Customer Experience Management in Banking: Best Practices for 2025

Customer experience management in banking shapes the future of financial services. Banks now see that 86% of buyers will pay more for a better customer experience, and strong CX strategies drive up to 1.8x higher profitability.

- 80% of customers prefer personalized experiences.

- By 2025, 85% of interactions may be managed by AI.

- Banks with robust omnichannel strategies retain 89% of customers.

| Trend Description | Statistic / Percentage |

|---|---|

| Increase in digital channel usage for banking products in Europe | From 33% in 2020 to 45% in 2023 |

| Consumers likely to leave a brand without personalization | 66% |

| Customers using digital platforms to reduce branch reliance | 37% |

Sobot AI empowers banks to meet rising customer expectations and deliver a seamless banking experience across every channel.

Personalization with AI and Data

Customer Data Insights

Banks today rely on customer data insights to shape every part of the customer experience. They use sentiment analysis, behavioral analysis, and predictive analytics to understand what customers want. Transactional data helps banks spot spending patterns and choose the best channels for marketing. Predictive analytics supports banks in predicting when customers might leave and helps them act early to keep them. Nearly 75% of customers say personalization is very important in financial services. Over half of Gen X and Millennials would switch banks for better personalized services. Banks that use customer data for personalization see higher satisfaction, loyalty, and retention. They also achieve strong revenue growth—up to $300 million per $100 billion in assets.

Banks that excel in personalization generate 40% higher revenue, and 76% of consumers are more likely to buy from brands that personalize their service (McKinsey).

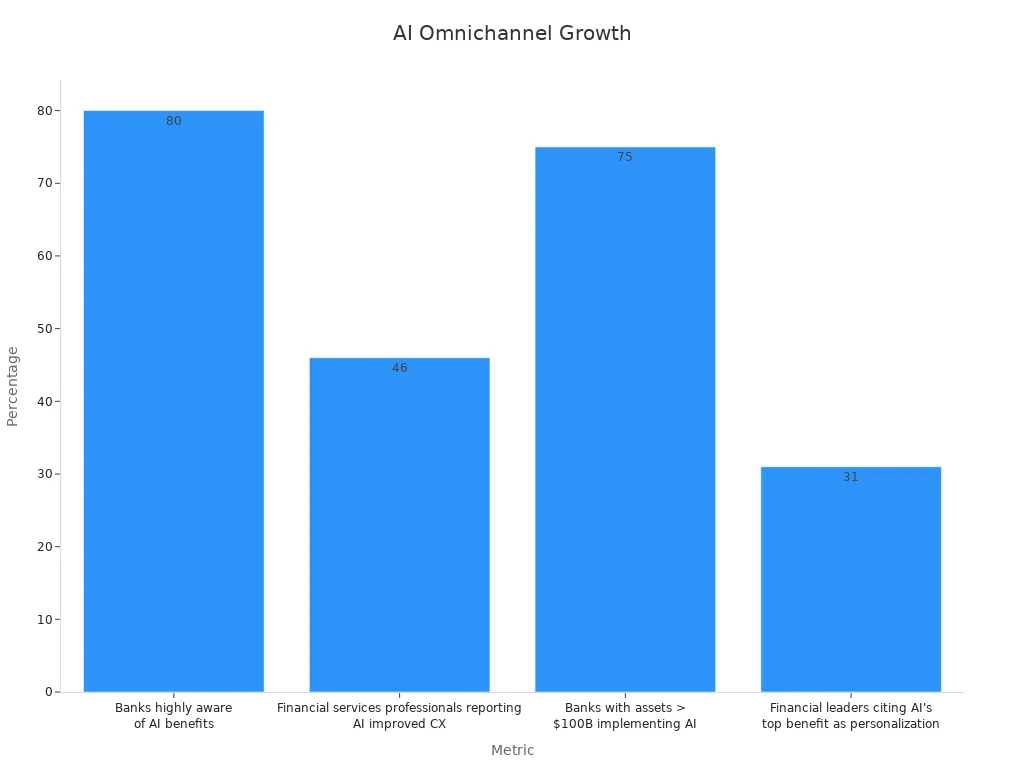

AI-Driven Service

AI-driven service transforms the banking experience by making customer service faster and more accurate. AI models help banks make real-time credit decisions and improve risk assessment. Virtual assistants can handle many customer queries at once, which increases service capacity and reduces wait times. Automation of routine tasks speeds up processes and lowers costs. AI also helps banks keep customer data safe and ensures compliance with regulations.

