Contact Centre Compliance Trends Transforming Customer Service

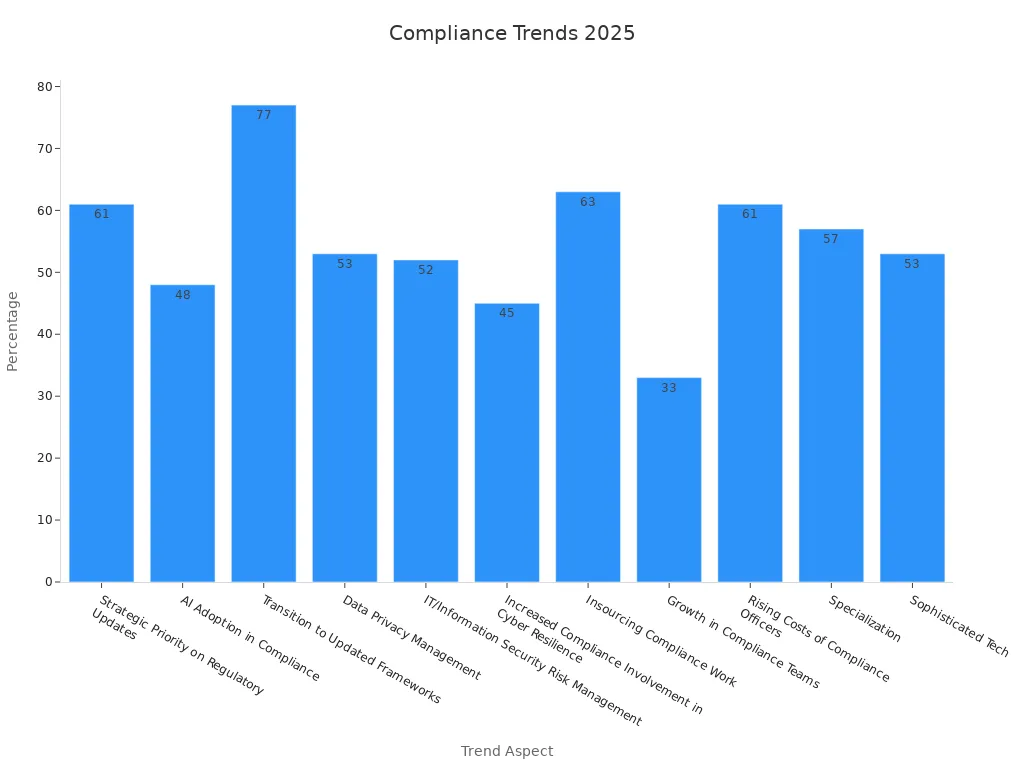

Contact centre compliance will define customer experience and trust in 2025. Businesses now face increasing pressure to keep up with new trends and regulations. A recent industry survey shows that 61% of professionals see regulatory updates as a top priority, while 53% consider data privacy management essential. The chart below highlights how compliance shapes contact centers:

| Compliance Trend Aspect | Statistic / Percentage | Explanation |

|---|---|---|

| Strategic Priority on Regulatory Updates | 61% | Majority of professionals prioritize staying updated on regulatory and legislative changes. |

| AI Adoption in Compliance | 48% | Nearly half believe AI enhances internal efficiency; 35% say it helps keep up with changes. |

| Transition to Updated Frameworks | 77% | Security and IT leaders plan to adopt updated frameworks like PCI DSS 4.0 soon. |

| Data Privacy Management | 53% | Over half consider managing data privacy as absolutely essential. |

| IT/Information Security Risk Management | 52% | Similarly, over half see IT security risk management as critical. |

| Increased Compliance Involvement in Cyber Resilience | 45% | Nearly half expect compliance to play a bigger role in cyber resilience efforts. |

| Insourcing Compliance Work | 63% | Majority report more compliance work being insourced recently. |

| Growth in Compliance Teams | 33% | One-third predict their compliance teams will grow within the next year. |

| Rising Costs of Compliance Officers | 61% | Most expect the cost of senior compliance officers to increase. |

| Specialization and Use of Sophisticated Tech | 57% and 53% | Over half report more specialized roles and advanced technology use in compliance. |

Sobot and Sobot AI deliver secure solutions that support these needs, helping companies protect data and build stronger customer relationships.

