive the acceptance of a chatbot in insurance. Addressing challenges like data privacy and integration remains essential for insurers aiming to deliver superior customer service. Sobot’s Chatbot empowers insurers to overcome these barriers with secure, user-friendly, and scalable solutions. Industry data shows AI chatbots now handle up to 80% of inquiries and boost satisfaction by 20%. By 2030, AI will become essential for competitive insurance firms.

| Statistic Description | Value / Impact |

|---|---|

| Percentage of customer inquiries handled by chatbots without human intervention | Up to 80% |

| Increase in customer satisfaction reported by companies using AI chatbots | 20% |

| Reduction in response times due to AI chatbot implementation | 30% |

| Higher customer satisfaction rate for personalized AI-driven insurance products | 50% |

The future of chatbot in insurance promises smarter automation, faster service, and stronger customer relationships.

FAQ

What is a chatbot in insurance?

A chatbot in insurance is an AI-powered tool that helps customers with policy questions, claims, and updates. It works 24/7, answers common queries, and improves service speed. Sobot’s chatbot in insurance supports multiple languages and channels, making customer support easier and faster.

How does Sobot’s chatbot in insurance protect customer data?

Sobot’s chatbot in insurance uses secure cloud infrastructure and follows industry standards. It supports end-to-end encryption and strong access controls. These features help insurers keep sensitive information safe and build trust with policyholders.

Can a chatbot in insurance handle complex claims?

A chatbot in insurance can manage routine claims and guide users through simple steps. For complex cases, Sobot’s chatbot in insurance escalates the issue to a human agent. This ensures customers always receive the right support.

Why do customers prefer using a chatbot in insurance?

Customers like using a chatbot in insurance because it gives instant answers, reduces wait times, and works any time of day. Sobot’s chatbot in insurance also provides clear instructions and supports multiple languages, making it easy for everyone to use.

How can insurers measure the success of a chatbot in insurance?

Insurers track metrics like resolution rates, customer satisfaction scores, and response times. Sobot’s chatbot in insurance offers detailed analytics and reporting tools. These help insurers see how well the chatbot in insurance improves service and efficiency.

See Also

Ways Chatbots Enhance Customer Experience In Online Shopping

Simple Steps To Add Chatbot Examples On Your Website

A Complete Guide For Selecting Top Chatbot Software