- 24/7 support means customers get help anytime, improving satisfaction.

- AI-driven recommendations make customer engagement more proactive and personal.

- Banks using AI handle 80% of routine inquiries with automation, freeing staff for complex issues.

- AI-powered onboarding and loan approvals now take hours instead of days.

Personalization Examples

Sobot’s Live Chat and AI tools help banks deliver a personalized customer experience across every channel. For example, Opay, a leading financial platform, used Sobot’s omnichannel solution to unify customer service on social media, email, and voice. This led to a jump in customer satisfaction from 60% to 90%, a 20% drop in costs, and a 17% increase in conversion rates. Sobot’s platform enabled Opay to send targeted messages and manage all customer interactions in one place, making the retail banking experience smoother and more efficient.

Sobot’s Live Chat uses precise profiling and AI to turn visitors into clients, boosting conversion by 38%. This approach extends the customer lifecycle and increases loyalty, showing how personalization can transform banking.

Omnichannel Engagement Strategies

Unified Customer Journeys

Banks today must deliver a unified customer journey to meet rising expectations. Customers want to move between digital and physical channels without losing context. Research shows that banks with strong omnichannel strategies report higher satisfaction and loyalty. Data-driven personalization and AI-powered insights help banks tailor services, increasing engagement. For example, 91% of consumers are more likely to interact with brands that offer relevant recommendations. Personalization can boost marketing ROI by up to eight times. Real-time notifications and alerts also improve digital engagement, which leads to greater trust and satisfaction. Banks that use unified customer data platforms achieve 2.5 times better retention rates than those with fragmented systems. This approach creates a seamless retail bank customer experience across every touchpoint.

Tip: Mapping the customer journey helps banks uncover pain points and optimize each step for a better bank customer experience.

Seamless Channel Switching

Seamless channel switching is essential for a modern retail bank customer experience. Customers expect to start a conversation on one channel and continue it on another without repeating themselves. Studies in retail banking show that high-quality multichannel integration increases the perceived value of the bank. This effect is even stronger in complex systems with many channels. When banks enable smooth transitions, customers feel valued and understood. This leads to higher satisfaction, loyalty, and a stronger overall bank customer experience. Banks that master seamless channel switching set themselves apart in a crowded market.

- 82% of customers value access to local branches, even as digital banking grows.

- 89% use mobile banking, showing the need for both digital and traditional channels.

- 66% are satisfied when online chat connects them to human agents, highlighting the importance of human touchpoints.