Contact Centre Compliance in 2025

Regulatory Pressures

Contact centre compliance faces mounting regulatory pressures in 2025. New and updated laws demand strict adherence to data privacy, consent, and ethical conduct. Several major regulations shape the landscape:

- PCI regulations prohibit recording or storing credit card information. Contact centers must enforce strict data collection and recording policies to avoid fines and fraud.

- GDPR requires transparency about data collection. Customers must know when their data is recorded and have the right to request removal.

- The Fair Debt Collection Practices Act (FDCPA) enforces ethical conduct for agents, banning abusive or harassing behavior.

- PCI and zero-trust security models require least-privilege access and two-factor authentication to protect sensitive data.

- Ofcom regulates the use of automated dialing technologies, preventing misuse and imposing fines for violations.

- Industry-specific rules, such as HIPAA for healthcare, add further requirements for data privacy and security.

- New state laws, like the Iowa Privacy Law and Delaware Data Protection Act, introduce opt-in and opt-out consent requirements, with significant penalties for non-compliance.

Contact centers must implement comprehensive security measures, including encryption, access control, and network monitoring, to meet these compliance regulations. The FCC's revocation of consent rule, effective April 2025, increases the complexity of consent management by requiring opt-out requests to be honored across all channels within 10 business days.

Note: The shift to remote and hybrid work environments introduces new compliance risks. Monitoring distributed teams and securing data outside traditional office settings have become critical challenges.

Business Risks

Non-compliance with call center compliance regulations exposes organizations to severe business risks. Mishandling sensitive payment data can result in PCI DSS violations, leading to financial penalties and forming the basis for compliance with other regulations like GDPR and HIPAA. Failure to inform customers about call recording practices risks breaching GDPR, which can cause fines and data security issues. Misuse of predictive dialers, especially when contacting consumers on Do Not Call lists, can result in regulatory fines enforced by authorities such as Ofcom.

Contact centers must also comply with the FDCPA and FINRA rules. These require accurate communication, proper record-keeping, and agent licensing. Violations, such as making false statements or using abusive language, can lead to lawsuits and regulatory penalties. The consequences of non-compliance include:

- Financial penalties, such as fines up to $10,000 per TCPA violation.

- Reputational damage that can erode customer trust.

- Potential shutdowns of call center operations.

- Increased scrutiny from regulatory bodies.

Call center compliance trends show a shift from reactive to proactive approaches. Many organizations now use AI-powered quality and compliance software to detect risks in real time and transform insights into actionable steps. This proactive stance helps reduce the likelihood of violations and supports ongoing business continuity.

Customer Trust

Customer trust stands at the core of successful contact centre compliance. Transparency in compliance practices directly influences customer loyalty and satisfaction. According to the 2021 Edelman Trust Barometer, 81% of consumers consider trust essential to their purchase decisions. Companies that maintain high transparency enjoy a 23% advantage in customer loyalty compared to less transparent competitors.

| Compliance Practice | Impact on Trust and Loyalty |

|---|---|

| Transparent data handling | Increases customer trust |

| Clear consent management | Boosts loyalty and satisfaction |

| Proactive communication | Reduces customer anxiety |

Contact centers that prioritize call center compliance trends and maintain open communication about data use build stronger relationships with customers. Nearly 87% of contact centers now rank customer satisfaction as their most important metric. As organizations adopt new compliance measures, they must ensure that every interaction reinforces trust and demonstrates a commitment to protecting customer information.

Tip: Companies that invest in transparent compliance programs not only meet regulatory demands but also gain a competitive edge by fostering lasting customer relationships.

