The rise of artificial intelligence (AI) has sparked intense debate across many industries — and the insurance sector is no exception. With the growing presence of the AI agent, many are asking: Will AI replace insurance agents? While AI is transforming how insurance companies operate, the answer is more complex than a simple yes or no.

What Is an AI Agent?

An AI agent refers to a software system powered by artificial intelligence that can perform tasks typically requiring human intelligence. In the insurance industry, AI agents are being used to:

- Automate claims processing

- Provide instant customer support

- Analyze risk profiles

- Recommend personalized insurance plans

- Detect fraud in real time

These AI-driven capabilities are improving efficiency, reducing costs, and enhancing the customer experience. But can they truly replace human insurance agents?

The Role of Insurance Agents Today

Traditional insurance agents play a critical role in helping customers:

- Understand complex policy options

- Navigate claims and coverage issues

- Provide personalized advice based on life needs

- Build trust through human interaction

The value of human intuition, empathy, and relationship-building is still a major factor in the decision-making process for many clients—especially when it comes to significant life choices like health, life, or property insurance.

How AI Agents Are Changing the Insurance Landscape

The introduction of AI agents is not about replacing human agents altogether, but rather augmenting their capabilities. Here’s how AI is enhancing the insurance industry:

- Faster Customer Service

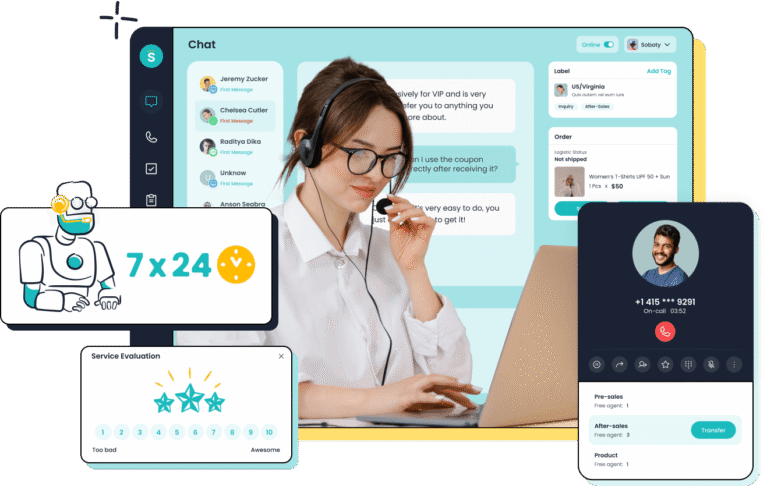

AI chatbots and virtual assistants can handle routine questions 24/7, allowing human agents to focus on more complex customer needs.

- Improved Risk Assessment

AI algorithms analyze large volumes of data to help insurers evaluate risk more accurately and offer better premiums.

- Streamlined Claims Processing

AI agents can process standard claims quickly, reducing wait times and improving customer satisfaction.

- Personalized Policy Recommendations

By analyzing customer data and preferences, AI can suggest tailored policies that match individual needs — often more accurately than a human agent.

Will AI Replace Human Insurance Agents Completely?

While AI agents are revolutionizing insurance operations, they are unlikely to replace human agents entirely. Instead, we can expect a hybrid model where technology and human expertise work together.

AI can handle repetitive, data-driven tasks, while human agents provide emotional intelligence, judgment, and relationship management — elements that are hard to replicate with machines.

The Future: Collaboration, Not Replacement

Rather than fearing replacement, insurance agents should embrace AI as a tool to improve their workflow. Agents who leverage AI will be able to:

- Serve more clients efficiently

- Focus on relationship-building

- Make data-driven decisions

- Stay competitive in a tech-driven marketplace

Conclusion

So, will AI replace insurance agents? The answer is no — but it will redefine their role. The AI agent is a powerful tool that empowers human agents to be more productive, informed, and customer-focused. The future of insurance lies not in choosing between AI and humans, but in combining both to deliver exceptional service.

For insurance professionals, now is the time to adapt, learn, and thrive in a world where AI works with you — not against you.