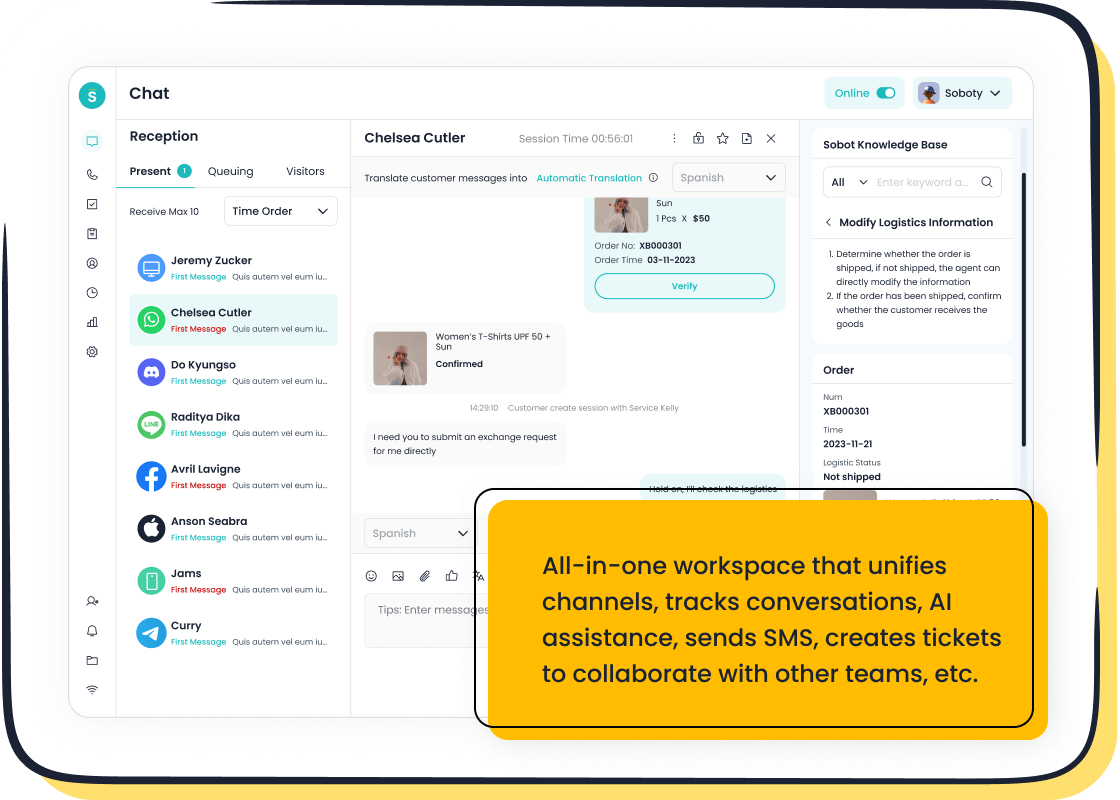

Sobot Live Chat Integration

Sobot Live Chat empowers banks to deliver a true omnichannel customer experience. The platform unifies conversations from websites, apps, and social media into one workspace. Agents can view customer history and context, making every interaction personal and efficient. Sobot’s AI tools help banks profile customers and provide tailored service, boosting conversion rates by 38%. Built-in analytics track over 150 indicators, helping banks optimize the retail bank customer experience. Sobot’s integration supports seamless channel switching, so customers never have to repeat themselves. This unified approach enhances the banking experience and drives measurable improvements in bank customer experience.

Empowering Employees for Better Service

Training and Tools

Banks invest in training programs and modern tools to boost employee skills and motivation. Training effectiveness studies show that managerial staff benefit most, with an adjusted R² of 0.732, while non-managerial staff see a 0.571 score. The Kirkpatrick model confirms that training improves reaction, learning, behavior, and results. Employees who receive regular training show better teamwork, higher job satisfaction, and improved work quality. These improvements lead to more efficient customer service and higher customer retention.

- Training programs help staff develop new skills and adapt to changing customer needs.

- Employees who feel supported by training deliver better customer service and resolve issues faster.

- Sobot provides banks with unified workspaces and AI-powered tools, making it easier for agents to access information and respond quickly.

AI Knowledge Base

AI knowledge bases transform how bank employees deliver customer service. Banks using AI-driven analytics report a 62% rise in client satisfaction and a 54% increase in revenue performance. Internal AI systems give staff instant access to customer data and product information, which speeds up responses and reduces errors. For example, Morgan Stanley’s AI Assistant supports over 98% of advisor teams, helping them answer questions quickly and accurately.

Bangor Savings Bank upskilled employees in AI and data literacy, allowing them to automate routine tasks and focus on building stronger customer relationships. Sobot’s AI-powered chatbots and knowledge base tools help agents stay updated on regulations and products, ensuring consistent and high-quality customer service.

Employee Impact on Customer Experience

Empowered employees drive better customer service and higher satisfaction. Research shows that psychological and structural empowerment increases job satisfaction, confidence, and creativity. Empowered staff handle stressful situations and customer needs more effectively.

| Aspect | Evidence Summary |

|---|---|

| Psychological Empowerment | Increases job satisfaction among bank employees |

| Structural Empowerment | Linked to higher job satisfaction and confidence |

| Employee Outcomes | Boosts creativity, competence, and ability to handle customer needs |

| Customer Satisfaction | Leads to improved service quality and loyalty |

Virgin Money’s employee-driven personalization efforts led to a 13% increase in customer response rates and doubled its Net Promoter Score year-on-year. Other banks have seen a 15-20% reduction in Customer Effort Score and a 10-15% improvement in retention rates. Sobot’s unified platform supports these outcomes by giving employees the tools they need to deliver excellent customer service.