Data Privacy

Global Standards

Contact centers operate in a world where data privacy regulations continue to evolve rapidly. The General Data Protection Regulation (GDPR) set a global benchmark, leading to stricter enforcement and higher penalties for non-compliance. Many countries now follow this example. For instance, China’s PIPL, India’s DPDPA, and Saudi Arabia’s PDPL all require organizations to provide privacy notices, obtain consent, and allow individuals to access or delete their data. Companies must also comply with rules for cross-border data transfers and adapt to regional differences. A global trend toward harmonizing privacy standards helps organizations manage compliance across multiple jurisdictions.

| Compliance Standard | Jurisdiction | Key Features |

|---|---|---|

| GDPR | EU | Unified framework, strong consumer rights, cross-border rules |

| PIPL | China | Privacy notices, impact assessments, consent for transfers |

| DPDPA | India | Personal data processing framework, evolving requirements |

| PDPL | Saudi Arabia | Rights to access, delete, and request copies of data |

Storage and Retention

Effective data privacy measures depend on strong storage and retention policies. Organizations must identify what data to keep, how long to keep it, and when to delete it. Automated purging plans help manage data after retention periods expire. Encryption and data loss prevention tools protect information from unauthorized access. Companies should monitor user activity and third-party vendors to ensure compliance. Regular reviews and updates keep policies aligned with changing technology and data privacy regulations. Assigning a policy manager and educating employees further strengthens compliance.

Tip: Regularly reviewing and updating retention policies prevents data loss and supports compliance with new laws.

Sobot’s Secure Solutions

Sobot delivers secure solutions that help contact centers meet strict data privacy regulations. The platform uses AI-powered chatbots and a hybrid live chat system to handle customer inquiries efficiently. Its ticketing system tracks and prioritizes issues, while analytics tools monitor key performance indicators like customer satisfaction and resolution rates. Sobot’s security features include advanced encryption, customizable access controls, and compliance with industry standards. These capabilities support high retention rates, reduce churn, and improve customer satisfaction. Sobot’s approach to data privacy measures ensures that organizations can protect sensitive information and build trust with customers.

AI Compliance

New AI Regulations

AI regulations continue to evolve, shaping how contact centers operate. The EU AI Act and the US Executive Order on AI Safety set new standards for transparency, data security, and ethical AI use. Contact centers must now disclose when AI handles customer interactions. They must also protect sensitive data, especially biometric information, and ensure AI systems do not generate unsafe or misleading content. These regulations require businesses to:

- Obtain clear, documented customer consent for data use.

- Maintain compliance across all communication channels.

- Oversee remote and hybrid agents securely.

- Provide special support for vulnerable customers, such as the elderly or those in healthcare.

| Compliance Trend | Description |

|---|---|

| AI Transparency | Disclose AI involvement and explain decision-making. |

| Customer Consent | Require real-time, documented consent for analytics and recording. |

| Omnichannel Compliance | Maintain compliance across every channel. |

| Workforce Compliance Management | Securely manage remote and hybrid agents. |

| Protection of Vulnerable Customers | Implement policies and training for at-risk groups. |

| Proactive Compliance | Use AI-powered QA tools to anticipate and address risks. |

AI regulations now demand that organizations balance innovation with strict regulatory alignment. This shift encourages cross-functional collaboration and ethical AI use.

Sobot AI Capabilities

Sobot’s AI system addresses these compliance challenges with a robust, multi-layered approach. The platform features a Secure AI component that ensures data privacy and regulatory adherence. Sobot aligns with ISO and GDPR standards, reinforcing its commitment to security. The system provides:

- Extensive process monitoring and quality inspection.

- Over 300 statistical reports and thousands of compliance indicators.

- Integration of Omnichannel AI, Scenario-based AI, Multi-faceted AI, Generative AI, and Secure AI.

