In the fast-evolving financial industry, providing efficient and reliable customer support is essential. With growing demands for instant responses and personalized assistance, finance AI chatbots have become a vital tool for banks, fintech companies, and other financial institutions. But what makes a chatbot the best choice for customer support in finance? Let’s explore the features, benefits, and examples that define the ideal solution.

Why Finance AI Chatbots Matter

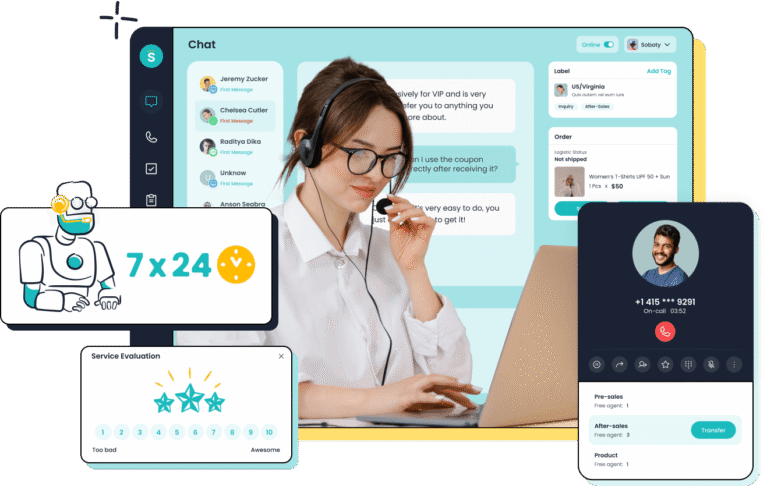

Customer expectations in finance have shifted dramatically. Clients now seek quick solutions to inquiries such as account balances, transaction histories, loan options, and more. A finance AI chatbot helps address these needs by offering 24/7 support, reducing wait times, and improving customer satisfaction. Unlike traditional customer service, chatbots can handle multiple queries simultaneously, ensuring a seamless experience for every client.

Moreover, chatbots in finance aren’t limited to simple Q&A. Advanced AI capabilities allow them to understand natural language, provide personalized recommendations, and even detect potential fraud. This combination of efficiency and intelligence makes them indispensable in modern financial operations.

Key Features of the Best Finance Chatbots

When evaluating the best chatbots for customer support in finance, several features stand out:

Natural Language Processing (NLP): NLP allows chatbots to understand and interpret customer queries accurately. A chatbot with strong NLP can answer complex financial questions and engage in meaningful conversations.

Secure Transactions: Financial institutions deal with sensitive data. The best chatbots prioritize security, using encryption and authentication to protect client information during interactions.

Integration Capabilities: A top finance AI chatbot integrates seamlessly with existing banking systems, CRM platforms, and mobile apps. This ensures that clients receive real-time, accurate information without switching between platforms.

Personalization: Modern chatbots leverage AI to provide tailored advice based on a client’s financial history, spending patterns, or investment goals. Personalization enhances trust and builds stronger customer relationships.

Analytics and Reporting: Understanding customer behavior is crucial for improving services. The best chatbots offer analytics dashboards to monitor engagement, identify common queries, and optimize support strategies.

Examples of Effective Finance AI Chatbots

Several financial institutions have successfully implemented AI chatbots:

- Erica by Bank of America: Offers personalized financial guidance, transaction search, and bill reminders.

- Ceba by Commonwealth Bank: Assists with account queries and provides proactive alerts for financial activities.

- Kasisto’s KAI: Supports multiple banks globally, offering conversational AI solutions for banking and fintech platforms.

- These chatbots illustrate how AI-powered solutions can enhance customer experiences while streamlining operations.

Conclusion

Choosing the best finance AI chatbot for customer support depends on features, security, and integration capabilities. By leveraging AI, banks and fintech companies can deliver faster, smarter, and more personalized assistance to their clients. As technology continues to advance, finance chatbots will play an increasingly critical role in redefining customer support and ensuring clients receive the attention they deserve.

Investing in the right chatbot not only improves operational efficiency but also strengthens customer trust and loyalty, making it a strategic asset for any financial institution.