Customer Feedback and Continuous Improvement

Feedback Collection

Banks collect feedback to understand customer expectations and improve the retail bank customer experience. They use Voice of Customer (VoC) programs, user testing, and sentiment analysis to gather actionable insights. For example, Microsoft processes over 5 million feedback items each month, while Adobe’s VoC program has driven over $300 million in annual revenue impact. User testing helps banks like Bank of America redesign their platforms based on real user behavior. Customer interviews and focus groups reveal motivations and pain points. Sentiment analysis with AI tools detects issues early, allowing banks to respond quickly.

- 76% of consumers expect companies to understand their needs and expectations (Salesforce).

- 78% of banking consumers use online reviews when choosing a bank.

- Responding to feedback within 24 hours leads to 30% higher customer satisfaction (Harvard Business Review).

Sobot’s omnichannel solutions help banks collect feedback across digital and traditional channels, making it easier to track and act on customer insights.

Data-Driven Decisions

Banks use data-driven decisions to enhance the retail bank customer experience. By analyzing feedback, they can anticipate needs, customize products, and improve marketing. HSBC uses client data to offer dynamic interest rates, while Barclays speeds up loan approvals with real-time analytics. These actions lead to faster service and higher customer satisfaction.

Companies using continuous improvement techniques see a 20% increase in customer satisfaction and 35% growth in financial performance (Bain & Company).

Sobot’s built-in analytics evaluate over 150 indicators, helping banks identify trends and optimize the retail banking experience. This approach ensures that every decision supports customer satisfaction and loyalty.

Enhancing Customer Satisfaction

Banks measure customer satisfaction using Net Promoter Score (NPS), Customer Satisfaction Score (CSAT), and Customer Effort Score (CES). High NPS scores show strong customer loyalty. Focused surveys and systematic feedback analysis help banks identify recurring issues and improve service quality. TD Bank, for example, regularly collects and analyzes feedback to drive continuous improvement.

- Companies with strong omnichannel engagement retain 89% of customers.

- A promoter is worth 4 to 6 times more than a detractor over time.

- A 5% increase in retention can boost profitability by 25% to 95%.

Sobot’s unified platform enables banks to monitor these KPIs and implement changes that enhance the retail bank customer experience. Leveraging technology and agile methods, banks can meet evolving customer expectations and deliver superior customer satisfaction.