AI-powered compliance engines automate quality checks, reviewing all customer interactions instead of just a small sample. This automation reduces human error, minimizes compliance breaches, and accelerates regulatory processes. In healthcare, for example, up to 45% of incoming calls are now automated, and about 34% of organizations have fully automated compliance processes.

| Statistic Description | Value/Impact |

|---|---|

| Percentage of incoming healthcare contact calls automated | Up to 45% |

| Adoption rate of AI-driven training tools by healthcare orgs | About 40% |

| U.S. healthcare orgs with fully automated compliance | About 34% |

| AI compliance checks coverage vs. traditional methods | Reviews all interactions vs. 1-3% sampled |

| Impact on compliance monitoring | Reduces human error, improves oversight |

Monitoring and Auditing

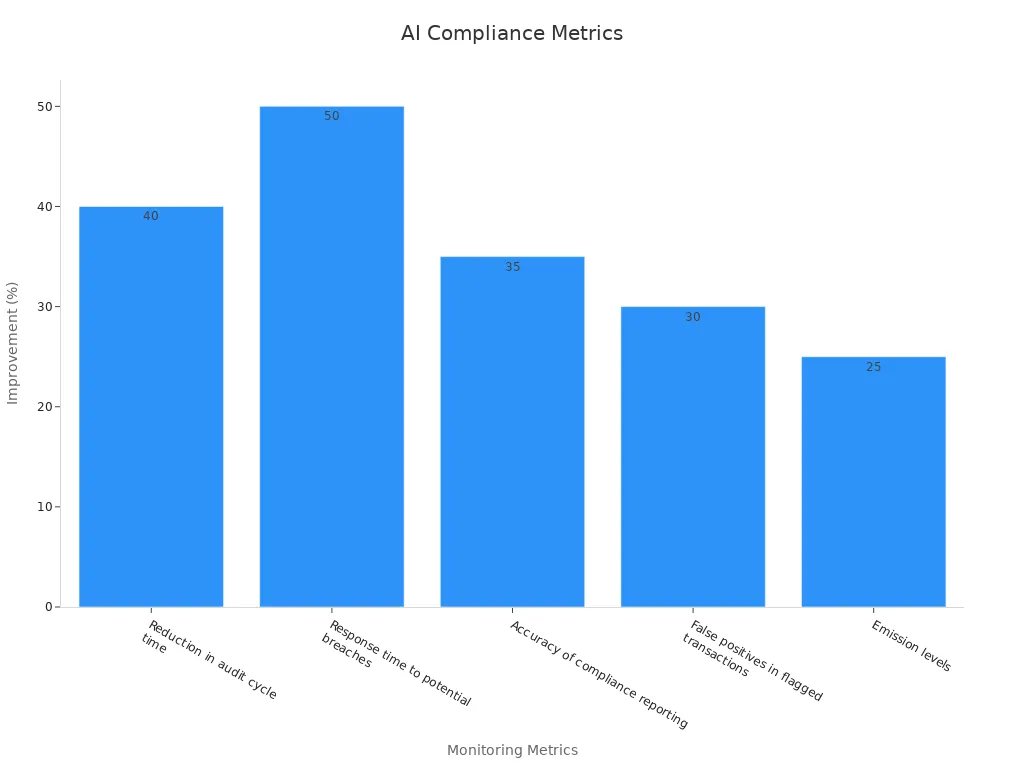

AI-powered monitoring and auditing tools provide real-time dashboards and customizable reports. These features allow stakeholders to track compliance trends and performance metrics efficiently. Automation speeds up audit cycles, improves reporting accuracy, and reduces false positives. Organizations can handle larger data volumes without increasing staff, supporting compliance as they grow.

| Metric / Improvement | Description / Impact | Example / Result |

|---|---|---|

| Reduction in audit cycle time | Faster audits improve efficiency and responsiveness | 40% reduction in audit cycle time at a financial institution within six months |

| Response time to potential breaches | Real-time alerts enable quicker reaction to compliance issues | 50% reduction in response times to data breaches in healthcare provider case study |

| Accuracy of compliance reporting | Improved accuracy reduces risk of violations and false positives | Over 35% improvement in reporting accuracy, reducing inadvertent violations |

| False positives in flagged transactions | Enhanced anomaly detection reduces unnecessary investigations | 30% decrease in false positives in financial audits |

| Reporting transparency | Detailed logs and analytics improve stakeholder trust and regulatory confidence | Enhanced transparency with shared analytics to environmental regulatory bodies |

| Customizable reports and dashboards | Enables ongoing monitoring of compliance trends and performance | AI-powered dashboards provide tailored insights for stakeholders |

AI compliance solutions from Sobot empower contact centers to maintain regulatory alignment, reduce risk, and build trust with customers through transparent, data-driven oversight.