Self-Service and Automation

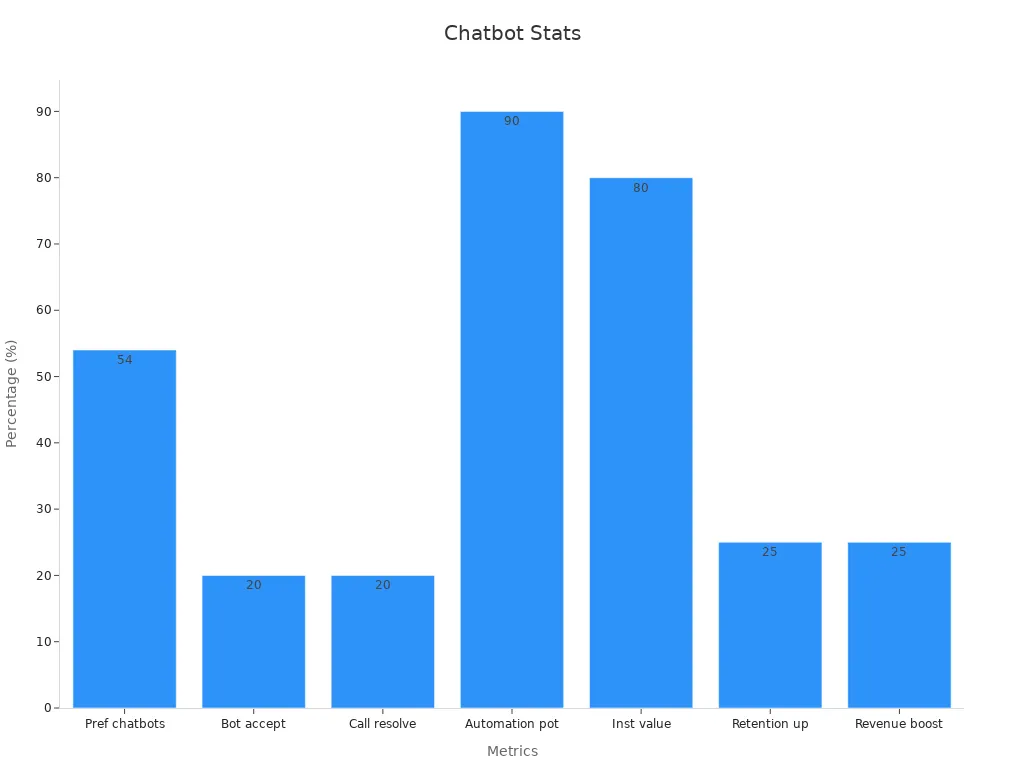

Chatbots and Automation

Banks now use chatbots and automation to transform customer service. These tools handle routine questions, process transactions, and provide instant support. Chatbots deliver answers three times faster than traditional channels, improving the bank customer experience. They also help banks save up to 30% on customer service expenses. Many customers prefer chatbots for payment transactions, with 54% choosing this option. In 2022, 98 million people in the US interacted with bank bots, showing widespread adoption. Chatbots improve first-call resolution rates by 20%, saving over four minutes per inquiry. Banks can automate up to 90% of customer interactions, freeing staff to focus on complex needs.

| Metric / Result | Statistic | Description |

|---|---|---|

| Customer preference for finance chatbots | 54% | Customers favor using chatbots for payment transactions |

| First-call resolution improvement | +20% | Chatbots improve first-call resolution rates from 50% to 70% |

| Cost savings per interaction | $0.50 - $0.70 | Estimated savings per chatbot interaction for banks |

| Customer retention increase | 25% | Increase in customer retention attributed to chatbot use |

Sobot’s AI-powered chatbots provide 24/7 support, automate routine tasks, and ensure consistent, compliant responses. This approach boosts efficiency and enhances the bank customer experience.

Self-Service Options

Self-service options have become essential in modern banking. Customers now expect to open accounts, deposit checks, and apply for loans without visiting a branch. During the pandemic, 45% of consumers increased their use of digital channels. Mobile banking app usage reached 55% in the US and 85% in Europe. Self-service digital onboarding became the biggest area of progress for community banks. Staff supporting online channels saw a 300% productivity improvement. Sobot’s omnichannel platform offers self-service opportunities across web, mobile, and social media, making banking more convenient for all age groups.

Note: Self-service options empower customers and reduce pressure on customer service teams, leading to a smoother bank customer experience.

Reducing Friction in Bank Customer Experience

Automation reduces friction in every step of the bank customer experience. Automated fund transfers and loan processing speed up approvals and minimize errors. Chatbots provide instant responses, reducing wait times and improving satisfaction. Automated KYC processes streamline onboarding, while real-time analytics help banks refine services. Sobot’s unified workspace integrates automated workflows, allowing agents to focus on complex issues and deliver better customer service. Banks report fewer bottlenecks, greater transparency, and lower operational costs due to automation.

- Automation enables faster, more reliable transactions.

- Consistent workflows cut waiting times and boost satisfaction.

- Real-time analytics support continuous improvement in bank customer experience.

Security, Trust, and Compliance

Data Privacy

Banks treat data privacy as a top priority to protect the retail bank customer experience. Strong privacy practices help banks keep customer trust and meet strict regulations. Research shows that banks lose about $2.5 billion each year to cyberattacks, and over 20,000 attacks in the past 20 years caused $12 billion in losses. These numbers show why banks must use access controls, encryption, and continuous threat monitoring.

| Evidence Aspect | Description |

|---|---|

| Qualitative Insight | Banks view robust data privacy and cybersecurity as critical for customer trust and competitive advantage. |

| Strategies Employed | Access controls, continuous threat monitoring, employee training, regulatory compliance, data encryption. |

| Quantitative Impact | Banks suffer US$ 2.5 billion annual losses due to cyberattacks; over 20,000 attacks caused US$ 12 billion losses in 20 years. |

| Implication for Customer Confidence | Protecting data privacy reduces risks and upholds consumer trust, essential for maintaining customer confidence in banks. |

Transparency in data privacy practices helps banks build stronger relationships with customers. When banks clearly explain how they use and protect data, customers feel less vulnerable and more confident in the bank customer experience. Sobot’s financial solutions support banks with secure data handling and compliance tools, helping them maintain high standards in privacy and trust.

Secure Interactions

Secure interactions form the backbone of a reliable bank customer experience. Over 100 million customers felt the impact of the Capital One data breach in 2019, showing how security failures can damage trust. Customers now expect banks to use multi-factor authentication, encryption, and real-time fraud detection to keep their information safe.

- Multi-factor authentication reduces unauthorized access.

- Encryption protects sensitive data during every transaction.

- Real-time fraud detection spots suspicious activity quickly.

Sobot’s omnichannel platform uses advanced security features to protect every customer interaction. The system supports secure messaging and encrypted data transfers, ensuring that the retail bank customer experience remains safe and compliant. Banks that invest in these measures see higher customer satisfaction and lower risk of fraud.

Note: Consistent security practices across all channels help banks deliver a seamless and secure customer experience.

Building Customer Trust

Building trust is essential for long-term success in the retail bank customer experience. Trust Bank’s focus on instant rewards and referral programs led to 70% of new customers joining through referrals, cutting acquisition costs to one-seventh of the industry average. The 2023 iResearch Services Retail Banking Survey found that 70% of people believe their bank acts in their best interest, up from 63% in 2020. This rise in trust supports stronger customer loyalty and better performance metrics.

Consistency in service also matters. Customers want reliable, predictable experiences at every touchpoint. When banks deliver on promises and protect customer data, they reinforce trust and encourage long-term relationships. Sobot’s unified platform helps banks provide consistent, secure, and transparent service, supporting trust at every stage of the bank customer experience.

Trust drives loyalty, retention, and engagement—key outcomes for any bank focused on customer experience management.

Customer experience management in banking drives growth and loyalty. Banks that use AI, omnichannel platforms, and real-time analytics see higher customer satisfaction and retention. Sobot’s unified solutions help banks deliver seamless service and improve customer satisfaction at every touchpoint.

To achieve excellence, banks should:

- Manage branch traffic with virtual queues and mobile alerts.

- Use AI analytics for real-time support and personalized offers.

- Capture feedback after each interaction to boost customer satisfaction.

- Build a customer success culture for long-term relationships.

These steps ensure customer experience management in banking remains strong and future-ready.

FAQ

What is customer experience management in banking?

Customer experience management in banking means banks use strategies and technology to improve every customer interaction. Banks focus on making services faster, more personal, and easier to use. This approach increases satisfaction and loyalty. Sobot helps banks unify channels and deliver a seamless bank customer experience.

How does AI improve the retail bank customer experience?

AI helps banks answer questions quickly, personalize offers, and predict customer needs. For example, Sobot’s AI chatbots handle 80% of routine inquiries, reducing wait times and improving satisfaction. Banks using AI see higher customer retention and better customer experience management in banking.

Why is omnichannel engagement important for bank customer experience?

Omnichannel engagement lets customers switch between channels—like chat, phone, or social media—without losing information. Sobot’s Live Chat unifies all conversations, so agents see the full history. This seamless approach boosts the retail bank customer experience and increases loyalty.

How do banks measure customer experience management success?

Banks use metrics like Net Promoter Score (NPS), Customer Satisfaction Score (CSAT), and Customer Effort Score (CES). High scores show strong customer loyalty. Sobot’s analytics help banks track these metrics and improve the bank customer experience with real-time data.

What role does security play in customer experience management in banking?

Security protects customer data and builds trust. Banks use encryption, multi-factor authentication, and real-time monitoring. Sobot’s financial solutions support secure interactions and compliance, helping banks deliver a safe and reliable retail bank customer experience.

See Also

Effective Strategies For Managing Call Center Quality

Revealing The Leading Cloud Contact Centers Of 2025

Comprehensive Reviews Of Best Contact Center Solutions 2024