Cybersecurity

Threat Detection

Cybersecurity threats in contact centers continue to evolve rapidly. Attackers use advanced tactics to target sensitive customer data and disrupt operations. Recent reports show that 56% of customer experience leaders faced data breaches or cyberattacks in the past year. Credential theft now accounts for nearly one in three security incidents. Attackers bypass knowledge-based authentication over 80% of the time, while genuine callers succeed only 46% of the time. Voice deepfake technology has become a major threat, enabling criminals to clone voices and cause significant financial losses. Human error remains a critical factor, with 74% of breaches involving employee actions.

Contact centers must address these risks with layered security strategies. These include advanced voice authentication, AI-driven anomaly detection, and robust employee training. The rise of distributed denial of service attacks, voice phishing, ransomware, and insider threats highlights the need for continuous vigilance.

| Metric | Description | Significance in Confirming Cybersecurity Effectiveness |

|---|---|---|

| Mean Time to Detect (MTTD) | Average time taken to detect a potential security incident. | Shorter MTTD indicates faster threat detection, enabling quicker mitigation. |

| Mean Time to Contain (MTTC) | Duration to control or limit the impact of a detected threat. | Reduced MTTC shows efficient containment and minimized damage. |

| Incident Prevention Ratio | Ratio of successfully prevented data incidents to total attempts. | Higher ratio confirms the effectiveness of prevention controls. |

Call Center Compliance

Call center compliance trends emphasize the importance of monitoring and protecting customer data. Organizations use compliance scores for agents, based on transcripts and recordings, to identify training needs. Redaction software removes sensitive data during calls. Encryption and restricted access protect information from unauthorized users. Automated monitoring covers 100% of calls and interactions, helping identify compliance violations in real time. Supervisors receive notifications and can coach agents immediately.

Key compliance metrics include:

- Number of data breaches

- Unauthorized access attempts

- Data retention compliance

- Security breach incidents

- Speech analytics compliance rate

- Audit readiness

- Call compliance rate

- Agent adherence to compliance protocols

These metrics help organizations strengthen call center compliance and reduce risks.

Sobot Voice/Call Center Security

Sobot’s voice and call center solutions deliver robust security for contact centre compliance. The platform uses encrypted storage to protect sensitive voice data. Granular access controls ensure only authorized personnel can access information. Retention schedules and audit logs support proper data management and traceability. Sobot maintains compliance with regulations such as GDPR and HIPAA. Agents can pause and resume call recording to manage privacy-sensitive moments. AI-driven tools provide transcription, sentiment analysis, and real-time monitoring for secure and compliant call handling. Supervisors can monitor calls silently, offer guidance, or take over calls when needed. These features help organizations meet call center compliance requirements and adapt to evolving call center compliance trends.

Omnichannel Compliance

Multichannel Challenges

Contact centers face significant challenges when managing compliance across multiple communication channels. Teams often struggle with fragmented customer experiences, which can lead to customer churn. Many organizations lack integration between channels, making it difficult to deliver consistent service. Resource shortages and skill gaps further complicate the management of omnichannel campaigns. Data silos form when information comes from different sources, increasing the risk of breaches and making compliance with regulations like GDPR and CCPA more complex. Companies also find it hard to maintain a consistent brand voice and message across platforms. Cybersecurity risks grow as more channels create new endpoints for potential attacks, such as phishing or ransomware. Ensuring staff receive proper training and maintaining consistent service quality across all channels remain ongoing challenges.

Note: Data privacy and security become harder to manage as the number of communication channels increases. Organizations must use encryption, AI-driven threat detection, and regular employee training to protect customer data.

Unified Customer Experience

A unified customer experience depends on integrating customer data from sales, support, and marketing into a single platform. This approach eliminates data silos and gives agents a complete view of each customer’s journey. Centralized data helps prevent customers from repeating information and supports consistent, personalized interactions. Contact centers monitor key metrics such as Average Handle Time, Customer Satisfaction, Net Promoter Score, and First Contact Resolution to measure success. AI-powered automation tools, like natural language processing and large language models, transcribe calls, summarize conversations, and automate routine tasks. These tools allow agents to focus on complex issues, improving both compliance and customer experience. Secure omnichannel platforms use encryption and access controls to protect data and ensure compliance with industry standards.

Sobot and Opay Case

Sobot’s omnichannel platform demonstrates how unified solutions can improve compliance and customer experience. Opay, a leading financial service provider, partnered with Sobot to streamline customer service across social media, email, and voice channels. The integration allowed Opay to manage all interactions in one workspace, reducing response times by 30% and automating over 40% of routine tasks. Customer satisfaction rose from 60% to 90%, while conversion rates increased by 17%. The unified platform also improved customer engagement and loyalty, with many firms reporting up to a 45% increase in engagement and a 35% improvement in retention. Sobot’s secure, integrated system helped Opay maintain compliance and deliver a seamless customer experience across every channel.

Customer Experience and Consent

Consent Management

Consent management stands as a foundation for building trust in contact centers. Companies must collect, track, and honor customer permissions across every channel. Regulations such as GDPR and TCPA require explicit consent before recording calls or sending marketing messages. Customers need clear information at the start of each call and must have the option to opt out. Consent Management Platforms (CMPs) help automate this process, storing permissions and making audits easier.

- Non-compliance can lead to fines up to $43,792 per violation and damage brand reputation.

- Strong consent management increases trust and improves marketing results.

- A 2024 Cisco survey found that 75% of consumers avoid companies they do not trust with their data.

- Consent-based data is more accurate, leading to better insights and higher customer satisfaction.

- CMPs allow users to change or revoke consent easily, supporting ongoing compliance.

Companies that respect customer choices see better engagement and loyalty. Targeting only consenting users also improves campaign efficiency and return on investment.

Protecting Vulnerable Customers

Contact centers must identify and support vulnerable customers to ensure fair treatment. The FCA’s Consumer Duty requires firms to tailor services and communication for those at risk, such as the elderly or people facing financial hardship. Staff receive training to spot signs of vulnerability, like confusion or unusual spending. Flexible communication channels and alternative identification methods help prevent exclusion.

| Compliance Area | FCA Expectations and Research Findings | Practical Recommendations |

|---|---|---|

| Outcome Testing | Firms must capture holistic customer journey data to avoid masking poor outcomes. | Use both individual and end-to-end metrics to assess vulnerable customer outcomes. |

| Product Adaptation | Tailor products, services, and communications to vulnerable customers; provide accessible and proactive support channels. | Consult specialist groups during design; offer alternative ID options; adapt engagement approaches. |

| Governance | Embed fair treatment culture; equip staff with training and resources; ensure leadership commitment. | Train staff on vulnerability; improve recruitment and retention; embed fair treatment in policies and rewards. |

| Future Priorities | Anticipate regulatory focus on vulnerable customer harm in specific areas like bereavement and claims handling. | Prepare for supervisory reviews; continuously improve vulnerability frameworks. |

By protecting vulnerable customers, organizations build trust and improve overall customer experience.

Training and Best Practices

Ongoing training ensures that agents understand compliance rules and deliver excellent customer experience. Companies use both quantitative and qualitative metrics to measure training effectiveness. These include completion rates, knowledge assessments, and feedback from employees and customers. Behavioral changes, such as improved communication and fewer compliance incidents, show real progress.

| Metric Category | Examples and Description |

|---|---|

| Quantitative Metrics | Training completion rates; knowledge assessment scores; incident reporting trends; timeliness of completion |

| Qualitative Metrics | Employee feedback; scenario-based assessments; customer satisfaction improvements; peer and manager observations |

| Behavioral Changes | Recognition of compliant behavior; long-term tracking; reduction in non-compliance incidents |

| External Benchmarks | Industry standards; regulatory trends; peer collaboration |

Effective training programs help agents personalize interactions, respond quickly, and resolve issues. This leads to higher customer satisfaction and loyalty. Companies that invest in best practices see measurable gains in customer experience, retention, and business growth.

Contact Center Trends: AI and Automation

Proactive Compliance

Contact center trends in 2025 show a shift toward proactive compliance. AI-powered transformation enables organizations to anticipate risks before they become problems. Predictive analytics forecast call volumes and optimize staffing, which reduces agent stress and errors. Real-time speech and sentiment analysis detect potential compliance issues during calls, allowing immediate correction. Robotic Process Automation (RPA) handles repetitive tasks, freeing agents to focus on complex cases and improving accuracy. Intelligent call routing matches customers with the best agents, supporting first-call resolution and consistent service delivery. Security-focused AI applications protect sensitive data and detect fraud, ensuring compliance with data protection regulations.

Automation reduces human error and operates around the clock. Continuous system monitoring identifies vulnerabilities early, while automated compliance processes increase efficiency and lower costs. Financial institutions using automated compliance technologies have reduced operational costs by up to 30% over five years. These proactive measures help contact centers avoid penalties and maintain a strong compliance posture.

Quality Assurance

AI and automation have transformed quality assurance in contact centers. AI-powered tools analyze 100% of customer interactions, providing detailed insights into agent performance and customer sentiment. Automated scorecards deliver real-time feedback, enabling timely coaching and reducing compliance risks. AI-based visualization tools detect inconsistencies that humans might miss, while automated bug tracing quickly identifies and tracks defects. Predictive analytics forecast potential issues, allowing teams to address them before they impact service quality. These advancements improve stability, reliability, and efficiency across all operations.

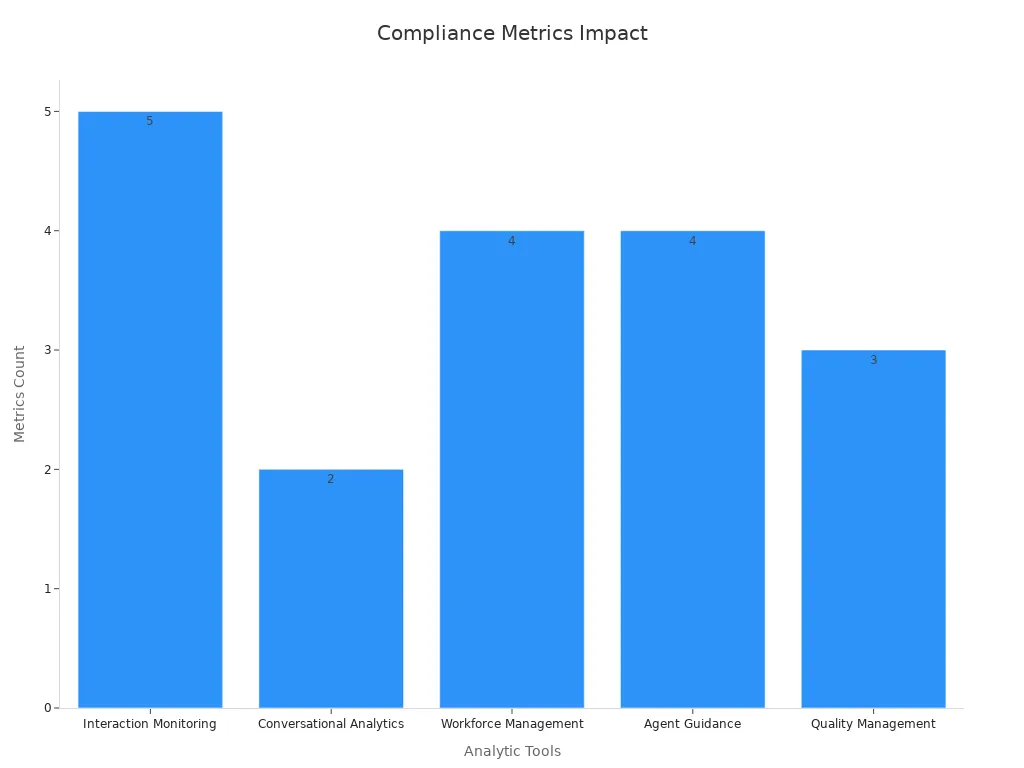

Analytics and Insights

Advanced analytics drive measurable improvements in compliance and customer satisfaction. Interaction monitoring identifies performance gaps through call and screen recordings. Conversational analytics assess real-time interactions and flag compliance issues. Workforce management tools predict staffing needs and monitor agent performance. Agent guidance systems provide real-time prompts, helping agents resolve issues faster. Quality management platforms offer coaching and training to improve agent skills and adherence to service standards.

| Analytic Tool | What It Does | Metrics Impacted | Why It Matters |

|---|---|---|---|

| Interaction Monitoring | Identifies agent performance gaps through call and screen recordings | Call Abandonment Rate, SLA Compliance, NPS, AHT, FCR | Enables addressing compliance gaps and ensures service standards are met |

| Conversational Analytics | Analyzes real-time interactions, customer sentiment, and compliance flags | Customer Satisfaction Score, AHT | Helps refine service strategies and improve customer satisfaction |

| Workforce Management | Predicts staffing needs and monitors agent performance in real time | CAR, AHT, FCR, CSAT | Ensures proper staffing for efficient service delivery and compliance adherence |

| Agent Guidance | Provides real-time prompts and centralized data to agents | CSAT, AHT, FCR, CAR | Equips agents to resolve issues faster, improving compliance and customer satisfaction |

| Quality Management | Offers coaching, gamification, and training to improve agent performance | CSAT, NPS, SLA Compliance | Continuous feedback drives agent improvement and compliance with service level agreements |

Contact center trends highlight that these AI-powered solutions not only support compliance but also elevate the customer experience, leading to higher customer satisfaction and operational excellence.

Contact center compliance trends reshape customer service by driving the adoption of advanced analytics, AI, and real-time monitoring. Organizations now track key metrics and use data-driven interventions to improve both agent performance and customer satisfaction.

| Aspect of Transformation | Impact on Customer Service Operations |

|---|---|

| Advanced Analytics & AI Integration | Enables proactive compliance management and operational efficiency. |

| Real-Time & Historical Monitoring | Supports agile decision-making and continuous improvement. |

| Data-Driven Interventions | Creates continuous improvement engines transforming service delivery. |

Leaders who invest in technology, training, and compliance monitoring—using platforms like Sobot—stay ahead in 2025 and deliver exceptional customer experiences.

FAQ

What is contact center compliance?

Contact center compliance means following laws and rules that protect customer data and privacy. Teams must use secure systems, get customer consent, and keep records safe. Compliance helps companies avoid fines and build trust with customers.

How does Sobot help with data privacy?

Sobot uses encryption, access controls, and secure storage to protect customer data. The platform follows global privacy standards like GDPR. Sobot’s tools help companies manage data safely and meet strict privacy requirements.

Why is omnichannel compliance important?

Omnichannel compliance ensures that customer data stays safe across all channels, like phone, chat, and email. It helps agents give consistent service. Companies avoid data breaches and meet regulations by using unified platforms.

What role does AI play in compliance?

AI automates compliance checks, monitors calls, and flags risks in real time. It helps teams find problems quickly and follow rules. AI also improves training and reporting, making compliance easier for contact centers.

How can companies protect vulnerable customers?

Companies train agents to spot signs of vulnerability, like confusion or distress. They use flexible communication methods and offer extra support. Protecting vulnerable customers builds trust and meets regulatory standards.

See Also

Effective Strategies For Managing Call Center Quality

Best Contact Center Technologies Evaluated For 2024

Leading Cloud-Based Contact Center Services Reviewed 2024

Step-By-Step Guide To Deploy Omnichannel Contact Centers

Comprehensive Guide To Quality Management Systems In Call Centers